Backwardation softens as Russian flows to Asia pick up through August

Asia:

The Asian naphtha market is currently quiet after a bullish July. The decline in Russian product supply shifted the market from contango to backwardation, but the recovery in Russian refinery output threatens to bring weakness back to the MOPJ (Mean of Platts Japan) complex.

The entire curve is still in backwardation, and both premiums for physical delivery and the price differences between East and West regions are also showing positive values. Additionally, after being absent for 6 months, paraffinic escalation has reappeared in the market, though only at a rate of $2 per metric ton for an 83-min grade. However, the situation changed in August with the increased availability of Russian supply. This shift could potentially signal the conclusion of the primary factor that has been bolstering strength in the naphtha market.

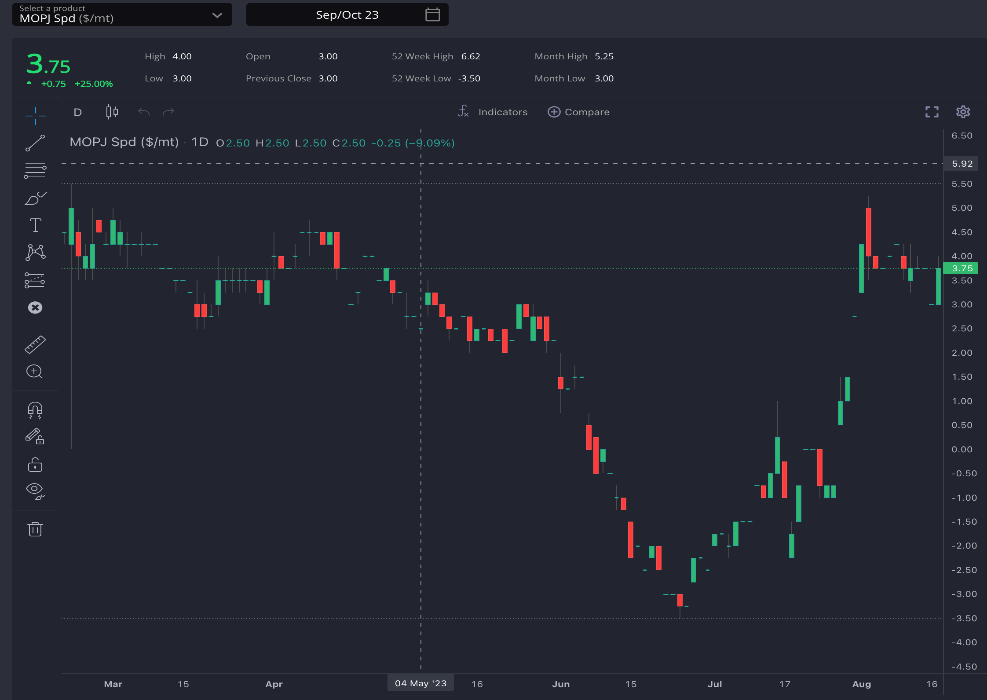

Over the past month, we have witnessed how the MOPJ spread for Sep/Oct climbed from -$3/mt to +$5/mt, currently trading slightly lower at +$3.75/mt with the September E/W spread moving from +$1/mt to +$7/mt during August as well. This opened the arbitrage for European HFRN into Asia briefly, but an increase in European FOB premiums and increasing freight rates have since closed this opportunity.

Re-opening arb flows out of Europe would require a substantial reduction in Mediterranean premiums and a further widening of the E/W spread. However, it is unlikely that this arbitrage opportunity will reemerge in the upcoming weeks. With European sanctions having resulted in Russian products being exclusively directed to Asia, European participants remain priced out of the Asian market at current demand levels

Europe:

Europe is following in Asia’s footsteps this summer. Without a push coming from domestic petrochemical demand, the strength displayed originates from tracking Asian demand and attempting to retain shipments in NWE to offset the E/W push during last months.

This week, contango threatened the Sept/Oct time spread, which is currently trading at just $0.5/mt as of the time of writing this report. This prompt spread has maintained the entire curve in backwardation, but there are more uncertainties compared to last week regarding if backwardation will last.

The most significant point of the week in Europe has been the sharp correction in physical spot premiums for the heavier naphthas. Following the shift in focus towards winter gasoline specification, these premiums have fallen to the range of 50-60 $/mt in August, falling from premiums as high as +$150/mt for the top blending qualities seen earlier this summer.

