Europe shows first signs of weakening despite higher petrochemical demand, while Asia keeps arb closed

The strong backwardation has persisted in the naphtha market, but in recent days, we have observed the first signs of a correction.

The focus has shifted from Asia to Europe on incrementally higher petrochemical and robust blending demand, but higher aromatic prices are harming blending and could further correct the European market.

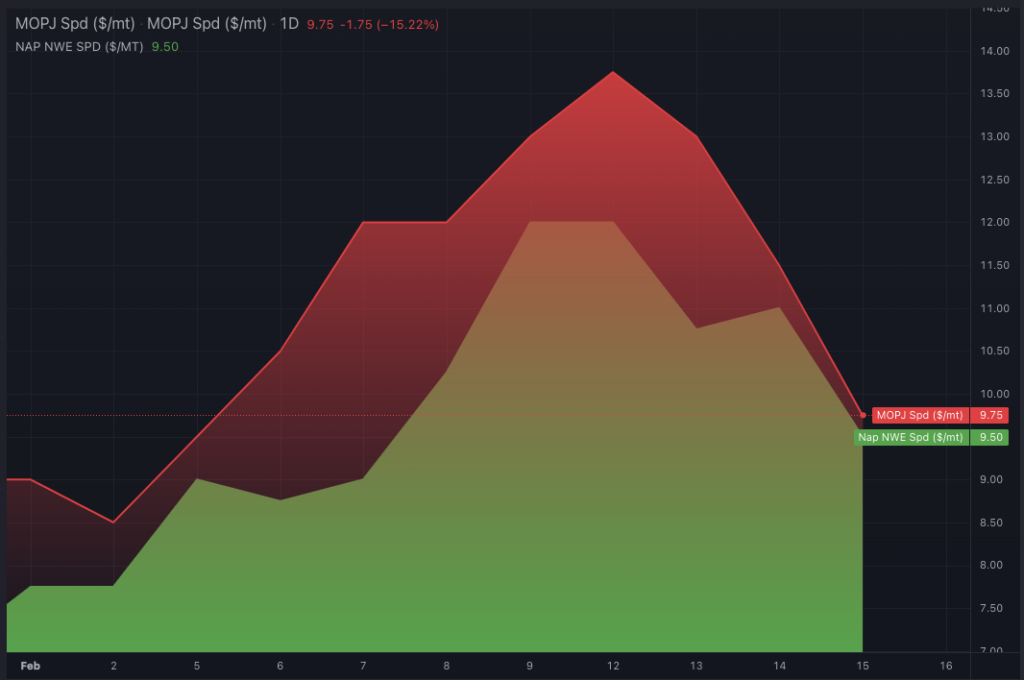

Spreads have been the focus showing marked volatility in the last weeks, with Europe leading the pack and the March-April E/W box flattening during the European market opening on Thursday.

However, the $3/mt correction in the European Mach-April spread during the last two days, indicates an overheated market that has reached its short-term peak, potentially leading to further declines in the coming weeks.

The main drivers that have led to such a backwardated market in Europe have been an increase in cracking demand in recent weeks, driven by the need to boost the production of final chemical products due to difficulties in importing them from the East.

Additionally, there has been a strong demand for gasoline with an open margin to blend E10 and Gas-Nap setting new record highs.

To these factors, we add the recent increase in shipments to Brazil, which has helped maintain a tight European market.

The strong blending margins have pushed naphtha demand higher, but the situation could quickly change. Given disruptions in the US and AG, as well as wider gas-nap spreads in Europe, the call on higher octane components in Europe is rising dramatically.

This has been felt in component prices, with light reformate leading the uptrend and closing the spot blending margin for E10, as reformate accounts for around 30% of the winter blend.

Another bearish factor for the European market could be the consolidation of the arbitrage from the Red Sea to Europe due to the lower risk it poses compared to the Asian alternative.

If this flow is established, mainly from the western part of Saudi Arabia, it could have a bearish impact on Europe, affecting mainly Med prices.

