Window for North Sea bearishness is closing, while heavy crude pool rallies further

The market response to the Middle East over the weekend has been muted with events on the low end of the escalatory scale and encouraging signs of restraint from most parties, at least for now.

At the start of last week the rally in flat prices had pulled up both physical and paper crude structure.

However, if more evidence emerges that Middle Eastern tensions have peaked for now, we could see pressure on flat price and structure.

This may now be a larger risk to physical pricing in the North Sea than the physical arb perspective.

Window for North Sea bearishness is closing

There was a notable rise in BFOET FOB premia w-o-w. That has moved these grades’ margins more in line with WTI, which in NWE had briefly looked overly weak vs competitors (partly on the back of a stronger TD25).

The outlook is still on balance slightly bearish in the very short-term from the arbs perspective, but now is a good time to point out caveats and competing bullish factors. For the bears:

- General Atlantic Basin arb econs to the Far East remain weak. A certain number of North Sea light sweet cargoes have nonetheless headed East (mostly China-bound) against the prevailing economics, and had arguably kept the North Sea artificially bid up. The EFS has started to pare gains.

- WTI sailings were briefly interrupted by bad weather last week, but should rebound now. Rapidly rising US commercial crude stocks point to a need to up exports and look also to be putting particular pressure on WTI spreads (Cushing stocks are normalising), raising US-origin competitiveness.

- There is competition in NWE from competing grades to BFOETM out of the Med and Black Sea, with BTC, Azeri, Saharan, Es Sider all showing relatively healthy margins. Spot premia for these crudes have declined w-o-w.

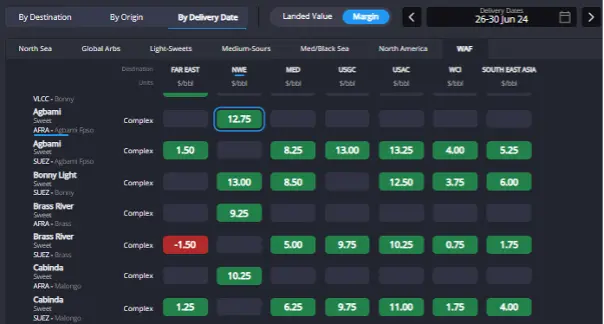

- The weakening in WAF diffs that we had signposted over the last few weeks is emerging, but has room to run lower from at least one perspective, with even medium sweets still uncompetitive against light sweets into NWE, and arbs to the Far East hovering around zero.

Forties margins to Far East have erased recent gains amid higher landed values. Stronger Brent structure, FOB premia, and freight are at play. (Sparta Global ARBS – ARBs Dashboard)

Black Sea and Med grades are competitive against North Sea light sweets even into NWE. (Sparta Global ARBS – ARBs Dashboard)

However, we should start to point out some caveats, beyond the simple fact that NWE refiners are soon to return from peak maintenance. Bullish factors include:

- Lower WAF diffs have helped to firm up margins to WCI and Southeast Asia which are better than to the Far East and are firmly positive at least on an outright basis, albeit not against competitors. Medium sweet WAF margins to the USGC are now on par with Johan Sverdrup.

- WTI margins to the Far East have improved markedly over the last two weeks, even against Murban, partly on lower freight rates. The marginal barrel of lighter crude from an Asian perspective may start to move to WTI.

- The US is – based on preliminary EIA data – already making some moves to up seaborne alternatives to Mexican grades (K-factors were ramped up particularly to NWE and US destinations last week) and that ultimately may also benefit heavier WAF crudes.

WTI margins into Far East have gained substantial ground amid lower landed value. Weaker freight, a relative weakening in WTI futures & FOBs are at play. WTI margins gained ground vs Murban. (Sparta Global ARBS – ARBs Dashboard)

WAF margins into Far East remain very poor but are slightly better into other East of Suez locations. (Sparta Global ARBS – ARBs Dashboard)

Heavy crude rally continues

LatAm crude still looks to be comparatively more in demand as reflected by steadily rising FOB premia.

Most of these are heavier grades and are also landing cheap into Asia even versus most spot MEG crudes. As such there is further room to the upside.

Steadily rising PADD-5 runs are also at play; a support that may begin to make less of an impact soon assuming new Canadian heavy crude loading in Burnaby ends up in West Coast refineries (the TMX startup is slated now for early May).

Spot Basrah barrels are no exception to the wider strengthening in the heavy crude pool.

SOMO hiked its term OSPs to European customers, and since then spot diffs to their respective OSPs are now over $1.20/bbl for Medium and $1/bbl for Heavy.

That seems to be justifiable since spot Basrah Medium margins into NWE (VLCC) remain some of the strongest, while margins to the Med even round the Cape remain substantially higher than North Sea and WAF medium crudes.

Spot Basrah margins remain competitive even after OSP hikes and higher spot FOB premia to OSPs. Alternative grades such as JS may thus have further room to run higher. (Sparta Global ARBS – ARBs Dashboard)

Sparta is a live, market intelligence and forecasting platform that enables oil traders, refiners, banks, hedge funds and wholesalers to have access to real-time and global actionable insights to capture market opportunities before others.

To find out how Sparta can allow you to make smarter trading decisions, faster, contact us for a demonstration at sales@spartacommodites.com