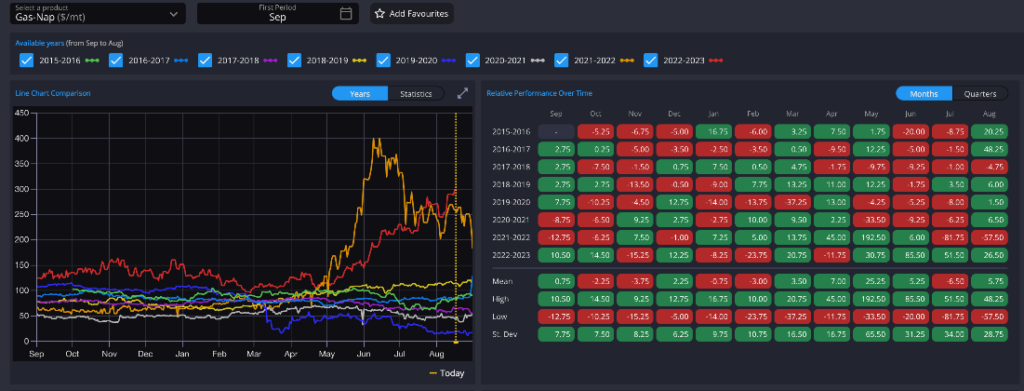

However, this shift in pricing for reforming and blending qualities has not affected gas-nap at all, as it continues to climb toward yearly highs after breaking new support levels this week. Strength is expected to remain in gas-nap (finished gasoline vs open spec naphtha) although it is unlikely that we will see the escalation of heavy naphtha in recent months again as winter spec gasoline relies less heavily on these barrels.

US

In the US, the spread between gasoline and naphtha has also widened and remains at record high levels. The current imbalance between light naphtha and gasoline and the seasonally low stock levels in US has taken the September contract to almost double its figure since March, going from 63 cpg to 110 cpg.

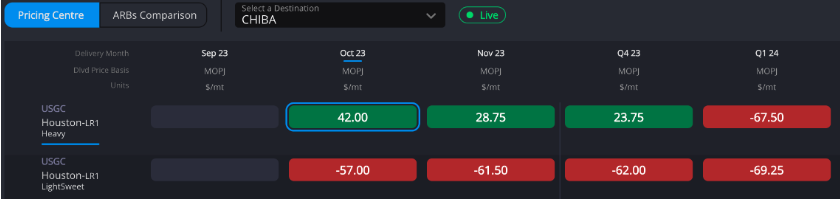

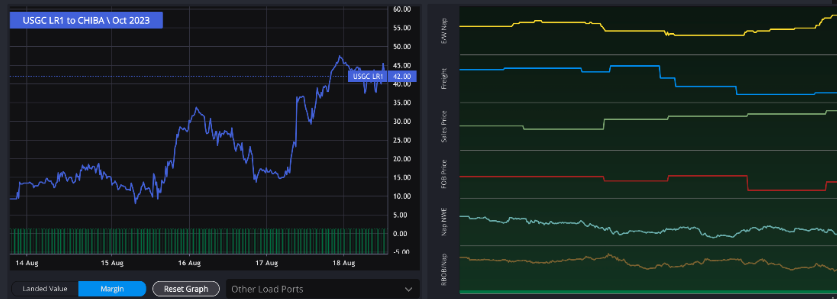

Despite this strength in the gasoline market, naphtha discounts vs RBOB are widening both in USGC and NYH. This could drive more opportunities for exports from USGC in the short term. Currently the heavy naphtha arb is working to Asia, although Panama Canal demurrage is harming these arbs, making NWE the preferred destination for USGC origin barrels to avoid these delays.

Jorge Molinero is Commodity Owner for Naphtha and LPG at Sparta. Starting his career as a financial analyst with BBVA, Jorge quickly transitioned to market intelligence within the energy sector, spending 4 years as a naphtha analyst with Repsol before joining Sparta in early 2023.

Sparta is a live, market intelligence and forecasting platform that enables oil traders, refiners, banks, hedge funds and wholesalers to have access to real-time and global actionable insights to capture market opportunities before others.

To find out how Sparta can allow you to make smarter trading decisions, faster, contact us for a demonstration at sales@spartacommodites.com