TI/Brent still primed to narrow; European crude demand yet to fire higher

Flat price crept higher w-o-w, despite what can probably be called a reasonable show of restraint by both Israel and Iran and a cooling in tensions. The region remains on thin ice, but all else equal geopolitical premiums should cool.

That said, ICE Brent timespreads have charged higher ($0.50 w-o-w) and are in our view now partly diverged from both the physical market as well as the equivalent spreads in WTI futures, which are little changed w-o-w.

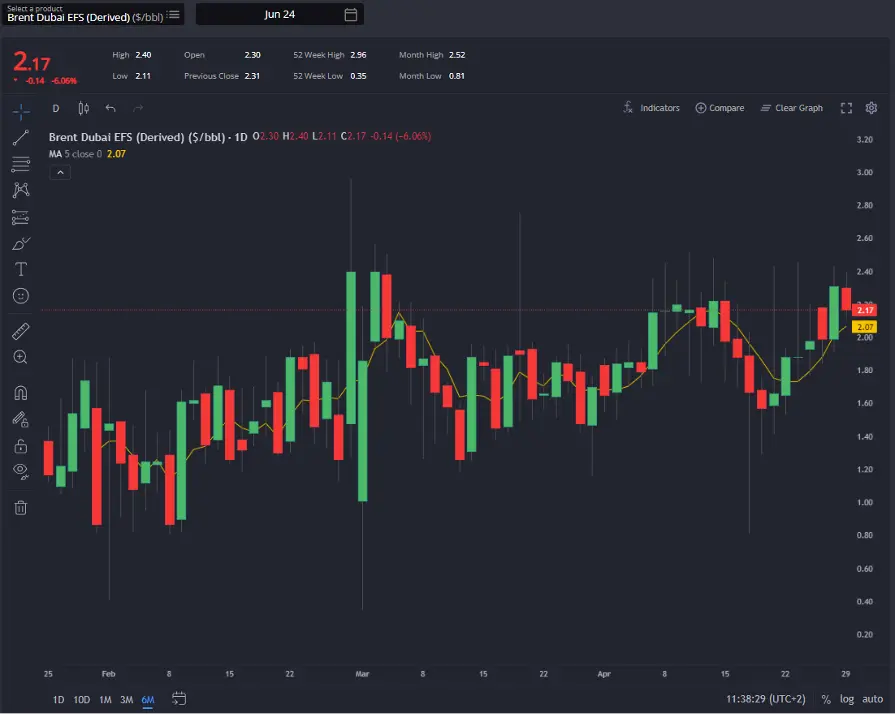

That has coincided with a wider TI/Brent and the EFS pushing back out well above $2/bbl.

The Brent/Dubai EFS has rallied with Brent timespreads leading the charge in global benchmarks over the last week. (Sparta Live Curves)

WTI at MEH has, with the start of the June trade month, rallied against Cushing, having traded particularly weakly over the prior few days.

That, and a stronger May TD25, has started to land WTI into NWE on an Afra a little more expensive with the likes of Es Sider and & Saharan Blend now landing cheaper.

TD25 has rallied a little, but decent Afra avails should cap the upside. (Sparta Live Curves)

Nevertheless, all told WTI remains competitive vs much of the N.Sea, WAF and even some alternative medium sweets e.g. out of Guyana.

As such we don’t see this as a blocker to MEH beginning to drag up Cushing in the short term and continue to see TI/Brent futures narrower from here.

WTI on an Afra has lost ground against some competitors out of the Med (here charted against Es Sider), though it remains overall competitive. (Sparta Global ARBS – ARBs Comparison)

Other factors continue to point in that direction:

- US balances should be allowed to tighten over May with higher exports/runs in the USG. PADD-2 runs also have seasonal upside and may draw Cushing stocks.

- May TD25 has rallied a little over the last week or two, but a fairly sizeable position list for Afras in the USGC may limit the upside from here.

- Net speculative length from money managers has been fairly extended for ICE Brent, and length was already being trimmed in latest data.

- A stronger EFS and still flat FOB pricing for N.Sea & WAF has start to drag relative econs East weaker, putting the onus on Europe to drive demand for the time being or needing to drive FOB premia lower.

- Yet physical pricing still doesn’t paint a convincing picture of strong European demand.

On this last point, CFDs have strengthened somewhat w-o-w, but there has been a lack of upside to BFOET premia to go alongside this.

What is more, a substantial weakening in Johan Sverdrup FOB premia this week, as well as reports of an overhang in May cargoes suggest overall European refinery buying for summer is still anaemic.

In fact Johan Sverdrup is now landing very competitively into the US Gulf Coast against the likes of Guyanan grades and Tupi, despite the recent widening in the TI/Brent spread.

The weakening in JS premia has helped open up the arb to the USGC over the last week against medium sweet competitors from Latin America. (Sparta Global ARBS – ARBs Comparison)

Overall it could be argued that global physical pricing actually paints a weakish demand picture in both EoS and WoS at this point in time, with sustained strength only really evident in MEG spot premia (subject obviously to supply constraints) and in heavy sweet LatAm grades (Napo premiums are the latest to rally) that form base slates in various regions.

Spot Basrah crudes for Asian destinations have now followed their European counterparts higher, with both Heavy and Medium up well over $1/bbl+ w-o-w, while spot UAE and Oman continue to rise.

The US medium/heavy market has cooled and is subject to headlines for the time being (concerns over an early May startup to the TMX expansion and significant Pemex refinery outages potentially limiting planned Mexican export cuts at least in the short term).

Meanwhile, pressure has emerged on SE Asian crudes over the last week with the likes of Kutubu and Cossack premia down the most on weaker naphtha cracks.

The likes of Sutu Den (35 API) FOB premia are also weaker which may indicate poor regional demand; we may need to see these grades re-strengthen first as an indicator of imminent demand for marginal Atlantic Basin barrels from Asia.

Sparta is a live, market intelligence and forecasting platform that enables oil traders, refiners, banks, hedge funds and wholesalers to have access to real-time and global actionable insights to capture market opportunities before others.

To find out how Sparta can allow you to make smarter trading decisions, faster, contact us for a demonstration at sales@spartacommodites.com