European strength briefly opens the TA arb whilst Chinese gasoil and Russian diesel export ban weighs on the East/West

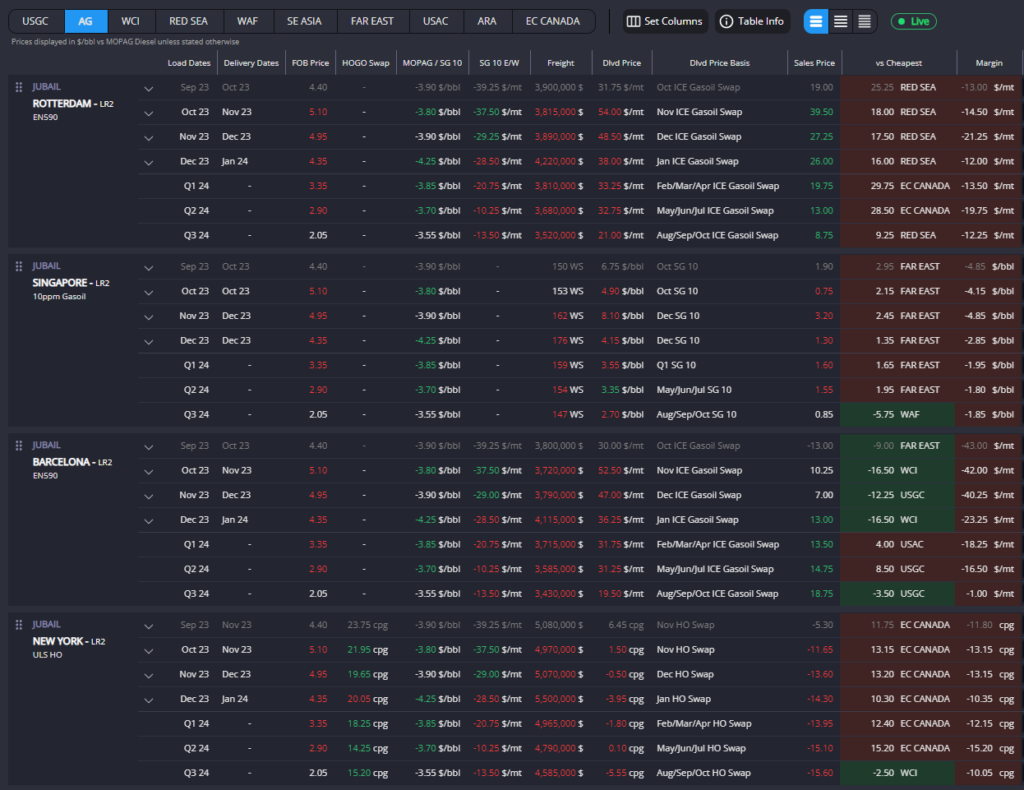

Red Sea maintained its position as the most cost-effective option into Europe, appearing robustly open for the remainder of the year. East Coast (EC) Canada arbs follow this trend, but these currently favour New York/PADD 1, as revealed by our Arbs Comparison dashboard.

Beyond the Red Sea and EC Canada, the Arabian Gulf (AG) and West Coast India (WCI) emerge as formidable contenders.

