Bearish Asian and European diesel with some glimmers of hope in the US, whilst European jet continues to suffer

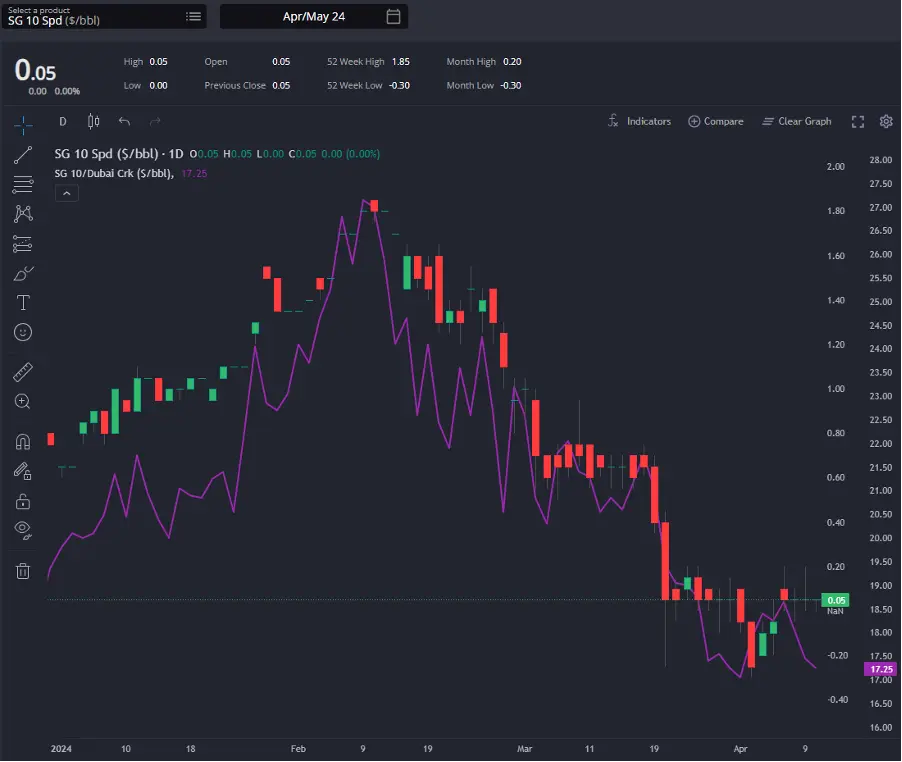

April’s Singapore diesel crack and spread. (Sparta Live Curves)

Singapore diesel cracks have continued their downward trajectory since early February, marking a challenging week for the market. Although the diesel spread has shown signs of stability, hovering just above contango, the overall trend remains bearish.

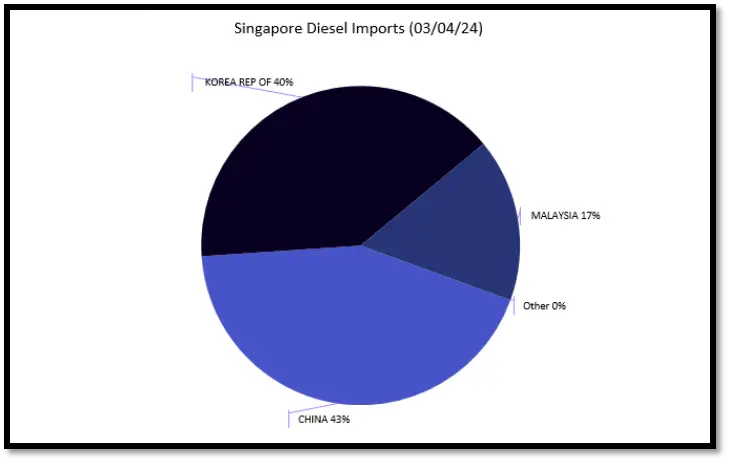

Singapore diesel imports; week ending April 3rd 2024 (Enterprise Singapore via Sparta)

The persistently high levels of Singapore diesel stocks have contributed significantly to this decline, exacerbated by substantial imports from China and South Korea.

Insights from our Senior Pricing Analyst Thomas Cho have previously shed light on the record-high South Korean diesel exports in April and he anticipates further pressure with the potential for an additional 18 million mt of Chinese refined product export quotas rumoured in late April.

