Europe receives large Eastern flow, whilst global cracks and spreads move up on refinery and hurricane fears

Red Sea arbitrage routes have maintained their status as the most cost-effective option into Europe, appearing double-digit open throughout the remainder of the year.

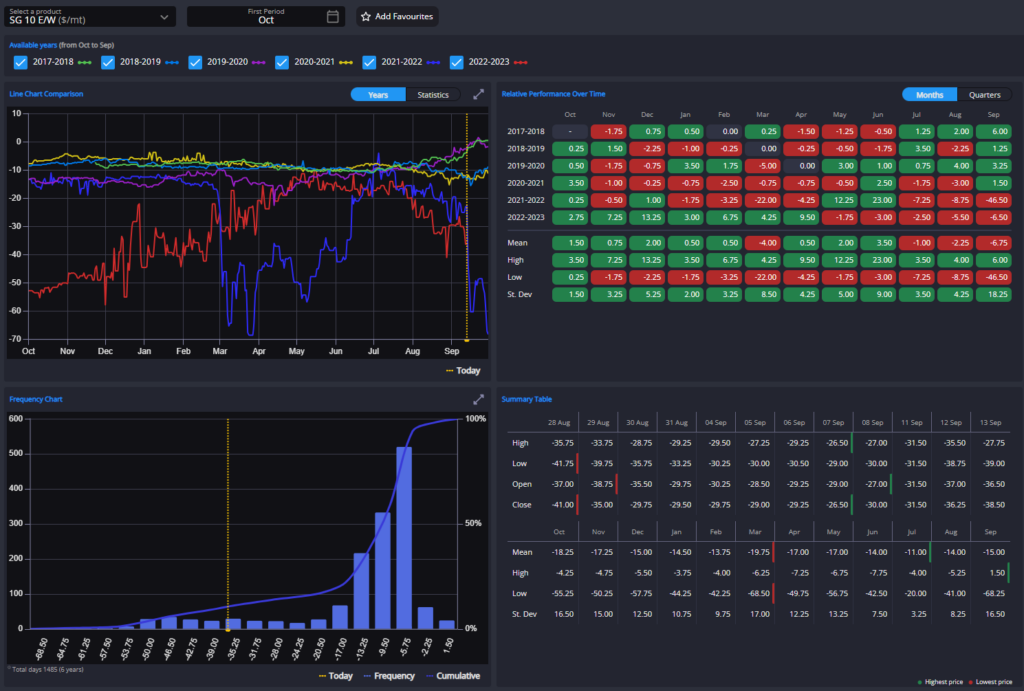

Additionally, September’s E/W spread has widened in the past week from -$26.5 to -$41 /bbl, opening arbitrage opportunities for Arabian Gulf (AG) and West Coast India (WCI) barrels into Europe, especially at the front of the market.

Europe is experiencing a surge in diesel imports for the first half of September, marking the highest levels in the past eight months. This increase is primarily driven by elevated EoS imports, and with the above-mentioned opening of EoS arbitrage routes into Europe, this trend is expected to continue.

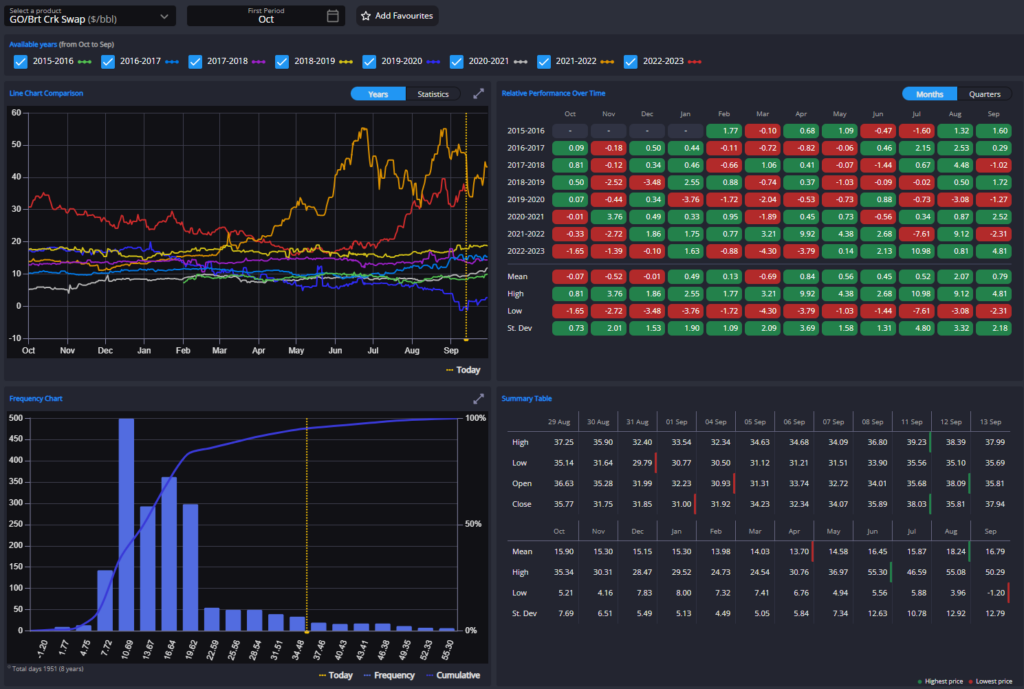

October’s ICE GO swap spreads and cracks have risen (cracks moving from +$33 to +$37.75/bbl), reflecting the tightness in European diesel inventories. These inventories are currently 8% below their ten-year seasonal average as of the end of August.