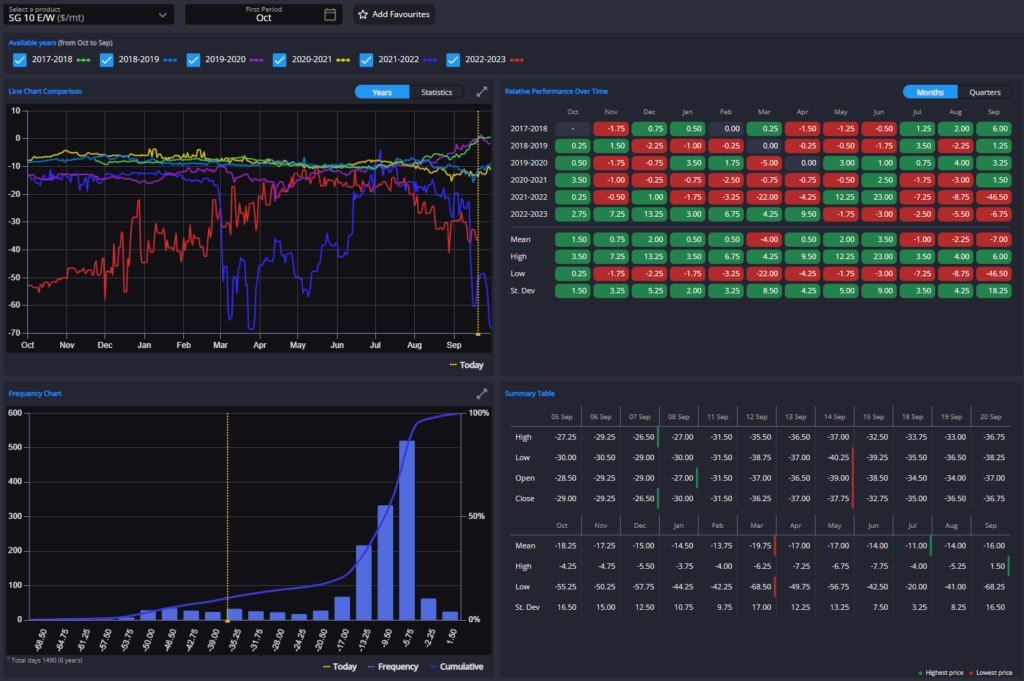

These arbs firmly target Europe, as the October East-West (E/W) ULSD experiences its widest seasonal spread in the past eight years, (discounting 2022’s data), despite October E/W narrowing slightly this week from -$38 to -$36.75 /mt. It should be noted here that AG and WCI FOB premia have been on the rise due to heightened demand from Europe and East Africa, coupled with reduced imports from Russia.

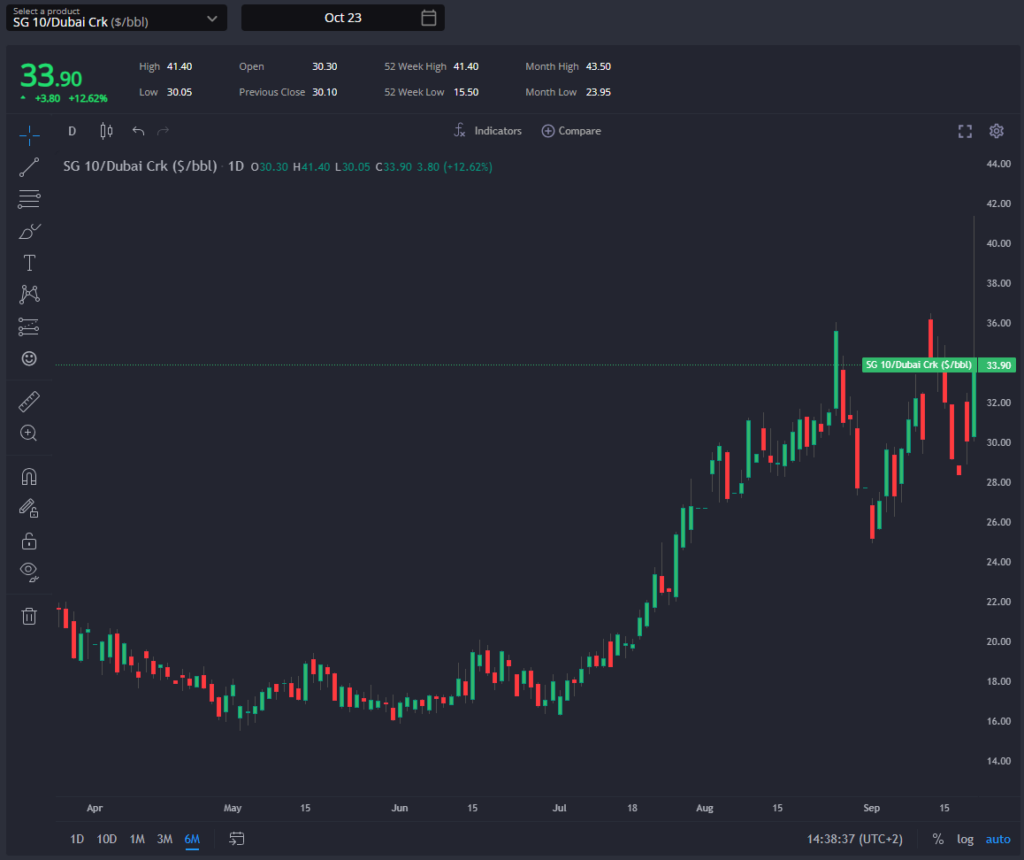

European sales prices remain robust, with both October GO cracks and spreads currently at their highest seasonal levels in eight years.

