US strength set to reverse flows in the prompt as NYH pulls European volumes and USGC shuts export avenues

The most striking aspect of the global naphtha market this week is centred around an unusually open arb opportunity for heavy naphtha cargoes out of NWE into NYH.

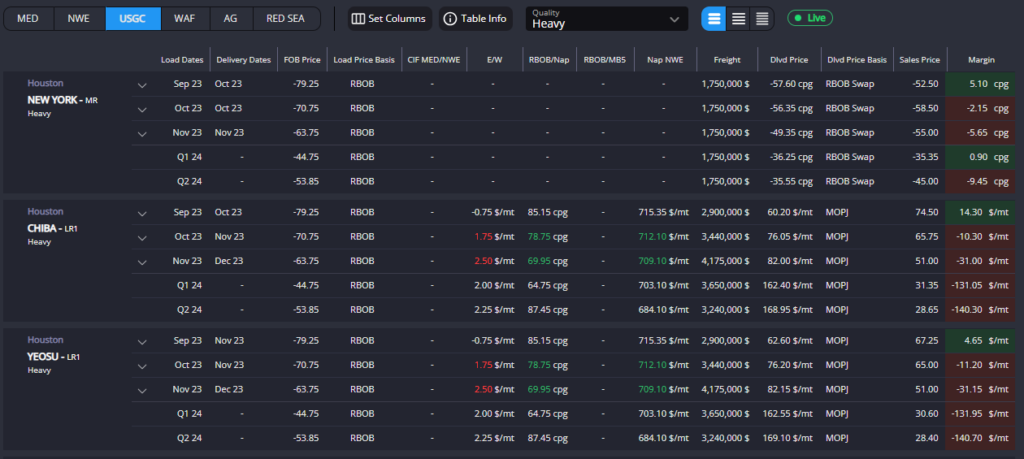

NYH sales prices for heavy volumes have been moving steadily higher through September and are now almost 35cpg higher than they were at the beginning of the month – opening up the prompt arb from Rotterdam at a time when the arb for RBOB on the same route remains firmly shut.

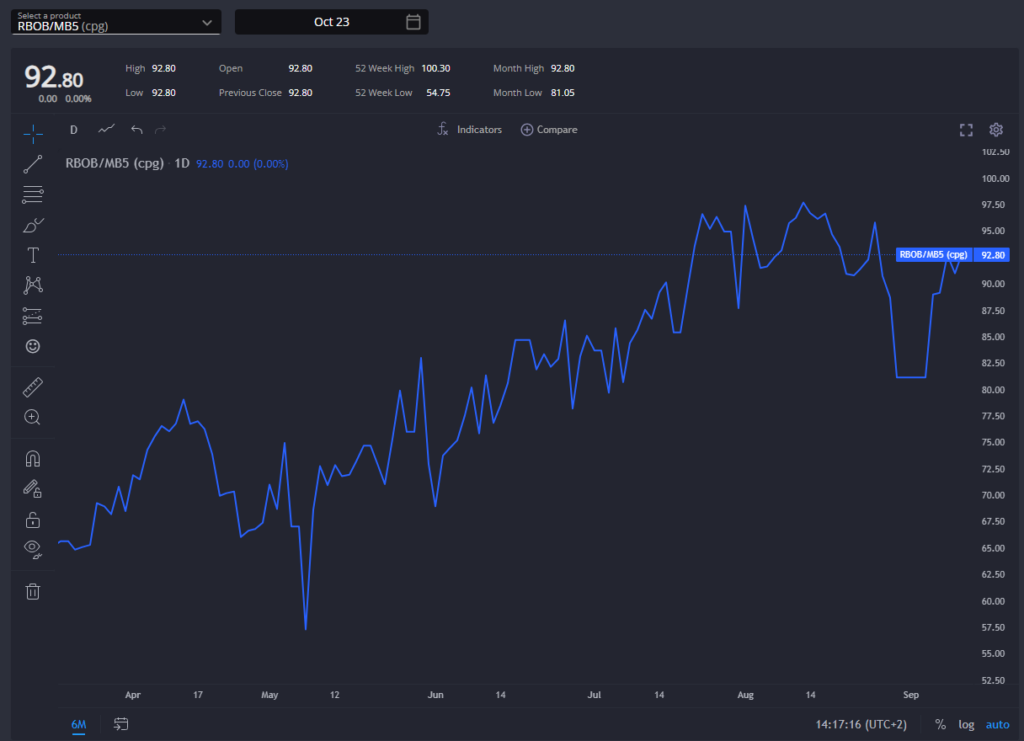

This contradiction – NYH is looking to pull in gasoline blending components rather than finished barrels – may be an early indication that the tightness in the USGC gasoline market is having a knock-on effect on PADD-1 already, and will require also the RBOB arb to open in the coming days.

