Gas-nap blowout sees TA Arb spread narrowing to close prompt RBOB movements

The prompt RBOB arb – open since early-April for April loaders – has been shut for ARA blenders over the last few hours thanks to a significant drop in the TA paper spread.

Having opened significantly on the back of the blowout in gas-nap spreads (with RBOB able to take significantly higher naphtha percentages than EBOB), the paper spread has become the instrument of choice to shut this opportunity again.

With little indication that gas-nap spreads will narrow from their current $250/mt levels in the short-term, pressure is set to remain on this TA spread which has now (RVO-adjusted) actually turned negative.

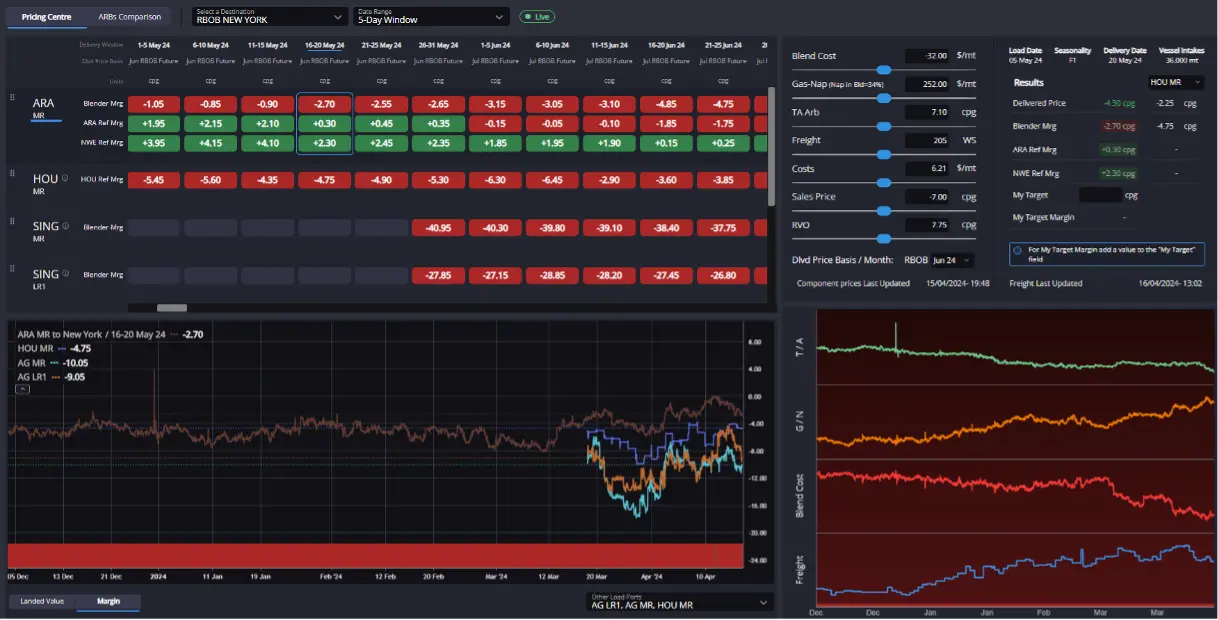

The RBOB arb has been shut for ARA blenders, but prompt flows already fixed and refiners still able to make it work. (Sparta Global ARBS – Pricing Centre)

With TC2 trending sideways still, there is little indication that this prompt demand for cargoes to move TA from Europe has been enough to tighten vessel availability in ARA.

Indeed, although the distillate arb from the USGC into ARA looks closed on paper currently, TC14 appears to remain well-supported and we are likely to see vessel availability therefore remaining strong in short-term, removing the likelihood that an upturn in TC2 rates can provide a floor for the TA Arb spread.

The TA Arb is now in negative territory when RVO-adjusted, but wide gas-nap in Europe keeping physical arb opportunity open. (Sparta Live Curves)

Instead, eyes should be on the sustainability of the upturn in the EBOB complex. With a handful of FCC outages in Europe currently, and some inland supply issues in Western Germany, there is some short-term support for the European market from the supply side, but we are struggling to see much beyond the open RBOB opportunities on the demand side.

The narrowed TA Arb has effectively cut off opportunities to place European-origin barrels into the Americas, and the uptick in EBOB vs both RBOB and SG92 is seeing increasing competition into typical European export destinations also from the AG and Singapore.

