Flat-price collapse aside, diesel markets struggling to show any strong direction

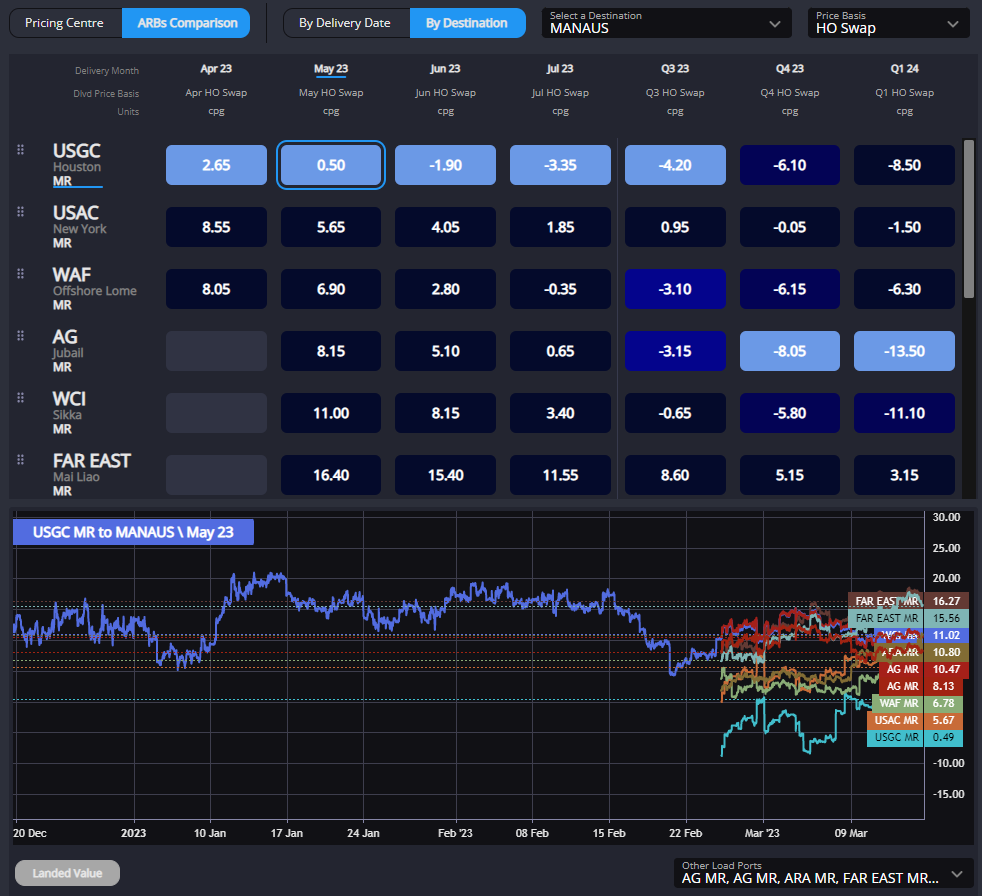

The opening up of the USGC -> Rotterdam route towards the end of February turned out to be short-lived, with USGC barrels currently finding sufficient demand in LATAM to support a stabilisation in prompt cash diffs there in recent days.

This leaves us with a similar picture to what we have been seeing essentially since the turn of the year, with the Red Sea just about open into Rotterdam with all other routes out of the money for now both in the prompt and through the summer.

Barrels out of the Red Sea remain a viable option largely thanks to falling cash premiums on barrels out of the AG in recent weeks, with flows out of Russia into the East of Suez picking up recently – forcing physical prices lower as the AG begins to have more barrels to play with.

Russian barrels now flowing increasingly into the East of Suez, as well as Chinese exports continuing to make a sustained return in 2023, is being felt in the SG 10 curve as well as the physical premiums quoted in Singapore and across the Far East.

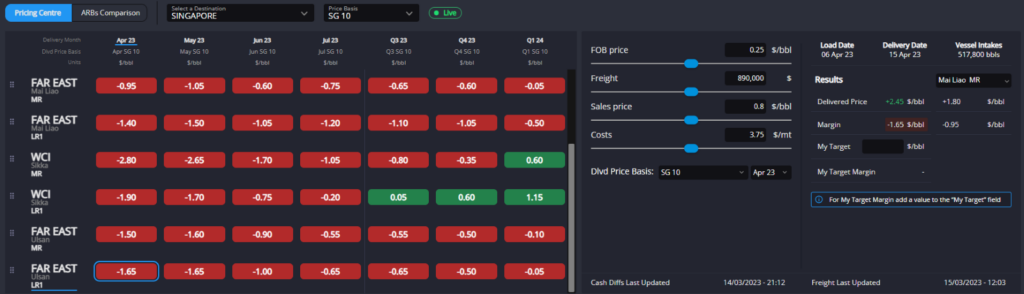

With the sales price in Singapore consistently under $1/bbl in recent days, and the MOPAG/SG 10 narrowing, margins into Singapore are currently also closed. Whilst this doesn’t necessarily mean that volumes into Singapore will dry up, we wouldn’t be surprised to see Northeast Asian exporters looking further afield.

The west coast of South America is currently very much pointing to Northeast Asia over the USGC as the origin of choice, and we are even seeing fixtures from Korea into NWE, although this doesn’t appear to be optimal at current levels.

As mentioned above, the USGC has re-established itself as the origin-of-choice for the east coast of South America, and for now at least filling the shorts into Argentina and Brazil are likely to be enough to keep USGC export econs afloat.

Going forward much will continue to depend on where barrels out of Russia end up flowing. Early indications continue to point towards the East of Suez and North Africa, but any competitive pressure from either Russian barrels or a further weakening in WAF pricing (which we already see increasing pressure through H2-2023) may coincide with increased PADD-3 supply in the summer months to once-again pressure pricing here.

Finally, although we are yet to see a return to any undisputed signs of tightness emerging in the NWE market, there are some early indications that pricing is beginning to turn, preparing for greater flows into ARA in the months ahead even if most arbs are not yet open.

The HOGO in April and May, for example, has been falling steadily in recent weeks, discouraging further divergences across the Atlantic of barrels out of the east. We may have to wait a little while longer before the inevitable fundamental tightness in the European market is translated into pricing signals, however, with market wobbles on the fallout from SVB and Credit Suisse issues sending a few dubious signals through the market currently.

[hubspot type=cta portal=7807592 id=38c8d3f4-d2d3-4781-a4a2-ba10ca4055bc]

Philip Jones-Lux is Commodity Owner for Sparta. Having worked with organisations such as JBC Energy and RP Global, Philip is a seasoned energy market analyst with expertise across the oil barrel and power markets

Sparta is a live, pre trade analytics platform that enables oil traders, refiners, banks, hedge funds and wholesalers to have access to real-time and global actionable insights to capture market opportunities before others.

To find out how Sparta can allow you to make smarter trading decisions, faster, contact us for a demonstration at sales@spartacommodites.com