European and Asian diesel markets exhibit more weakness than the US whilst jet recovery is unlikely until the end of April

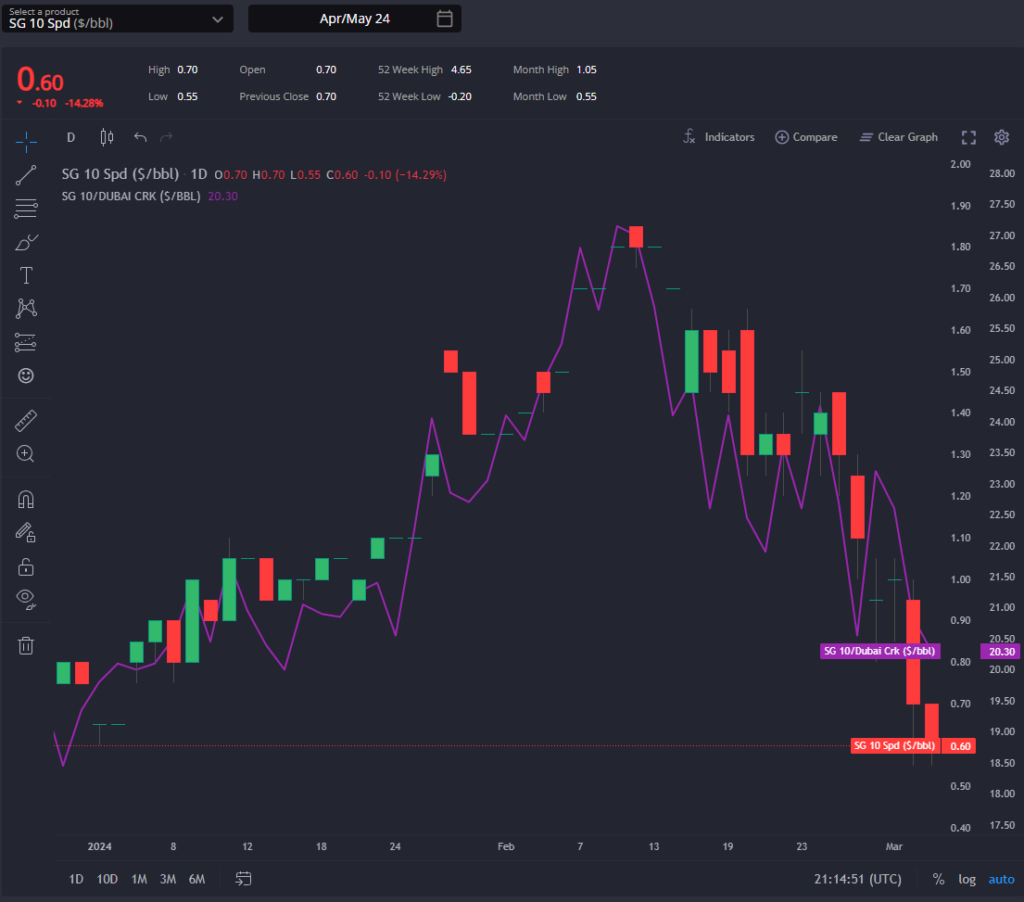

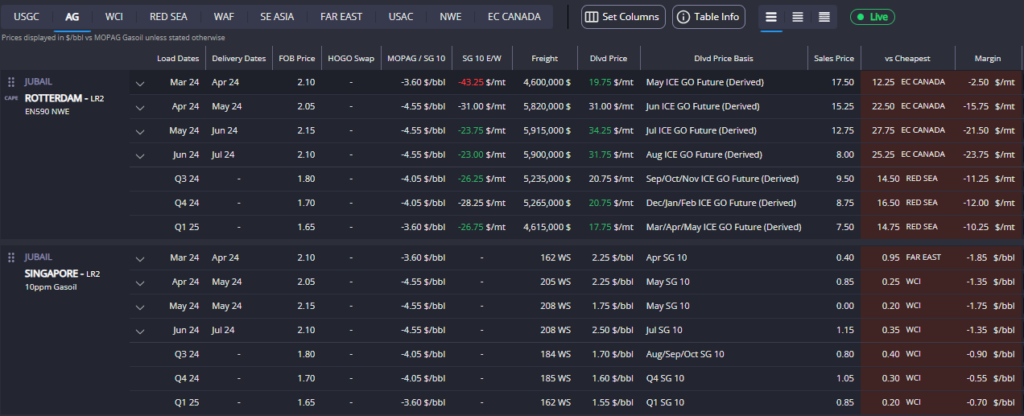

Singapore’s diesel cracks and spreads have sustained a downward trajectory since early February, with April’s figures dropping from +$22.5 to +$20.5 /bbl this week. This trend echoes in the US and EU markets, reflecting a broader pattern.

Similarly, Singapore’s spreads have followed suit, decreasing from $1.17 to $0.60 /bbl currently for April. In contrast, US and EU diesel spreads have largely stabilised over the same period.

The surge in Chinese and North Asian distillate exports further fuels this trend, with March’s Chinese exports anticipated to reach around 1.06 million mt of diesel and 2.21 million mt of jet fuel.

However, challenges arise from high North Asian freight rates, likely leading to delays in the Chinese program and/or the reduced FOB prices we see currently.

Previously large imports from WCI and AG in February have helped to boost middle distillate stocks in Singapore to a three-month high of 10.175 million bbls.

Despite this AG and WCI April loaders favour East over West due to a narrowing GO E/W and reduced LR2 freight rates from the Middle East. This dynamic suggests a continuing weakness in Singapore gasoil in the short to medium term.

