Global cracks continue their fall as USGC diesel faces heavy global competition into LatAm

Despite marginally increasing Red Sea FOB prices, the E/W has done the work of keeping this arb as ARA’s typical and preferred first point of re-supply.

This week it has faced some competition at the front from both WCI, earlier this week open all the way down the curve, and the USGC. In the case of WCI, this has been due to the continued fall in cash premiums over the MOPAG Gasoil assessment for physical loadings (fob prices), which have seen an almost three-fold reduction since the beginning of the year (from 7.45 $/bbl in Jan to 2.05 $/bbl currently).

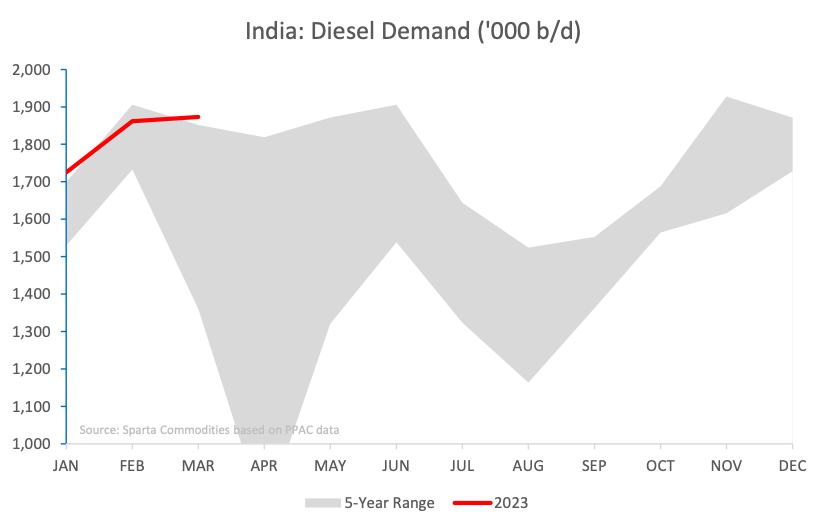

This is despite March Indian diesel demand having been recorded at 5-year record levels (PPAC). This indicates, when we consider the context of Red Sea and AG FOB prices also falling, that the effect of abundant Russian ULSD barrels into the Middle East and India has been enough to lengthen the regional balance despite robust demand.

As for other sources of supply into ARA, the AG and EC Canada (ECC) ULSD arbs currently paint a slightly different picture. The currently weak NYH market makes ECC barrels appear attractive into Europe, with the caveat that there is a limited supply in comparison with other sources.

The AG continues to be the real swing barrel of late, being much more sensitive to the E/W and with fixtures currently showing Singapore or West for orders – although the econs currently point firmly towards Rotterdam over Singapore for prompt loading barrels.

