Cracks and spreads soar, stronger NY market, but blending demand support is set to fade

Timespreads in Europe and Asia have seen a bullish trend as contango has disappeared in Europe following three weeks of near-constant negative timespreads.

This escalation is also reflected across the entire MOPJ curve, reaching values around +$5/mt for the Q1 2024 spreads, probably too high compared to the current market fundamentals and we should see lower values in the coming weeks looking at the current market demand.

Signs of strengthened demand in recent weeks are also visible in cracks. The significant movements that were previously linked to Brent’s collapse have now moved beyond what can be explained purely by weaker crude markets, indicating an improvement in short-term demand in the naphtha market.

The underlying reason for the paper spike is the renewed interest in the physical market, mainly for blending demand in the European market. With petrochemical demand not picking up, the premiums for heavy and LVN have increased above OSN, which in NWE has turned positive after two weeks of being discounted compared to Nap NWE.

We do not see the upward trend likely to persist in cracks and spreads in the coming weeks, as the petrochemical landscape has yet to rebound, and the recent rise in blending costs does not bode well for continued high demand in the coming months.

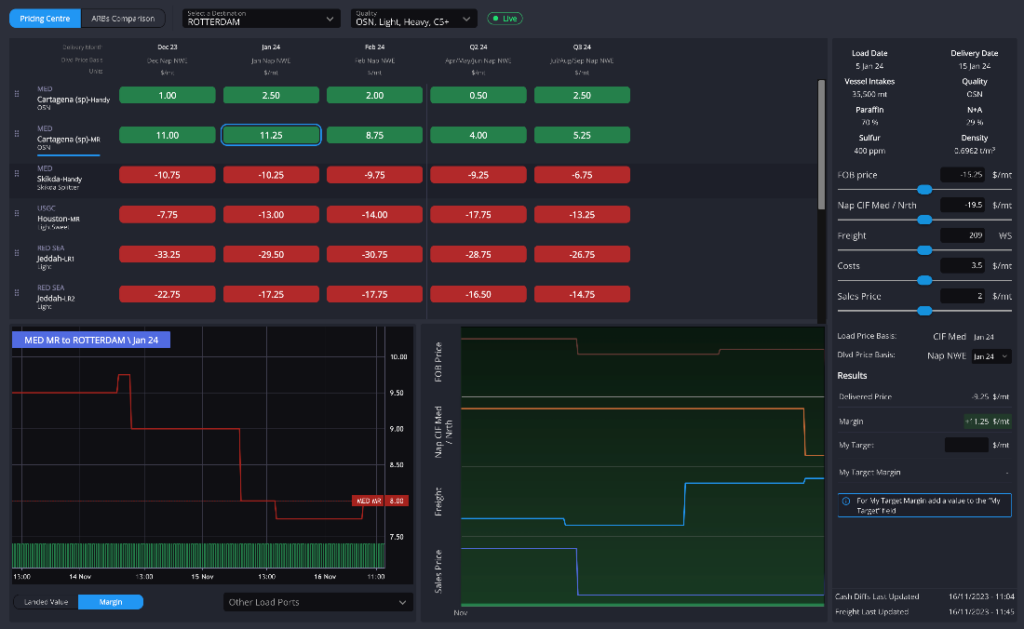

The increased blending incentive has established NWE as the reference market in recent weeks, however, leaving Asia aside for shipments apart from the HFRN grades that traded last week with destinations in Asia.

After the E/W correction during the week, the incentive is higher to the north, although the strength of Europe could be threatened by the fall of EBOB in the last session and some qualities could find a better outlook to the East at current market levels.

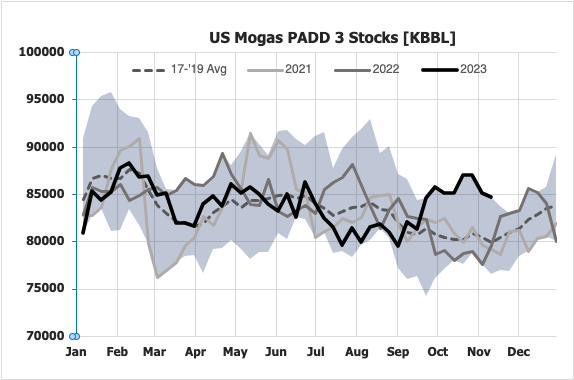

There is bearish pressure on European blending as USGC, following the recent rise in PADD 3 stocks, emerges as the most competitive gasoline exporter to various markets, competing with European blenders and limiting current demand in Europe to blending naphtha while putting pressure on Mogas-Nap for further corrections.

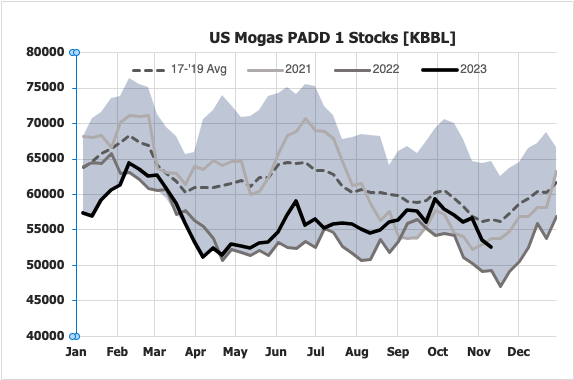

Another noteworthy point in the market is the current support in NY, especially for heavy naphthas. We have seen its premium vs. RBOB increase by 20cpg in recent weeks, opening the arbitrage for heavy grades from NWE and closing the export options from USGC to the Asian market.

Exporters, besides being hampered by delays in Panama, have observed a substantial increase in the incentive to keep product in the American market. The current divergence between gasoline stocks in PADD 3 and PADD 1 is supporting the incentive for USGC to NYH arbitrage, even on MRs, and more shipments could arrive from Europe for blending in NYH in the coming weeks.

Jorge Molinero is Commodity Owner for Naphtha and LPG at Sparta. Starting his career as a financial analyst with BBVA, Jorge quickly transitioned to market intelligence within the energy sector, spending 4 years as a naphtha analyst with Repsol before joining Sparta in early 2023.

Sparta is a live, market intelligence and forecasting platform that enables oil traders, refiners, banks, hedge funds and wholesalers to have access to real-time and global actionable insights to capture market opportunities before others.

To find out how Sparta can allow you to make smarter trading decisions, faster, contact us for a demonstration at sales@spartacommodites.com