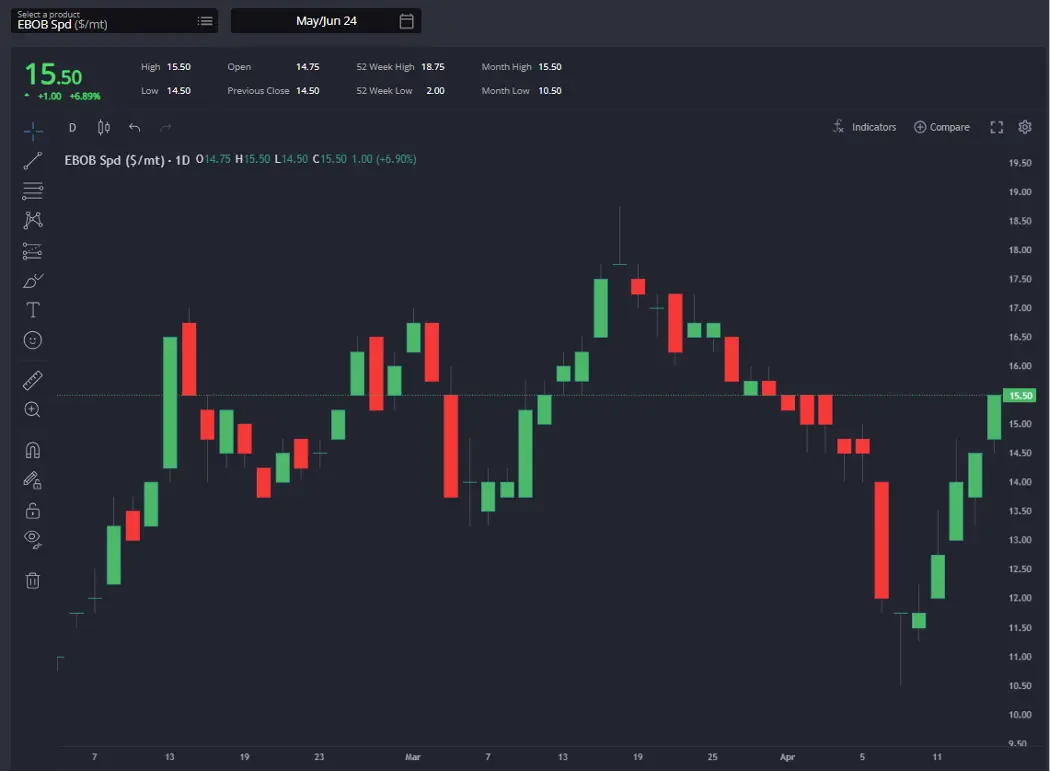

EBOB spreads have rallied back to their early-April levels on supply concerns, but demand unlikely to justify the uptick. (Sparta Live Curves)

For example, despite the wider gas-nap spread in Europe helping to bring down blend costs, the soft clean freight market in the EoS currently and the wider E/W spread (now back into double-digits) has opened up the opportunity for AG-origin barrels to place into WAF.

Whilst this was a relatively rare occurrence in recent years, when this opportunity has arisen in recent years it has turned into more and more physical flows.

The Arbs into WAF are pointing definitively to the AG currently. (Sparta Global ARBS – ARBs Comparison)

The timing for the USGC to become the undisputed primary supplier for the Americas comes at the right time, with inventories in PADD-3 building strongly in recent weeks.

That being said, exports have been consistently above the 5-year average and are now set to remain high, with little indication that high exports will be enough on their own to curb inventory builds.

The oversupply situation in PADD-3 is likely also being impacted by a growing naphtha overhang with flows towards Canada low currently thanks to field maintenance, with more light ends in PADD-3 pushing MB5/RBOB spread now at ~-113cpg, 10% wider than at the beginning of the month.

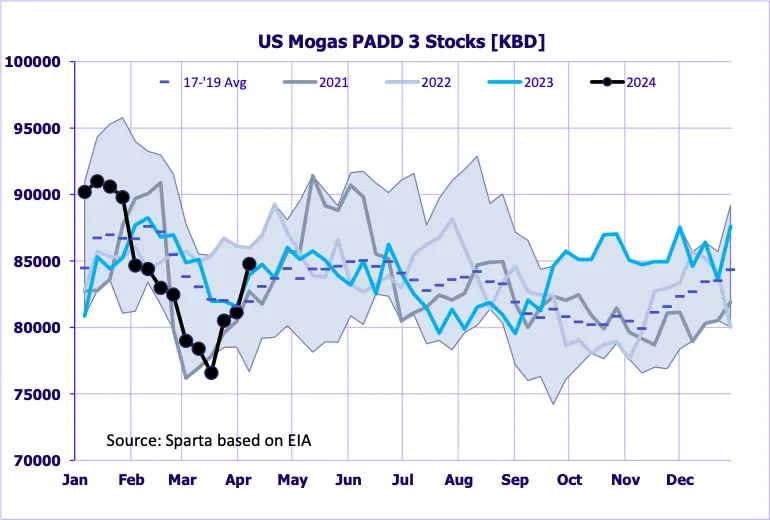

PADD-3 gasoline inventories have built faster than expected, and will need contribute to keeping the RBOB complex comparatively subdued vs Europe. (Source: EIA)

Finally, in the East, there have not been any significant movements over the last week or so with public holidays quieting the market.

Overall, the market continues to appear to be quite well supported, but there are beginning to be some telltale signs of weakening components premiums in both Singapore and the AG – including in some of the direct streams from major exporters – which indicate the market is ripe to lose a little of its strength in the coming week or so.

With the west coast of the Americas also now pointing back to the USGC for resupply, opportunities to cut into the Asian balance by exporting across the Pacific are likely to dwindle, applying a little more pressure here as we move towards May.

Outlets into the Americas are closing for the Asian market, with the need to look to the West now for extra-regional exports. (Sparta Global ARBS – ARBs Comparison)

Philip Jones-Lux is Commodity Owner for Sparta. Having worked with organisations such as JBC Energy and RP Global, Philip is a seasoned energy market analyst with expertise across the oil barrel and power markets

Sparta is a live, market intelligence and forecasting platform that enables oil traders, refiners, banks, hedge funds and wholesalers to have access to real-time and global actionable insights to capture market opportunities before others.

To find out how Sparta can allow you to make smarter trading decisions, faster, contact us for a demonstration at sales@spartacommodites.com