On the Asian side, despite the rebound in physical premiums, the increase is not sustainable enough to attract cargoes from the West, with the arbitrage currently closed from Europe and the US.

The accumulated drop of E/W to around $20/mt and the increase in freight, along with the risk posed by the Red Sea, keep the economics closed even when opting for the Cape of Good Hope route from the Med.

In addition to these factors, there is an increase in exports from the Middle East for March arrivals, values that will be closer to the average than during January and February.

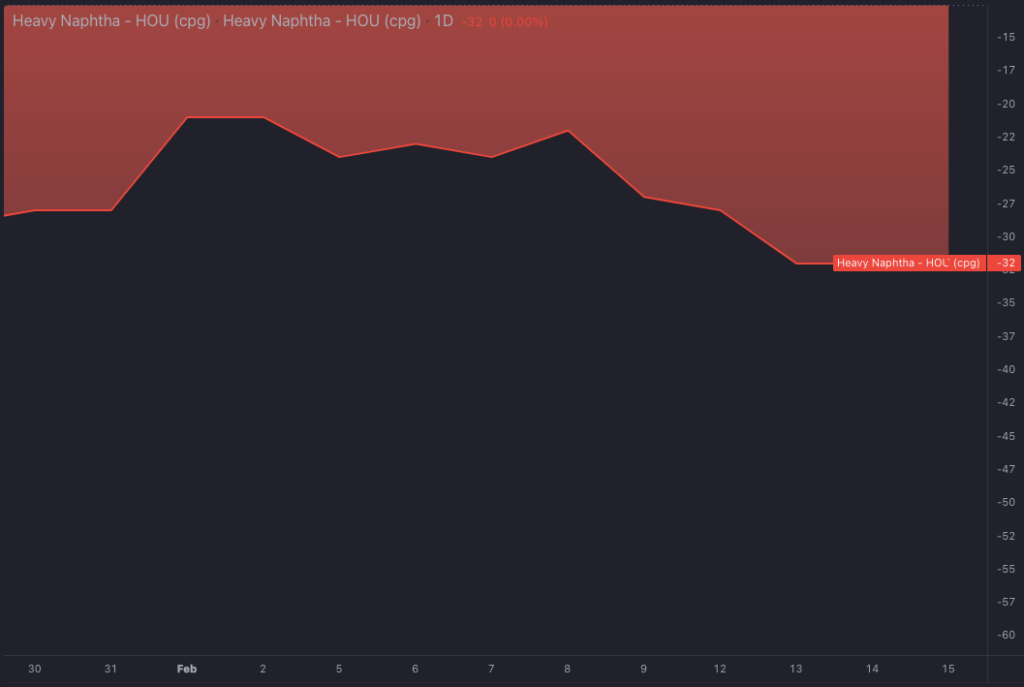

In the American market, the bearish trend in naphtha continues, as we mentioned last week, and the recent drop in RBOB will accentuate this dynamic in the coming days.

Since the mid-January cold wave, naphtha premiums have increased significantly, but there has been a considerable drop especially in Gulf premiums, mainly in those related to heavy naphtha, whose differential with RBOB has lost 10 cents per gallon since the beginning of the month.

The arbitrage to Asia still remains closed but given the trend of SIN 92 and its impact on the price of Asian blending grades, a greater weakness in USGC naphtha could substantially improve the economics of the arbitrage by the end of Q1 and the beginning of Q2.

Jorge Molinero is Commodity Owner for Naphtha and LPG at Sparta. Starting his career as a financial analyst with BBVA, Jorge quickly transitioned to market intelligence within the energy sector, spending 4 years as a naphtha analyst with Repsol before joining Sparta in early 2023.

Sparta is a live, market intelligence and forecasting platform that enables oil traders, refiners, banks, hedge funds and wholesalers to have access to real-time and global actionable insights to capture market opportunities before others.

To find out how Sparta can allow you to make smarter trading decisions, faster, contact us for a demonstration at sales@spartacommodites.com