NYH blenders are increasing premiums in an effort to source products from a robust Europe in the physical market, despite a weaker trend on paper

Europe

Despite timespreads and cracks downtrend in the past week, not all the news in the naphtha market is bearish.

European physical is holding the premiums for another week on gasoline support coming from the Russian ban on their exports and fresh buying for petrochemical players after the end of Q3 destocking.

European spreads have room to improve their performance on a new round of physical trades. (Sparta Live Curves)

On the paraffinic side, Mediterranean OSN and FRN premiums remain strong in an effort to retain volume in a European market with increased demand for petrochemical and blending cargoes.

NWE players seized the opportunity of the rebound in petrochemical demand due to low end-of-quarter stocks and renewed interest from blenders, supported by the halt in Russian gasoline exports for the coming months.

This will mean losing one competitor in West Africa and NWE and will push reformer and blending European qualities in the short term.

Blending grades have more opportunities to continue rising in the coming weeks. Despite the strength of OSN over the past two weeks, weak petrochemical margins are limiting larger premium increases in the European market.

This rebound in European blending activity, along with the weakness in RBOB, closed opportunities for the arrival of heavy naphtha from NWE to NYH.

However, the recent uptick in the American market is putting upward pressure on naphtha, and we could see new import opportunities from Europe to the US in the coming weeks.

USGC heavy naphtha rebound during last two weeks. (Sparta Live Curves)

The weaker RBOB market increased the opportunity to export naphtha cargoes overseas and the arb has been open for heavy qualities out of the US to Asia since the beginning of the month.

Now the dynamic in the market points in the opposite direction. We have witnessed a deterioration in the economics of exporting heavy naphtha from USGC to Asia due to the recent price increases in NWE and the moderate rise in RBOB/Nap, which encourages increased blending in NYH.

The decline in gasoline stocks in PADD 1 following yesterday’s EIA report could indicate a potential strengthening of RBOB in the short-term reversing the current trend, what will drive to a higher demand for blending in NYH and increasing opportunities for European exports.

Heavy naphtha from USGC to Asia. (Sparta Global ARBs – Pricing Centre)

Meanwhile, the gasoline market on Asia remains very week and China’s Golden Week holiday in early October has also hampered spot liquidity.

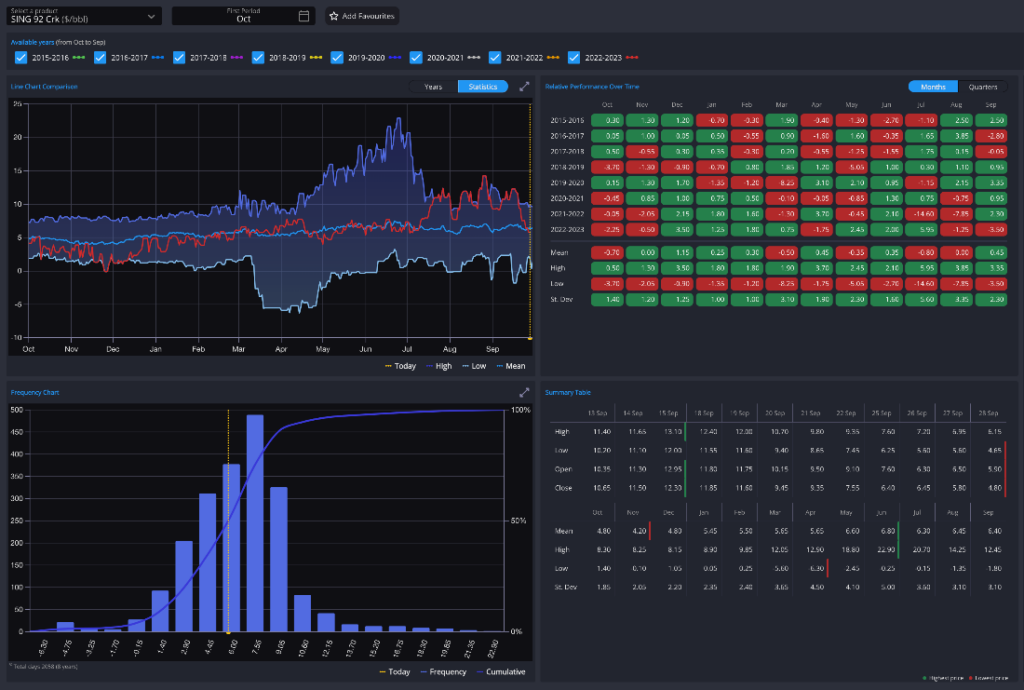

The October Sing 92 crack has shifted from above the 5-year average to below the mean in the last couple weeks.

OSN is weaker with MOPJ Oct/Nov spread falling to +2/mt and cracks to -$14/mt on higher crude pressure, but heavy premiums remain high compared to petchem pool qualities with an escalation that ranges from +$40/mt to +$70/mt depending on the quality

Arbitrage from the USGC remains open on paper but the weakness in the gasoline market in the East of Suez points to weaker premiums for the Asian outlets’ blending qualities.

Together with Panama Canal demurrages still ranging from 2-7 days, this could harm these opportunities in the short term, helping NYH to retain more naphtha from blending.

Jorge Molinero is Commodity Owner for Naphtha and LPG at Sparta. Starting his career as a financial analyst with BBVA, Jorge quickly transitioned to market intelligence within the energy sector, spending 4 years as a naphtha analyst with Repsol before joining Sparta in early 2023.

Sparta is a live, market intelligence and forecasting platform that enables oil traders, refiners, banks, hedge funds and wholesalers to have access to real-time and global actionable insights to capture market opportunities before others.

To find out how Sparta can allow you to make smarter trading decisions, faster, contact us for a demonstration at sales@spartacommodites.com