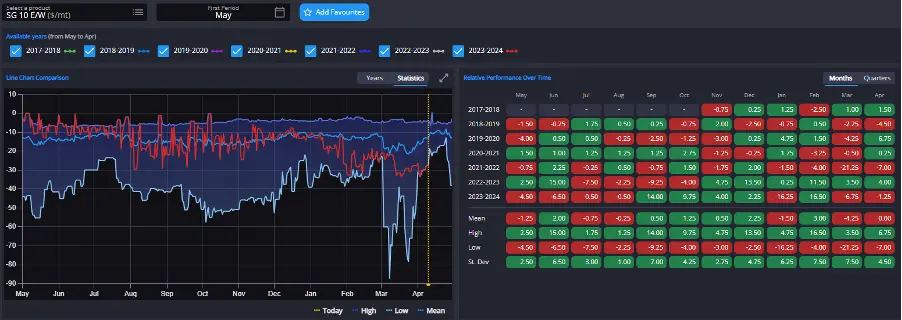

May’s GO E/W & By Origin Dashboard; Sikka. (Sparta Historical Forwards)

Despite a slight narrowing of the GO E/W this week, our newly released By Origin dashboard, underscores that AG/WCI loaders continue to firmly point towards Europe and the Americas.

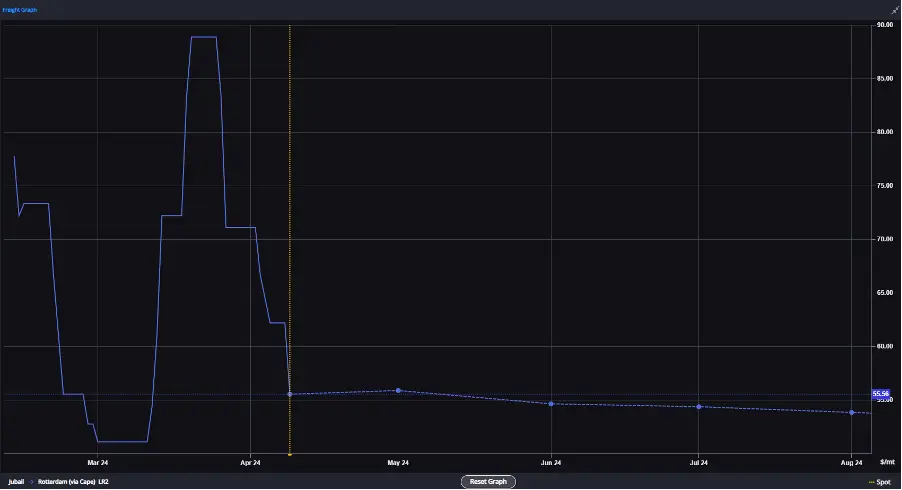

This directional preference is supported by recent fixture observations, including LR2s Golden Eagle & Spetses Lady, corroborated by insights from our Freight Commodity Owner David Thwaite regarding the significant drop in LR2 freights to Europe via the Cape.

While this may offer some relief for Singapore diesel pricing, the overall outlook remains neutral to bearish.

Jubail to Rotterdam (via Cape) LR2 freight rates.

The upcoming peak in refinery turnarounds in May suggests a possible floor in cracks and spreads in the medium term, but uncertainties persist amidst ongoing market challenges in the region.

