Diesel arbs are closed to Europe whilst US and Singapore diesel stocks reduce; signals somewhat of a recovery/floor after a long period of bearish sentiment in the diesel market

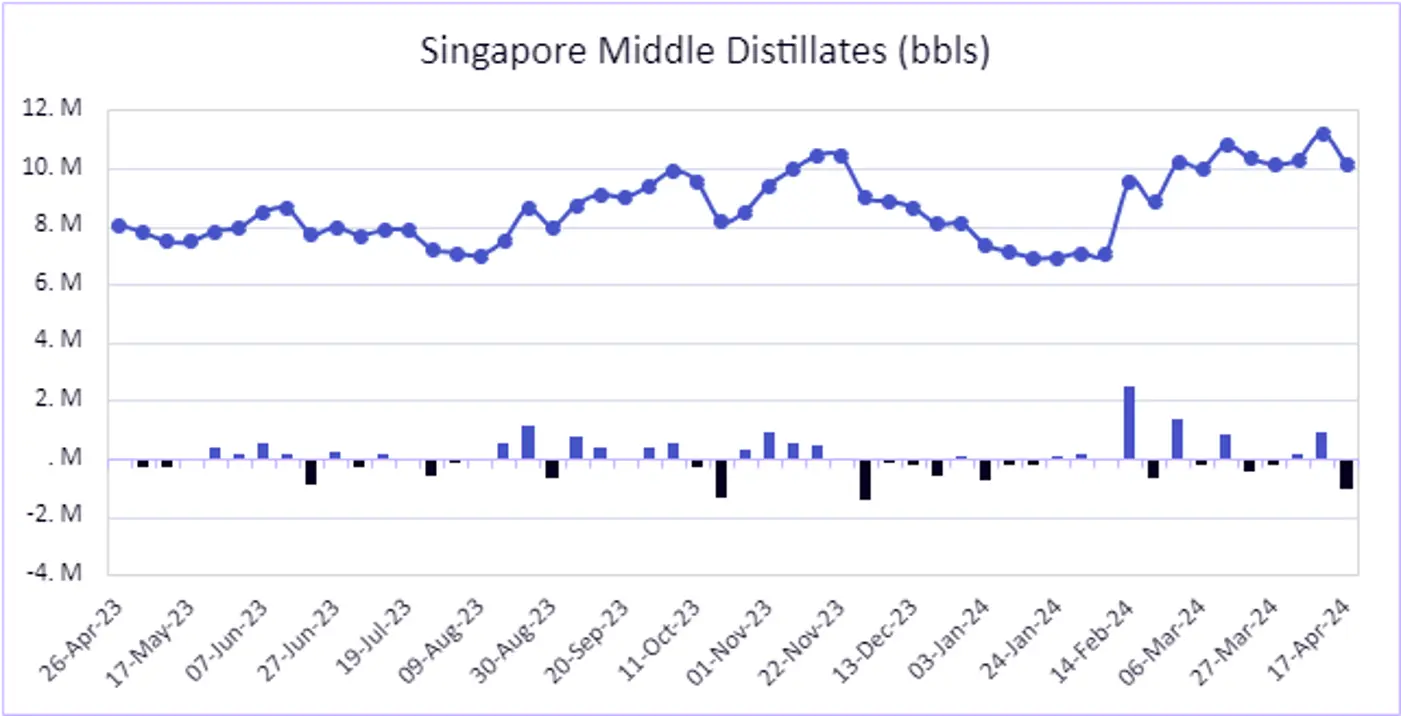

Singapore middle distillate stocks.(Enterprise Singapore via Sparta)

Singapore diesel cracks and spreads have sustained their downward trajectory since early February, particularly affecting the crack but with the spread also very close to contango.

Whilst the spread experienced a relatively minor decline, May’s crack declined significantly from $17.15 to $15.15 /bbl this week.

