Blending off the menu as ARA appreciates

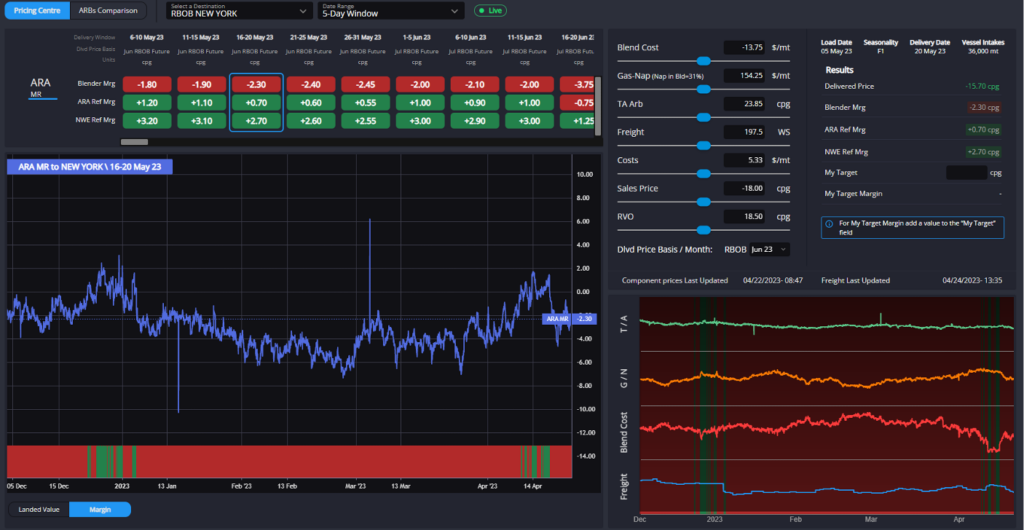

The open RBOB arb for blenders in ARA proved short-lived, as it typically does, and despite the imminent arrival of a higher demand period in the US, we are not currently foreseeing a return to working economics for blenders in the short-term.

The visibility of this arb opportunity tends to make it only fleetingly available, highlighting the importance of moving quickly to secure such opportunities, but also confirming that the balance to be covered on the PADD-1 side was relatively quickly and easily dealt with.

A narrowing gas-nap spread as well as sharp upticks in alkylate and a number of other components which had been present in the blend that made this route work have combined to shut the arb for blenders, although still at levels workable for an ARA or NWE refiner, ensuring adequate coverage for the PADD-1 market in the short-term.

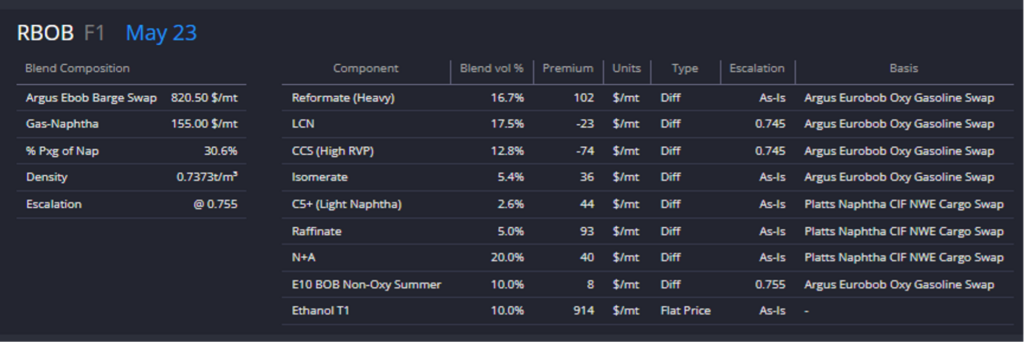

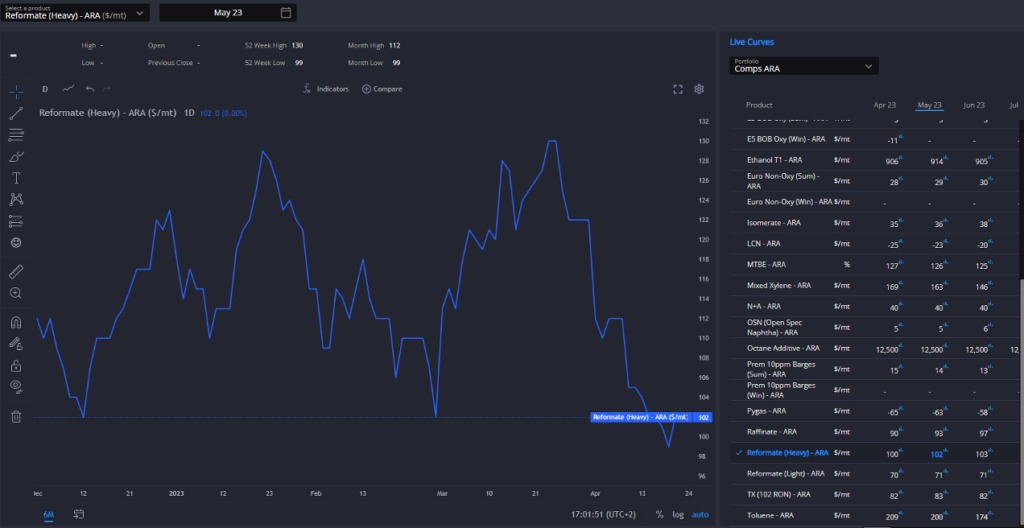

The current ideal RBOB blend in ARA for May reflects a somewhat different make-up to that seen just a few weeks back, and sees the return of heavy reformate to the mix. Reformate premiums in ARA have fallen considerably since the turn of the month, reflective of an improved supply in the region.

