Remaining very cautiously optimistic on diesel and jet pricing from here, despite positions held in the market

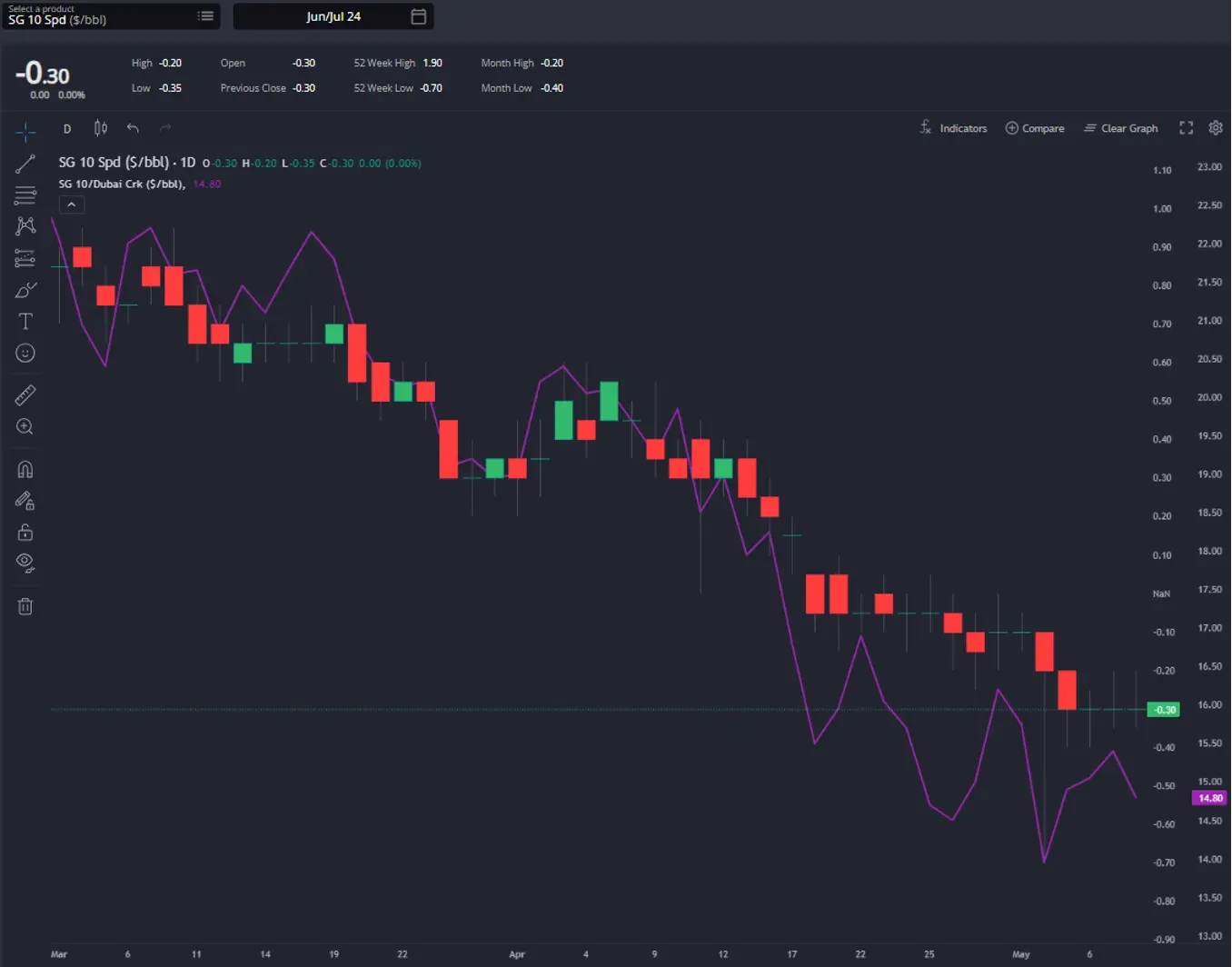

June’s Singapore diesel cracks and spreads. (Sparta Live Curves)