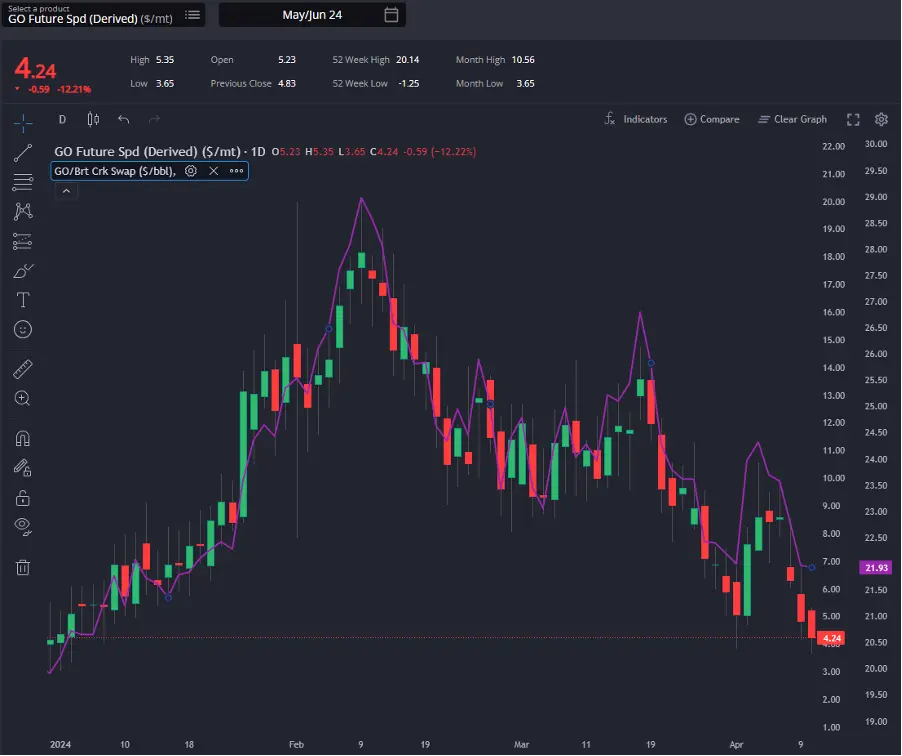

May’s ICE GO future spread and crack. (Sparta Live Curves)

Despite Europe being in the midst of its peak turnaround period in April, both ICE GO diesel cracks and spreads have persisted in their downward trajectory this week.

This trend persists as the European diesel market has largely adapted to the challenges of Asian origin vessels rerouting around the Cape due to ongoing geopolitical factors as well as to Russian sanctions and refinery attacks.

The influx of US and East of Suez arbitrage arrivals into Europe has contributed to a surge in ARA diesel stocks, reaching their highest level since June 2023.

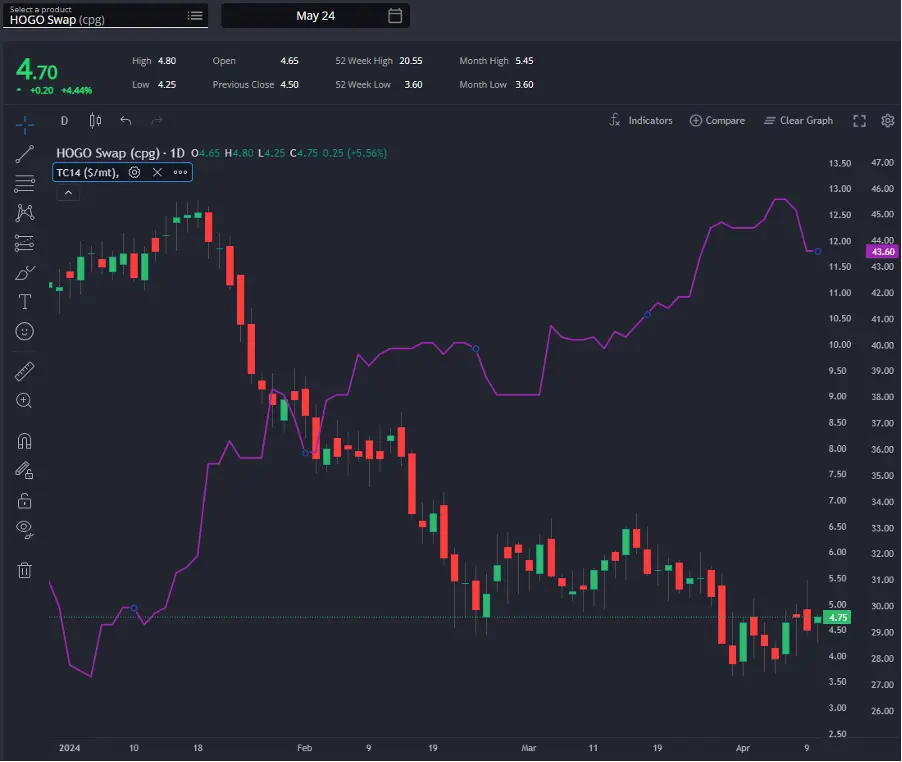

May’s HOGO swap & TC14 freight. (Sparta Live Curves)

The above-mentioned narrowing of the GO E/W over the past week has followed Europe requiring less Asian-origin diesel resupply, while the widening of the HOGO reflects the decreased European need for US diesel. These trends are expected to persist in the short to medium term.

