An extremely bullish, but warranted, sentiment prevails in Atlantic Basin diesel, though less so in Asia Pacific and global jet

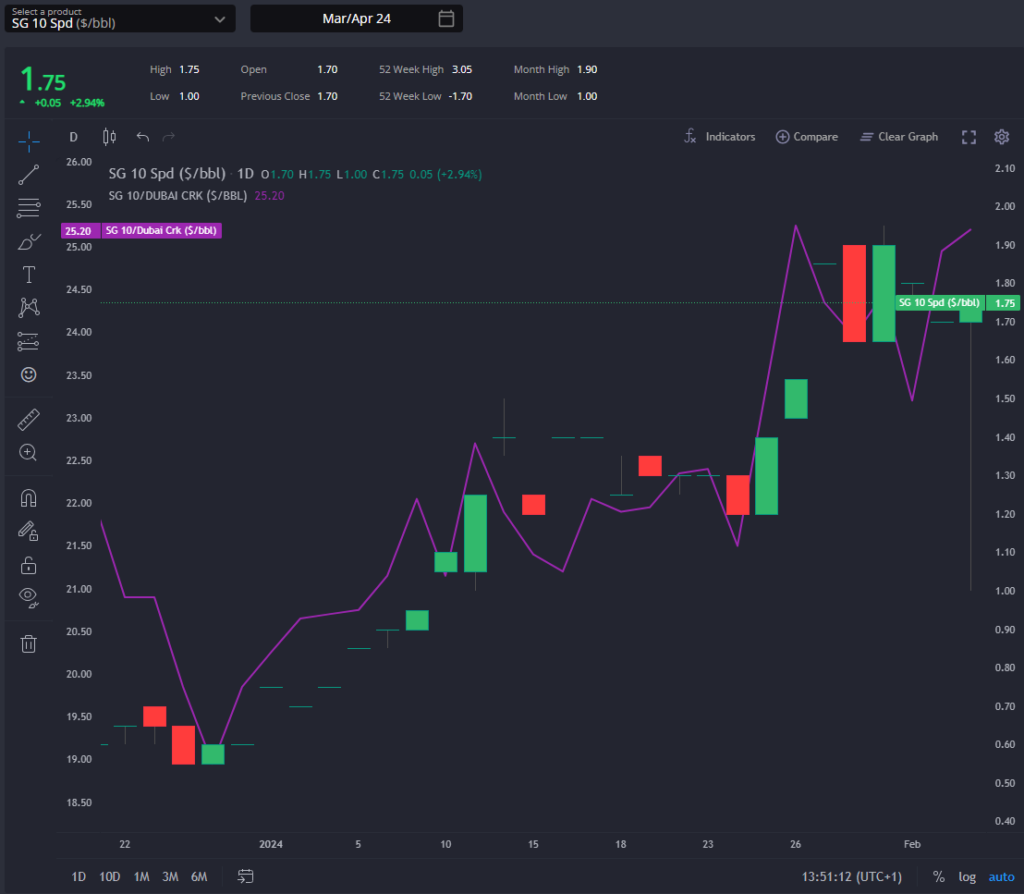

As with the entire global gasoil market, Singapore spreads and cracks have been on a persistent upward trajectory since the onset of the year, with March cracks continuing the trend this week by escalating from +$23.50 to the present level of +$25.20 /bbl.

However, amidst this surge, Singapore spreads have experienced a flattening trend this week, largely attributed to speculations surrounding a possible ceasefire in the Red Sea, Yemen, and Israel issues.

Last week’s commentary highlighted how high freight rates, compounded by the onset of Chinese New Year, led to some delays in Chinese exports that consequently buoyed the Singapore gasoil market.

The situation was further exacerbated by continuing issues at the Pengerang refinery in Malaysia.

Notably, the declines in WCI and South Korean (and Chinese) FOB premia indicate that these arbitrage routes are already open into Singapore.

WCI exports are now directed towards Singapore rather than Europe, owing to the elevated freight costs associated with European bound voyages.

Our freight commodity owner Michael Ryan indicates that Eastern freight rates (TC5 & TC17) look to have reached a ceiling and should drift lower unless there is another Red Sea attack headline forthcoming. “Charterers now have their pick of vessels compared to the last couple weeks of owners being in the driving seat”.

With expected increases in gasoil arrivals from China, South Korea, and WCI into Singapore, driven in part by robust distillate cracks and a sluggish Chinese economy, projections suggest that the current upward momentum in cracks and spreads will encounter a ceiling in the short term.

