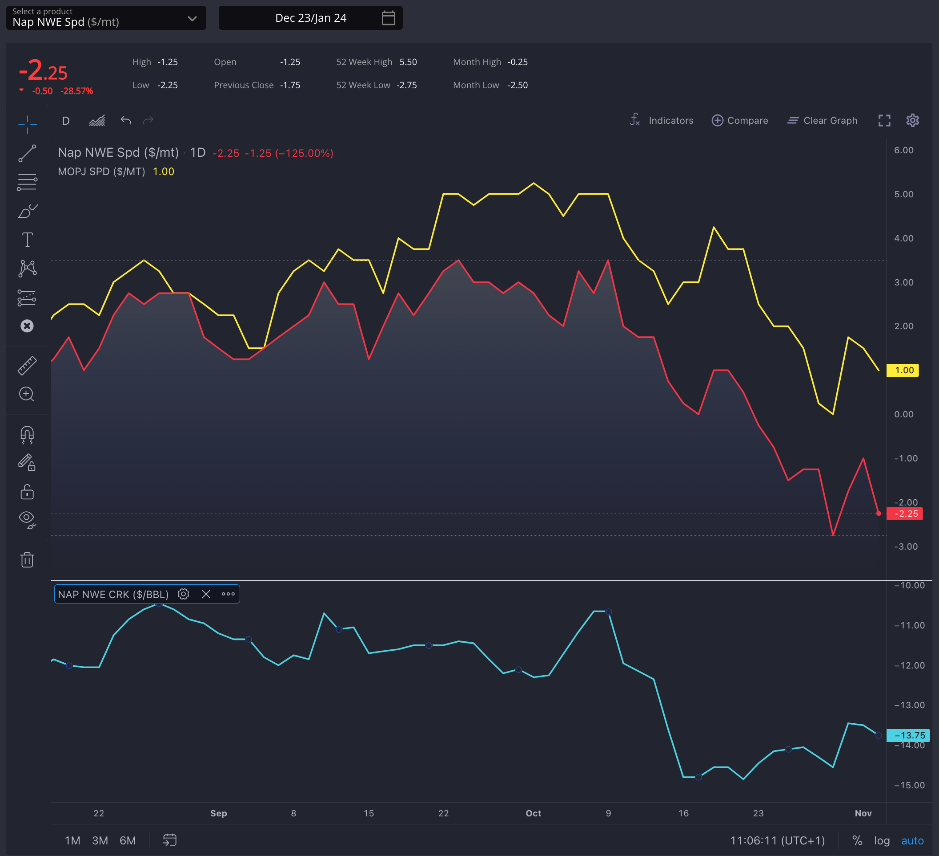

Crack rebound looks overdone on weak fundamentals outlook as physical premiums remain sluggish

Higher volatility in timespreads were observed during the last session for both sides of the Suez.

At the beginning of the week, it appeared that Europe was rebounding, but currently it seems more likely that Q1-2024 will shift to contango than a renewed strength for Q4 on the back of a currently oversupplied European market.

The correction in crude prices due to the recent increase in price volatility caused by instability in the Middle East conflict has added some strength to cracks.

However, with no fundamental strength from petrochemical demand and the potential overbuying of gasoline in Europe, the recent spike in the European crack appears to be short-lived.

The highest of -$13.5/mt reached at Nap NWE December during the week seems too high for the current naphtha outlook.

In addition to the bearish trend in timespreads, another trend that persists is the rise of the E/W spread along the curve. The November contract is currently trading close to $20/mt for the first time since late 2022.

Despite a weaker Asian market in terms of physical premiums and time spreads, European demand has not substantially improved in the North, and Med premiums are trading lower.

This means that the opportunities to send OSN and FRN cargoes from Europe to Asia will remain open in the coming weeks, and we don’t see a massive correction on the horizon to prevent it.

Regarding physical premiums, the dynamics are bearish for Asian OSN, for the third consecutive week, with Japan joining the negative values seen in Korea two weeks ago.

