Panama Canal demurrage leads to an unbalanced heavy market

Asia:

Market structure in Asia continued the uptrend which started back at the beginning of July. Over the last two months, the Sept/Oct 23 spread has gone from -$3.5/mt to +$5/mt.

After a threat of decline two weeks ago, also felt in the European market, the upward trend has returned bringing steeper MOPJ spreads and higher physical premiums.

Resurgent strength in the Asian naphtha market has so far failed to yield any significant changes in our arbitrage calculations out of Europe, however.

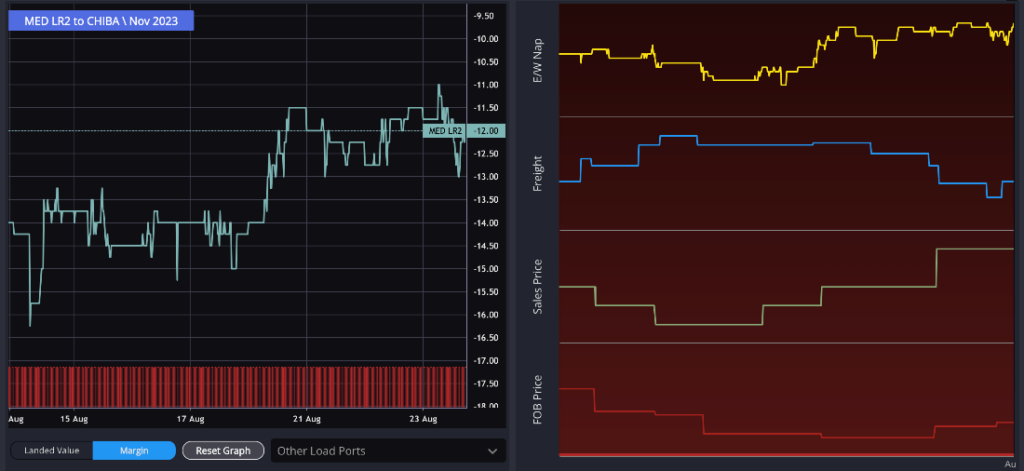

Fixtures from the Med to Asia over August have been sluggish on the back of difficult-to-work arbitrage economics, with the NWE market matching recent moves in Asia and limiting the E/W spread to +$9/mt.

At these levels, the arb for Heavy Full-range cargoes from the Med to Asia remains closed even on an LR2 basis. Skikda Refinery quality comes closest thanks to improved physical premiums on heavier barrels in Japan but remains shut despite freight rates softening recently.

Asian players would need to increase E/W and a weaker MED physical market after the TA’s season would be needed to see these barrel facing Asia in the coming months.

Europe

Europe has been the strongest market during last week, with the September crack gaining $2.5/mt and facing the support at -$10/mt for the first time since May.

Unexpected refinery outages around Europe have pushed the whole oil complex, including naphtha and gasoline, higher as prompt supply is cut and traders have to pay up for prompt barrels.

Petrochemical margins remain very weak in the North, and the overall availability of barrels in Europe has improved through August thanks to the closed arb to Asia and a steady stream of US inflows, so the bullish trend is not expected to last further once the immediate supply constraints are gone.

The picture is quite different in the heavy naphtha market. The end of summer gasoline season saw physical premiums begin to fall in Europe.

On paper, USGC exporters are encouraged to send their shipments to Asia. However, due to the current exceptionally high demurrage costs at the Panama Canal, they are opting to either sell the volumes into the barge market in New York Harbor (NYH), or send them to Europe.

These two dynamics have taken heavy premiums over OSN in the ARA market from +$120/mt to +$10/mt during August.

US

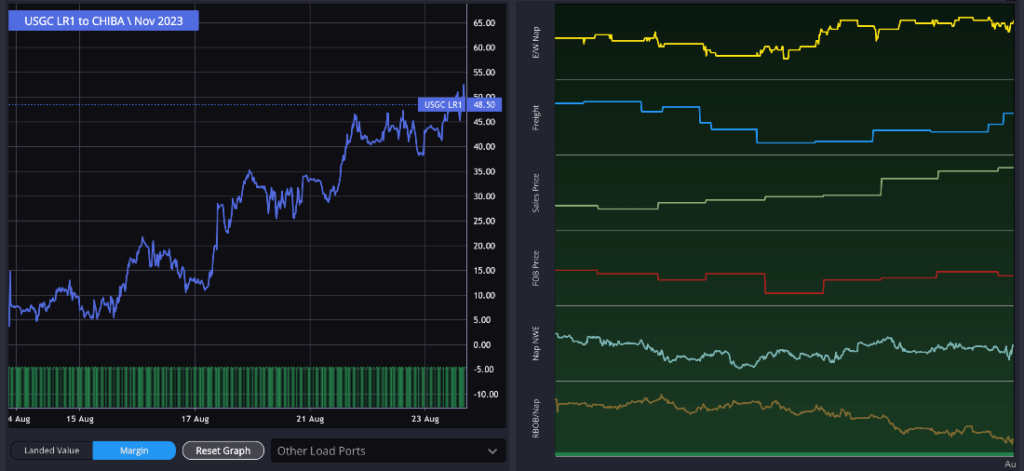

As mentioned in previous articles, the biggest regional price differential currently on the market is between heavy naphthas in the USGC and Asia. There is a clear pricing gap between these two regions and not even the latest spike in freight rates has come close to closing the arbitrage numbers.

Avoiding the Panama Canal can add an additional ~20-25 days of sailing time to the USGC->Far East journey time, and this is disrupting traders’ ability to capitalise on this otherwise-open arbitrage due to extreme demurrage costs.

With the Asian market pricing heavy qualities so strongly and US gasoline stocks getting closer to the seasonal average levels, we are likely to keep seeing an opportunity on these cargoes with traders waiting Panama Canal congestion to be gone to fill the gap.

Meanwhile, USGC heavy naphtha keeps becoming more negative vs RBOB while Asia is the only market where huge heavy escalation remains after the end of the end of the low RVP season has finished. USGC exporters have to find a less rewarded outlet on the barge market or sending it to Europe.

Jorge Molinero is Commodity Owner for Naphtha and LPG at Sparta. Starting his career as a financial analyst with BBVA, Jorge quickly transitioned to market intelligence within the energy sector, spending 4 years as a naphtha analyst with Repsol before joining Sparta in early 2023.

Sparta is a live, market intelligence and forecasting platform that enables oil traders, refiners, banks, hedge funds and wholesalers to have access to real-time and global actionable insights to capture market opportunities before others.

To find out how Sparta can allow you to make smarter trading decisions, faster, contact us for a demonstration at sales@spartacommodites.com