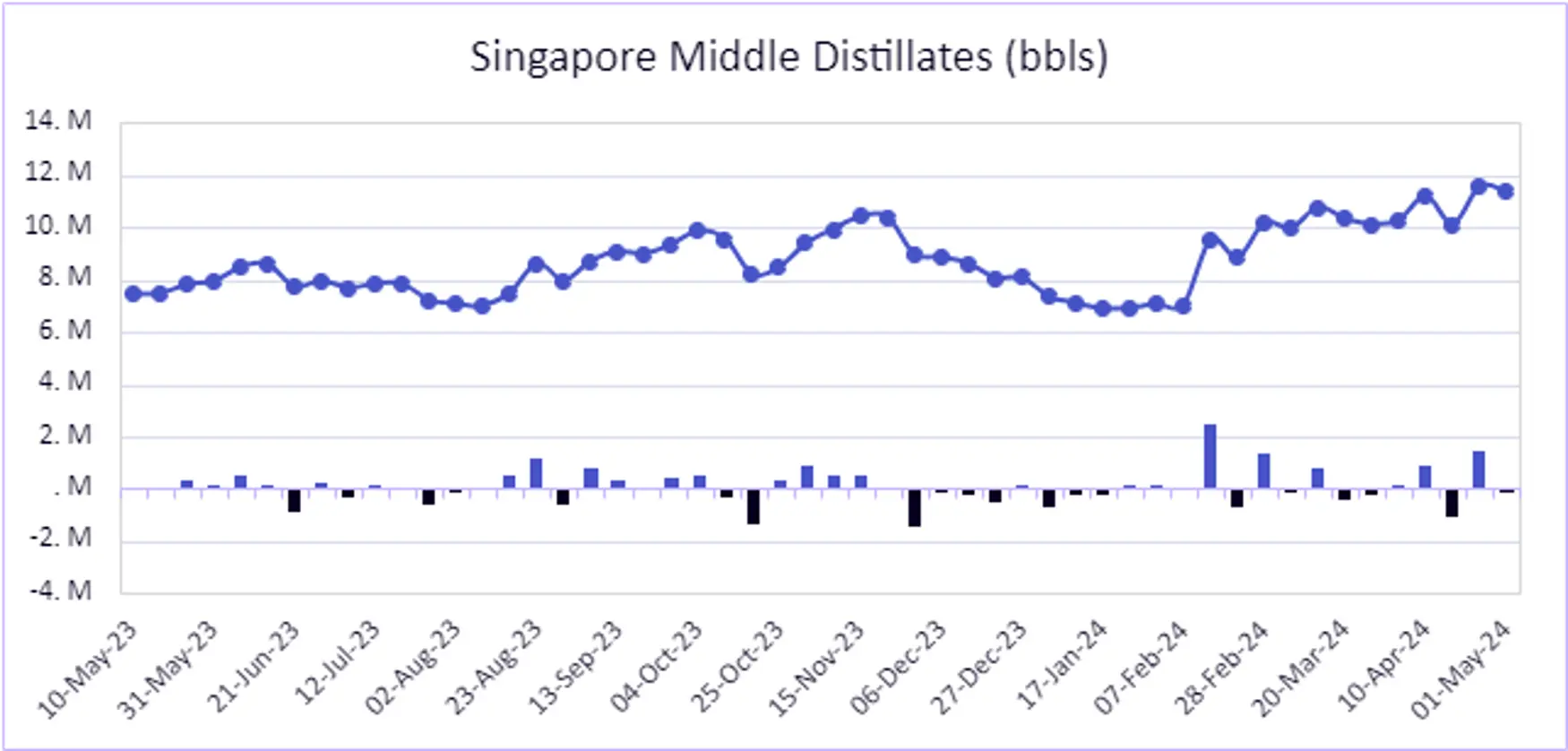

Singapore middle distillate stocks (Enterprise Singapore via Sparta)

Despite ongoing high imports from South Korea, Singapore middle distillate stocks have begun to decrease, indicating a shift in the market.