While the escalation of paraffins disappears, heavy naphtha slightly increases its value, allowing the arbitrage to remain open from USGC, and the A-grade premium is maintained to ensure the arrival of cargoes from the MED.

In Europe, the dynamics have been different between the Mediterranean and the North. While we have seen a slight appreciation of OSN in the NWE market, it remains in the negative territory.

In the MED, there has been a considerable drop in FOB premiums, driven by the lack of demand from northern crackers.

With the current levels in the physical market and the advancement of the E/W spread, the arbitrage to Asia remains open, both from Europe for HFRN cargoes and from heavy naphtha from USGC.

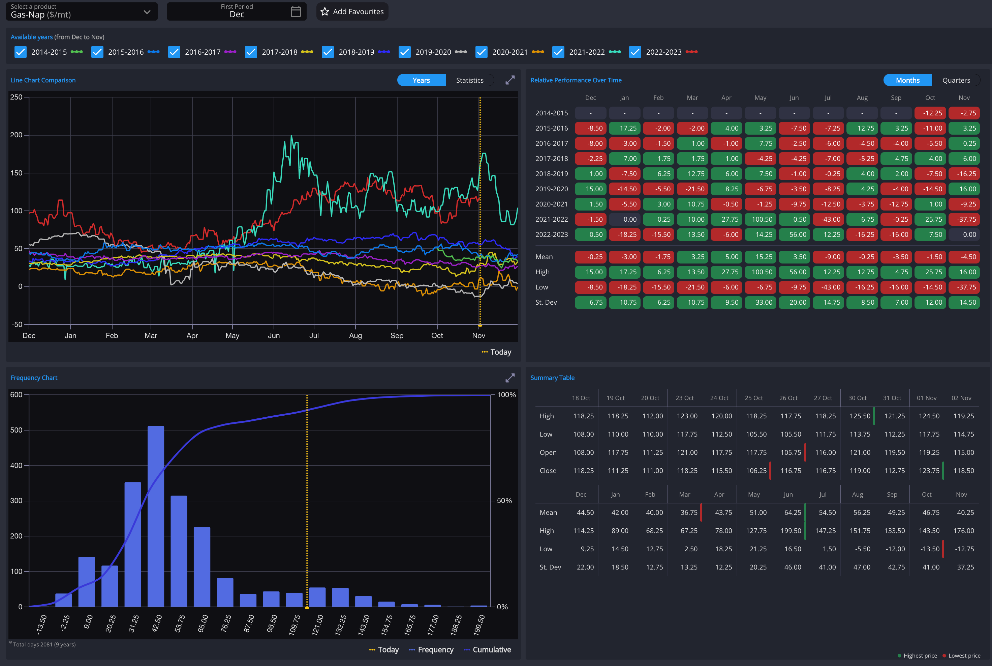

On the gasoline side, Gas-Nap continues to strengthen due to the recent spike in EBOB prices and is close to the historical highs reached last year. However, the incentive for blending in Europe is currently hindered by the high prices of higher-octane components in blending.

Currently, USGC is pricing itself as the best option for gasoline delivery to ECSAM (East Coast South America) destinations, while EBOB blending economics are affected by prompt strength in these high-octane components, reducing naphtha demand for the blending pool at the moment.

However, in the last few days, we have seen a drop in reformate prices in Europe, which is easing blending costs.

This dynamic would encourage naphtha demand in the short term, given the current level of Gas-Nap.

Jorge Molinero is Commodity Owner for Naphtha and LPG at Sparta. Starting his career as a financial analyst with BBVA, Jorge quickly transitioned to market intelligence within the energy sector, spending 4 years as a naphtha analyst with Repsol before joining Sparta in early 2023.

Sparta is a live, market intelligence and forecasting platform that enables oil traders, refiners, banks, hedge funds and wholesalers to have access to real-time and global actionable insights to capture market opportunities before others.

To find out how Sparta can allow you to make smarter trading decisions, faster, contact us for a demonstration at sales@spartacommodites.com