Quality vs quantity to remain the main price driver into the summer months, with some short-term downside still on the cards for Atlantic Basin gasoline

Whilst it is a price spread that we have talked about often already, the continued seasonal record highs in gas-nap remains one of the most significant drivers in global gasoline markets currently.

Looking at the history of the June gas-nap spread from the last few years, we can see that we are already well above previous years’ levels and whilst last year only hit current levels through May, there appears to be no reason to suspect this year’s spread will narrow again in the short-term.

Without significant investment in new naphtha upgrading capacity, this will remain a feature of the market, impacting most notably the baseline level of the TA Arb spread.

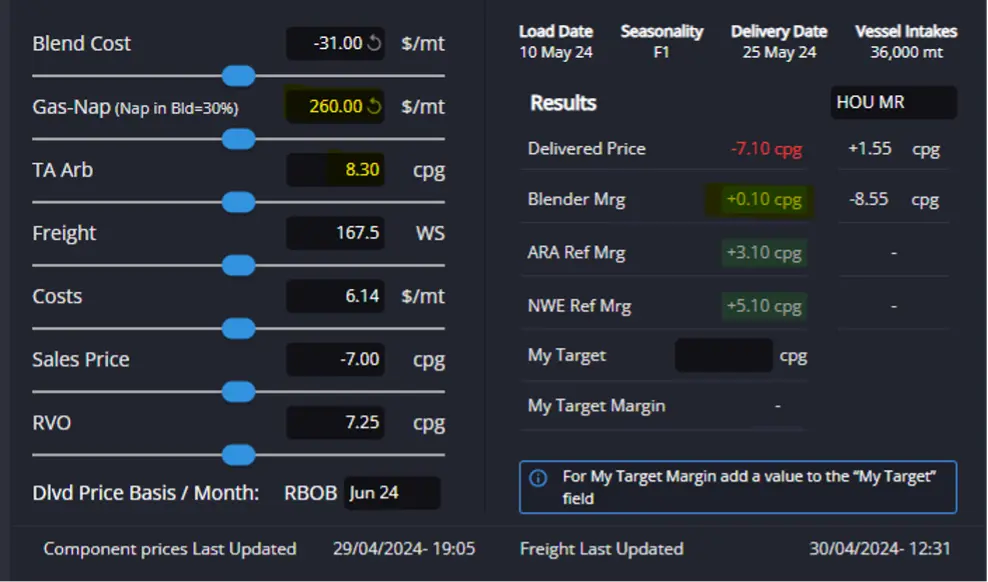

Over the last week or so, the RBOB arb has closed further, in this case despite the wide gas-nap. With the paper TA Arb spread holding steady in the low 8cpg range, another ~$30/mt on the gas-nap spread would be enough to reopen the arb for ARA blenders without any move on the underlying paper.

This makes it increasingly difficult to confidently call the underlying paper spread between the two pricing benchmarks, leaving us to take a closer look at pricing indicators on either side of the Atlantic in isolation instead.

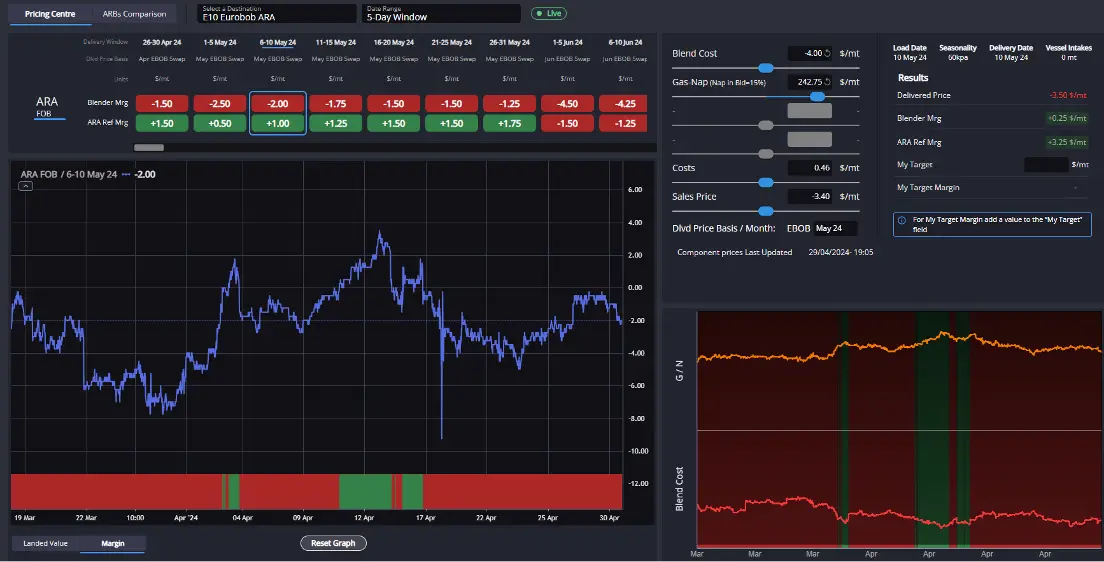

With prompt E10 blend margins still just about closed, we are seeing no strong support for component pricing currently, with only WAF as an outlet which is definitively pointing to ARA for resupply.

The marginal uptick in the TA Arb and a strengthening USGC market is starting to see ARA arbs pressure into EC Canada, but that remains the extent of the outlets for now. With refinery supply ramping up in Europe without any strong domestic demand signs, the outlook on EBOB remains soft.

Across the Atlantic, the USGC still has options into the Pacific, with WC Mexico and Australia looking to Houston at the moment – helped in large part by consistently falling freight rates out of PADD-3.

Coupled with no significant uptick in component premiums in the USGC to indicate any kind of tightness, and it looks as though the USGC market is still looking to push the marginal barrel out into the market and is probably at least a month away from starting to display any typical summer tightening.

In the East, the picture remains decidedly mixed without any strong direction. The USGC is pressuring somewhat into swing outlets for Singapore-origin barrels, but spreads and cracks have been decidedly range bound since March.

Looking ahead, the most likely source of movement for the Asian market now looks to be the distillate market and potential pressure on overall refining margins.

With incremental naphtha supplies potentially being hit first, this would help to provide a solid floor underneath the Asian gasoline complex for the summer ahead.

Philip Jones-Lux is Commodity Owner for Sparta. Having worked with organisations such as JBC Energy and RP Global, Philip is a seasoned energy market analyst with expertise across the oil barrel and power markets

Sparta is a live, market intelligence and forecasting platform that enables oil traders, refiners, banks, hedge funds and wholesalers to have access to real-time and global actionable insights to capture market opportunities before others.

To find out how Sparta can allow you to make smarter trading decisions, faster, contact us for a demonstration at sales@spartacommodites.com