This strength is due to ongoing low stock levels and maintenance activities as we approach winter, with the recent hydrocracker leak at Shell Pernis exacerbating the situation and contributing to a liquidity surge in the Northwest European (NWE) barge market.

European strength, coupled with low US Gulf Coast (USGC) Medium Range (MR) tanker freight rates at their lowest levels since May 2023, nearly opened the Transatlantic (TA) arb at the beginning of the week.

It seems clear that this European distillate momentum will endure through to the end of 2023, despite forthcoming large amounts of external resupply. Consequently, elevated spreads and cracks are expected to persist, and the E/W spread is likely to widen further from its current historically broad position.

The USGC has solidified its status as the most cost-effective source for Northern Brazil, buoyed by reduced USGC MR freight rates and a narrowing of October’s Heating Oil versus Gasoil (HOGO) from 24 to 21.50 cpg over the past week.

In this week’s report, the US Energy Administration (EIA) disclosed a 7.6% draw in PADD 3 stocks and a 2.4% draw in US stocks overall. This drawdown suggests that pricing in New York Harbour (NYH) and a recently narrowing HOGO may stabilize or even rebound.

Despite these reductions in US pricing and freights, AG/WCI barrels have not been displaced, pricewise, by USGC barrels into Southern Brazil and Argentina, despite soaring FOB premia in those regions. However, the availability of spare barrels for flow to Latin America from AG/WCI is constrained by ongoing turnarounds at MRPL, Jamnagar, and AG refineries, as well as heightened pull from Europe and East Africa.

Russia’s ongoing turnaround period, coupled with rising domestic demand and potential export bans, is expected to further reduce exports, creating additional opportunities for USGC resupply.

Transpacific barrels continue to dominate West Coast Latam, reflecting a trend seen in recent weeks, with a parallel scenario unfolding on the West Coast US.

As winter approaches the US and the wider Atlantic Basin are experiencing a need for resupply, with stocks below their five-year averages.

Consequently, expectations point to Heating Oil (HO) cracks regaining their recent losses in the short to medium term, accompanied by matching widening moves in the HOGO spread.

Currently Taiwanese and South Korean barrels are locked in competition for the title of the most cost-effective option into Singapore. However, data indicates a significant flow of Taiwanese barrels to Singapore, while South Korean barrels are drawn to destinations like Australia and the West Coast of the Americas.

Both Taiwanese and South Korean barrels boast cost advantages over AG/WCI options. This is attributed to increased availability as they emerge from turnaround periods, whereas AG/WCI barrels face rising premia due to factors such as heightened demand from Europe and East Africa, reduced Russian imports, and their own turnaround schedules.

Currently the earlier mentioned position of E/W spread reveals Europe’s robust distillate strength relative to East Asia. This disparity firmly directs AG/WCI barrels westward, aligning with Europe’s relatively higher need at present.

China has made strategic shifts, transferring quotas from low-sulphur fuel oil (LSFO) exports to oil products like gasoline, diesel, and jet fuel for 2023.

Additionally, industry sources inform that China will issue further refined fuel export quotas in Q4 2023. The full extent of which should be known on or after October 6th.

While Singapore’s middle distillate stocks this week dipped to a two-week low, they had surged to a 24-week high in the week prior.

Anticipation of increased Chinese gasoil exports due to a prolonged manufacturing downturn and Singapore’s relatively high stocks compared to the Atlantic Basin, are expected to exert downward pressure on Singapore diesel cracks.

Consequently, the East/West (E/W) spread is likely to remain at its widened position or widen further in the medium term.

James Noel-Beswick is Commodity Owner for Sparta. Before joining Sparta, James worked as an analyst for likes of BP and Shell, and leads our continued development of the distillate product vertical.

Sparta is a live, market intelligence and forecasting platform that enables oil traders, refiners, banks, hedge funds and wholesalers to have access to real-time and global actionable insights to capture market opportunities before others.

To find out how Sparta can allow you to make smarter trading decisions, faster, contact us for a demonstration at sales@spartacommodites.com