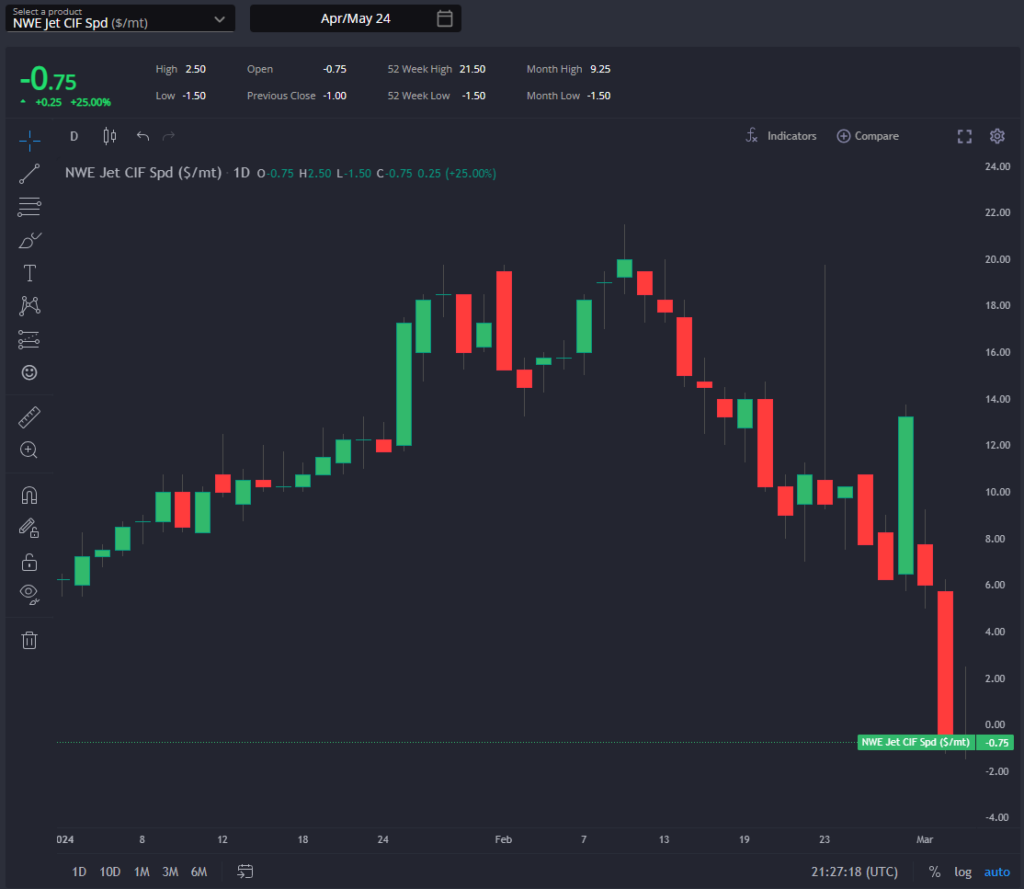

Meanwhile, European jet prices exhibit signs of stabilizing, with a slight recovery in NWE jet diffs and reported end-March buying activity.

However, April NWE jet entering contango over the past two days indicates that we may need to wait until the end of April to fully see this recovery.

With Singapore regrade nearing its seasonal average for April, almost all Asian-origin jet arbs remain closed