Bullish overtones continue as gasoline market looks to spring

We have seen no let-up this week in the counter-seasonal support European mogas markets are seeing, with strong cracks being supported by a particularly tight octane market.

With most eyes on missing Russian volumes of naphtha, diesel, and residues into Europe, relative pricing developments vs previous years continue to highlight the majority of support in mogas markets currently is rather a quality question rather than a volumetric one.

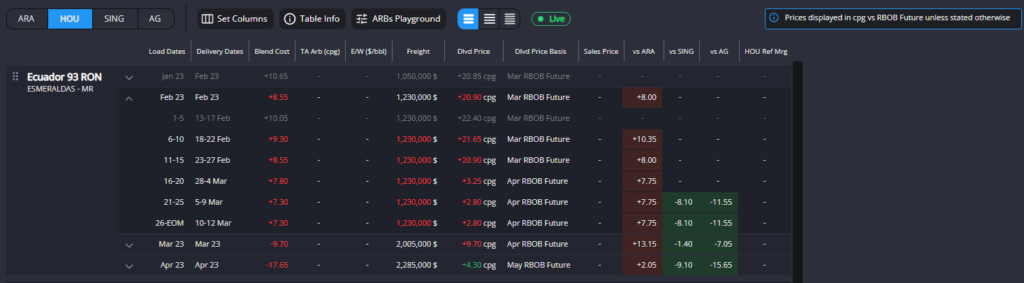

Whilst the pull from PADD-1 remains, particularly for higher octane European barrels, our blend and arbitrage economics show a reopening of potential ARA arbs into Lat Am, having recently once again become the cheapest source of supply in the prompt into Brazil, Peru and Colombia to name just a few.

As such, we see recent upwards trends in European cracks and spreads as well supported and sustainable, with supply constraints on lower Russian volumes and refinery maintenance running into a pull on barrels from across the Atlantic.

With Europe tight, it might seem counterintuitive to see arb pulls opening up from Lat Am, but as we have mentioned in previous posts, the market in the US is also seeing some fundamental support from scheduled turnarounds through the months ahead and an apparent continued lack of higher-octane materials.

The USGC has been quite often the most attractive source of supply for most of Lat Am in recent months, ensuring a decent baseline of export barrels. However, with lower octane destinations in particular now looking to ARA for resupply, the current pricing out of PADD-3 appears unsustainable with fewer outlets and sustained backwardation into the summer months not yet incentivising building up summer stocks.

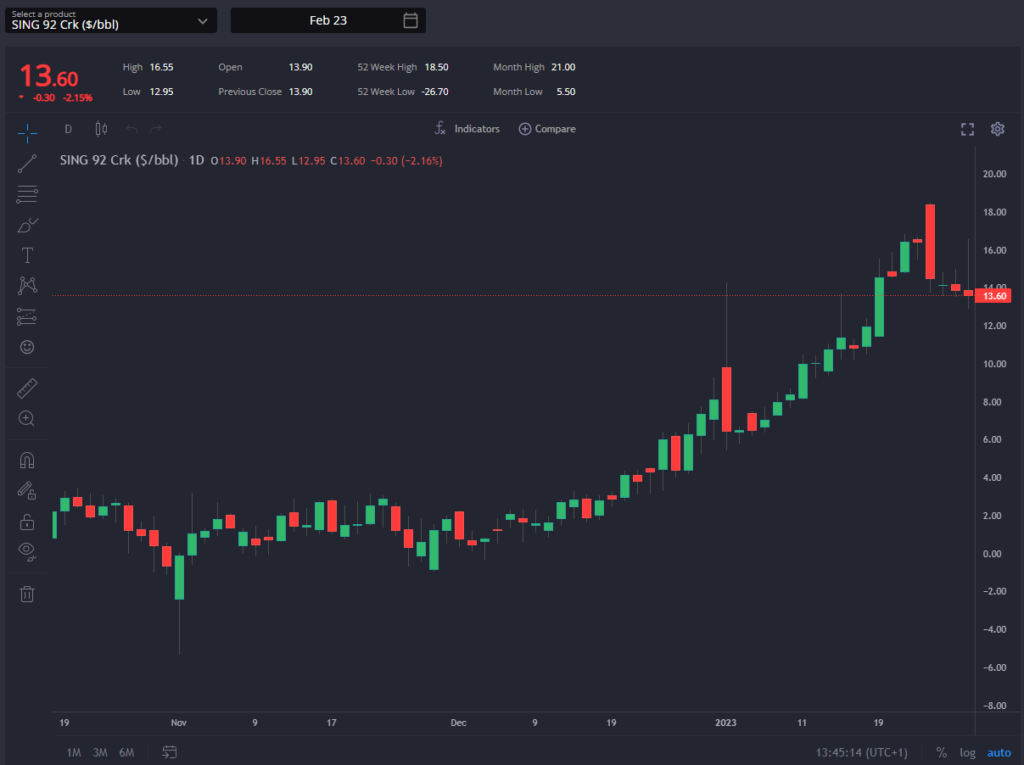

Finally for gasoline, we are seeing signs of the Singapore market tightening up once more as Chinese inflows slow dramatically and demand appears to be resilient within Asia. As low freight costs are helping to AG to remain attractive into plenty of Atlantic Basin destinations, it is Singapore which is likely to be providing the bulk of the volume for Asia through Q1, with pricing supportive to match. On the naphtha side, however, the moves have been more dramatic.

