Naphtha market collapse in Asia due to urgency to cover the lack of Middle East product

The situation in the Bad Al-Mandab Strait continues to dominate headlines in the naphtha market, overshadowing the impact of headlines on tepid Chinese growth and the US cold for the moment.

Asia’s response to this reduction in flows through the Red Sea has been to cover its short position in naphtha with European, North African and West Mediterranean exporters’ products.

The impact has been severe on MOPJ spreads, cracks and especially the E/W spread and box, due to the recent declines in Middle East exports during Q1.

The MOPJ spread for February has gained $2/mt in two sessions, settling at one-year highs, while E/W has climbed to more than $30/t and is close to $40/t in the prompt after a $15/mt rally.

The E/W movement has been similar to the one at the end of December when the first fear of imminent disruption reached the market after Houthi attacks.

This time it has materialised in a lower arbitrage over Suez, and it is reasonable to think that the pressure on E/W may remain.

To ensure a profitable arbitrage via the Cape of Good Hope or a level of heavy and sour light naphtha from USGC that offsets the loss of European product, it will be necessary for E/W to stay elevated.

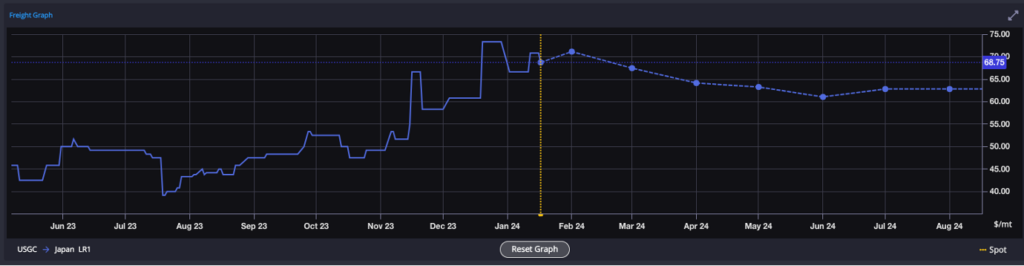

The USGC does not appear as a clear marginal barrel to cover the Asian short in the meantime. The arb is closed for heavy cargoes for March deliveries currently, and freight for LR1 is under pressure, as it has gone from $2 million on lump sum since mid-December to $4.3 million currently as seen in the graph below.

Pressure on the overall freight market is preventing the decrease but stronger MOPJ and physical premiums in Asia, which should persist in the coming weeks, should continue to push for USGC cargoes.

Physical prices have also remained steady since the beginning of the year for both for USGC and NWE and haven’t increased in the last couple of days despite the cold in North America. Meanwhile, freight continues to skyrocket, as seen in the graph below. If the market can’t find a proper balance to cover the Asian short from USGC or through the Cape of Good Hope, we expect E/W to remain close $30/mt, and physical Asian premiums could go even higher after last week’s drop.

In the European naphtha market, there haven’t been significant movements despite the sharp rise in E/W. There has been a slight increase in Med premiums and a slight decline in NWE.

Under ordinary circumstances, recent tensions would have intensified pressure on European naphtha, as observed during the December spike.

However, the current scenario, characterised by low petrochemical demand and a pessimistic economic outlook, especially with Chinese macroeconomic data leading the downturn, is sustained only by the market imbalance in the East.

This situation is likely to exacerbate in Q2 when transit to Asia normalises, and the Middle East increases its exports, when lower spreads and cracks could materialise.

In the meantime, we will expect E/W and freight to remain under pressure, especially for TC15 but we would be cautious regarding risk of contagion over all the geographies.

Jorge Molinero is Commodity Owner for Naphtha and LPG at Sparta. Starting his career as a financial analyst with BBVA, Jorge quickly transitioned to market intelligence within the energy sector, spending 4 years as a naphtha analyst with Repsol before joining Sparta in early 2023.

Sparta is a live, market intelligence and forecasting platform that enables oil traders, refiners, banks, hedge funds and wholesalers to have access to real-time and global actionable insights to capture market opportunities before others.

To find out how Sparta can allow you to make smarter trading decisions, faster, contact us for a demonstration at sales@spartacommodites.com