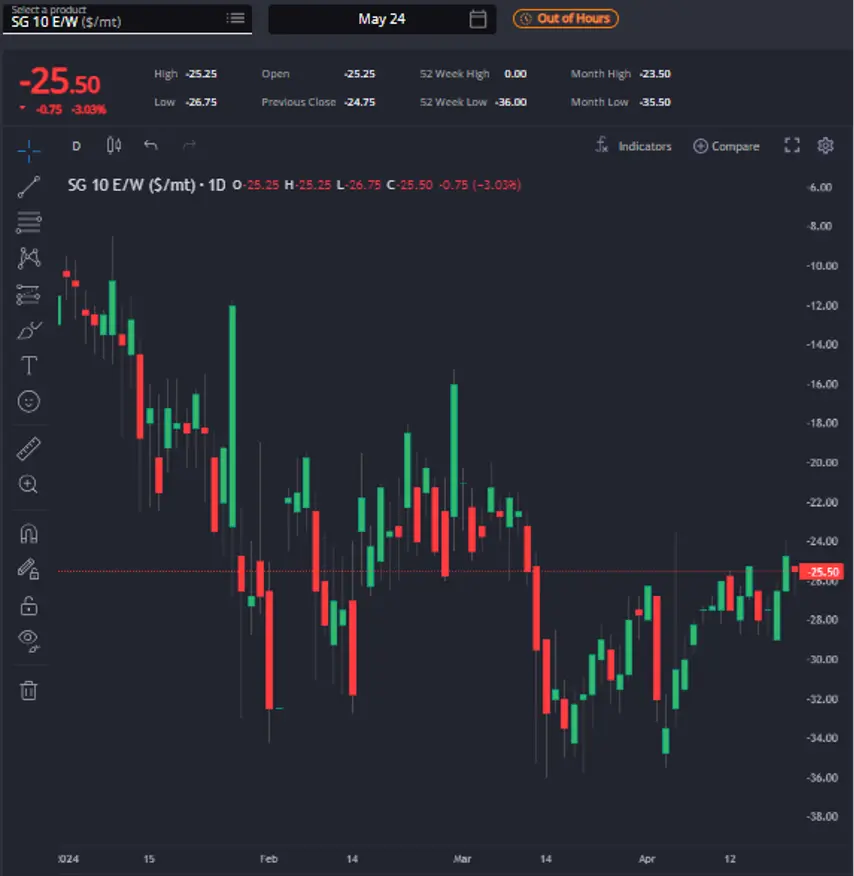

May’s GO E/W. (Sparta Live Curves)

Nevertheless, European pricing has weakened further relatively speaking, with the GO E/W narrowing to -$25.5 /mt this week.

Diesel; Jubail. (Sparta Global ARBS – ARBs Comparison)

AG and WCI loaders now direct toward the Singapore region rather than Europe in the very prompt, albeit the difference in netbacks, particularly with the MED, are more marginal down the curve.

Although Singapore middle distillate stocks showed a notable draw in recent figures, the outlook remains neutral to bearish in the short to medium term.

This view is established by the combination of an impending increase in Asia Pacific turnarounds by the end of April and the shift of AG/WCI diesel loaders towards Singapore.

May’s ICE GO spread and crack. (Sparta Live Curves)

Diesel; Rotterdam. (Sparta Global ARBS – ARBs Comparison)

ICE GO diesel cracks and spreads have sustained their downward trend, with May’s ICE GO future spread currently at -$2.25 /mt.

The previously mentioned narrowing of the GO E/W has started to point AG/WCI arbs marginally eastward.

Therefore, the most cost-effective arbs into Europe currently are EC Canada, Red Sea, and then USGC.

Even habitually open Red Sea arbs to Europe are currently closed.

USGC arbs remain shut by $8 to $10 /mt due to the widened HOGO largely caused by European diesel weakness, despite weak TC14 freights.

May’s HOGO swap and TC14 freight. (Sparta Live Curves)

Shipbroker reports indicate Atlantic Basin freight rates are struggling and with Europe underperforming, USAC tonnage continues to filter to the USGC.

As such TC14 freights are expected to decrease in the short to medium term and with limited Latin American demand for USGC diesel cargoes more flow to Europe is anticipated.

However, with AG/WCI cargoes heading east and USGC and Red Sea arbs closed to Europe, a short- to medium-term improvement in European diesel pricing is projected, after Europe has somewhat worked through its current diesel surplus.

As such European demand improvement is an important factor to monitor here.