to Europe, with South Korea, and most probably Chinese, jet arbs being exceptions due to decreasing FOB premia, to mitigate the above-mentioned high freight rates at present, a theme that is mirrored in the diesel market.

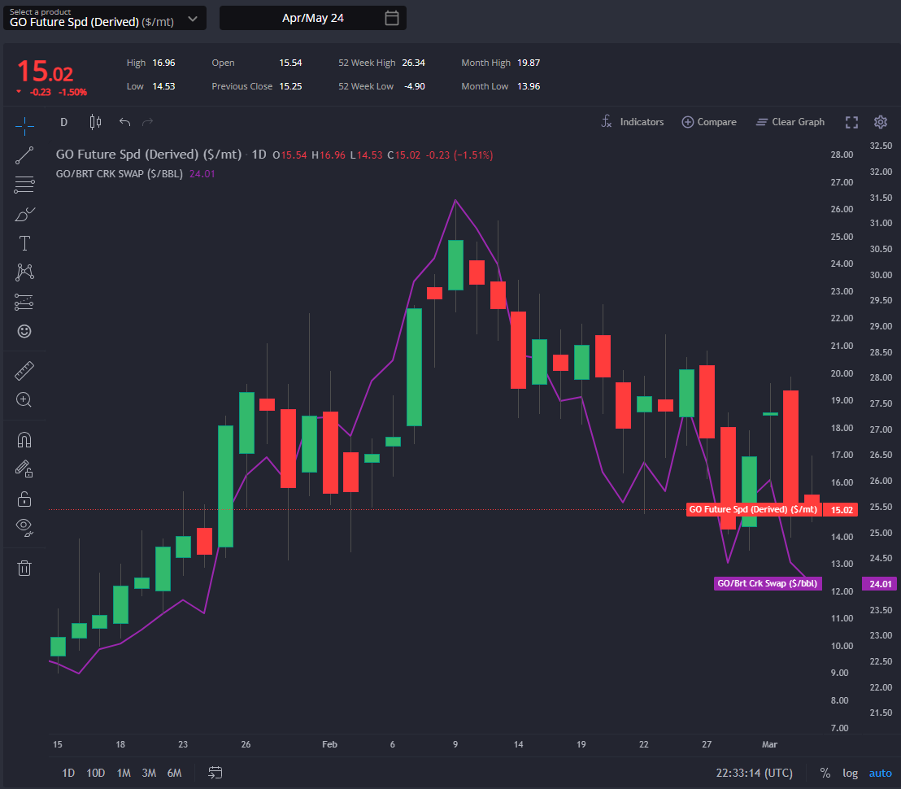

ICE GO cracks have mirrored the global downward trend, mentioned in Singapore above, since early February, with April’s crack decreasing from +$25.5 to +$24.0 /bbl currently.