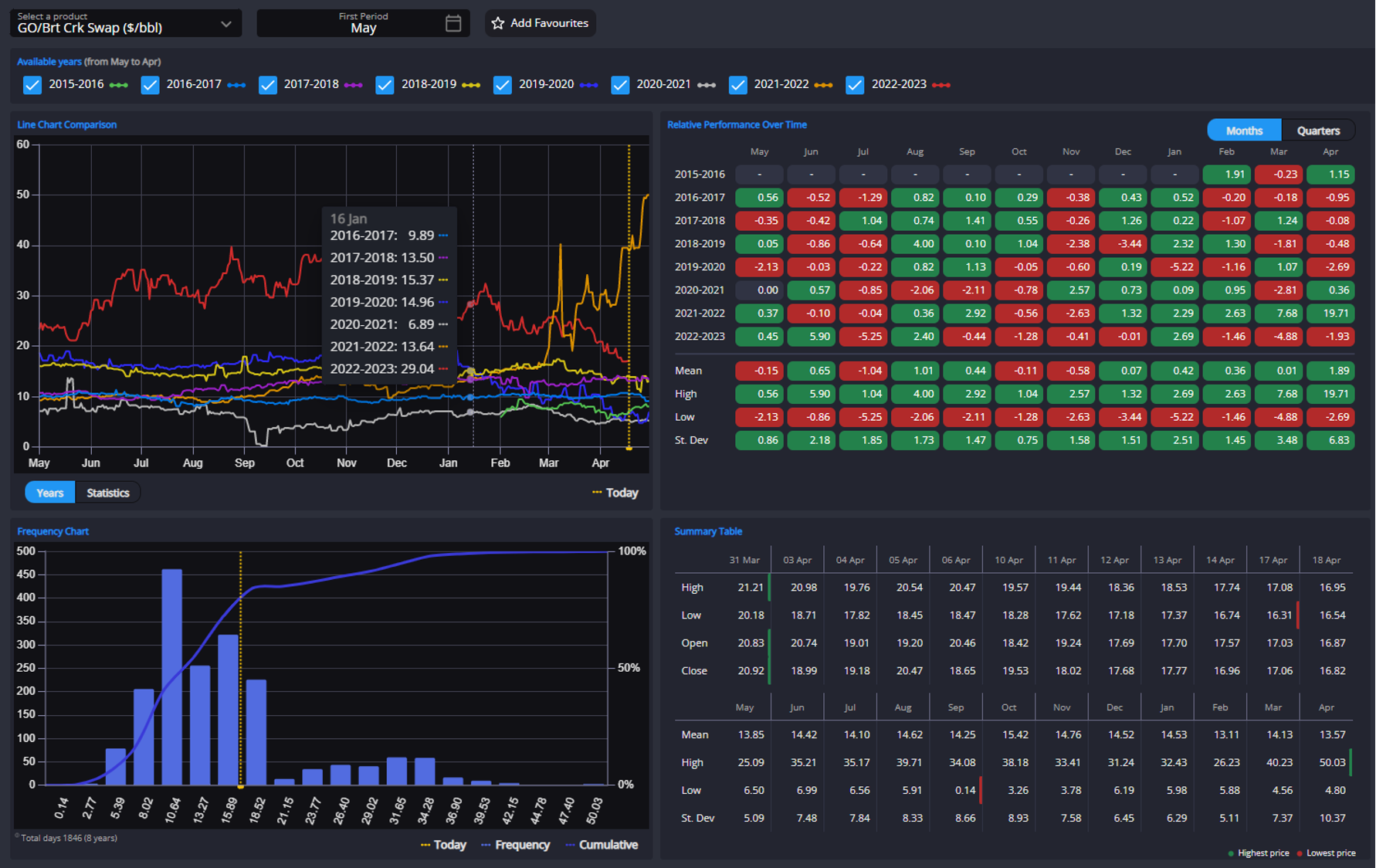

Under the weight of increased EoS ULSD arrivals, demand/recession fears and the return of the French refineries/ports, European gasoil spreads and cracks have continued their downward trend of the previous week.

However, with both being still towards the top end of their respective 5-year ranges, if we exclude last year, combined with the need to refill stocks after the recent French strikes and ARA depletion, the outlook may be healthier than some are professing.

Indeed, although there may still be some further downside to cracks in the short-term, anything short of a significant decline in outright demand through Q2 and beyond should keep cracks in the upper-half of their 5-year range.

The AG has been the MED’s primary source of external re-supply of late, with this arb having been open, at the front, for significant periods of this week (with some competition from the USGC due to reasons mentioned above).

This has occurred due to the buoyancy given to the MED ULSD diff by French refinery strikes and the current European maintenance period having been reportedly concentrated in the MED.

However, with this maintenance period now shifting more to the North and with French refinery strikes having ended, we have already started to see the MED diff come off, a trend that is likely to continue in coming weeks. The fixtures we had witnessed over the last few weeks of ARA to MED having stopped appearing.