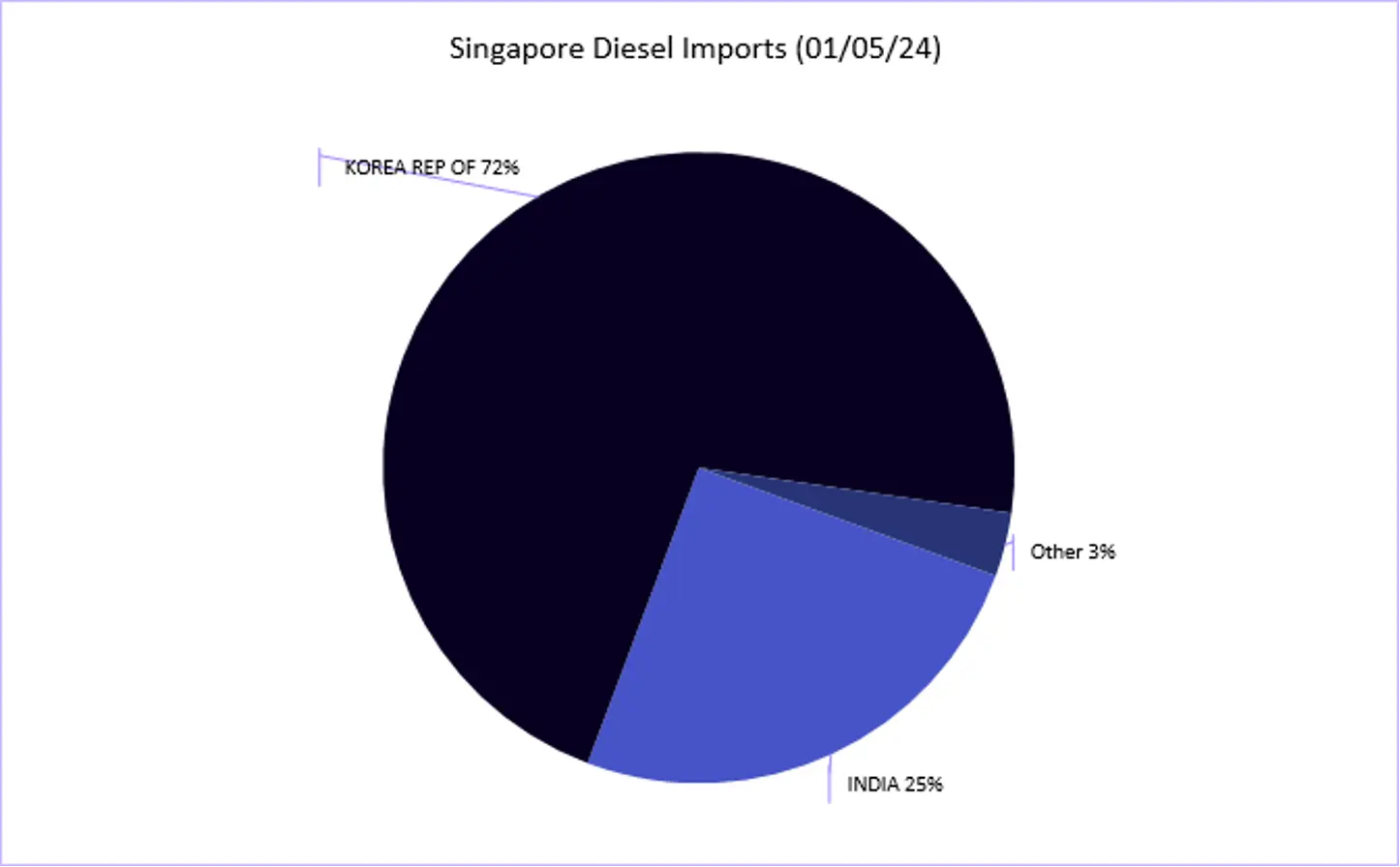

By Origin Dashboard; Sikka. (Sparta Global ARBS – ARBs Comparison)

