West Coast India lands best into Singapore whilst Europe pulls more from the US Gulf Coast

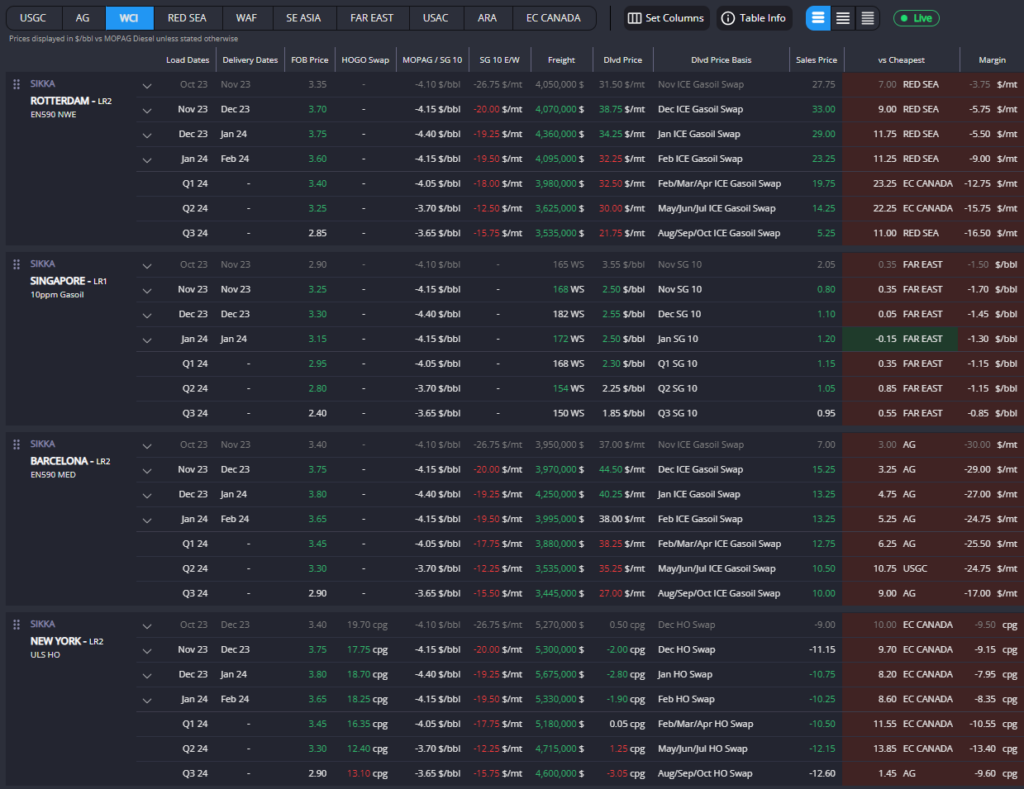

West Coast India (WCI) arbs have established themselves as the most cost-effective route into Singapore, surpassing even the South Korean refineries that traditionally hold this position.

This achievement can be attributed to the continual decline in WCI FOB premia, which have dropped from a peak of $7.5 /bbl to the current $4.2 per barrel against MOPAG 10ppm since the start of October.

The recent addition of Vizag refinery’s new 3 million metric tons per year hydrocracker unit has played a significant role in this shift.

Additionally, November’s MOPAG to SG 10ppm has reached its widest spread since April, driven by Singapore’s middle distillate stocks dropping to their lowest levels in nearly two months.

October’s Chinese gasoil exports having so far been somewhat below those of September and no more Chinese refined product export quotas are expected in 2023.

