As the East/West narrows West Coast India exports point to Singapore

Due to Sparta’s annual team strategising event in Mallorca, this week’s commentary has been abbreviated.

Taiwanese and South Korean barrels continue to compete for the title of the most cost-effective choice for shipments to Singapore.

Notably, South Korean barrels are currently holding the cost-efficiency advantage. This is primarily due to a decline in South Korean FOB premia, with these premia hitting negative values versus MOPS for the first time since early September.

Furthermore, a significant number of South Korean MR cargoes are currently available in the market.

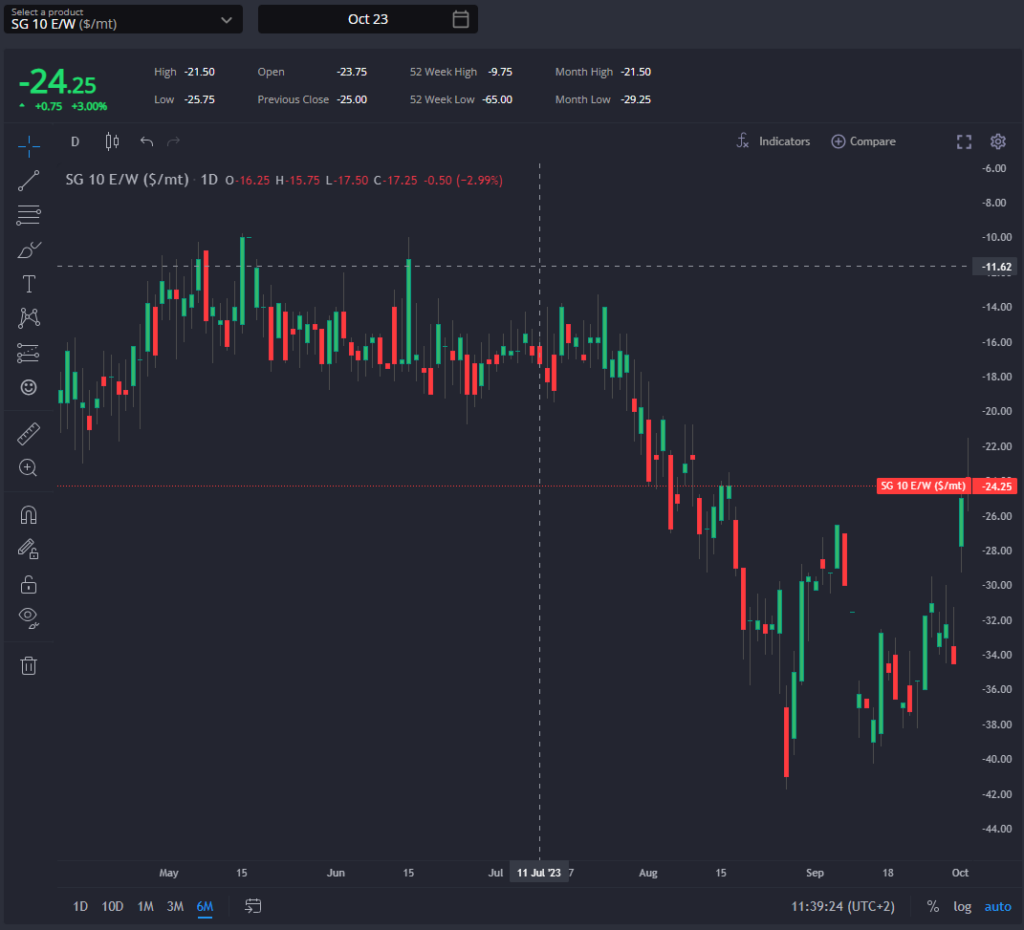

October’s East/West (E/W) ULSD spread narrowed this week, moving from -$33 to -$24/mt despite the apparent length in the Far East balance thanks to availability out of Korea.

This is its narrowest position since mid-August, largely attributed to a softening on the European side thanks to the accumulation of stocks in ARA, currently at their highest level in over a month.

The increase in East of Suez arrivals in recent weeks has contributed to this build. The rumour that there may not be another Chinese product export quota released this year is also contributing.

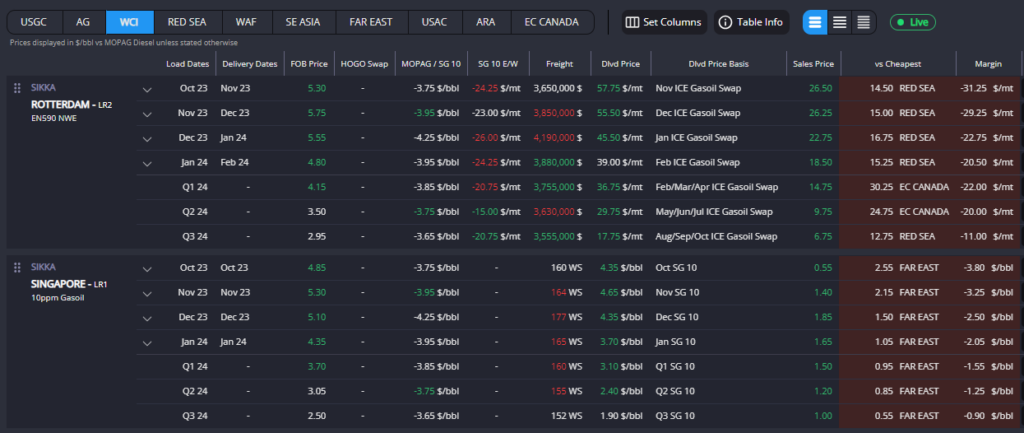

While Arabian Gulf (AG) and Red Sea barrels maintain their westward trajectory, West Coast India (WCI) barrels are now oriented toward Singapore and the East.

Singapore spreads and cracks have decreased this week, as Singapore stocks reached a 26-week high due to rising imports from China, South Korea, and Taiwan.

This situation suggests that as Europe will require imports from the WCI region due to its advantageous cold properties as winter approaches, we can anticipate a reversal of the recent E/W narrowing to facilitate this supply flow.

All arbitrages into Europe are presently closed, extending down the entire curve. Among these, Red Sea arbs, followed by EC Canada, represent the most cost-effective routes into Europe, adhering to the usual pattern.

As the East/West ULSD spread has contracted, US Gulf Coast arbs currently land products in Europe more cost-effectively than AG and WCI exports.

A contributing factor to this is the USGC diff for November, which has this week reached its lowest point in the last four years.

This decline is attributed to reduced refinery utilisation in PADD1, resulting in draws (-3.3% w-o-w), while strong utilisation in PADD3 has led to builds (+5.0%). A number of MRs have been contracted this week for Transatlantic (TA) voyages.

James Noel-Beswick is Commodity Owner for Sparta. Before joining Sparta, James worked as an analyst for likes of BP and Shell, and leads our continued development of the distillate product vertical.

Sparta is a live, market intelligence and forecasting platform that enables oil traders, refiners, banks, hedge funds and wholesalers to have access to real-time and global actionable insights to capture market opportunities before others.

To find out how Sparta can allow you to make smarter trading decisions, faster, contact us for a demonstration at sales@spartacommodites.com