Contango on the horizon as pricing turns to Q4 challenges

Asia:

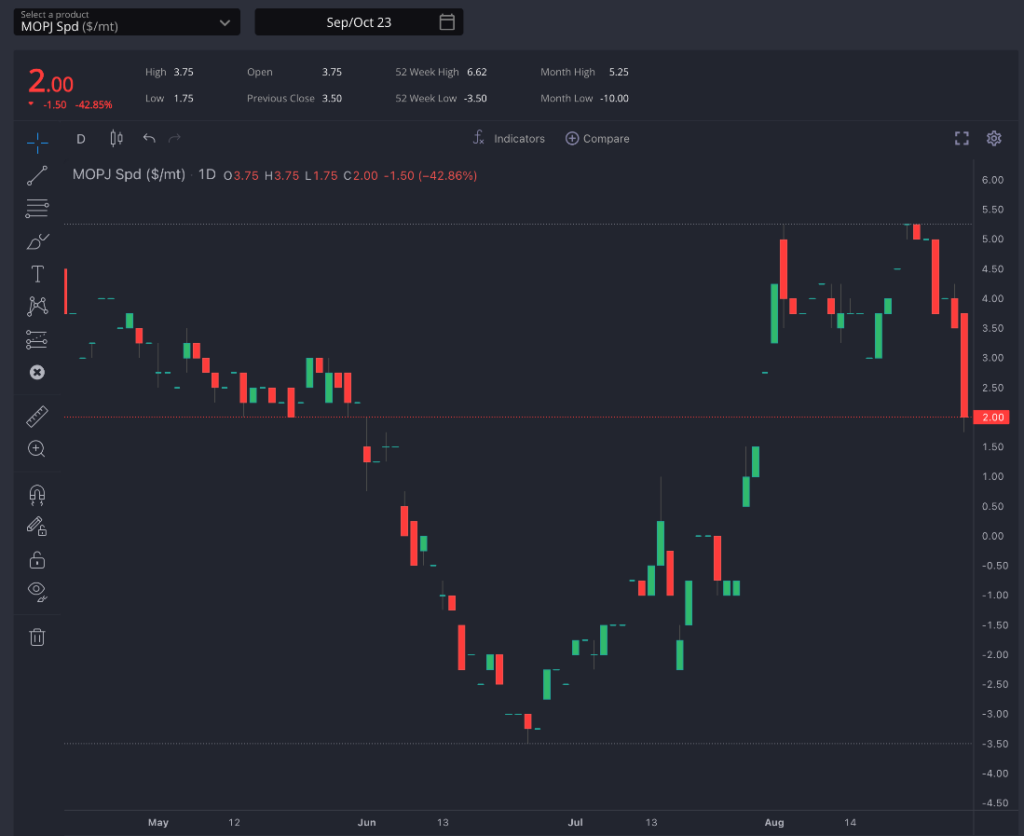

Last week was a bearish one in the Asian market, with timespreads losing $3.5/mt since our last report.

This move is effectively a mirroring of the change in the Sing 92 structure, however, indicating that the call on naphtha fundamentals themselves likely remains somewhat unchanged.

It does mean that the bullish trend on MOPJ structure we were seeing since the beginning of July has begun to reverse, and this has also been demonstrated in the crack which followed Sing 92 lower and returned below –$10/bbl for September 23 contract.

Even as a softening of the gasoline complex takes some of the recent bullish edge off of open-spec naphtha, the quality differentials that have eased in Europe and US, they remain wider than ever in Asia.

As we can see in the accompanying graphic, sales prices (physical premia) for Skikda refinery quality have jumped higher in recent days in order to try and attract A-grade arbitrage.

Korean players continue to push physical premiums for HFRN specs higher as we enter maintenance season in the Far East, and we would expect the October E/W naphtha spread may feel gain some support to widen a little further to do the rest of the work of attracting these barrels into the East.

Europe

Depending on developments in NWE and the wider Atlantic Basin market, however, the need for further movements in the E/W nap spread may be limited.

Although the arb for Med-origin cargoes towards Asia is currently closed, it remains significantly more profitable (~$40/mt) to fix heavier quality volumes to the East than it is into NWE.

Indeed, current arb levels should ensure that even lighter qualities out of the Med are being directed towards Asia, with little-to-no pull currently out of NWE on a weaker petrochemical margin.

Skikda Splitter quality, for example, is currently attracting ~$15/mt better economics from a voyage to Singapore than the same barrel would return in Rotterdam.

Whilst this would typically be a signal to ease some of the pressure on NWE naphtha pricing, ongoing very poor petrochemical margins in Europe and an influx of TA barrels that should otherwise be moving transpacific are likely to keep the European naphtha market subdued through the rest of the quarter.

US

Finally, as mentioned previously, heavier naphtha barrels out of the USGC have been seeing their cash premiums slashed in recent weeks in order to try and compensate for the ongoing high demurrage fees associated with Panama Canal delays.

Delays through the canal remain above two weeks currently and combined with potential loaded quantity restrictions due to low water levels on the route, the $50/mt positive arb margins into Yeosu on paper become only borderline workable for many USGC exporters.

Pricing in Chiba is currently a little more favourable, having moved up towards the $80-100/mt positive range in recent days, and this should start to see fixtures out of the USGC heading transpacific once more.

This should in turn halt the recent slide in physical premiums for heavier barrels out of the USGC, as well as begin to relieve some of the pressure on the European complex as some of the USGC’s net length diverts back towards the East.

Jorge Molinero is Commodity Owner for Naphtha and LPG at Sparta. Starting his career as a financial analyst with BBVA, Jorge quickly transitioned to market intelligence within the energy sector, spending 4 years as a naphtha analyst with Repsol before joining Sparta in early 2023.

Sparta is a live, market intelligence and forecasting platform that enables oil traders, refiners, banks, hedge funds and wholesalers to have access to real-time and global actionable insights to capture market opportunities before others.

To find out how Sparta can allow you to make smarter trading decisions, faster, contact us for a demonstration at sales@spartacommodites.com