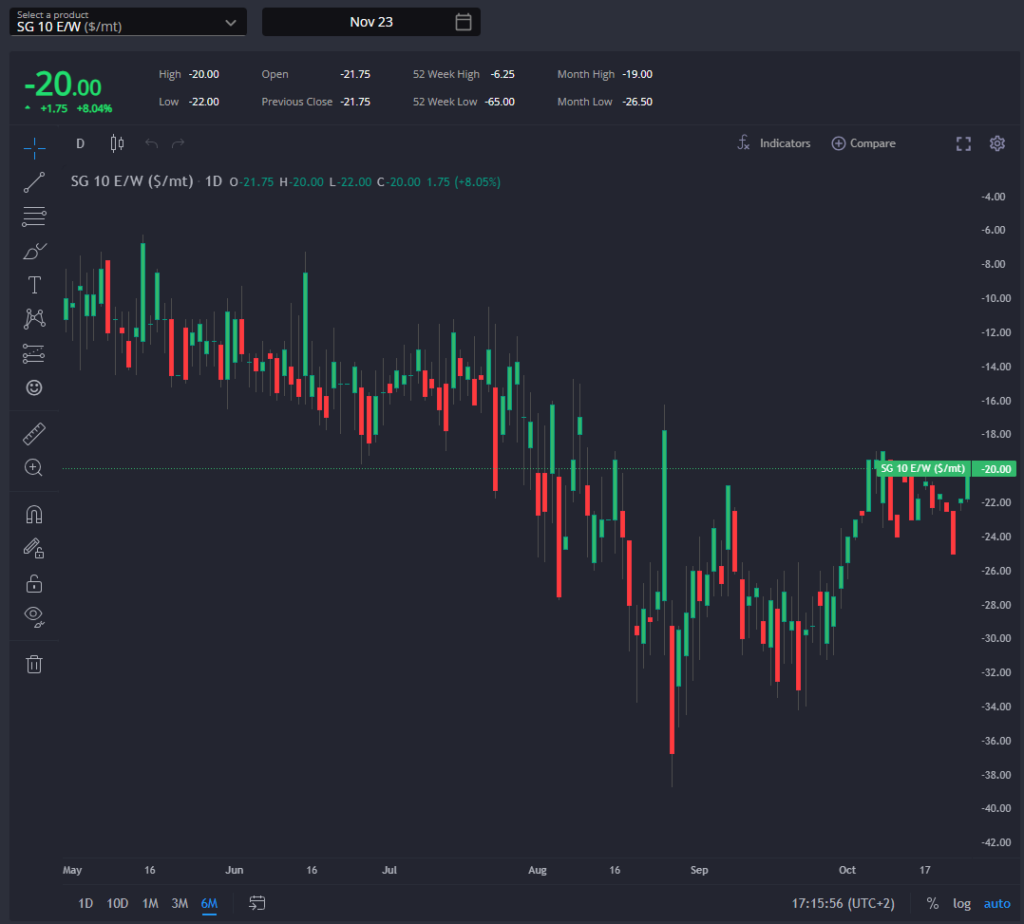

As such November’s ULSD East-West spread has remained relatively stable at around -$20 /mt since the start of October.

However, expectations point to widening pressure as Europe heads into winter, especially with rising domestic demand in the European continent.

Red Sea arbs remain the most cost-effective option into Europe and are currently the only ones appearing open.

Following closely behind are US Gulf Coast (USGC) arbs, which have maintained their position as the second most cost-effective route into Europe for the past two to three weeks.

In contrast, Arabian Gulf (AG) and West Coast India (WCI) arbs into Europe are currently closed. However, these arbs are pointing westward for the remainder of 2023 currently, primarily to Europe, rather than toward Singapore.

This is in part due to declining Singapore sales prices, which have fallen from $3.25 to $1.75 /bbl compared to MOPS since the beginning of November. The continuing reduction in Russian gasoil exports are also a contributing factor here.

Despite the closures in AG and WCI arbs, Europe’s demand is expected to persist as several German refineries, including Bayernoil, are currently experiencing outages.

As the winter season approaches, the East-West ULSD spread is likely to widen, accompanied by corresponding shifts in European cracks and spreads, as the continent’s need for resupply continues.

The USGC has emerged as the most cost-effective source for both Northern Brazil and the West Coast of South America, even as USGC FOB premiums have seen an increase over the past week.

The key driving force behind this cost-effectiveness is November’s USGC 10 diff dropping to an all-time low of -11.75 cpg, indicating a readiness among USGC refiners to export to various regions, including PADD 1, Latin America, or Transatlantic destinations.

In the case of Southern Brazil, the previously mentioned decrease in WCI ULSD FOB premiums has made WCI the most cost-effective option.

November Heating Oil (HO) cracks and spreads have slightly softened, with HO cracks moving from +$41 to +$39 per barrel this week. The US has found some incentive to export diesel, particularly with Europe in demand, indicating a likely narrowing of the Heating Oil vs. Gasoil (HOGO) spread in the short to medium term.

James Noel-Beswick is Commodity Owner for Sparta. Before joining Sparta, James worked as an analyst for likes of BP and Shell, and leads our continued development of the distillate product vertical.

Sparta is a live, market intelligence and forecasting platform that enables oil traders, refiners, banks, hedge funds and wholesalers to have access to real-time and global actionable insights to capture market opportunities before others.

To find out how Sparta can allow you to make smarter trading decisions, faster, contact us for a demonstration at sales@spartacommodites.com