Asian market continues to rise as Cape of Good Hope alternative materialises, while gasoline demand keeps pushing for blending naphtha in Europe and Asia

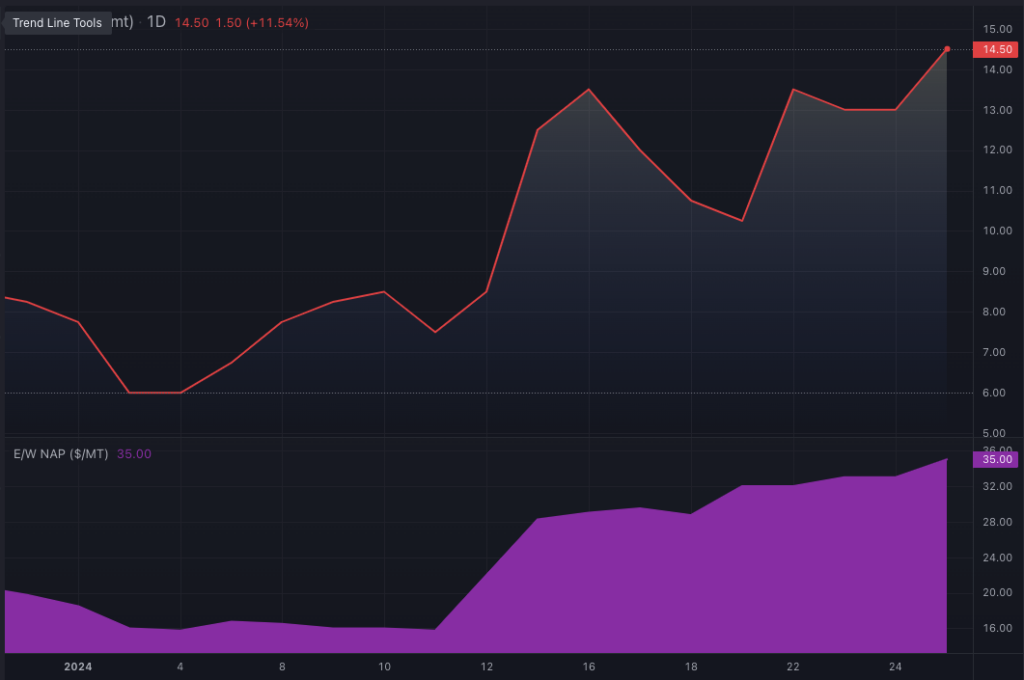

The Asian market continues to reflect the situation in the Red Sea with increases in physical premiums, spreads, and E/W.

The market has adjusted to make arbitrages through the Cape of Good Hope profitable and enable the product to take the alternative route.

The downside risk is limited as long as the Bab al-Mandab strait remains threatened in the short term.

Initial data suggests an increase in cost by around $0.7 million in lumpsum for an LR2 from the Med and an approximate delay of 16 days.

This will maintain the backwardation in Asia by delaying the arrival of planned deliveries in the next month.

The fire at Tuapse refinery could also reduce arrivals of product in Asia in the short term if it is not possible to replenish exports, providing further support to the Asian market.

On the US side, a heavy turnaround season has impacted the overall product market in the region.

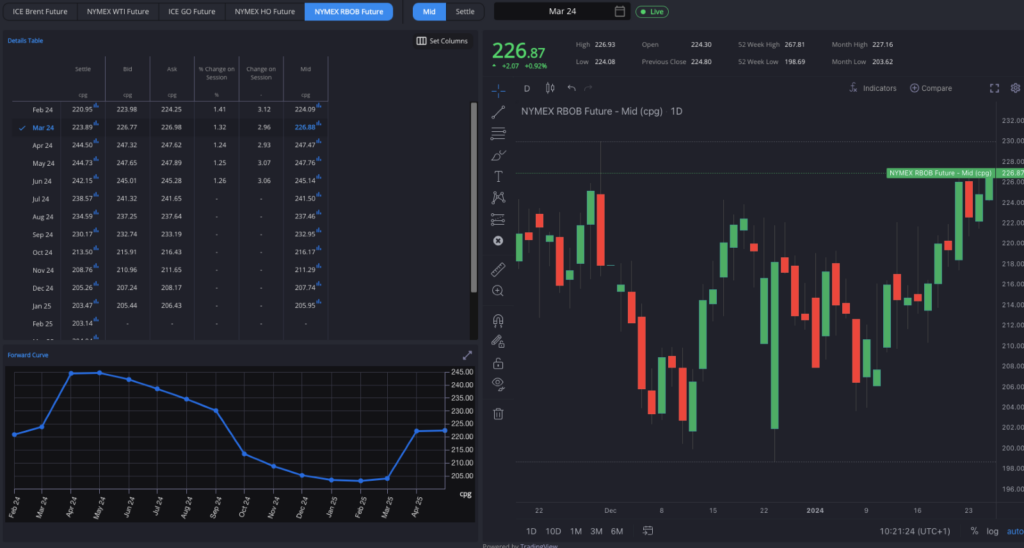

RBOB March futures have gained 20 cents per gallon in the last 10days, indicating a tighter gasoline market that is also pulling naphtha prices higher, especially in the rally for heavy qualities.

