European market continues to hit new highs on rising petrochemical demand, but gas-nap suggests gasoline demand could have already peaked

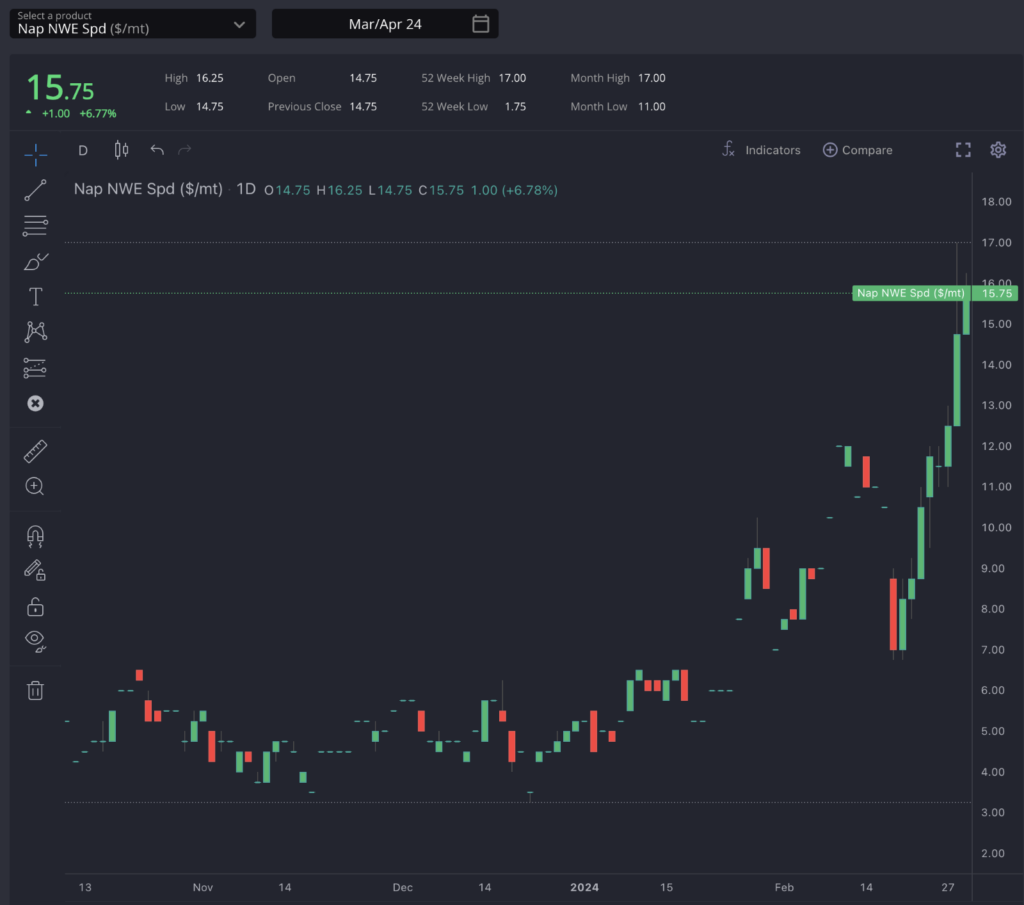

The recent trend in the naphtha market has continued for another week with backwardation increasing in Europe on eight consecutive days of spread gains.

Rising petrochemical demand and the E10 blending margin for March continue to push the European market higher, reflecting a strong backwardation throughout Q2.

The naphtha crack is also reaching fresh highs with Brent trading sideways and an upward flat price, reflecting the favourable conditions in naphtha demand in Europe.

The strength in time spreads and the crack is also being reflected on the other side of Suez, with MOPJ on the rise but with less strength than CIF NWE.

Indeed, the March-April spread has not yet reached the values seen in end-January and the E/W box remains in negative territory.

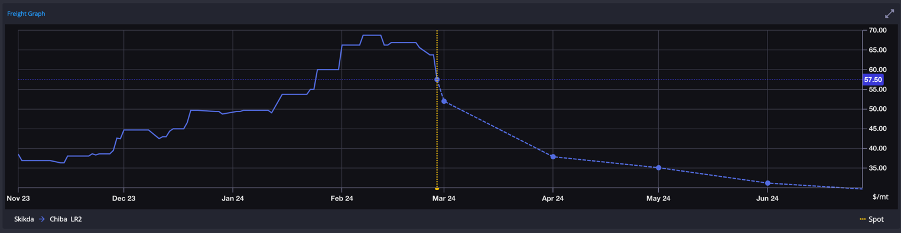

The dynamics of both markets in recent weeks have dragged the E/W to values prior to 2024 and closer to the historical average. After the initial rise in January due to the situation in the Red Sea, the E/W reached $30/mt ito cover the arbitrage to Asia through new routes via the Cape of Good Hope.

The attacks on Russian facilities, whose product is destined for Asia, further incentivised this trend. However, concerns about demand in Asia have shifted toward Europe, where petrochemical demand is at its best since the last 18 months, and the increase in exports from the Middle East has tempered the initial rise of the MOPJ.

In the short term, we see no reasons for a change in the dynamics of the West to East arbitrage, with Europe keeping its product for NWE consumption and petrochemical demand sustained by low stocks and the surge in prices for downstream products.