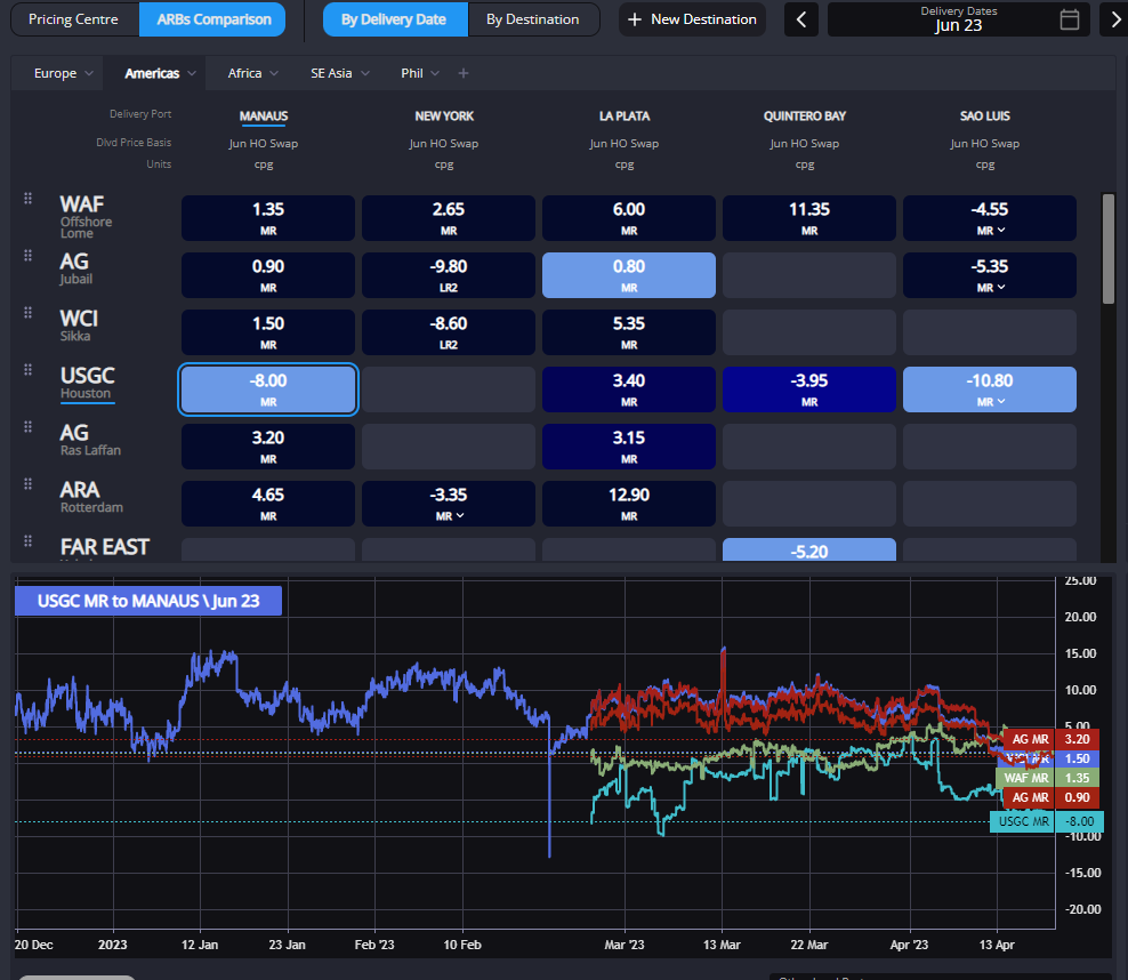

Under pressure from the mostly closed TA arb over the last week, MR freight price reduction in the region has done the work of keeping the USGC as the primary source of supply for Brazil. However, even here the competition has been fierce from the currently-sanctioned Russian barrels (and barrels out of the AG).

Brazil has been reported to have taken record levels of Russian ULSD in March, with this trend rumoured to be strengthening into April.

Looking ahead, the USGC complex appears to be pricing to compete vs these barrels rather than vs barrels out of WAF or the EoS, with mid-June arrivals into Manaus for example currently around 10cpg cheaper out of the USGC vs other non-sanctioned sources.

The picture for Argentina, presented as a mixed one in the previous week’s commentary, has altered. Here the previously mentioned reduction in the AG FOB prices, combined with steady HOGOs, has declared the AG as the clear winner into Argentina. The matching fixtures having been observed over the last week.

A similar picture has developed for WCSAM, where reduced East Asian FOB prices, reduced three-fold since the beginning of the 2023, combined with slightly widening HOGOs have caused Chile’s primary point of supply to continue to be the Far East.

The conclusion seems clear, we will have to see a reverse in the recent widening of forward HOGOs to allow an outlet for these excess USGC ULSD barrels, along with a reduction in USGC diffs. If this does not happen, the pressure is bound to continue to be negative on the HO crack, this having decreased by 5 $/bbl over the last week.

With Singapore cash premiums having halved since the beginning of April, all arbs into the region appear closed.

Due to the previously referenced reduction in WCI FOB prices, this arb into Singapore is currently best placed, the typical problems with the flash of WCI barrels notwithstanding.

Here we see a race to bottom taking place between WCI and Singapore to open this arb or not. The instrument to monitor here is the, slightly increasing this week, AG/SG 10 spread, which we would expect to widen further in the coming weeks to ensure a portion of these barrels are directed to Singapore.

With Sing MD stocks currently reducing, a heavy South Korean maintenance period starting, an OFAC warning being issued this week to discourage the trading of Eastern Russian gasoil exports and export margins sure to have the effect of reducing Chinese gasoil exports into April; we are of a bullish view on Singapore sales prices and the Singapore ULSD complex, here to be monitored via Sing 10 cracks, in the short term.

This should also be expected to have a positive effect on the ULSD E/W if we are to see these WCI and Middle Eastern arbs fully open into Singapore. We do not expect Kuwait’s Al Zour refinery’s two CDUs being currently offline to materially alter this conclusion.

[hubspot type=cta portal=7807592 id=38c8d3f4-d2d3-4781-a4a2-ba10ca4055bc]

James Noel-Beswick is Commodity Owner for Sparta. Before joining Sparta, James worked as an analyst for likes of BP and Shell, and leads our continued development of the distillate product vertical.

Sparta is a live, pre trade analytics platform that enables oil traders, refiners, banks, hedge funds and wholesalers to have access to real-time and global actionable insights to capture market opportunities before others.

To find out how Sparta can allow you to make smarter trading decisions, faster, contact us for a demonstration at sales@spartacommodites.com