In the prompt, there appears to be little incentive for USGC exporters to employ Jones Act vessels to help cover the deficit in PADD-1 with margins still better on journeys to the Far East, but this is set to reverse as we move further into Q4 and beyond with forward pricing currently dictating USGC barrels remain closer to home through the winter.

Interestingly, and helped by a widening in the RBOB/MB5 spread so far this month, also the OSN arbs into NYH have been moving ever closer to opening, with the physical premiums on OSN quality also having improved by some ~20-25cpg since the beginning of the month.

A NYH market short on light ends volumes is a boon to a Mediterranean market which has seen its opportunities to move volumes East tightening in recent days, and we would expect to see also some West Med naphtha volumes tempted to move TA in the short term.

This opportunity is likely to be short-lived, however, and given the availability of European barrels, should see the spread closing before long.

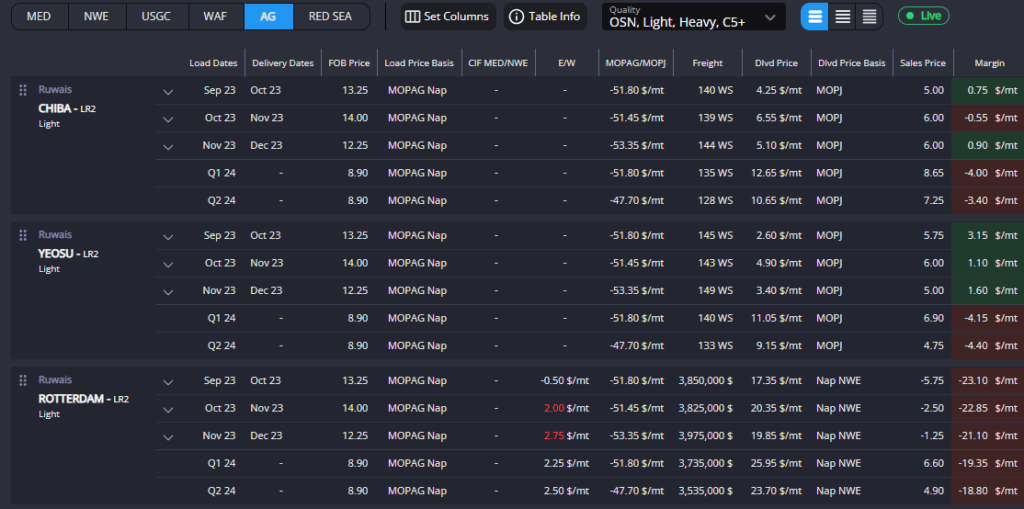

Some interest in keeping also lighter barrels in the Atlantic Basin is providing some breathing room for AG exporters whose margins have been coming under pressure in recent weeks.

FOB prices in the AG have been forced lower to keep margins into the Far East open, and these are currently hovering around the breakeven mark as demand in Asia continues to underwhelm as we enter what is usually a period of seasonally higher demand.

Indeed, demand in Asia continues to disappoint, at least in terms of pulling in external barrels to the region. Almost all Q4 arbs for both lighter and heavier specs into the Far East remain closed at current forward levels, with only the aforementioned AG-origin barrels showing any kind of positive arb margins.

Solidly closed arb margins out of the Med in particular contradict expectations that the Asian naphtha balance will be even tighter once through winter ‘23-24, meaning that either the E/W Nap spread will need to widen again significantly after having narrowed so far this month or the physical premiums paid in the East will need to rise again.

With freight rates on Med->East LR journeys having risen significantly since July thanks to an uptick in distillate voyages, and current FFA levels suggesting they should remain high, we are forced back to the E/W Nap spread as the most likely component to move if we believe that Asia will need those Med barrels through the coming winter.

Philip Jones-Lux is Commodity Owner for Sparta. Having worked with organisations such as JBC Energy and RP Global, Philip is a seasoned energy market analyst with expertise across the oil barrel and power markets

Sparta is a live, market intelligence and forecasting platform that enables oil traders, refiners, banks, hedge funds and wholesalers to have access to real-time and global actionable insights to capture market opportunities before others.

To find out how Sparta can allow you to make smarter trading decisions, faster, contact us for a demonstration at sales@spartacommodites.com