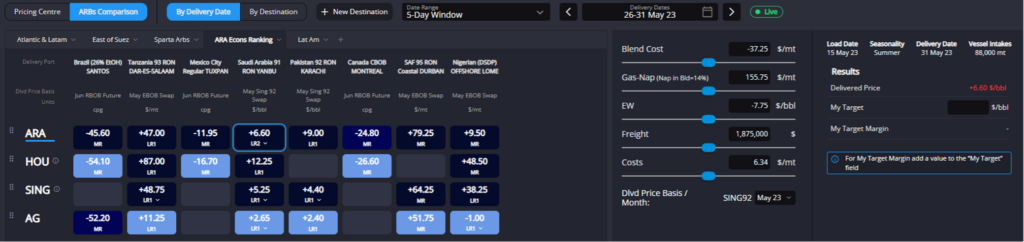

Lower reformate premiums have seen it return to a great number of the blends currently optimal in ARA for export to major importers such as the USAC, Nigeria, as well as North and East African grades. Whilst this is likely to see a floor on reformate premiums for now, it is also worth noting that this has coincided with ARA sliding down the relative pecking order for supplies into much of LatAm and the Middle East.

When considering a selection of destinations around the periphery of ARA’s typical sphere of export destinations, only Nigeria is still pointing unequivocally to ARA as its prime source of supply once the AG has been discounted.

This stands in contrast to the picture just one week ago and serves as another reminder that the European market was perhaps pricing a little on the cheap side and has now corrected towards levels which better reflect its physical ability to supply the regions it is currently the cheapest source into.

The appreciation on the European side of the Atlantic has seen the return of the USGC as supplier of choice for the majority of the Western Atlantic.

Recent upticks in waterborne exported volumes out of the USGC have not yet seen a marked tightening of supply availability, and with diesel yield pressure waning and domestic demand still a little way off seasonal highs, Houston barrels pricing competitively into their natural homes in Latin America is set to provide a steady floor over the next few weeks before domestic balances begin to tighten seasonally.

Importantly, destinations outside of the USGC’s immediate scope (Pacific coast, WAF, Canada) are all still pointing elsewhere for resupply in a sign that the PADD-3 market is pricing competitively but not weakly, with no signs from current arb econs that there is any particular pressure to sell.

Globally, the last week or two has seen a move towards narrower gas-nap spreads, with refining high levels (see chart), we certainly appear to be returning to levels around the top end of the ‘normal’ range.

This is having one impact on the gasoline complex which, if continued, would mark a distinct turnaround vs the previous ~12 months.

With the finished gasoline premium narrowing over naphtha in the world’s typical blend hubs, the spread between blend cost associated with producing finished grades in ARA, Houston, and Singapore has narrowed vs that coming out of the AG.

Although AG blends continue to be somewhat cheaper to generate, the gap is no longer so wide as to allow AG barrels to theoretically price into destinations well beyond the regions’ typical outlets. For example, Brazil has been showing AG as its cheapest source of supply ever since Sparta added the AG blender back in Dec-22, but this has now ended.

In the East of Suez, the AG is now the most expensive source of supply into Australia, and the premium for Singapore barrels over the AG into Saudi Arabia for example in the prompt has narrowed from over $8/bbl to less than $3/bbl in the last week or so.

Finally, the case of Australia is a slightly odd one, with the market currently pointing to ARA barrels on long-distance LR2 journeys over shorter journeys on smaller boats out of Singapore or the AG.

This comes despite a significant widening of the May E/W spread since the turn of the month and has been made possible by cheaper Euro grade barrels becoming available in Europe.

The fact that cracks and spreads falling steadily in recent weeks has not yet opened Singapore up to a wider variety (and greater volumetric pull) would typically suggest that we are yet to near the floor for these metrics.

However, ongoing South Korean refinery maintenance and rumours of reduced Chinese export quotas coming soon mean there remain at least some bullish elements to cling to in Singapore – even if we would expect a little more movement down to solidify export opportunities out of Singapore in the face of continued high Chinese imports for now and rising inventories.

[hubspot type=cta portal=7807592 id=38c8d3f4-d2d3-4781-a4a2-ba10ca4055bc]

Philip Jones-Lux is Commodity Owner for Sparta. Having worked with organisations such as JBC Energy and RP Global, Philip is a seasoned energy market analyst with expertise across the oil barrel and power markets

Sparta is a live, pre trade analytics platform that enables oil traders, refiners, banks, hedge funds and wholesalers to have access to real-time and global actionable insights to capture market opportunities before others.

To find out how Sparta can allow you to make smarter trading decisions, faster, contact us for a demonstration at sales@spartacommodites.com