Asian naphtha rally heats up Europe, but fundamentals still questionable going forward

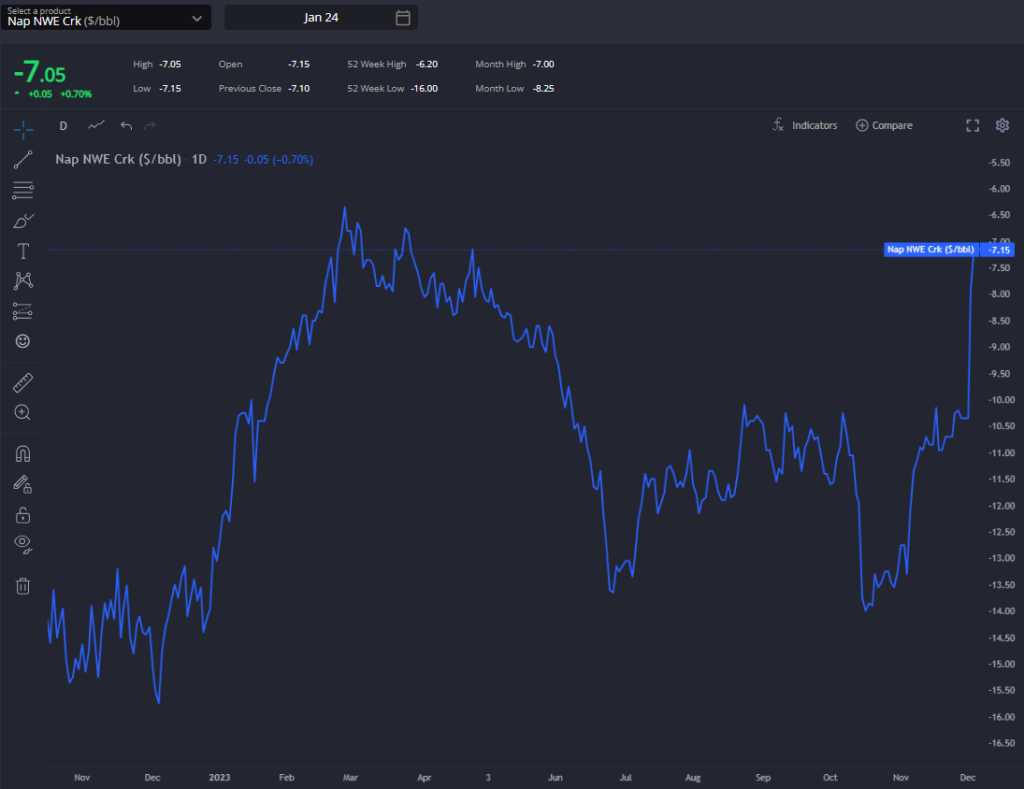

MOPJ spreads hit new highs for the month with Dec/Jan MOPJ rising to above $12/mt this week. NWE spreads followed Asia higher. Cracks also got a boost, though presumably partly driven by rapidly falling crude prices.

Some short-covering may have a played a further role in recent days. Naphtha is now strongly backwardated just as crude has plummeted into contango.

Similar to last week, a lot of the focus seems to be on the immediate supply side with Russian-East flows low, Indian spot avails lacking temporarily, and Middle East loadings also at reasonably weak levels for year-end.

All this is happening simultaneously and at least some elements should reverse near-term. E/W spreads for early Q1 continue to gradually ease but at strong levels.

What we should also begin to explore is the notion that near-ytd highs in naphtha cracks and a similar pattern in fuel oil over the last month (the latter may be supported going forward if Russian fuel oil exports are really reduced going forward as part of the OPEC+ deal) may begin to edge in the marginal hydro-skimmed barrel.

In other words, some straight-run refinery product supply increase could be around the corner in addition to seasonally high runs globally.

