Resurgent Asian demand drives the world to backwardation

Welcome to the first edition of our naphtha market commentary, an extension of our well-established gasoline and distillate market commentaries. Jorge Molinero, our Commodity Owner for Naphtha and LPG, will be spearheading our naphtha coverage with weekly commentaries that will keep you informed about the latest market developments, trends, and in-depth analysis.

Jorge has also been instrumental in creating our upcoming naphtha vertical, which is set to launch in a matter of weeks – if you would like to subscribe, please click here

Asia

The MOPJ market has once again shifted into backwardation across the entire curve, pushing also E/W to +10 $/mt for September contract.

A decrease in the Russian available barrels during July and August, and the sharp fall in European prices over recent weeks, reopened the arbitrage for spot Heavy Full Range Naphtha (HFRN) from the Mediterranean region during last week.

Notably, cracks and spreads have demonstrated considerable strength during the previous week in Asia, prompting a marked reaction in the European market with substantial increases in physical premiums observed in both MED and NWE, with NWE Open Spec naphtha moving from -$10/mt to -$2/mt.

As the market’s attention now turns to September arrivals, the focus remains on whether new arbitrage opportunities will materialise for HFRN and if lighter grades will join the party.

The market for heavier grades remains resilient, with a notable escalation in the demand for A-grade and heavier qualities witnessed over the past week.

This escalation serves as a clear indicator of the robustness of the gasoline market, particularly in the Asian region, as evidenced by the Sing 92/MOPJ spread.

As a result, it is likely that we will witness the emergence of new cargoes following the same trading route in the forthcoming weeks, as demonstrated by the prompt loading arb values generated by the Sparta platform, where USGC heavy naphtha going to Asia on an LR1 is showed a positive $9/mt margin.

Europe

The robustness of the Asian market has prompted a proactive response from the European market, aiming not to be left behind.

As a result, we have observed the European curve moving towards backwardation, except at the very prompt.

Furthermore, the European market has shown resilience pushing the crack to -$12/mt, an improvement from the floor of -$16/mt observed earlier this year.

Last week we witnessed successful arbitrage opportunities for Mediterranean grades destined for splitters in Asia. However, the rise in light premiums in Europe has hindered the arrival of additional paraffin grades.

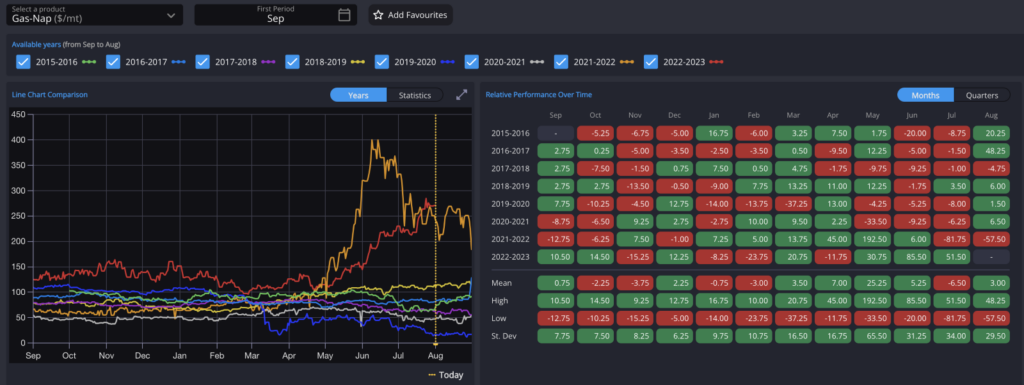

The gasoline/naphtha (gas-nap) differential has been on a relentless upward trajectory, soaring to unprecedented levels. Breaking through the support level at 220 $/mt, the September contract is now facing an impressive +280 $/mt, marking the highest-ever recorded differential during an August trading month, as seen in our Historical Forward charts.

Given these remarkable figures for gas-nap differentials in various markets, the escalation for Heavy Virgin Naphtha (HVN) is far from reaching its conclusion.

Last week, we observed a substantial +130 $/mt premium for low sulfur N+A. If gas-nap keeps pushing, we could come back to the all time historical high recorded last month, where HVN reached +150 vs OSN in Rotterdam.