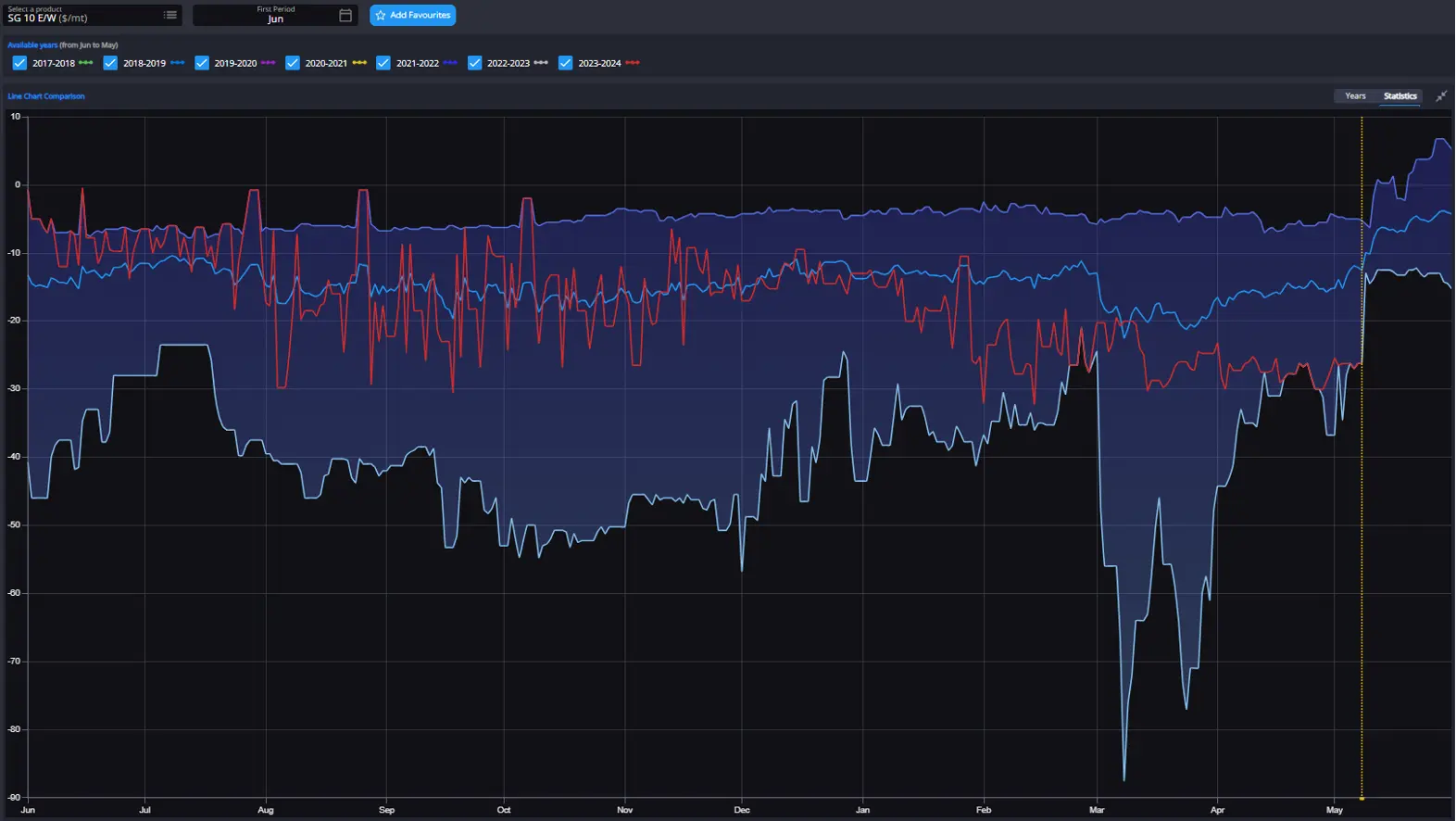

Notable diesel supply from WCI has also contributed to Singapore’s stock data, maintaining the GO E/W at relatively flat levels and directing WCI arbs towards the East.

China issued its second 2024 quota for refined fuel exports this week, albeit slightly reduced compared to the first 2024 batch. (2024’s first 2 batches were over 7% higher than those of 2023).

However, vessel tracking data reveals a slight decrease in Chinese diesel and jet exports as we move forward through 2024, likely due to diminishing export and refining margins, as well as ongoing turnarounds in China.

With these above-described factors in mind, including anticipated reduced exports from China and South Korea, there’s a growing sentiment of cautious optimism regarding Singapore diesel pricing in the short to medium term.

Rotterdam. (Sparta Global ARBS – Pricing Centre)

June’s GO E/W. (Sparta Historical Forwards)

ICE GO diesel cracks and spreads mirrored those of Singapore this week, flattening out after a period of decline.

Meanwhile, US diesel arbs remain closed to Europe, while East of Suez arbs either point mostly eastward or remain shut to Europe, indicating reduced diesel arrivals in the European market and to potentially lower elevated stock levels.