However, in contrast to Singapore, ICE GO spreads have stabilised this week, indicating a potential floor in the market.

This stabilisation is evident in the neutral paper positions exhibited in the European diesel market presently.

Despite ongoing refinery turnaround periods in Europe, concerns persist regarding the region’s diesel demand recovery.

External diesel arbs from Asia and the US are currently open into Europe only in the very prompt, with AG and WCI April diesel loaders pointing East instead of West. This suggests that the current tightness in European diesel balances is limited to the very prompt period.

As Europe navigates past the ongoing refinery turnaround period, diesel balances are expected to loosen, accompanied by corresponding price adjustments in the medium term and into the summer months.

This expectation is further supported by the anticipated contributions from Al-Zour, Duqm, and Dangote refineries, which are poised to bolster diesel production capacity.

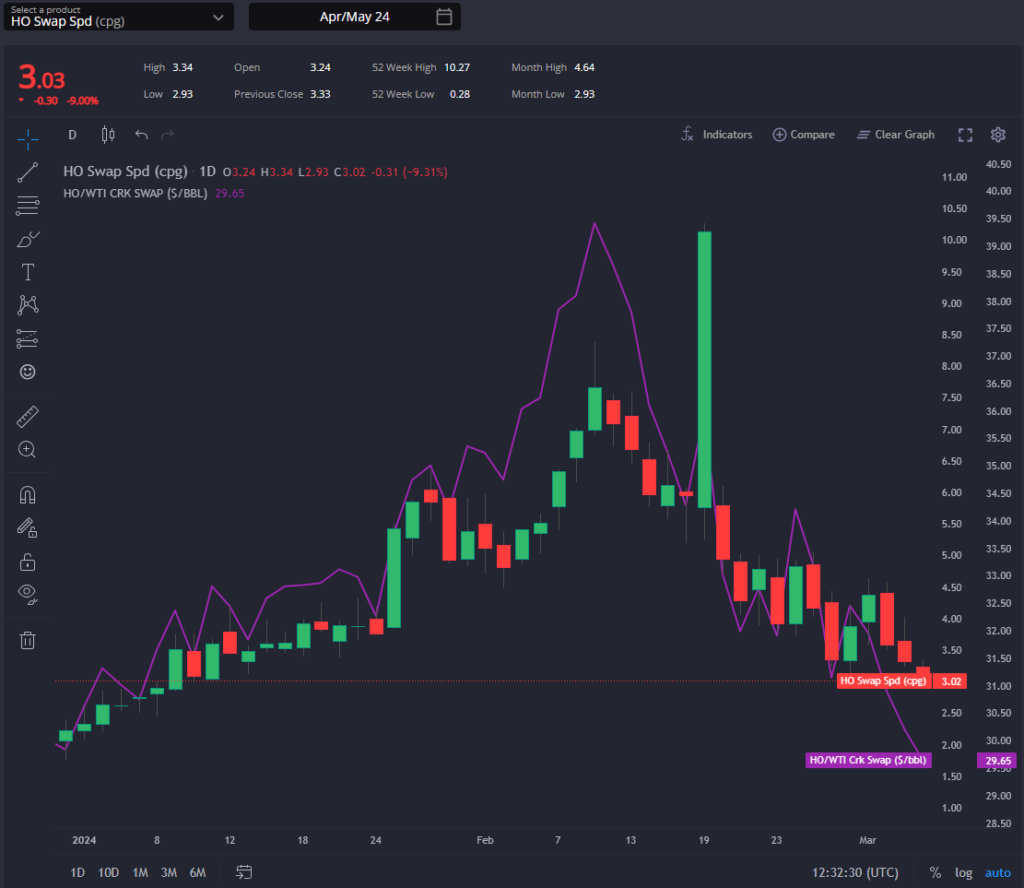

HO cracks and spreads this week have aligned more closely with ICE GO rather than following the trend observed in Singapore diesel, with cracks continuing to decline while spreads largely stabilised.

