Market recovers on the back of arb to Asia marginally open; PADD 1 stocks suggest further tightening

There has been another abrupt shift in the naphtha market trend, maintaining the high volatility seen since the end of Q1.

Robust European petrochemical demand, coupled with record gas-nap values that stimulated blending demand, was followed by a severe correction that particularly affected the European market, impacting spreads, cracks, and physical premiums.

However, the market is rebounding even more strongly.

There has been a large uptrend on time spreads in EU and Asia, while Asian physical prices climbed after a big downtrend since the beginning of the month. (Sparta Live Curves)

Market tightness raises the question of where the peak of the bullish market trend lies. The arbitrage to Asia is a significant indicator for maintaining premiums’ upward trajectory. If new opportunities are confirmed, it would help sustain the strength on European prices.

After nearly touching a discount in NWE sales, prices have rebounded by $5/mt for OSN grades destined for the region’s steam crackers.

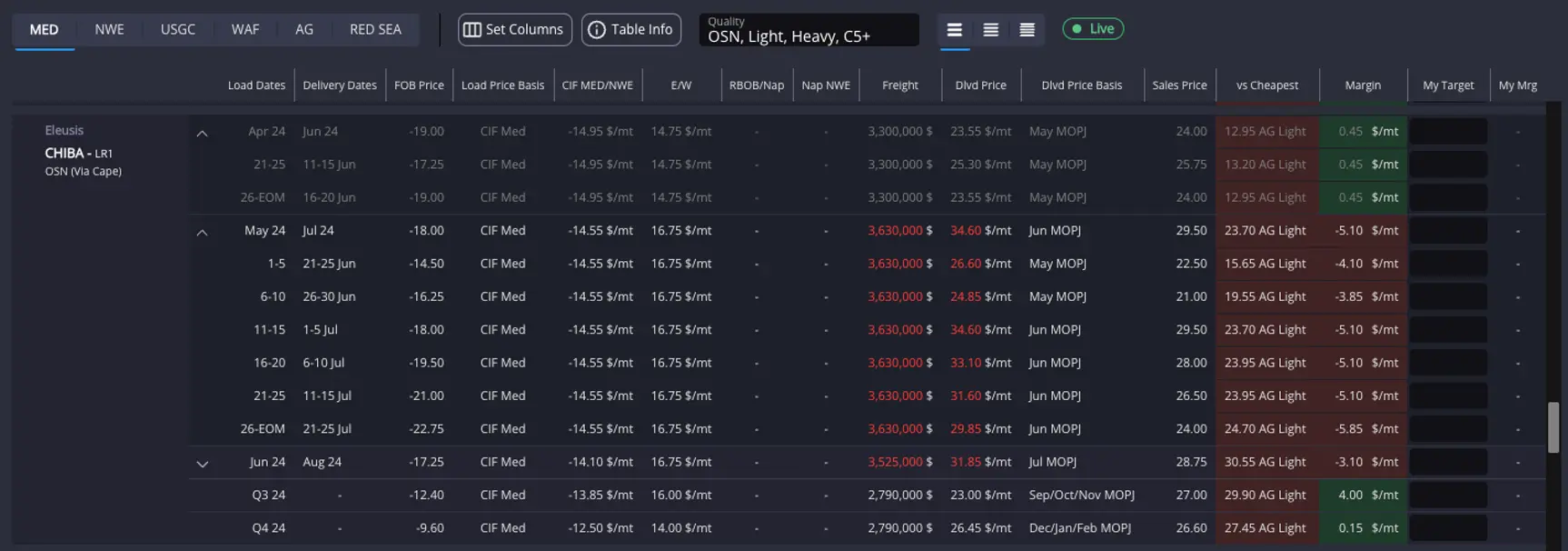

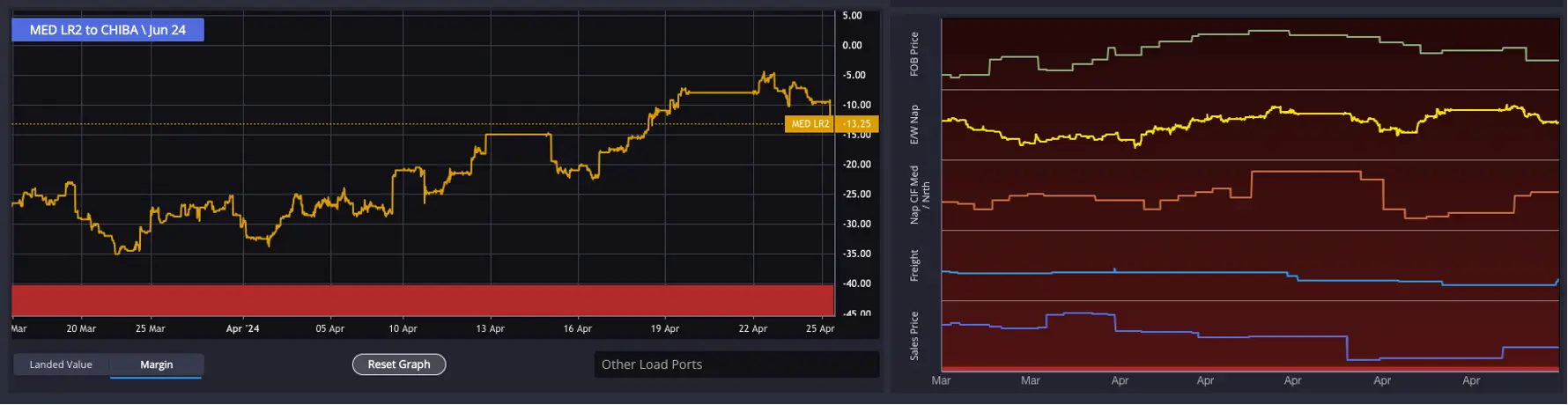

The economics of an LR2 arbitrage from the Med to Asia via the Cape of Good Hope are currently closed at $10/mt for paraffinic grades, having corrected downwards due to the rise in freight rates and the $3/mt decline in East/West differentials.

However, the outlook for July deliveries is substantially better, potentially leading to new shipments bound for Japan and Korea, pushing the European market for further increases.

During the beginning of the week, we did see the arbitrage open for the first time in over a month and a half. This was due to the uptick in Asian premiums along with the prolonged decline in FOB prices in Europe and the rise in East/West differentials.

This situation did not last long and after one or two sessions and the confirmation of a Skikda shipment heading Eastward, the margin closed again, indicating that for the time being, Asia is well covered and will not demand more spot cargoes from the West.

However, the outlook suggests that more opportunities will appear in the short term.

Med to Japan has been slightly open at the beginning of the week and now shows small negative numbers. (Sparta Global Arbs Table View)

The figures, taking into account the Red Sea route, show open arbitrages for some grades from the eastern Mediterranean. However, these options are not viable in the short term, so they would not have an immediate effect despite showing a positive margin for June deliveries.

