Flat price tumble sees North Sea-East arbs beginning to open, WTI beginning to lose competitiveness abroad

The flat price correction last week was led by ICE Brent, with M1/3 spreads falling roughly $1.20 in 5 sessions, significantly more than Dubai and WTI equivalents. Last week we did mention physical and paper slightly out of sync, which now looks at least partly resolved as a result.

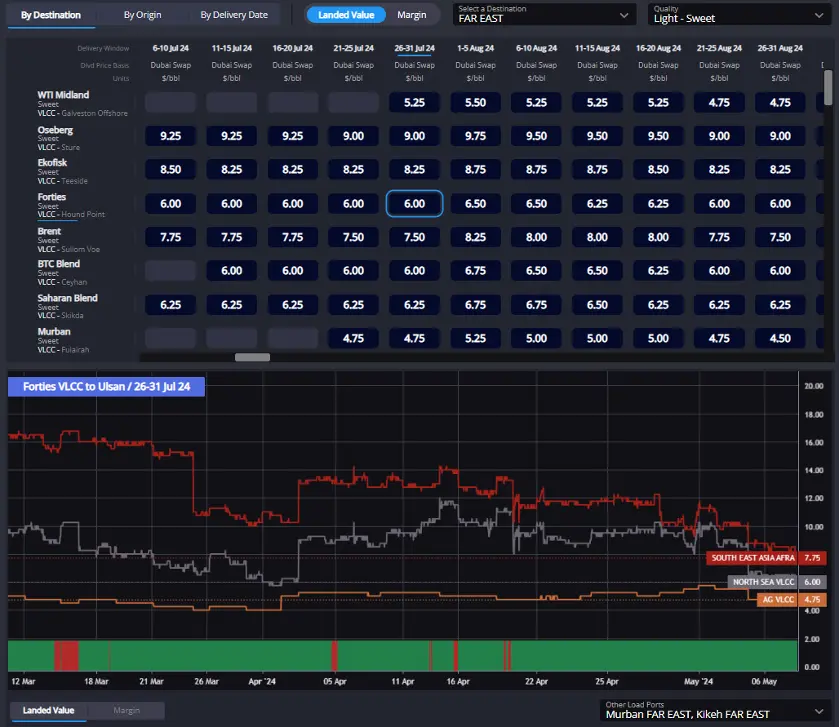

CFDs are of course also substantially weaker w-o-w, and alongside an $0.80 compression of the EFS, Brent-linked Atlantic/Med crudes are landing into Asia at their relative cheapest in quite some time.

Forties – whose FOB dropped $1/bbl late last week – is now landing at ‘only’ $1/bbl higher than Murban, basis our calculations, for late July delivery. The North Sea grade is also landing now almost $2/bbl cheaper than Malaysian Kikeh (fairly equivalent on an API basis).

Forties crude is growing more competitive in the Far East. (Sparta Global ARBS – ARBs Dashboard)

Interestingly, Forties is also landing essentially on par with WTI into the Med for early July, following several months landing at substantial premiums, and is beginning to grow fairly competitive with the likes of BTC Blend in the same region.

Forties is landing landing on par with WTI into the Med. (Sparta Global ARBS – ARBs Dashboard)

Black Sea FOB premia themselves are also making some attempt to price into the East of Suez. Azeri Light & BTC FOBs have dropped off a good 50 cents in the last few sessions relative to Dated, and both are now landing at substantially reduced premiums to e.g. WTI and Murban in West Coast India & Far East.

Black Sea and Med grades are also pricing better into East of Suez locations. (Sparta Global ARBS – ARBs Dashboard)

All this means there are higher chances for extra barrels to head East, assuming that Asian demand is there.

Much talk of economic run cuts in recent weeks is overblown in our opinion, with margins still healthy enough, which means rather that Asian demand could rather pick up once turnarounds peak and diminish. But North Sea/Forties also looks primed to rebound a little.

The other aspect here is WTI, which now looks slightly pricier vs competitors (out of the Atlantic Basin) than in prior weeks. In addition to the above, WTI barrels are now landing in NWE at $1/bbl higher than Forties for late June delivery, but also at a premium or flat with a number of Med & Black Sea barrels.

WTI is looking less clearly competitive in NWE. (Sparta Global ARBS – ARBs Dashboard)

A big issue here is the Wink-Webster pipeline, which should head into maintenance in early June and ultimately should tighten volumes taken to the USGC and push volumes to Cushing.

MEH is for now pricing at very substantial premiums to Cushing, already 3 weeks ahead of this maintenance.

This means extra barrels may be drawn to the USGC over the coming three weeks, potentially even drawing Cushing down.

That plus WTI’s relative loss of arb economics could mean MEH looks a little overbought this early in the month, and Cushing could still prove to be oversold in the very short term.

This week also brought with it the release of Aramco’s June OSPs. The market was somewhat surprised by the size of the hikes if not the direction itself.

These hikes reflect the wider strength in the medium/heavy market and even now term barrels from Aramco remain pretty competitive against spot medium barrels from the MEG and WAF/North Sea. Arab Light landing in the Far East in late July is for example still essentially on par with Johan Sverdrup (despite the latter’s plummeting landing costs of late), as well as spot Basrah Medium, which was bid up late in April.

There should be little concern about either the state of general refining economics, or demand for resid-heavy grades themselves which should remain in short supply.

Arab Light remains relatively cheap despite hikes to OSPs for June. (Sparta Global ARBS – ARBs Dashboard)

Sparta is a live, market intelligence and forecasting platform that enables oil traders, refiners, banks, hedge funds and wholesalers to have access to real-time and global actionable insights to capture market opportunities before others.

To find out how Sparta can allow you to make smarter trading decisions, faster, contact us for a demonstration at sales@spartacommodites.com