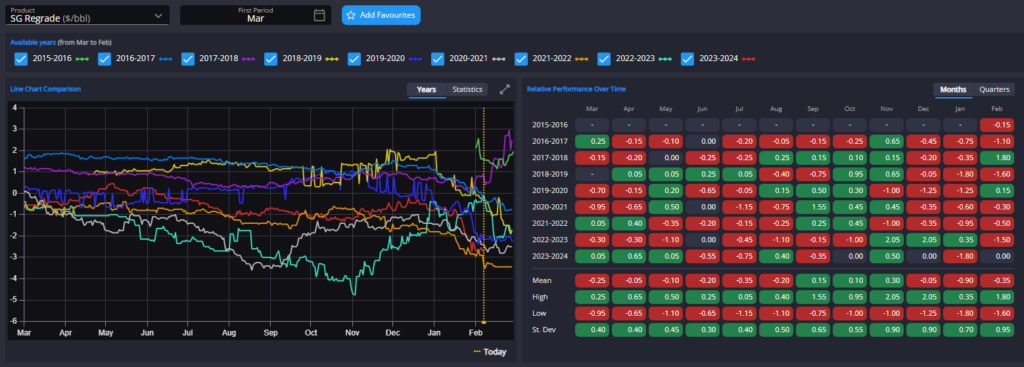

This forecast is expected to result in a reversal in the recent sharp widening of the Singapore regrade, although uncertainties regarding the pace of recovery in Chinese air passenger numbers linger.

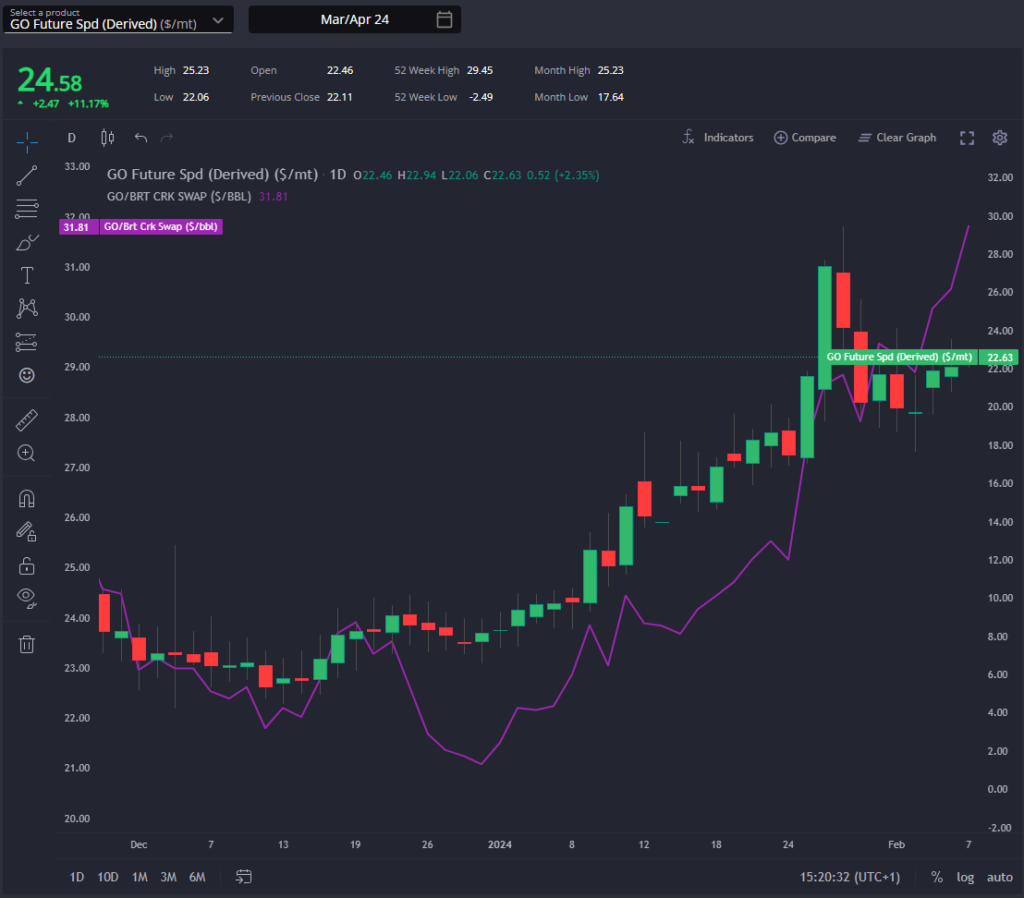

In lockstep with developments in Singapore, ICE GO cracks and spreads have maintained their upward trajectory since the turn of the New Year.