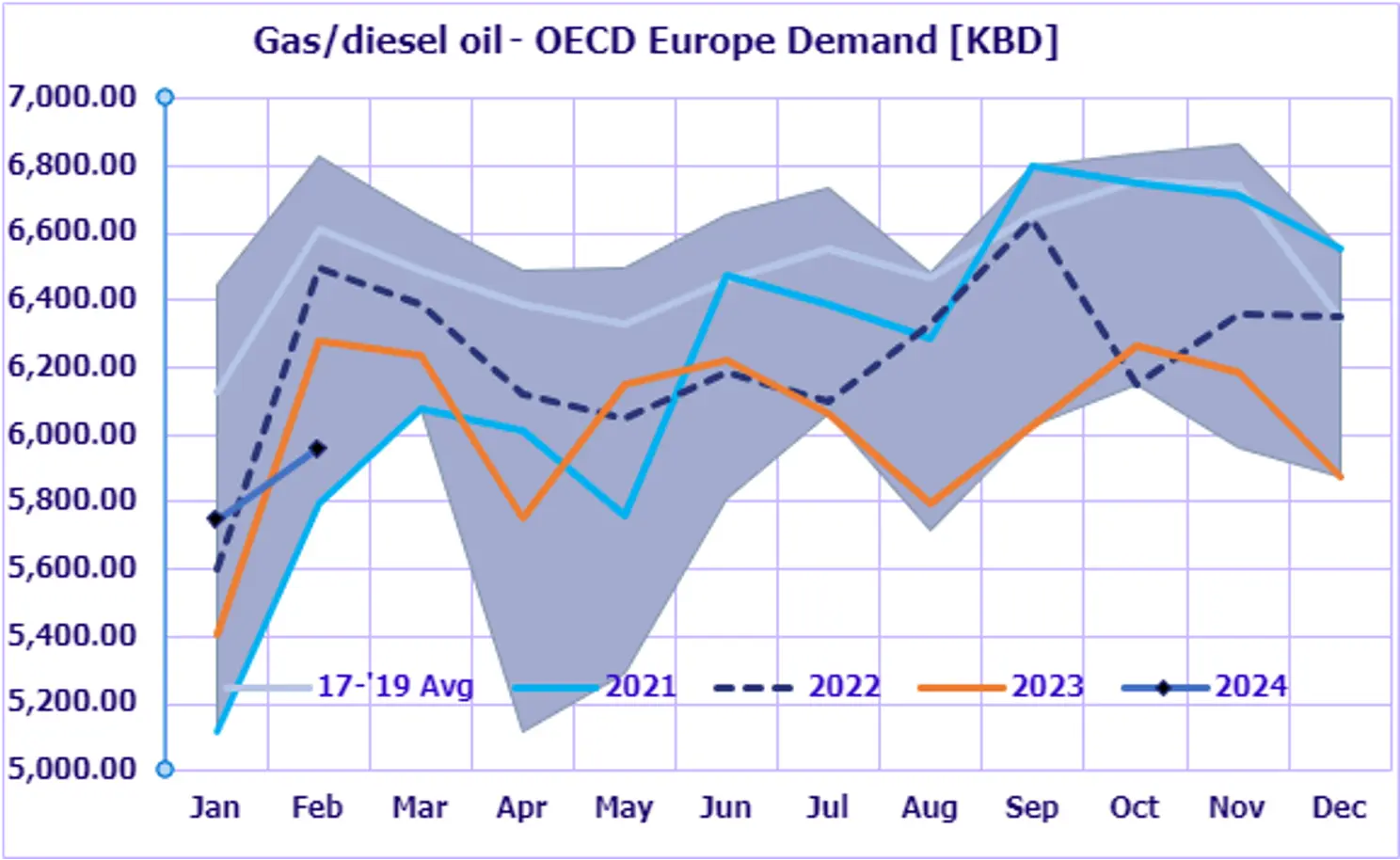

European diesel demand (JODI via Sparta)

Considering these factors, we maintain a cautiously bullish view of European diesel pricing, tempered by lingering weak demand and broker reports of some large diesel vessels again traversing the Suez Canal.

June’s NWE jet CIF differential and spreads. (Sparta Live Curves)

In contrast, European jet differentials and spreads have shown signs of improvement, aligning with earlier predictions.

Our previous observation of the closure of Asian jet arbs has led to decreased arb arrivals in Europe, reflecting market equilibrium and improving European demand as summer approaches.

June’s Singapore regrade. (Sparta Live Curves)

However, a widening Singapore regrade has led to the reopening of these arbs, underscoring the need for continued monitoring via our platform.