Europe’s refineries are planning for a reduced autumn maintenance season to capitalize on higher profit margins amid these low fuel inventories and the loss of Russian sanctioned diesel. This strategy is likely to impose a ceiling upon cracks and spreads in the near future.

In perhaps an early sign of this, ARA diesel stocks this week increased by 3.4% on the back of increased EoS arrivals and reduced demand along the Rhine.

Nonetheless, the overall direction of the E/W ULSD should remain unchanged, with Europe demonstrating a greater need for diesel compared to the East Asia/Singapore region. This dynamic is set to persist in the coming weeks.

USGC exporters are facing a notable challenge from Asian origin barrels into both West and East Coast Latin America destinations, even in the case of AG barrels into Northern Brazil.

This untypical situation can be attributed to rising FOB premiums in the USGC, coupled with an upswing in the Nymex Heating Oil (HO) pricing basis.

Oct/Nov HO Swap spreads have expanded, shifting from +10.75 to +13.50cpg this week. This move reflects several factors, including persistently low diesel stocks in the US, news of a significant reduction in Russian diesel exports and concerns about hurricane Lee disrupting operations at Irving’s St. John refinery.

However, the US is currently disincentivised to engage in substantial diesel exports. Low domestic stocks and ongoing maintenance at US Gulf refineries necessitate a focus on retaining diesel for internal use.

As a consequence, we can anticipate that HO cracks and spreads will remain at elevated levels for the remainder of the year, with the HOGO spread maintaining its current wide position to avoid leaching barrels to Europe.

South Korean barrels, both MRs and LR1s, have retained their status as the most cost-effective choice for Singapore due to decreasing FOB premiums, driven by the return of the Hyundai Oilbank refinery from maintenance and intensified competition from increased Chinese gasoil exports.

South Korean barrels also remain highly sought after for destinations including the West Coast of the US, Mexico, and Latin America.

In contrast, West Coast India (WCI) barrels, which often compete with South Korean barrels for Singapore, are experiencing rising premiums. This increase is attributed to heightened demand from East and Southern Africa as well as Europe.

As discussed earlier, the E/W dynamics continue to favour Europe, with AG and WCI barrels pointing in that direction, a trend expected to persist in the medium term.

China’s escalating refined product exports, particularly in August when they reached a six-month high, and the anticipation of September’s gasoil exports doubling compared to August, are impacting the Asian pricing complex.

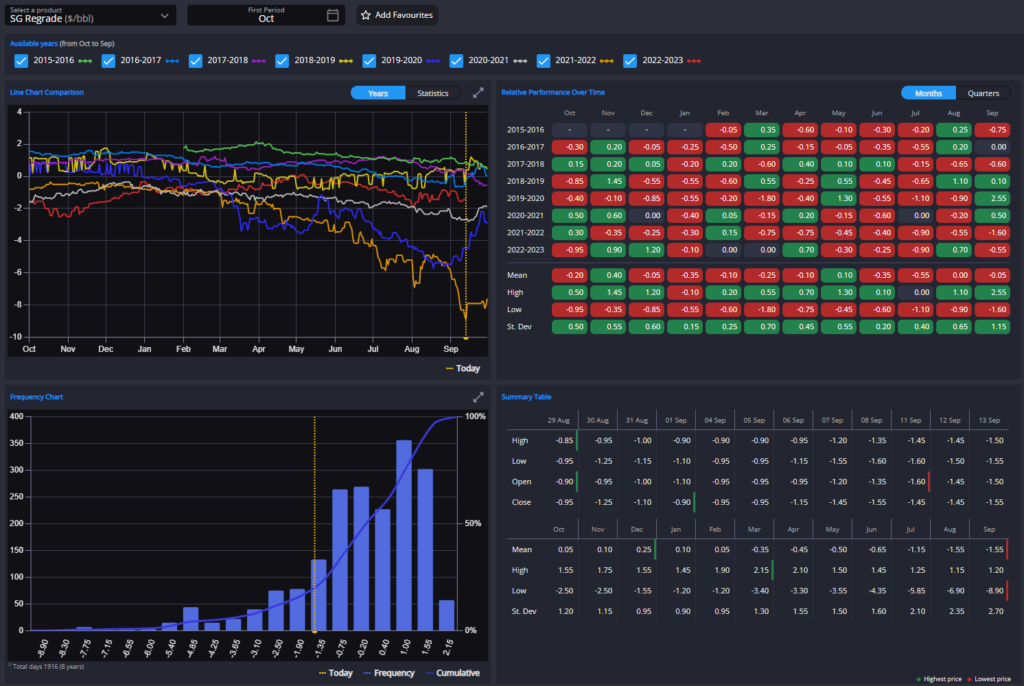

Singapore stocks reached a 21-week high this week, with October’s Singapore regrade pointing to gasoil as the concern, narrowing from -$1.80 to -$1.55 /bbl since August.

This scenario presents a stark contrast to Europe’s situation, reinforcing the argument that the E/W spread must remain wide enough to encourage Middle Eastern exports to head westward rather than eastward.

Although Singapore spreads and cracks have largely mirrored trends in HO and ICE GO, the above-mentioned factors suggest that they may soon reach their peak.

James Noel-Beswick is Commodity Owner for Sparta. Before joining Sparta, James worked as an analyst for likes of BP and Shell, and leads our continued development of the distillate product vertical.

Sparta is a live, market intelligence and forecasting platform that enables oil traders, refiners, banks, hedge funds and wholesalers to have access to real-time and global actionable insights to capture market opportunities before others.

To find out how Sparta can allow you to make smarter trading decisions, faster, contact us for a demonstration at sales@spartacommodites.com