This trend is underpinned by a prevailing bullish sentiment across Europe and the wider Atlantic Basin, fuelled by low stock levels and disruptions in Middle Eastern and Russian supplies.

The situation in the Red Sea continues to hold significant sway over arbitrage flows, with limited offerings on the LR side, and those that have come, have directed diesel flows around the Cape to NWE rather than the Mediterranean, as observed by our Mediterranean broker contacts.

Moreover, a positive outlook for demand resonates on both sides of the Atlantic, bolstered by signals from central banks indicating a move towards lower interest rates and improving manufacturing industry sentiments.

This optimism has translated into substantial increases in positions in European gas oil paper (+17 million bbls) and U.S. diesel paper (+7 million bbls) over the past week.

Despite these favourable indicators, only Red Sea diesel arbs (WCI arbs marginally but these point to Singapore) via the Suez and Eastern Canada arbs currently remain open into Europe.

However, it is crucial to consider that the calculation of Red Sea arbs does not account for additional war risk premiums.

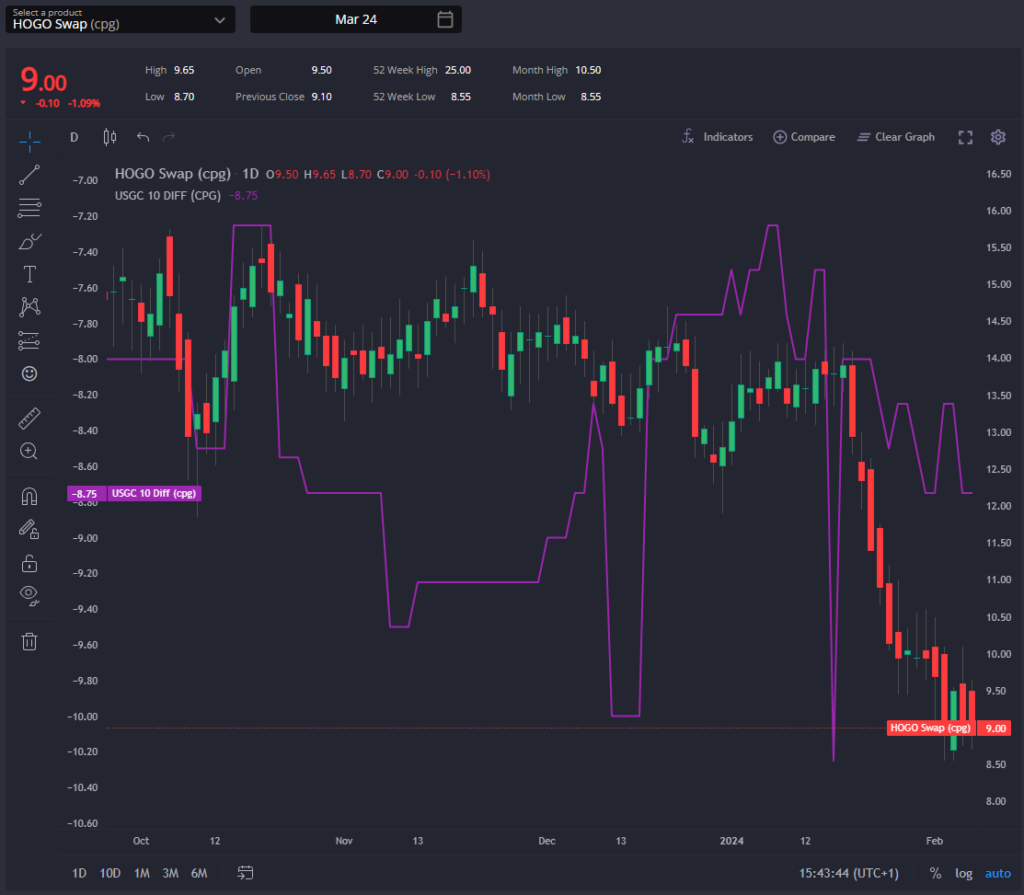

The persistence of high TC14 freight rates, RINS, and escalating USGC FOB premia, buoyed by an improving demand outlook and recently low crude runs in the U.S., are factors keeping the Transatlantic diesel arbitrage closed.