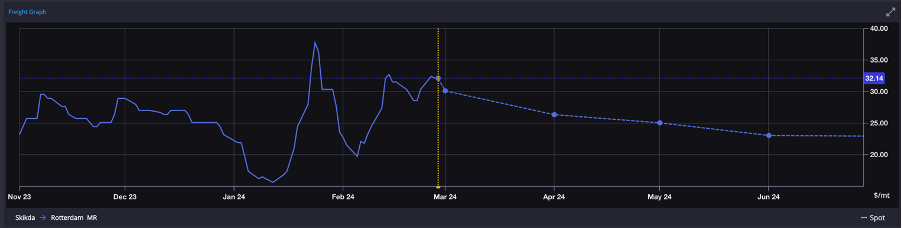

The freight market is also reflecting the current trend, with handy and MR freight rates from the Mediterranean to Lavera and Rotterdam reaching year-to-date highs, surpassing even the values from mid-January after the initial Red Sea attacks.

However, the LR2 alternative to Asia has recently become cheaper, both through the Bab al-Mandab and the Cape of Good Hope routes. This dynamic mirrors the behaviour of the E/W paper market.

Significant declines in freight to Asia and a considerable rebound in the E/W spread will be necessary for Asia to attract European product, something we do not foresee happening until possibly the late May or June deliveries when Asia will need product from abroad on potentially lower Russian exports.

At this point, the question is: What is the ceiling for backwardation and cracks in Europe? Petrochemical demand should remain strong in the near term.

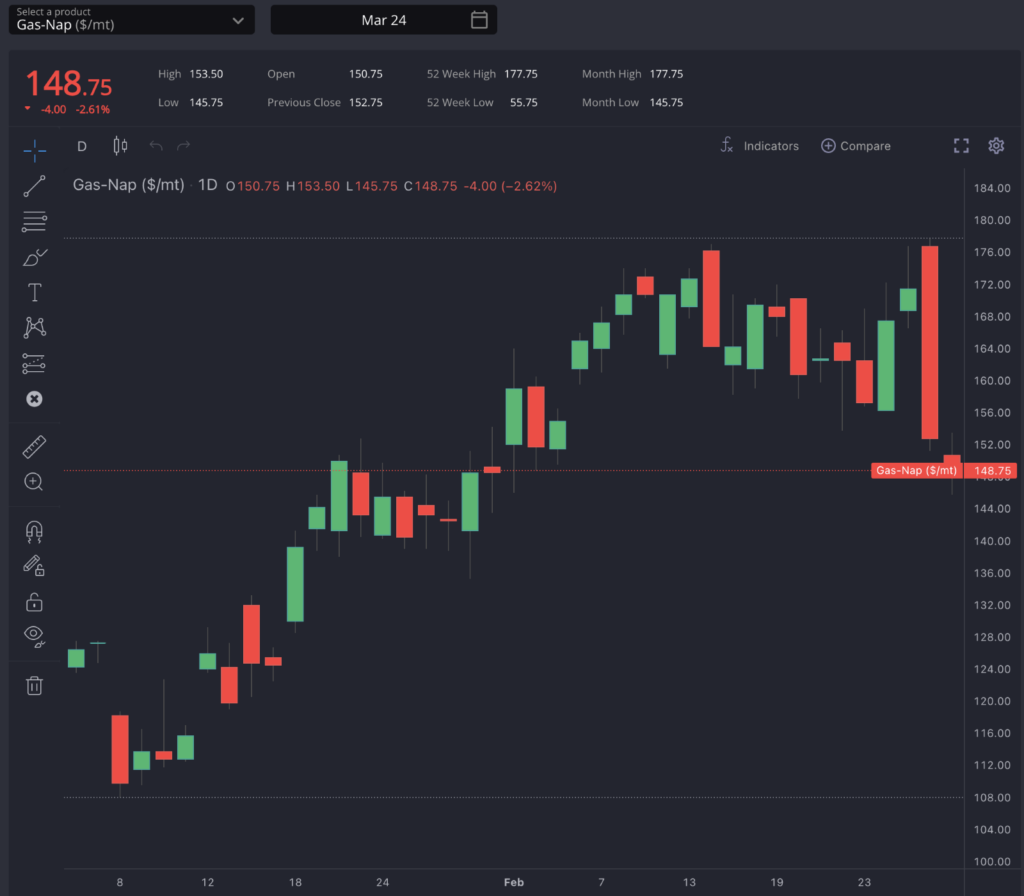

However, gas-nap has lost more than $20/mt since its recent highs. Although E10 blending still shows an open margin for March, it has been significantly affected by the recent drop and the pressure from high aromatic prices.

This worsening blending margin suggests that it will be challenging to see increases in cracks and spreads that surpass the current highs.

Jorge Molinero is Commodity Owner for Naphtha and LPG at Sparta. Starting his career as a financial analyst with BBVA, Jorge quickly transitioned to market intelligence within the energy sector, spending 4 years as a naphtha analyst with Repsol before joining Sparta in early 2023.

Sparta is a live, market intelligence and forecasting platform that enables oil traders, refiners, banks, hedge funds and wholesalers to have access to real-time and global actionable insights to capture market opportunities before others.

To find out how Sparta can allow you to make smarter trading decisions, faster, contact us for a demonstration at sales@spartacommodites.com