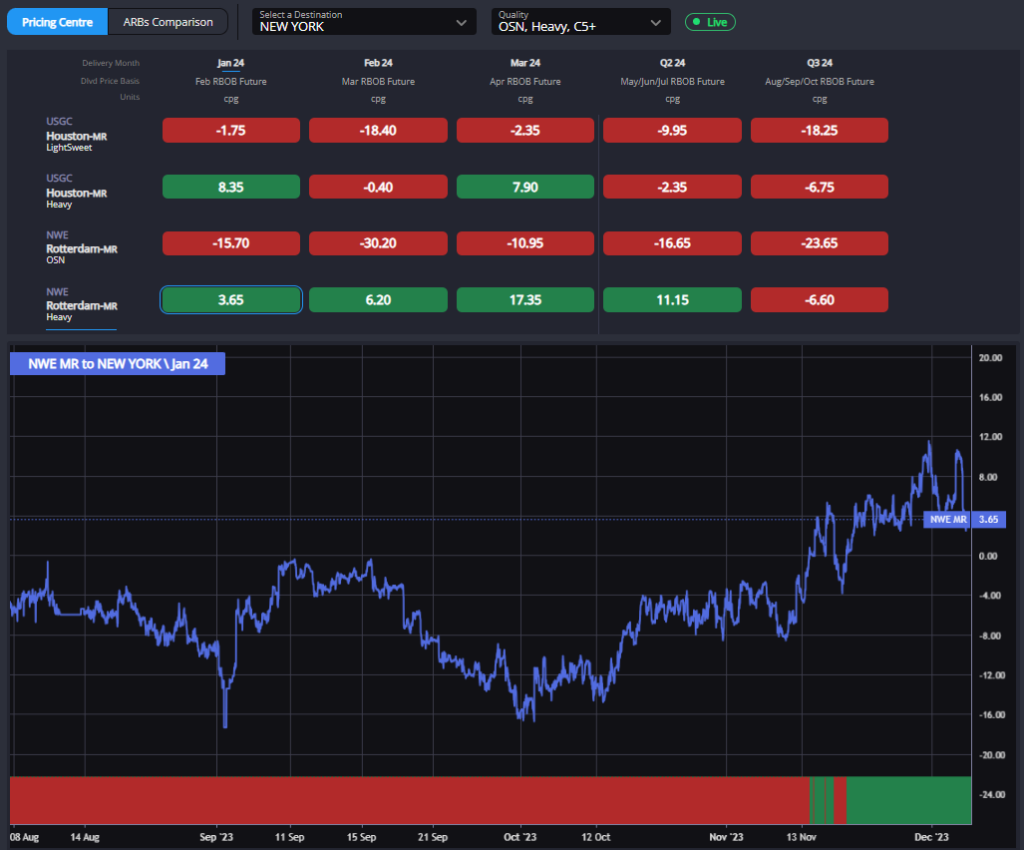

The strengthening in Europe has now seen OSN arbs to Chiba close off for early Q1, having remained open over the prior few weeks. High freight rates & a rise in FOB prices suggest eastbound flows have been healthy up to this point but could now begin to ease.

Light naphtha arbs from the AG remain firmly closed all down the curve, with a further weakening in freight reflective of the lack of prompt loadings there for now.

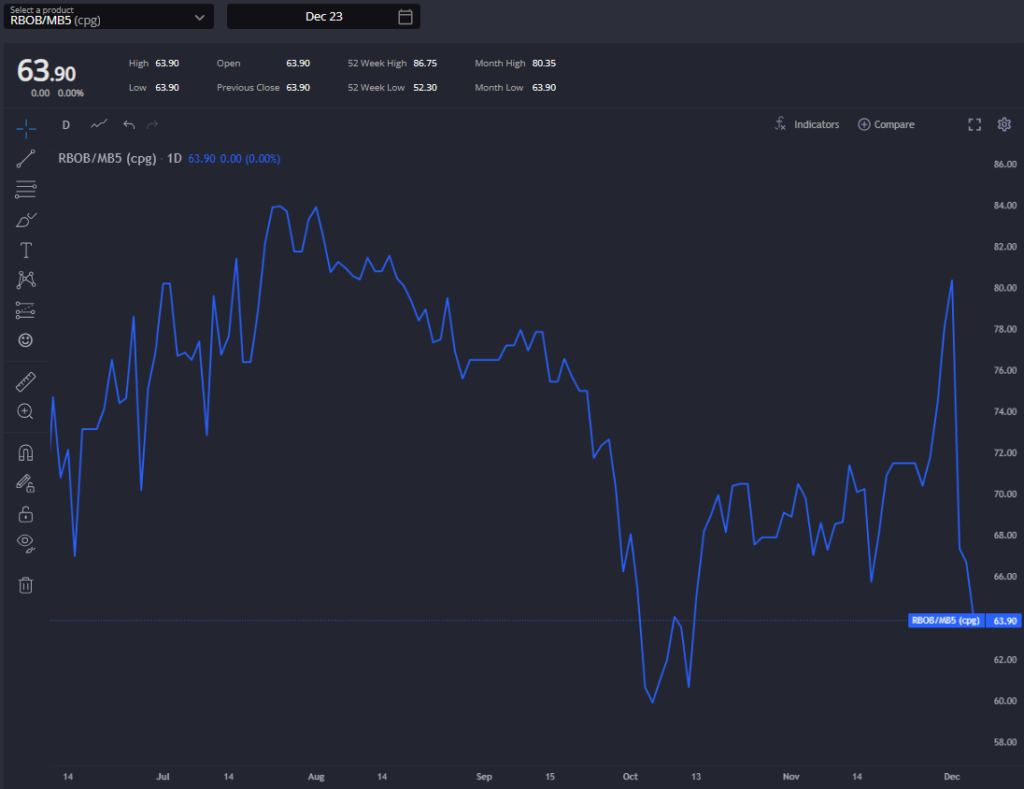

The next few weeks will be important from the gasoline blending side and may not be particularly supportive; US gasoline stocks rocketed higher last week, both in PADD 1 and PADD 3, the latter contributed to by a stark recovery in crude runs.

TA gasoline arb econs into NYH continue to take a hit despite weakening freight. Heavy naphtha arbs into NYH look now to have peaked and have further room to run lower assuming blending demand takes a hit going forward. Narrowed gas-nap spreads in the Atlantic Basin should contribute to that.

Largely closed arbs to the East and an apparent change in direction in the Atlantic Basin gasoline market suggests NWE paper naphtha has seen something of an overshoot and will reverse going forward.

There are signs already in a variety of cash premia: ARA C5+ premiums haves peaked, LCN and N+A premiums are cooling, while reformate prices in ARA are also weakening.

Neil Crosby is an experienced energy market and commodity analyst, specialising in crude oil, oil products, biofuels, and carbon. With roles at OilX and JBC Energy, he has extensive expertise in global oil industry analysis, forecasting tools, bespoke research, and client communication. His focus on refining and petrochemicals underscores his specialisation.

Sparta is a live, market intelligence and forecasting platform that enables oil traders, refiners, banks, hedge funds and wholesalers to have access to real-time and global actionable insights to capture market opportunities before others.

To find out how Sparta can allow you to make smarter trading decisions, faster, contact us for a demonstration at sales@spartacommodites.com