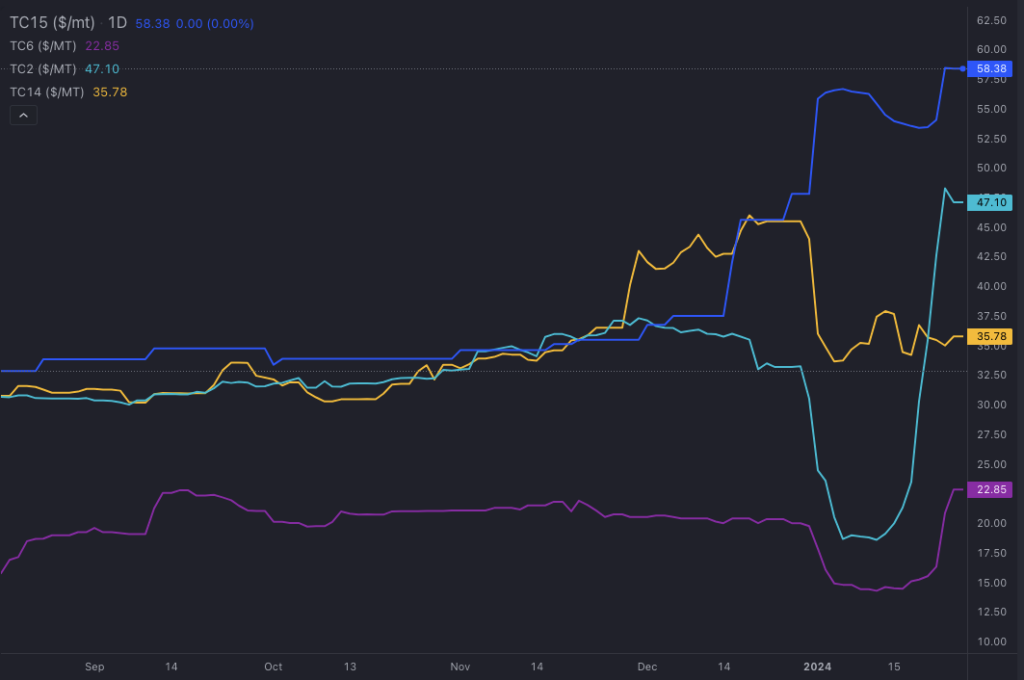

This strength in the U.S. market has significantly affected clean freight rates in the West, particularly witnessing a strong surge in TC2, fueled by the recent cold wave and global geopolitical tensions.

Despite the rise in freight costs, the arbitrage from NWE to NYH remains open for naphtha, and the strength of RBOB could be reflected in more cargo arrivals in the coming weeks.

The global clean freight market is already trending higher after the initial reaction of TC15 to Red Sea tensions. The West freight market has also followed this upward trend. A tighter market in the U.S. has contributed to this by pushing up TC2 for imports to the U.S. from Europe, surpassing TC14.

There has been a significant spike in European gasoline premiums as well as high aromatic blending components.

Despite the recent $15/mt loss in Gas-Nap, blending margins remain quite open in Europe for E10 and this has been pushing LVN and heavy naphtha higher in Europe.

Naphtha demand for blending looks healthy at current levels and a tighter Asian market due to turnarounds and some unplanned maintenance has also caused Sing 92 to skyrocket.

Demand for blending naphtha should stay on an upward trajectory in the coming weeks.

In summary, the Asian market is adapting to the challenges in the Red Sea, exploring arbitrage opportunities through the Cape of Good Hope with limited risks for E/W and physical premiums.

The ongoing turnaround season in Asia is boosting blending economics, leading to higher Sing 92 prices, and Europe’s strong blending margins for E10 will persist.

Geopolitical tensions, US rerouting, and an intense cold front are driving freight rates, and we anticipate this global trend to persist due to underlying fundamentals, maintaining a tight market.

Jorge Molinero is Commodity Owner for Naphtha and LPG at Sparta. Starting his career as a financial analyst with BBVA, Jorge quickly transitioned to market intelligence within the energy sector, spending 4 years as a naphtha analyst with Repsol before joining Sparta in early 2023.

Sparta is a live, market intelligence and forecasting platform that enables oil traders, refiners, banks, hedge funds and wholesalers to have access to real-time and global actionable insights to capture market opportunities before others.

To find out how Sparta can allow you to make smarter trading decisions, faster, contact us for a demonstration at sales@spartacommodites.com