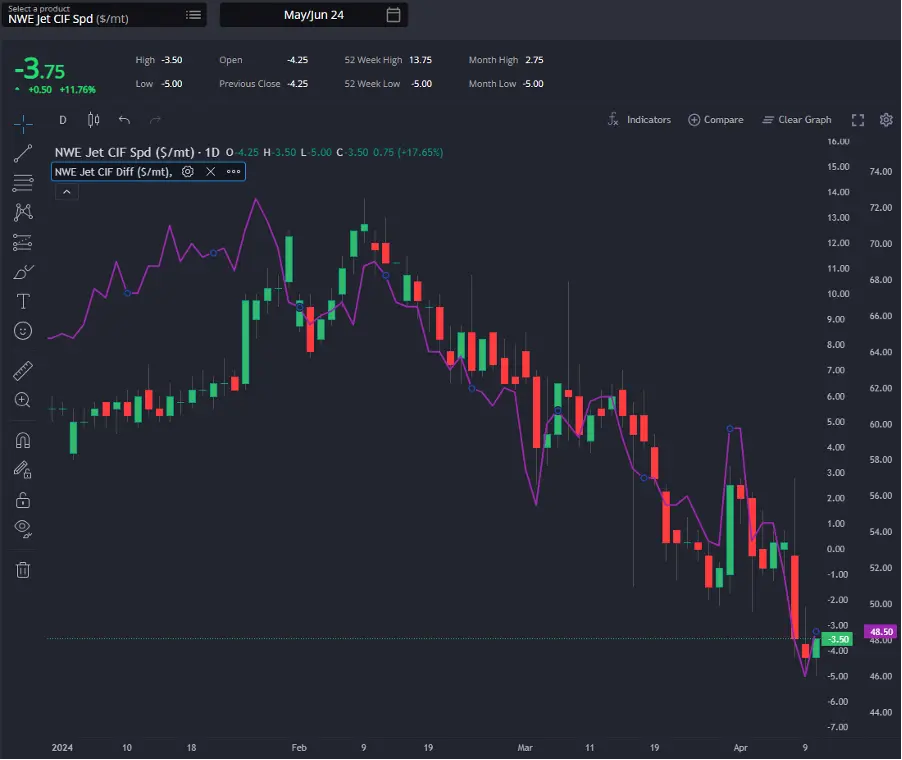

May’s NWE Jet CIF diff and spread. (Sparta Live Curves)

Additionally, European jet spreads and differentials have continued to decline due to high stock levels, decreasing arrivals, and weak demand. According to broker contacts, there is an oversupply of oil with traders diverting transpacific jet cargoes to Florida.

However, hopes are pinned on improving arbitrage margins and increasing jet demand in Europe as the region approaches the summer holiday period at the end of Q2 2024.

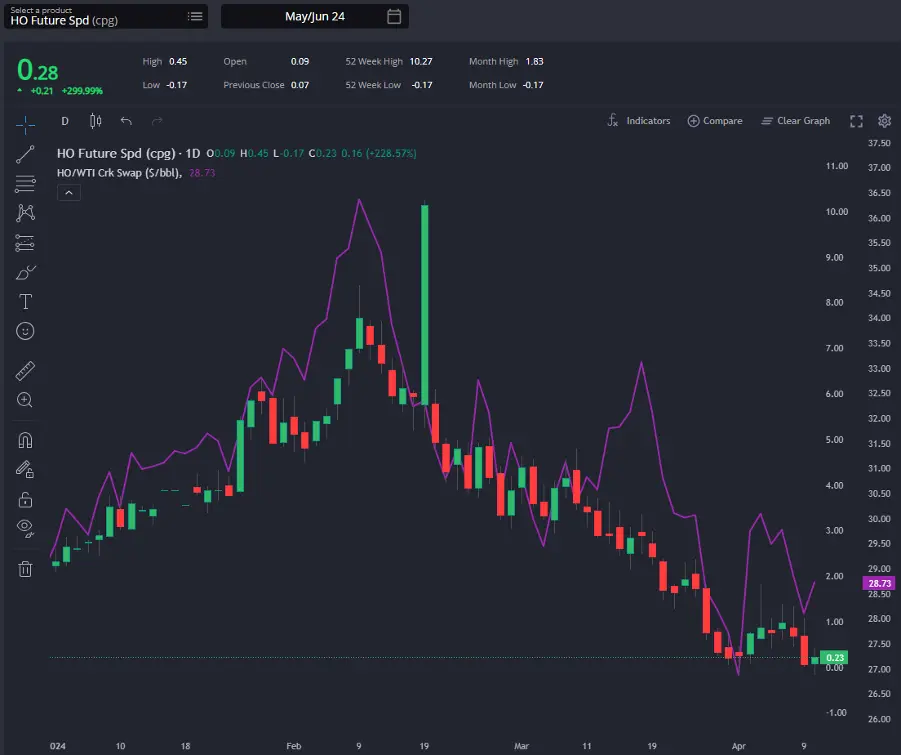

May’s HO future spread and crack. (Sparta Live Curves)

HO cracks and spreads have seen a week of fluctuations, with spreads largely levelling off while cracks show modest gains. This trend has initiated a slight narrowing of the HOGO, as mentioned above.

