Is April the peak of naphtha markets’ bull run?

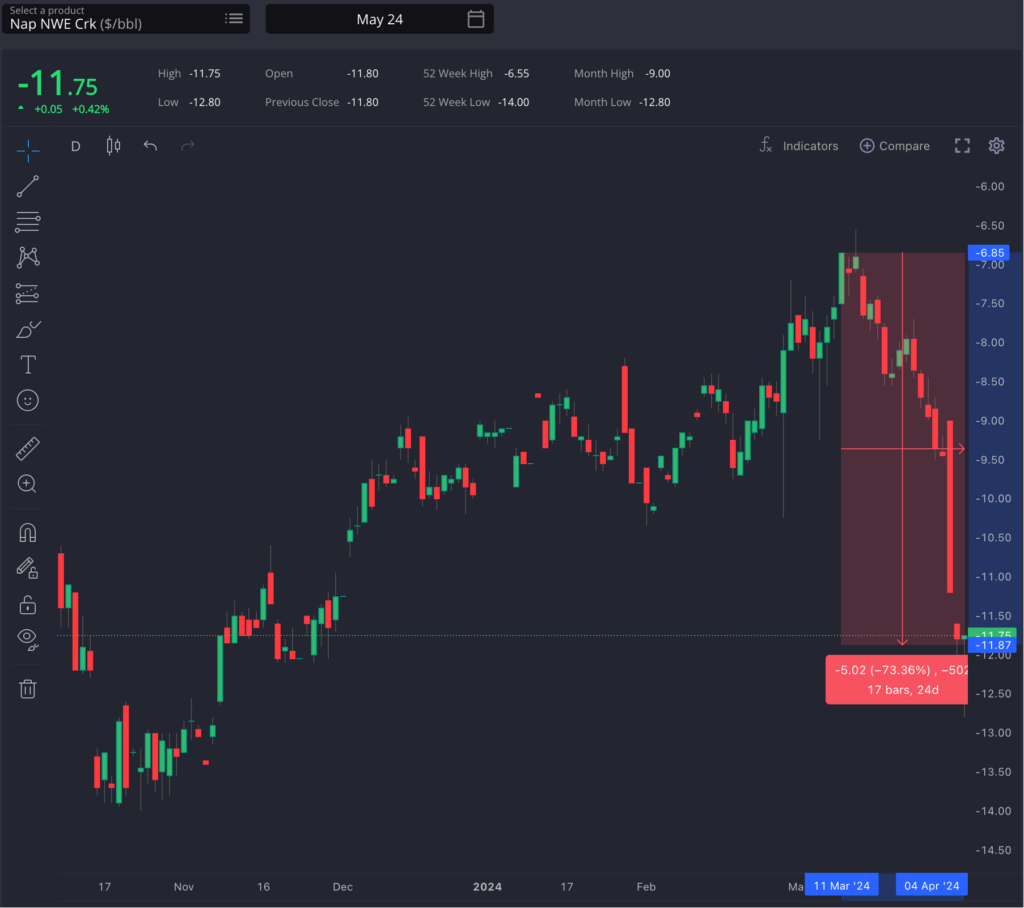

Big correction in cracks on both sides of the Suez with crude oil trading at five-month highs and Brent approaching $90/bbl, spurred by renewed demand strength from US and China, combined with a tight supply market due to geopolitical tensions in the Middle East and the wave of attacks on Russian refineries.