Concerns about US diesel demand have heightened amid doubts regarding the recovery of the US manufacturing sector, exacerbated by persistently high Federal Reserve interest rates.

The Institute for Supply Management’s purchasing index slipped to 47.8 in February, reflecting a downward trend from January’s 49.1.

Despite these challenges, paper positions in the diesel market remain relatively bullish on US diesel, suggesting a belief that the market may soon bottom out.

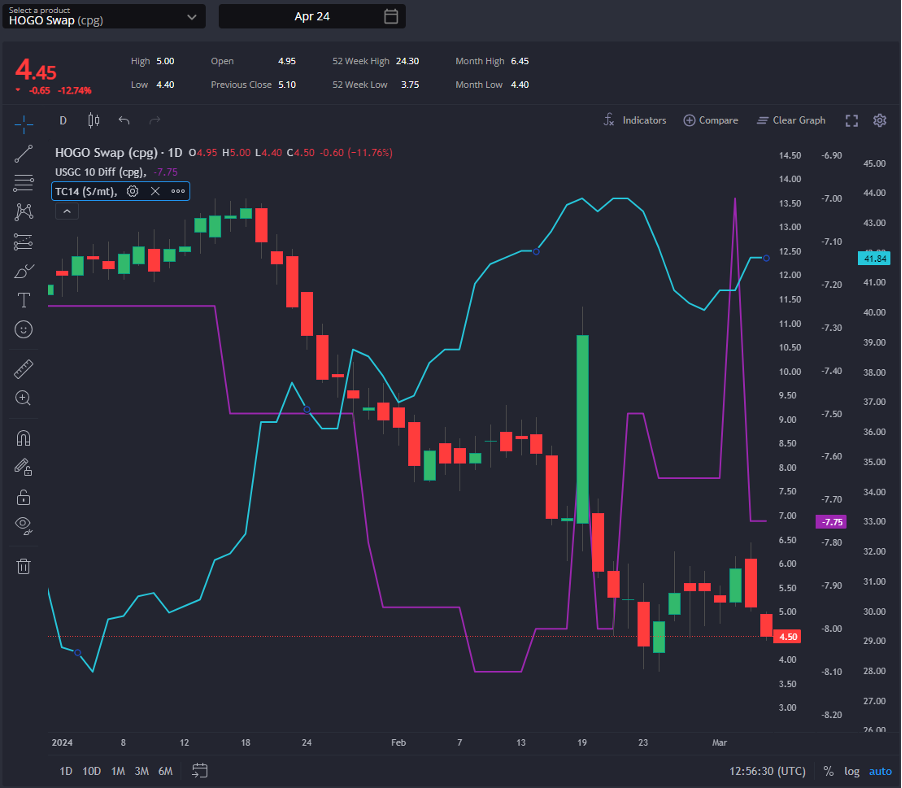

However, despite the weakness in US diesel, reflected in the narrowing of the HOGO, the ULSD TA arb remains closed due to the recent narrowing of the USGC diesel differential and an increase in USGC MR freights.

The US Gulf Coast continues to offer the best arbitrage opportunity into Latin America, given the high Asian freights to the region currently and the above-mentioned narrowing GO E/W spread.

With these factors in mind, the outlook for US diesel remains neutral to bullish in the short to medium term, with close attention needed on US crude runs and diesel demand moving forward.

James Noel-Beswick is Commodity Owner for Sparta. Before joining Sparta, James worked as an analyst for likes of BP and Shell, and leads our continued development of the distillate product vertical.

Sparta is a live, market intelligence and forecasting platform that enables oil traders, refiners, banks, hedge funds and wholesalers to have access to real-time and global actionable insights to capture market opportunities before others.

To find out how Sparta can allow you to make smarter trading decisions, faster, contact us for a demonstration at sales@spartacommodites.com