Looking ahead, the prevailing expectation is for ICE GO cracks and spreads to continue their upward trajectory into at least the medium term, contingent upon any substantive changes in the geopolitical landscape of the Middle East.

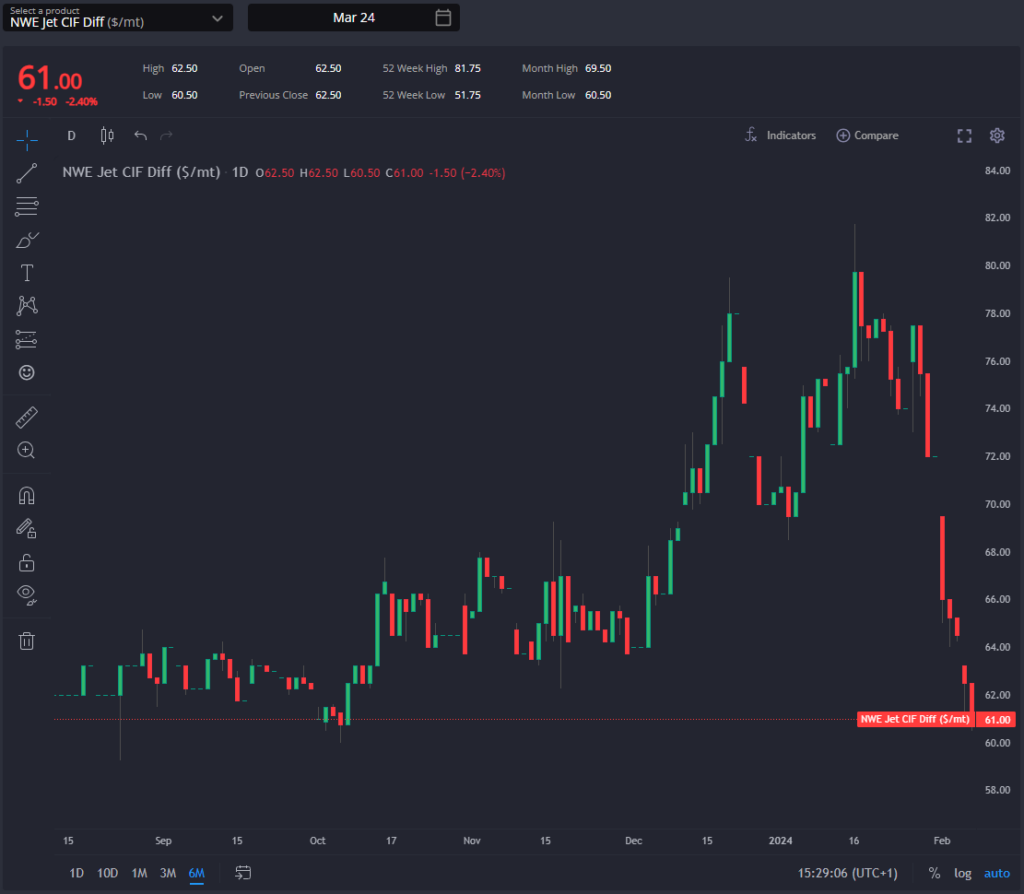

Concurrently, a notable influx of jet arrivals into Europe around the Cape and Suez, indicative of more workable arbitrage routes into Europe and combined with flagging European jet demand, suggests a continued downward trend in NWE jet differentials into the medium term.

We should expect to see either yield switching away from jet or jet blending into gasoil or both at these levels, especially with the need for gasoil globally.

HO cracks and spreads have matched the global trend, showing consistent increases since the start of the year, a trend that has persisted this week.

However, despite these gains, the HOGO spread continues to widen as Europe seeks to replenish its supplies.

This positive HO trend aligns with the above-mentioned, optimistic signals from the United States Federal Reserve regarding potential lower interest rates, reinforced by the Institute for Supply Management’s (ISM) manufacturing purchasing managers index rising to 49.1 in January from December’s 47.1.

With ongoing low crude runs in the U.S., the outlook remains bullish for HO spreads and cracks in the medium term

James Noel-Beswick is Commodity Owner for Sparta. Before joining Sparta, James worked as an analyst for likes of BP and Shell, and leads our continued development of the distillate product vertical.

Sparta is a live, market intelligence and forecasting platform that enables oil traders, refiners, banks, hedge funds and wholesalers to have access to real-time and global actionable insights to capture market opportunities before others.

To find out how Sparta can allow you to make smarter trading decisions, faster, contact us for a demonstration at sales@spartacommodites.com