The New Year suggests a softer market as the East is set to pull less than December highs

The naphtha market has started the new year with a general correction in both paper and physical aspects on both sides of the Suez.

Asia remains the primary driver due to high premiums amid declining exports from the Middle East, which recorded the lowest volume in the past year in December.

The expectation for Q1 includes new shutdowns that will keep the market firm, but the lack of product may not be as severe as last month, as reflected in the correction of the E/W at the beginning of this year.

The overall crude and products market is closely monitoring the situation in the Red Sea. Despite the current lower transit and the possibility of further escalations, crude prices are failing to move higher than $80/bbl but are significantly impacting freight rates through the canal.

This impact is particularly relevant in the naphtha market, as product shipments from the Mediterranean to Asia were crucial in December to compensate for lower exports from the Middle East.

Since the onset of tensions, the E/W differential appreciated to offset the rising freight costs. However, we currently observe that the freight rates remain at their peak while the E/W has already corrected.

Adding to these dynamics is the recent strength in the European market due to a resurgence in demand for restocking at the beginning of the year.

The pressure from freight to Asia, which is close to $4 million on a lump sumbasis for a LR2, and the decline in E/W have closed the near-term arbitrage to Asia.

However, the shutdowns in the Middle East will likely revive exports in the short term, probably setting a floor to current E/W levels in the coming weeks.

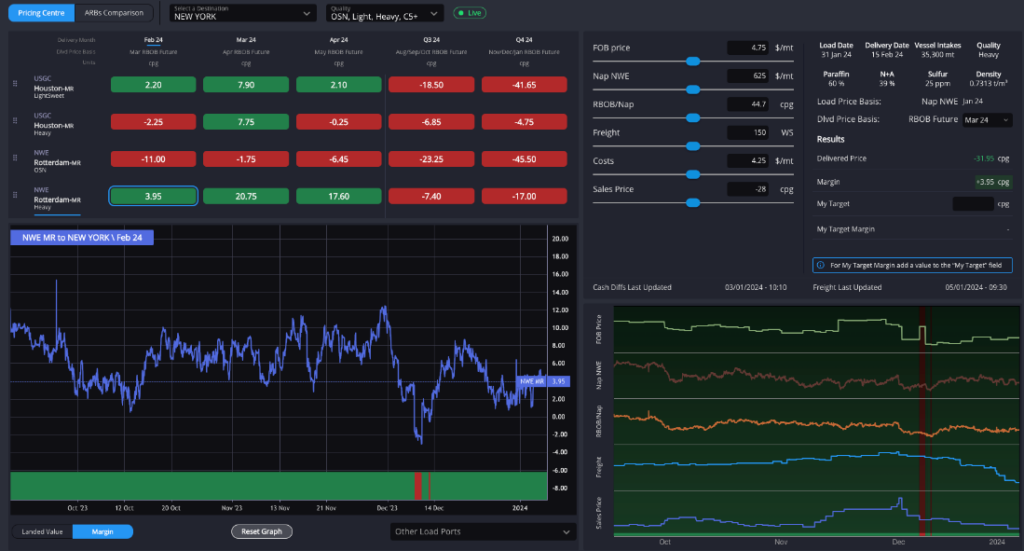

The American market continues to exhibit strength, supported by high gasoline exports and the low stocks in PADD 1 with which it closed last year. The demand for blending keeps the arbitrage for blending qualities open from NWE in the prompt.

The freight for a MR from Europe to the USA has consistently fallen since mid-December, and given the ongoing strength in naphtha prices in NYH, we expect the arbitrage to remain open throughout the rest of Q1, despite freight could be under pressure due to recently congestion lift in Panama that allows more vessels to cross the canal.

Jorge Molinero is Commodity Owner for Naphtha and LPG at Sparta. Starting his career as a financial analyst with BBVA, Jorge quickly transitioned to market intelligence within the energy sector, spending 4 years as a naphtha analyst with Repsol before joining Sparta in early 2023.

Sparta is a live, market intelligence and forecasting platform that enables oil traders, refiners, banks, hedge funds and wholesalers to have access to real-time and global actionable insights to capture market opportunities before others.

To find out how Sparta can allow you to make smarter trading decisions, faster, contact us for a demonstration at sales@spartacommodites.com