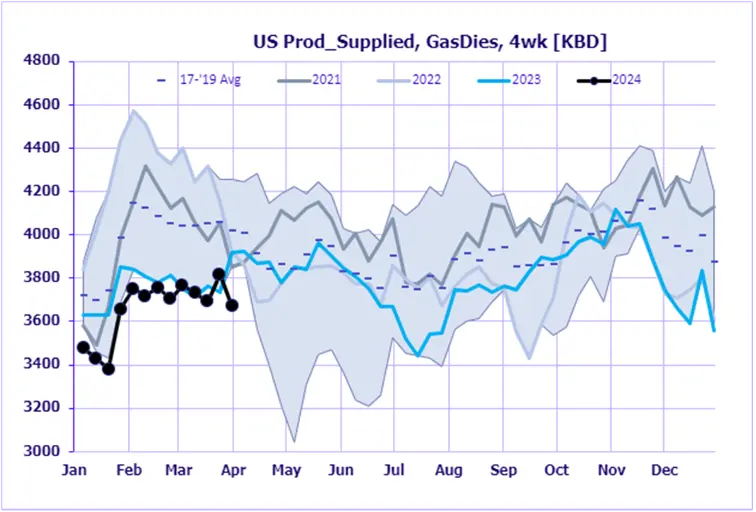

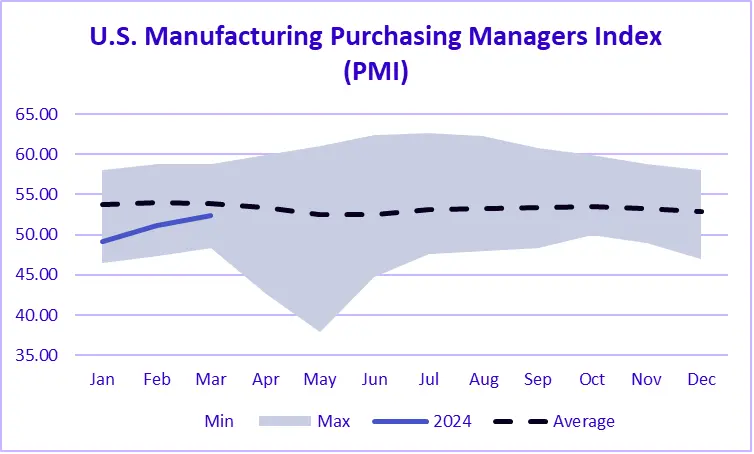

US diesel demand (EIA data via Sparta Commodities) and US Manufacturing Purchasing Managers Index

Despite persistently low US diesel demand, there are signs of optimism with improvements in US manufacturing, as evidenced by March’s PMI index reaching its highest level since July 2022. This uptick in manufacturing activity should lead to an increase in US diesel demand, potentially boosting HO crack spreads.

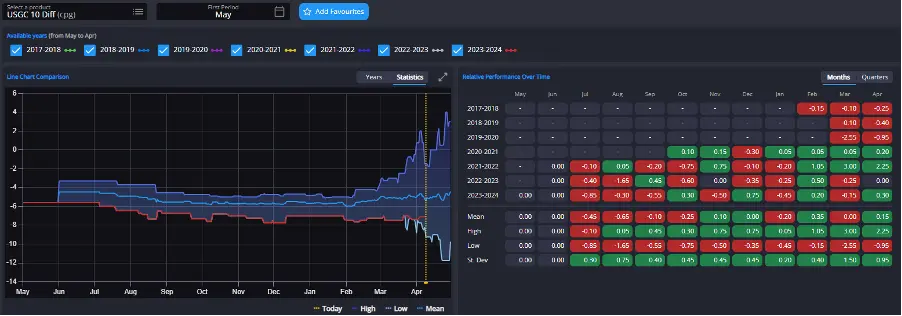

May’s USGC diesel differential. (Sparta Historical Forwards)

Already, the USGC diesel differential has moved away from historic lows over the past two weeks, signalling a shift in that region’s need to export. Additionally, ongoing Ukrainian attacks on Russian refineries are likely to further impact the market, adding a bullish sentiment to US diesel pricing in the medium term.

James Noel-Beswick is Commodity Owner for Sparta. Before joining Sparta, James worked as an analyst for likes of BP and Shell, and leads our continued development of the distillate product vertical.

Sparta is a live, market intelligence and forecasting platform that enables oil traders, refiners, banks, hedge funds and wholesalers to have access to real-time and global actionable insights to capture market opportunities before others.

To find out how Sparta can allow you to make smarter trading decisions, faster, contact us for a demonstration at sales@spartacommodites.com