Improving Ebob Cracks Justified As Usgc Focuses Closer To Home

EBOB STRENGTHENS, SUPPORTED BY ROBUST ATLANTIC BASIN DEMAND

We have spoken a lot in recent posts about how the various possible outlets for surplus European gasoline in the coming months and the relative economics of different destinations vs other supply hubs.

The attractiveness of European supply into essentially all swing importer destinations earlier this month has already had a sizeable impact, with EBOB blend costs moving higher, the E/W coming in by over $6/bbl in the last two weeks, and freight rates to move volumes East out of Europe ~20% higher now than at the beginning of the month.

Despite the East of Suez (EoS) now firmly shut for supplies out of Europe, it is interesting to note that freight costs on these E/W routes have also risen steadily in recent weeks.

This would suggest that although the relative economics currently point to EoS supply for destinations such as Saudi Arabia, Pakistan, and Tanzania, there are likely to have still been players looking to physically deliver cargoes locked in towards the beginning of the month which is now helping to keep that window firmly shut.

Elsewhere, the transatlantic arb from ARA into NYH has regained some of its appeal, with Hurricane Ian promising disruption along the USAC in the coming hours and days.

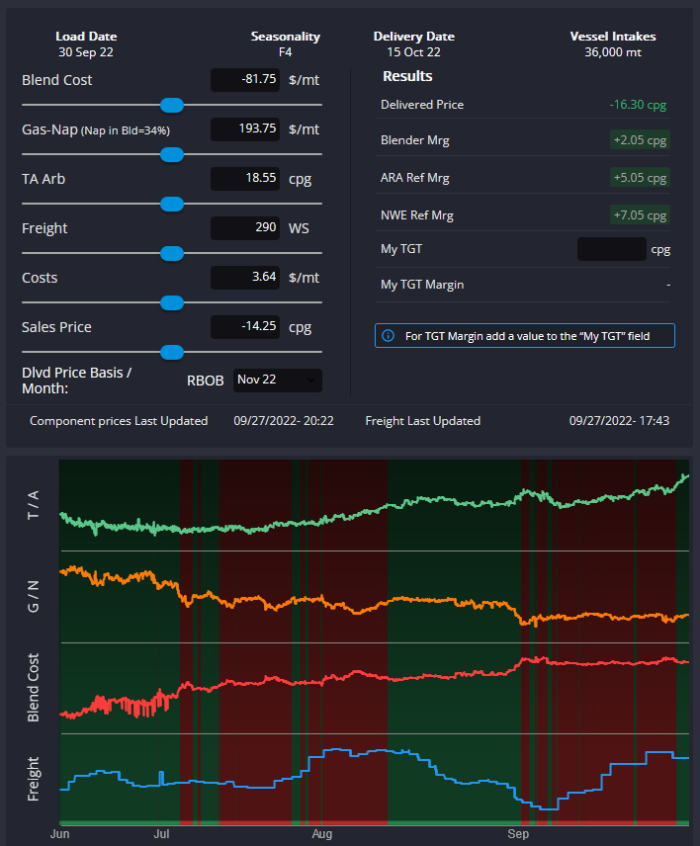

The T/A arb spread has been widening steadily in recent weeks, with the September arb closing the month around 18.5cpg, up from just 5.73cpg in the first week of September. This rise has been outweighing pressure on the arb from rising blend costs and freight rates (see chart).

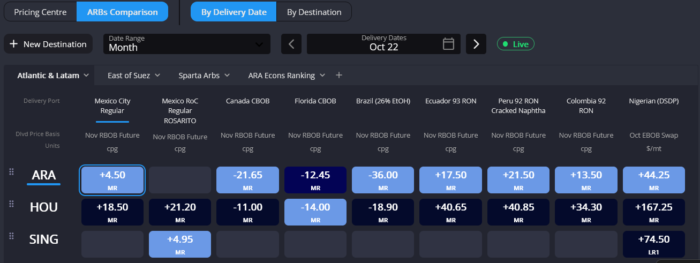

Finally, with structures remaining elevated, it is worth drawing attention to our 5-day loading windows and the extra level of detail these offer vs our monthly views, which typically take mid-month values. On the TA route, for example, we can see the sizeable shifts within given months – often enough to open and close the arb for blenders are refiners alike.

Crucially, for October, our monthly view shows the blender margin positive from ARA into NYH, because it takes the mid-month delivery window (15th October). In reality, however, the rest of the month looks quite firmly shut for blender margins in particular – a timely reminder to always look into the additional level of detail available.

Philip Jones-Lux is Commodity Owner for Sparta. Having worked with organisations such as JBC Energy and RP Global, Philip is a seasoned energy market analyst with expertise across the oil barrel and power markets

Sparta is a pricing and information platform that enables oil traders, refiners, banks, hedge funds and wholesalers to have access to real-time and global actionable insights to capture market opportunities before others.

To find out how Sparta can allow you to make smarter trading decisions, faster, contact us for a demonstration at sales@spartacommodites.com