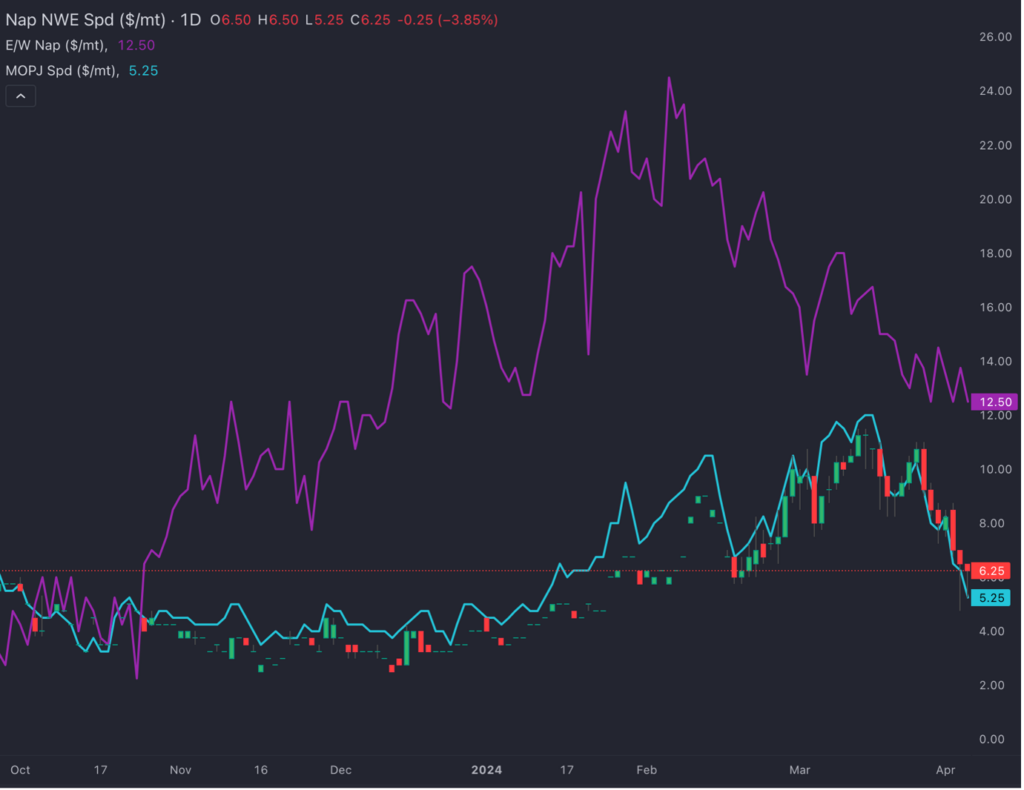

On the naphtha side, the European structure has reached year-to-date lows after a weak end of May with $5/mt losses for May/June spread and declines in six of the last seven trading sessions. The E/W box finally reached the top of the uptrend, going from -$5/mt to -$0.75/mt currently, while the Q2 outlook now looks less tight than a month ago and concern about short-term European supply has relaxed.

Nevertheless, physical prices for paraffinic naphthas remain strong in Europe due to still robust demand, although they have seen substantial drops in Asia during the last week.

The main market trend of Europe being tighter than Asia remains, so the risk now is to the upside on the European structure and bearish on the E/W and E/W box.

The strength driven by petrochemical demand from the end of Q1 has rolled into April, but the curve looks overbought with time spreads close to $15/mt.

The sustained closure of the Asia arbitrage over time and the arrival of shipments from the Red Sea, especially in March, has contributed to the outlook of the naphtha balance being less tight than expected at the start of Q2.

With the current prices in the European market and the correction of FOB MOPAG premiums, we could see more shipments arriving during April and May that would add downward pressure in the Med and NWE, potentially leading to a decrease in physical prices that remain robust despite the fall in paper. This is the most bearish indicator in Europe for the coming weeks.

On the other side of demand, gasoline blending appears set to continue driving naphtha consumption in Europe. Gas-nap remains very strong, reaching new historical highs over $240/mt, and the economics of blending look profitable in Europe, especially for E10.

Meanwhile, the US keeps pushing for more transatlantic (TA) arbitrage opportunities due to low inventories in the US. Furthermore, blending costs have decreased due to lower physical premiums for the aromatic complex, impacting heavy naphthas in Europe which have seen a moderate decrease in the last week, around $5/mt for blending naphtha and more than $20/mt for reformer grades.

These weaker aromatic naphthas in Europe and a tight market in NYH on low US stocks have opened a heavy naphtha arb from NWE to NYH in recent days, and we expect more cargoes to continue choosing this route.

Jorge Molinero is Commodity Owner for Naphtha and LPG at Sparta. Starting his career as a financial analyst with BBVA, Jorge quickly transitioned to market intelligence within the energy sector, spending 4 years as a naphtha analyst with Repsol before joining Sparta in early 2023.

Sparta is a live, market intelligence and forecasting platform that enables oil traders, refiners, banks, hedge funds and wholesalers to have access to real-time and global actionable insights to capture market opportunities before others.

To find out how Sparta can allow you to make smarter trading decisions, faster, contact us for a demonstration at sales@spartacommodites.com