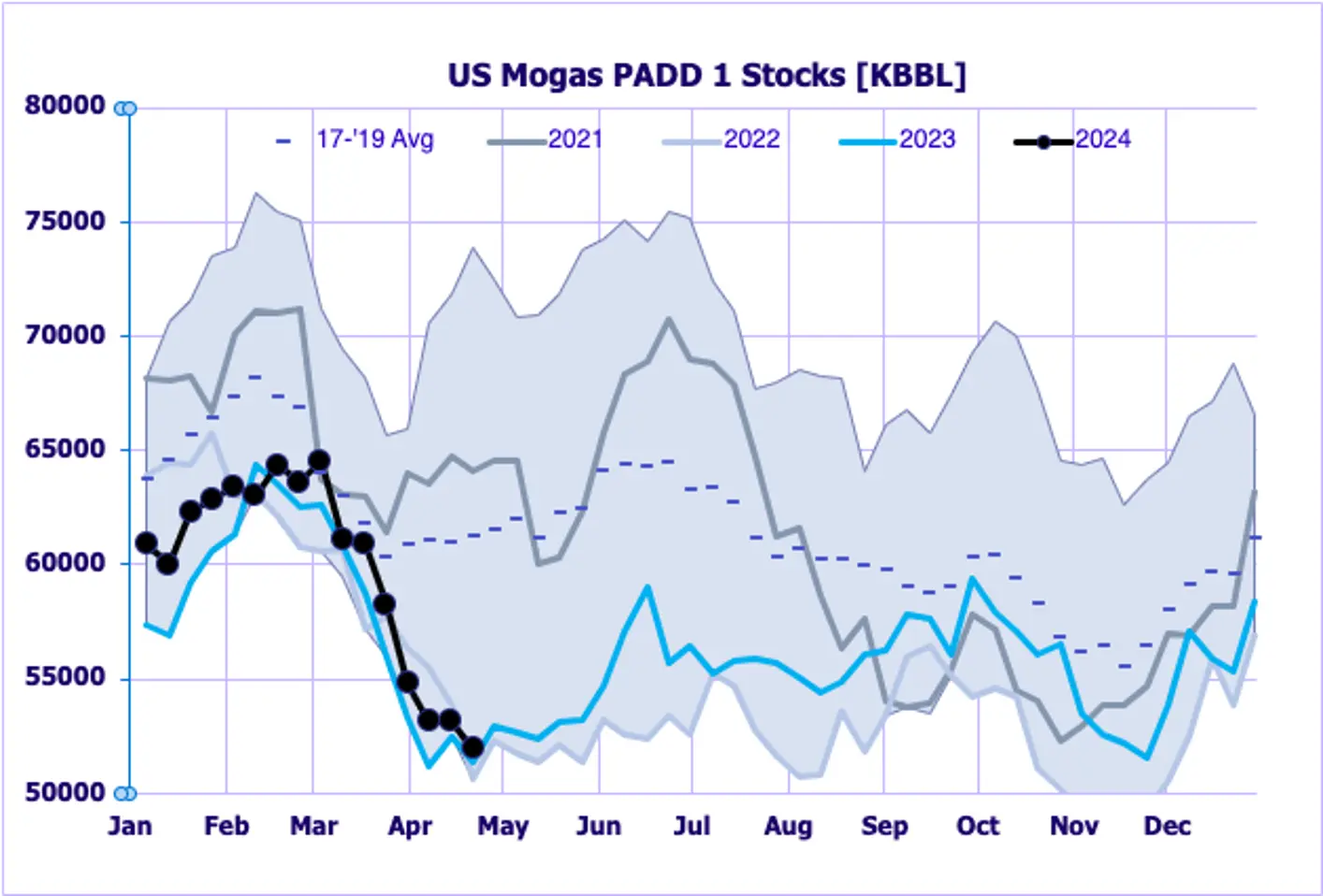

On the gasoline side, the focus is on tightening PADD 1 stocks, which have stimulated the TA arb and gas-nap slightly, affecting the gasoline market and also USGC prices.

Following last week’s rebound, arbitrages to Europe and Asia in the medium term have closed. Currently, the US gasoline market faces a divergence between a USGC, where stocks have rapidly recovered, surpassing the average of recent years after the end of Q1 turnarounds, and a PADD 1 that remains very tight due to low inventories.

NY tightness has impacted USGC-NWE naphtha arbs. (Sparta Global ARBS – ARBs Comparison)

Stocks in PADD 1 under pressure, keeping the US market tight. (Source: EIA)

Jorge Molinero is Commodity Owner for Naphtha and LPG at Sparta. Starting his career as a financial analyst with BBVA, Jorge quickly transitioned to market intelligence within the energy sector, spending 4 years as a naphtha analyst with Repsol before joining Sparta in early 2023.

Sparta is a live, market intelligence and forecasting platform that enables oil traders, refiners, banks, hedge funds and wholesalers to have access to real-time and global actionable insights to capture market opportunities before others.

To find out how Sparta can allow you to make smarter trading decisions, faster, contact us for a demonstration at sales@spartacommodites.com