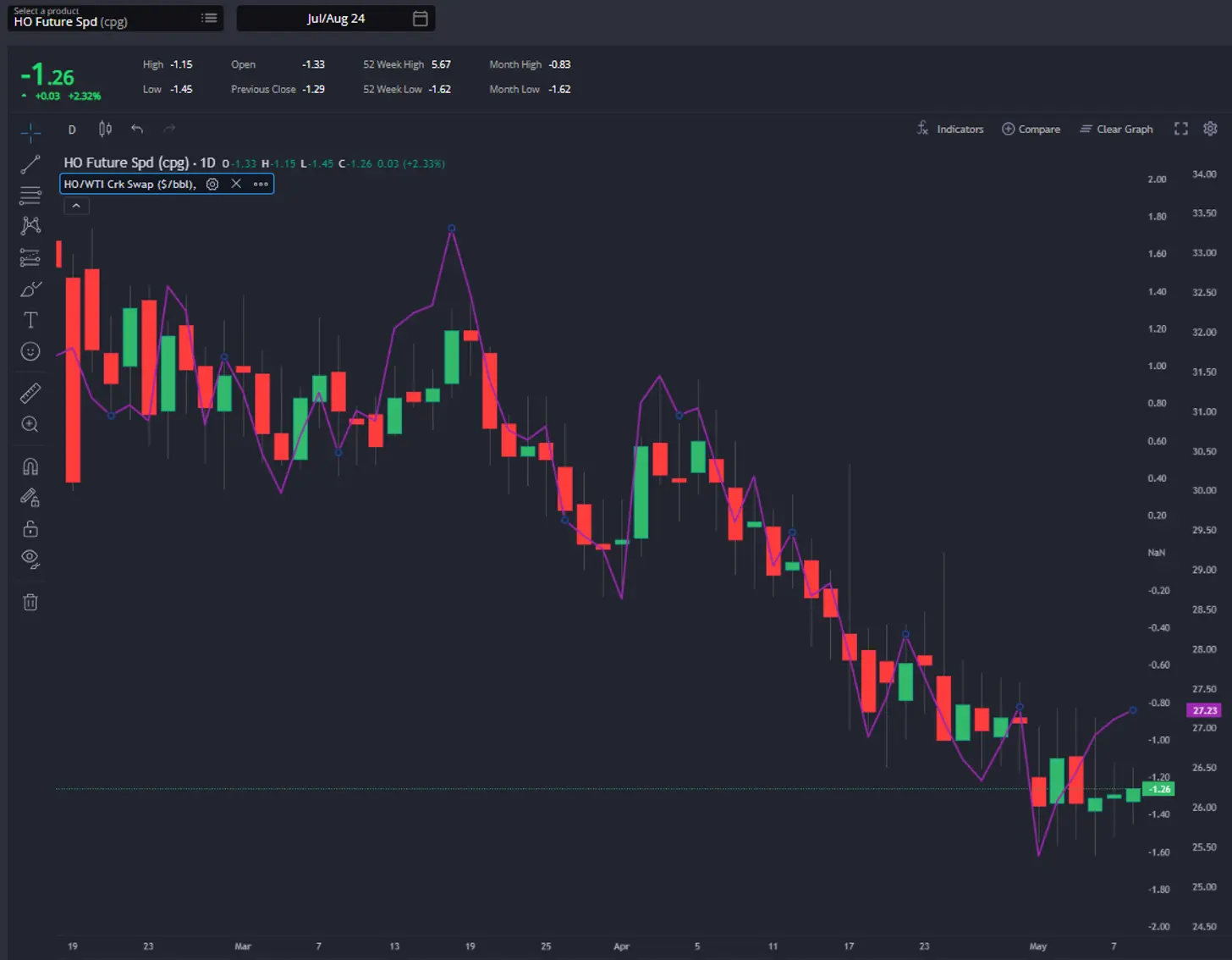

July’s HO crack and spread. (Sparta Live Curves)

This week, June’s HO cracks and spreads have mirrored the trend seen in Singapore and GO, showing signs of flattening out this week, albeit with some gains in the crack.

