Weak gasoline adds bearish pressure to naphtha demand for blending while E/W collapses after reaching $10/mt

Due to Sparta’s annual team strategising event in Mallorca, this week’s commentary has been abbreviated.

The announcement of Russian export restrictions and purchases by petrochemical players strengthened the European market in recent weeks. After the destocking in Q3, Mediterranean sellers seized the opportunity to ship to the North.

However, this fleeting opportunity has now given way to the realities of the current market: low petrochemical margins and an abundance of light product due to the substitution of Russian crude with lighter grades.

The premiums in the physical market have been hit harder than the spreads, with NWE naphtha still solidly in backwardation.

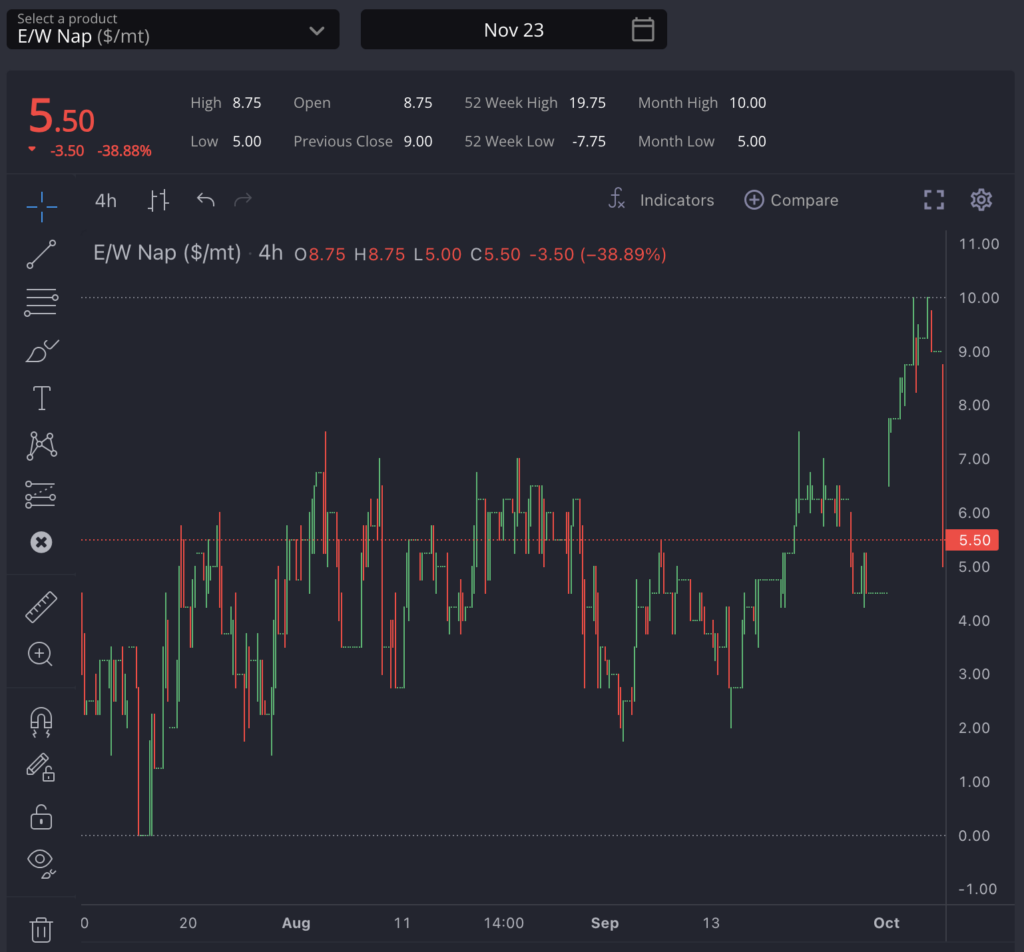

The most notable point in the paper market can be found in the E/W, higher volatility during the week with a $4.5/mt drop during current Asian session.

$10/mt E/W looked too high for November contract specially with the higher volume available from AG in the coming months and a weaker Q4 than expected on the petrochemical demand.

We don’t see significant chances of this high values to come back, despite the slight improvement in Asian premiums for OSN.

Petrochemical margins are still far from positive values, and the increase in AG (Arabian Gulf) led by exports from Kuwait and Oman will limit the potential rise of the E/W spread.

Meanwhile, heavy naphtha premiums continue to remain strong in the Asian market for another week. The opportunity to bring cargoes from USGC is harmed by the strength of USGC naphtha showed the arb closed on paper at the beginning of the week.

Currently it is slightly open on paper but persistent delays in Panama further complicate the settlement of these trades. Everything indicates that the strength of heavy naphtha in Asia will remain in the short term due to the need to attract cargoes for blending and reforming.

USGC strength is currently the spotlight on the naphtha market, currently US naphtha market is stronger than Europe and East of Suez during the last weeks.

The weakness in RBOB has pushed lower discount premiums in the American market, especially in the Gulf, with naphtha clearly over-performing gasoline.

During the month of September, we have seen heavy naphtha premiums go from trading at a discount of 100 cpg to just 50 compared to RBOB.

This trend reduces export opportunities for the US, and the short-term focus will be on Asia’s ability to bring in more cargoes.

The weakness in Europe and the strength of the E/W opened a spot opportunity for some lifters to bring product for MED, the market thought that there was too much difference between both regions and now the eyes are back to NWE again

Jorge Molinero is Commodity Owner for Naphtha and LPG at Sparta. Starting his career as a financial analyst with BBVA, Jorge quickly transitioned to market intelligence within the energy sector, spending 4 years as a naphtha analyst with Repsol before joining Sparta in early 2023.

Sparta is a live, market intelligence and forecasting platform that enables oil traders, refiners, banks, hedge funds and wholesalers to have access to real-time and global actionable insights to capture market opportunities before others.

To find out how Sparta can allow you to make smarter trading decisions, faster, contact us for a demonstration at sales@spartacommodites.com