Bearish sentiment creeps into gasoil complex as European arbs close but WAF opportunities present themselves

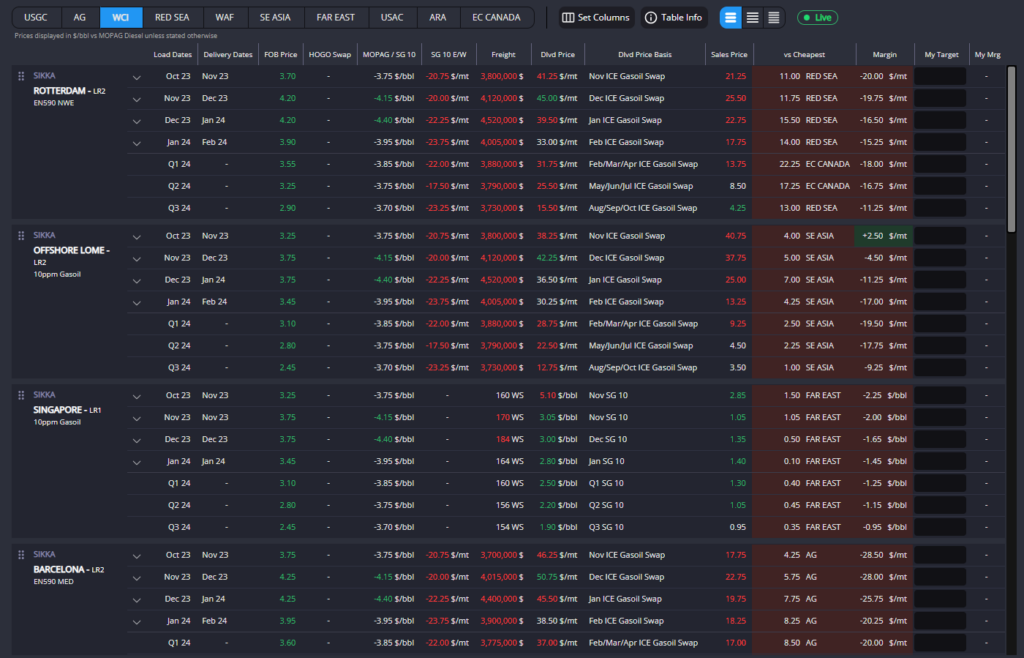

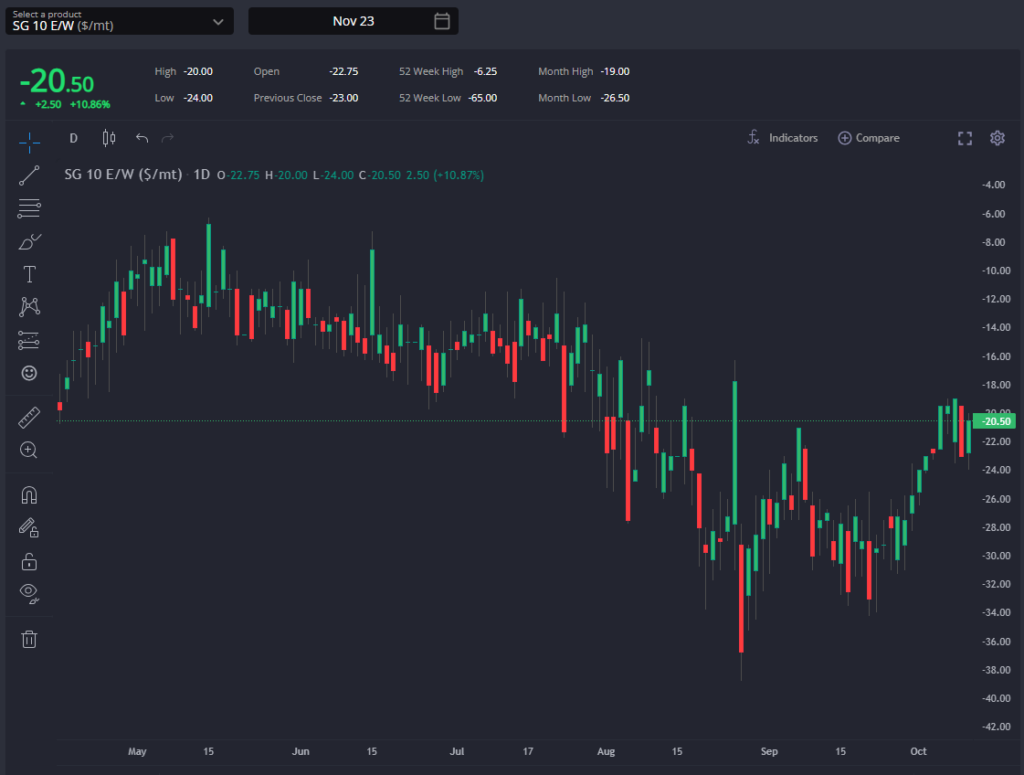

The market in the East has strengthened compared to the Atlantic Basin over the last week, narrowing the E/W spread and shutting the AG/WCI arb opportunities into Europe and pointing prompt swing arbs towards Singapore for the time being.

A strengthening WAF market is offering some relief currently, with positive margins for those able to supply larger vessels into the region in the prompt, although this opportunity is likely to remain open only briefly.

Missing Russian waterborne barrels are tightening markets in the Southern Atlantic Basin, but a partial repeal of the export ban is likely to reduce sales prices in WAF in the coming days.

The Singapore market is therefore set to see a robust resupply coming in from AG and WCI origins in the short-term which, coupled with refineries returning from maintenance in Vietnam and elsewhere in Asia, is likely to push SG 10 timespreads and cracks narrower still over the coming weeks.

The E/W spread has narrowed markedly over the first decade of October, but will need to widen once more through the rest of this month otherwise volumes pointing towards Singapore will likely overwhelm a fragile market there.

In Europe, macroeconomic worries have continued to largely outweigh support driven by missing Russian export barrels, and support from the latter is now anyway set to wain through the rest of the month.

Signals to refiners, however, remain very strong, with the European November diesel crack having essentially held its value since the beginning of September vs a relative ~40% drop in the Nov EBOB crack over the same period.

With arbs into Europe currently very shut, there is little to suggest that the signal to European refiners will weaken in the short term, and we would expect both cracks and timespreads to even out around current levels for the time being.

Finally, an extremely narrow RVO level currently is not hampering the relative viability of USGC export barrels into Latin America thanks to the HOGO spread having absorbed much of this impact.

The narrower E/W spread is also helping to price EoS barrels out of the equation, leaving PADD-3 barrels looking very attractive into destinations across Latin America which are currently looking to replace Russian flows.

A widening USGC 10 diff vs the HO contract is also pointing to a push factor out of PADD-3, with waterborne premiums also taking something of a downturn recently (even if lower RVO values make the fob price component of our arb calculations look as though they are rising).

With PADD-3 now comfortably the most economic source of resupply across the Americas, however, the downside for the USGC 10 diff as well as pressure on the HOGO spread should have reached its peak, with exports looking to tick higher and relieve some of the prompt pressure on USGC in the short term.

Philip Jones-Lux is Commodity Owner for Sparta. Having worked with organisations such as JBC Energy and RP Global, Philip is a seasoned energy market analyst with expertise across the oil barrel and power markets

Sparta is a live, market intelligence and forecasting platform that enables oil traders, refiners, banks, hedge funds and wholesalers to have access to real-time and global actionable insights to capture market opportunities before others.

To find out how Sparta can allow you to make smarter trading decisions, faster, contact us for a demonstration at sales@spartacommodites.com