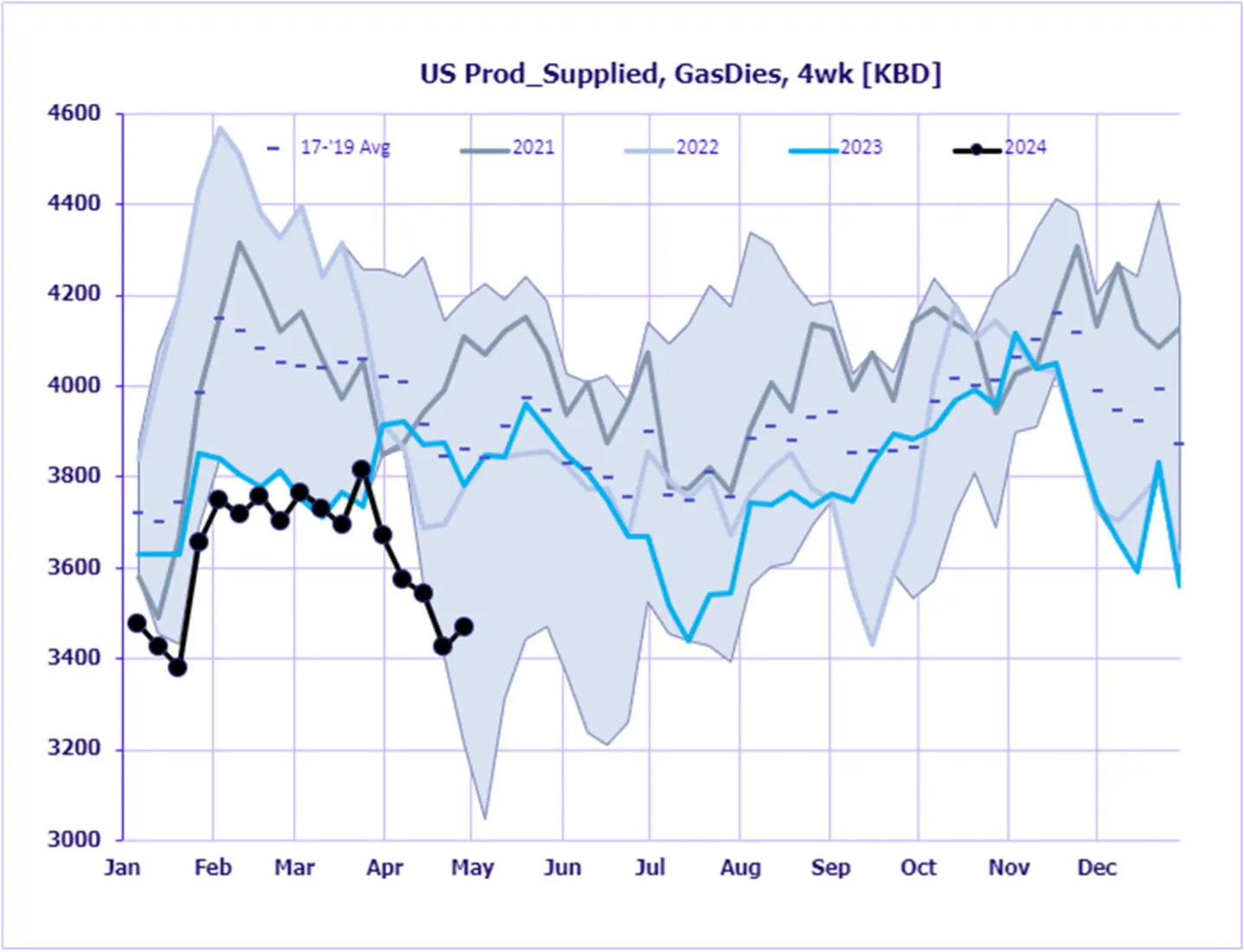

US diesel demand (Source: EIA)

This trend persists despite the USGC TA arb remaining closed and sluggish diesel demand in the US, attributed to bio substitution and ongoing economic sluggishness.

Reports from brokers and our platform indicate a heightened demand for US diesel from Latin America, driven by reductions in Russian diesel arrivals and the pricing up of Asian barrels. As a result, we cautiously anticipate a further increase in US diesel pricing.

James Noel-Beswick is Commodity Owner for Sparta. Before joining Sparta, James worked as an analyst for likes of BP and Shell, and leads our continued development of the distillate product vertical.

Sparta is a live, market intelligence and forecasting platform that enables oil traders, refiners, banks, hedge funds and wholesalers to have access to real-time and global actionable insights to capture market opportunities before others.

To find out how Sparta can allow you to make smarter trading decisions, faster, contact us for a demonstration at sales@spartacommodites.com