RBOB complex reacting quicker than EBOB to bearish signals, but pressure building on European pricing to move significantly lower soon as East struggles with high freight rates

We start today in the East, where bearish sentiment filtering through from the Atlantic Basin as well as a tight clean freight market and high refinery runs in the region are weighing on cracks and spreads.

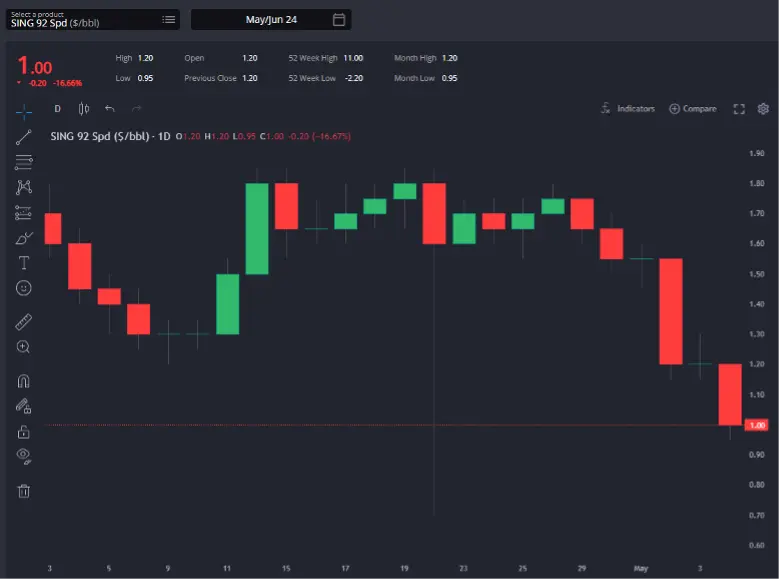

With the Sing 92 spread almost halving to under $1/bbl over the last week and cracks shedding $4/bbl there has clearly been some pressure emerging, but there are reasons to feel that the bottom has likely been reached.

Sing2 spreads have collapsed over the last week, mirroring developments in the West. (Sparta Live Curves)

Component pricing remains strong, with no signs yet from the physical market of any oversupply. (Sparta Live Curves)

With premiums on the majority of blendstocks in Singapore on the rise signalling potentially tightening supply out of Korea, China, Taiwan and WCI, as well as robust premiums on high octane components, the Singapore gasoline market does not look particularly oversupplied.

The Arb into Mexico remains competitive, as shown in our gasoline ARBs Comparison tool. (Sparta Global ARBS – ARBs Comparison)

The adjustment on the paper side has been necessary to keep Singapore competitive into the West Coast of Mexico.

Higher freight rates and gradually increasing component pricing has pushed blend costs higher in recent weeks, but these should have run their course now and overall it looks like it the Sing92 complex should have a floor here (although it can always be dragged lower if the Atlantic Basin continues to weaken).

The RBOB arb has slammed even further shut as RBOB retreats. (Sparta Global ARBS – Pricing Centre)

In the Atlantic Basin, the RBOB complex has reacted very strongly in comparison to EBOB in the last few days, slamming shut the opportunities that were beginning to creep open for ARA barrels into Canada, Brazil, etc.

The latest moves have also shut any marginal opportunity for even the more advantaged European players to place RBOB into NYH at a profit, with pressure now imminent on the European side.