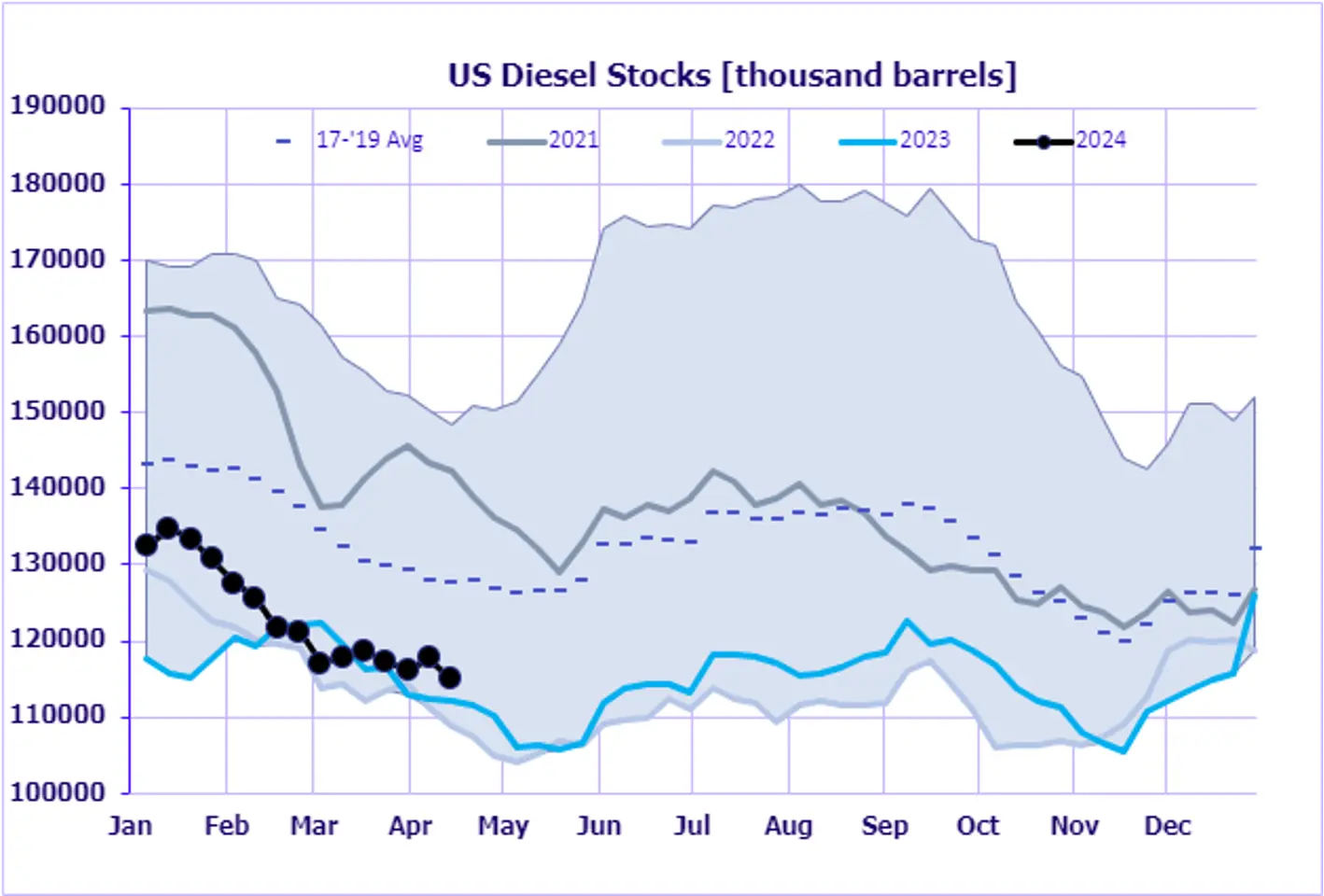

US diesel stocks (EIA data via Sparta)

HO cracks and spreads have stabilized this week following recent declines. Despite sluggish demand, US diesel stocks have seen a continual decrease.

Americas. (Sparta Global ARBS – ARBs Comparison)

The USGC has emerged as the prime option for arbitrage into Latin America, owing to the robustness of Asia Pacific diesel (it is important here to note the continuing large flow of Russian diesel to Brazil).

As such we see a neutral to bullish outlook for US diesel pricing in the short to medium term.

James Noel-Beswick is Commodity Owner for Sparta. Before joining Sparta, James worked as an analyst for likes of BP and Shell, and leads our continued development of the distillate product vertical.

Sparta is a live, market intelligence and forecasting platform that enables oil traders, refiners, banks, hedge funds and wholesalers to have access to real-time and global actionable insights to capture market opportunities before others.

To find out how Sparta can allow you to make smarter trading decisions, faster, contact us for a demonstration at sales@spartacommodites.com