US

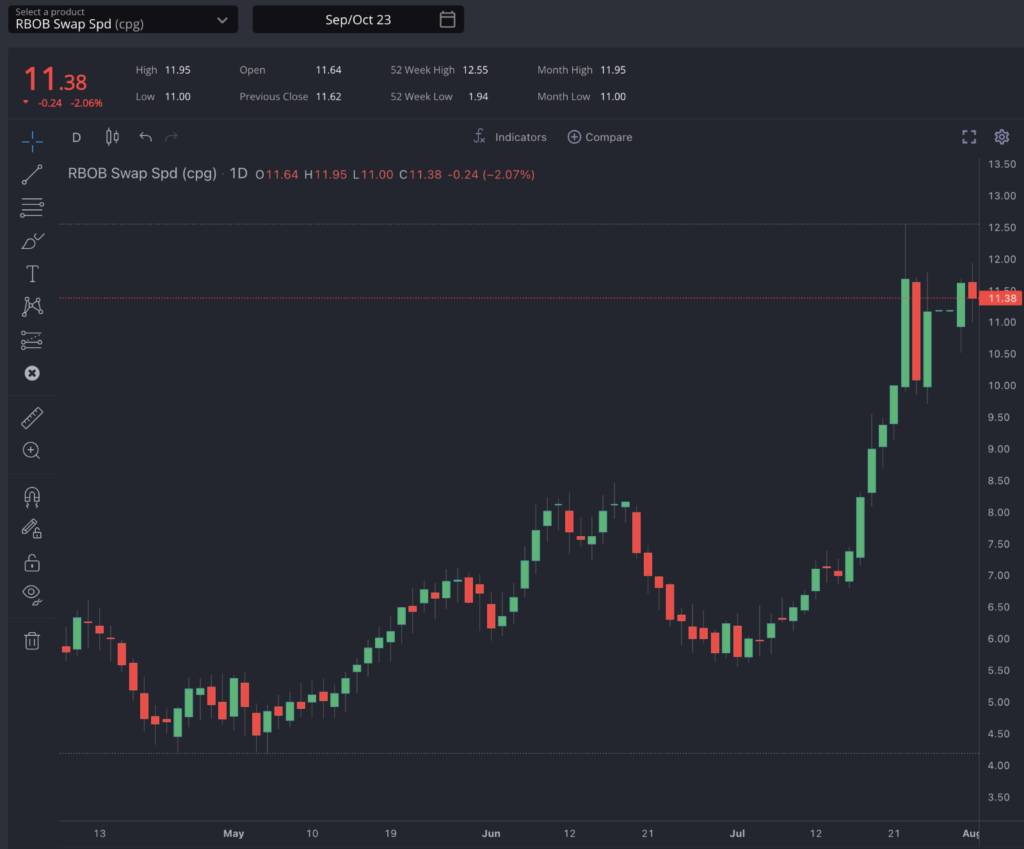

The recent robustness in the New York Harbor (NYH) prompt market is largely due to the heavy reliance on naphtha demand for blending purposes and the recent strength in RBOB that has taken the Sept/Oct spread over +12 cpg – although it collapsed back closer to +9.5cpg during yesterday’s session on the back of the bearish weekly EIA data release which saw an unexpected build in gasoline inventories nationwide (flat in PADD-1).

This has attracted gasoline cargoes from Northwest Europe during the first half of August, including components like HVN suitable for blending.

The strength in the Atlantic basin gasoline market has also driven up premiums for European and Asian blending and reformer naphthas.

The overall market outlook indicates that this escalation is likely to persist due to an unbalanced supply of light naphthas in relation to the demand for qualities needed for blending and reformer processes.

In the US Gulf Coast (USGC), the strength of light sour and sweet qualities has showed limited arbitrage opportunities overseas.

Last month, a 5 cents per gallon (cpg) increase for light sweet and a 3 cpg spike for physical premiums over MB5 saw sour grades balance the rise in the RBOB/MB5 September spread, keeping the differentials tight.

Meanwhile, heavy premiums have seen a decline against RBOB, dropping from -75 cpg to -86 cpg last week and experiencing a cumulative fall of 20 cpg versus the RBOB September future through July.

The decreased relevance of low RVP components in blending has opened up opportunities for exporting heavy naphtha to foreign destinations.

Although New York remains a highly favourable outlet with economically viable Medium Range (MR) load options, competition from Asian and Northwest European outlets is actively intensifying as they compete for these cargoes.

Jorge Molinero is Commodity Owner for Naphtha and LPG at Sparta. Starting his career as a financial analyst with BBVA, Jorge quickly transitioned to market intelligence within the energy sector, spending 4 years as a naphtha analyst with Repsol before joining Sparta in early 2023.

Sparta is a live, market intelligence and forecasting platform that enables oil traders, refiners, banks, hedge funds and wholesalers to have access to real-time and global actionable insights to capture market opportunities before others.

To find out how Sparta can allow you to make smarter trading decisions, faster, contact us for a demonstration at sales@spartacommodites.com