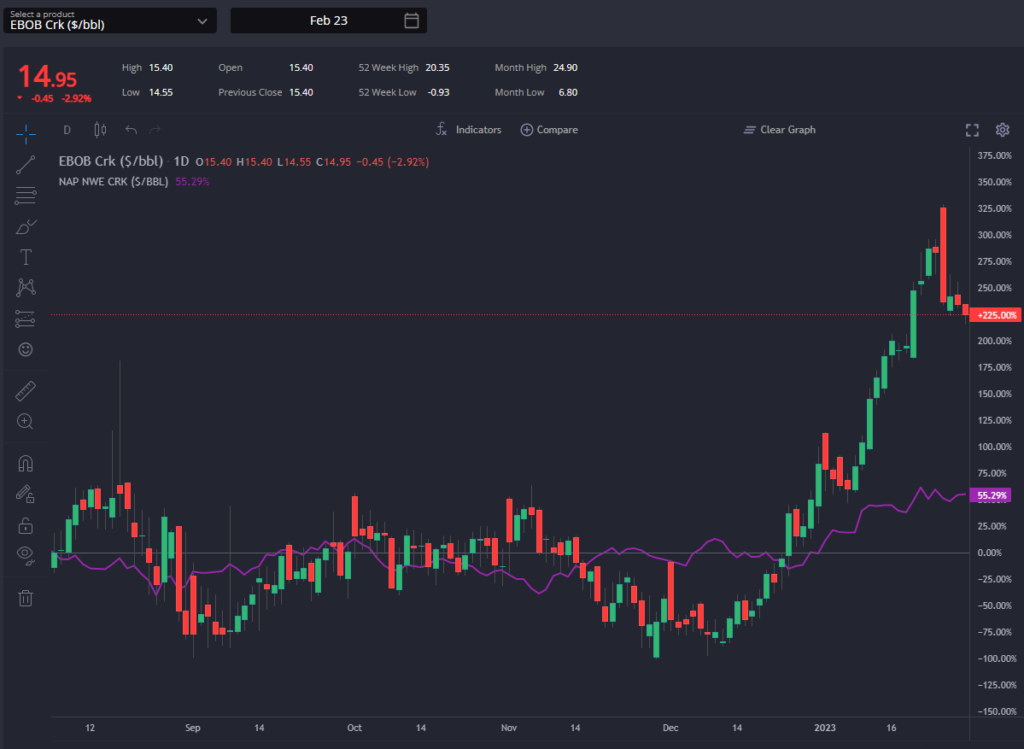

Both NWE and Singapore naphtha markets have seen a bullish start of the year with cracks, flat prices and spreads rising, but the strength has been somewhat one-sided in Europe’s favour. Normally E/W is positive since Asia is the shortest market and it demands European products, but a collapse in this spread over the last three weeks has slammed this window shut.

During 2022, arbitrage from Europe to Asia was closed for most of the year due to weak Asian petchem margins. As European demand returned to something near pre-pandemic levels, demand for plastics and gasoline in Asia remained hamstrung, negating the need to pull in barrels from the West.

By Q4-22 the arb opened once again to Asia, despite historically high freight rates of over 4 million $ (LS) on an LR1, as demand in Asia began to pick up once more.

2023 has begun with a return to the 2022 status quo, as the ban on imports of Russian naphtha is imminent and inventories have been falling in recent months alongside gasoline stocks. The market clearly reached a level in early-Jan which required the immediate and drastic closure of the arb window to the East, and may now reflect a new pricing reality for the foreseeable future.

With no Russian naphtha available, the European surplus is likely structurally cut to allow only sporadic additional exports east, with the impetus shifting to the Asian market to pay up if and when economics there allow.

[hubspot type=cta portal=7807592 id=38c8d3f4-d2d3-4781-a4a2-ba10ca4055bc]

Philip Jones-Lux is Commodity Owner for Sparta. Having worked with organisations such as JBC Energy and RP Global, Philip is a seasoned energy market analyst with expertise across the oil barrel and power markets

Sparta is a live, pre trade analytics platform that enables oil traders, refiners, banks, hedge funds and wholesalers to have access to real-time and global actionable insights to capture market opportunities before others.

To find out how Sparta can allow you to make smarter trading decisions, faster, contact us for a demonstration at sales@spartacommodites.com