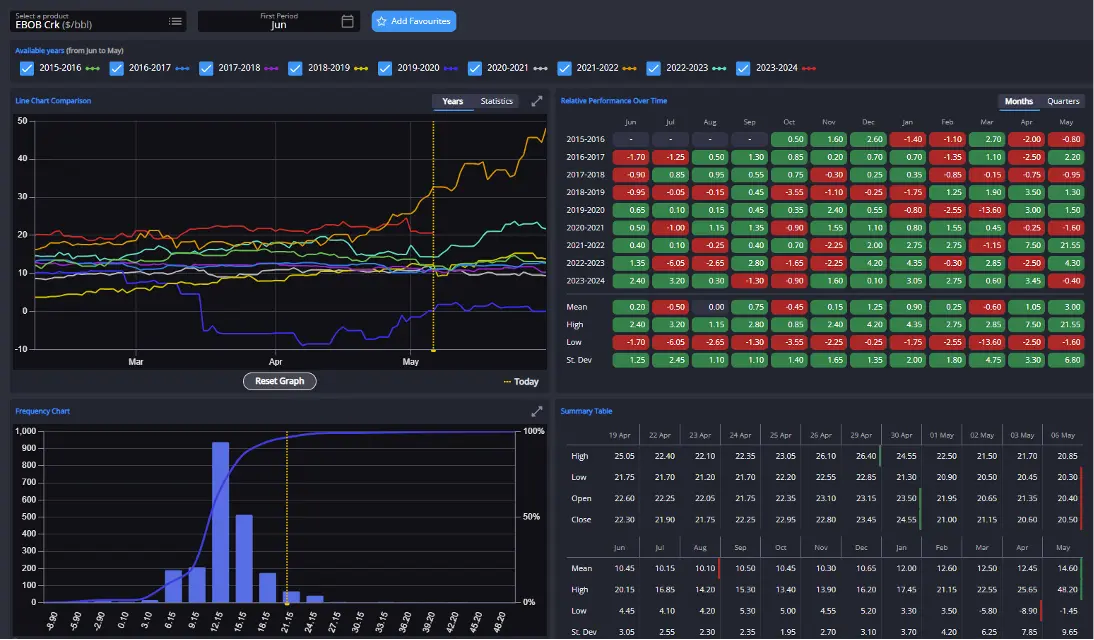

EBOB cracks remain in the 97% percentile for this time of year according to our Historical Forwards feature. (Sparta Historical Forwards)

EBOB cracks remain unseasonably and unjustifiably high. $20/bbl at this time of year is essentially unheard of and remains unjustifiable through the rest of the quarter as supply returns.

Even with ongoing Russian sanctions lifting the baseline for European refined products cracks, the cost of refining has come down significantly since even last year and we remain at crack levels significantly higher than 2023.

RBOB spreads narrowed more quickly than EBOB over the last week or two. (Sparta Live Curves)

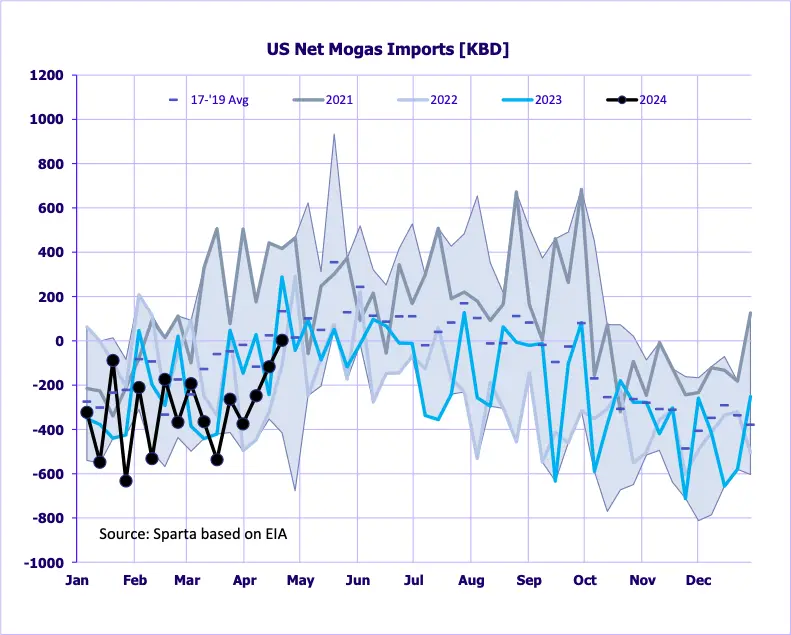

It is a relatively early return to net-importer status for the US according to recent EIA data. (Source: EIA)

Across the Atlantic, the latest US weekly numbers continue to paint a mixed bag for US gasoline fundamentals, with net exports returning to parity thanks to the wide-open RBOB arb early-April seeing a strong uptick in arrivals whilst exports took a step lower despite open opportunities on paper.

Yields on crude intake have been dipping, however, possibly reflective of the tightness in residue availability in the region.

A return to early-April freight rates would see the AG competitive into WAF destinations once again. (Sparta Global ARBS – ARBs Comparison)

Overall, with the Atlantic Basin is being shielded somewhat from potential encroachment by EoS barrels by high freight earnings in the East thanks to premiums associated with moving clean vessels from East to West, the USGC should see export demand remaining relatively healthy in the coming weeks.

Lower exports recently point to potentially softening demand from key export destinations in Latin America which could be a worry, but overall the US fundamentals continue to look stronger than those for Europe through the rest of the quarter and some reversal of the recent TA Arb narrowing should be on the books.

Philip Jones-Lux is Commodity Owner for Sparta. Having worked with organisations such as JBC Energy and RP Global, Philip is a seasoned energy market analyst with expertise across the oil barrel and power markets

Sparta is a live, market intelligence and forecasting platform that enables oil traders, refiners, banks, hedge funds and wholesalers to have access to real-time and global actionable insights to capture market opportunities before others.

To find out how Sparta can allow you to make smarter trading decisions, faster, contact us for a demonstration at sales@spartacommodites.com