Asian bullishness drags Europe higher, but some supports still to reverse

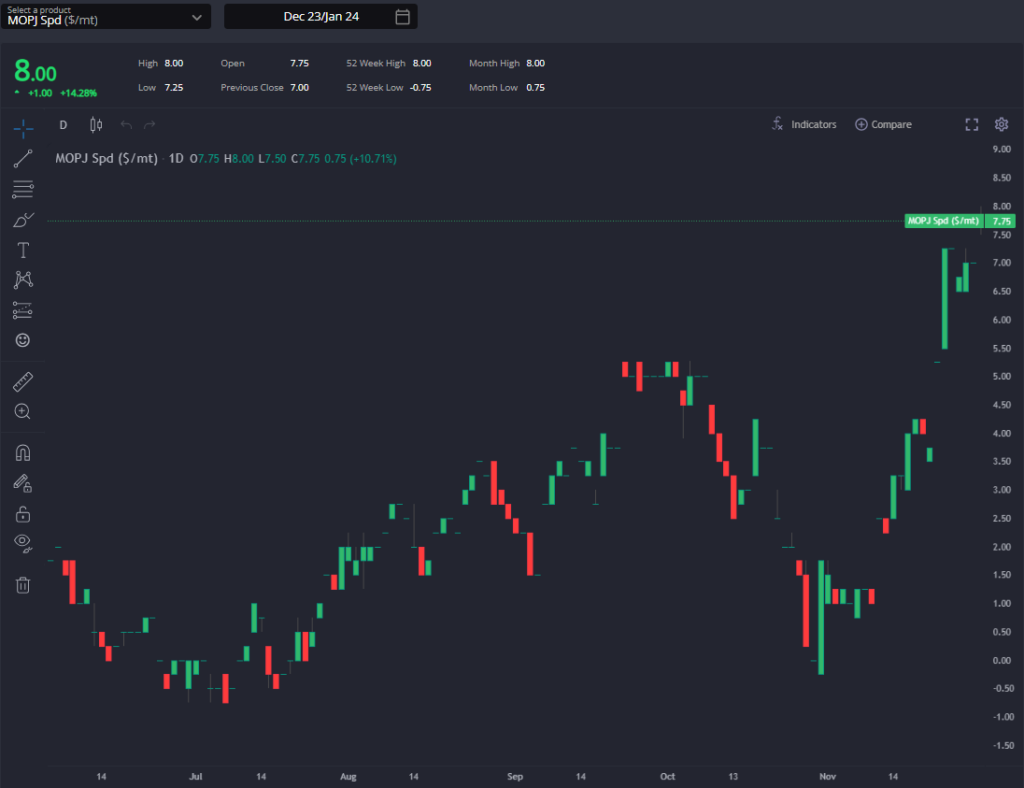

Dec MOPJ spreads kicked higher at the end of last week and continued upwards over recent days, heading towards +8/mt. NWE spreads were dragged higher as a result.

Cracks are not buying the hype yet, and the rally in spreads still looks likely to be short-lived with E/W spreads & eastward arbs already attempting a correction to squeeze marginal flows from here on for Q1. As we’ll see below, some of the supportive factors in Asia are one-offs or should be short-lived.

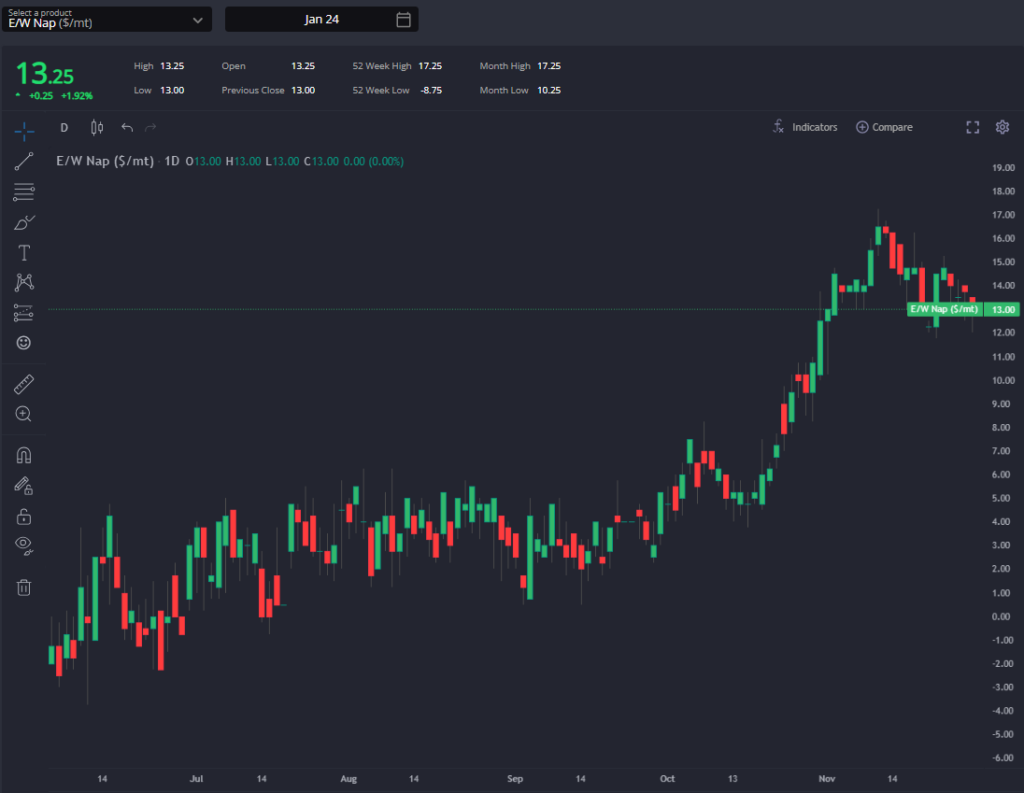

This last week has seen Dec & Q1 E/W come under pressure, now trending towards 1-month lows though still at high levels.

That is however not fully matching the picture on the physical arb side.

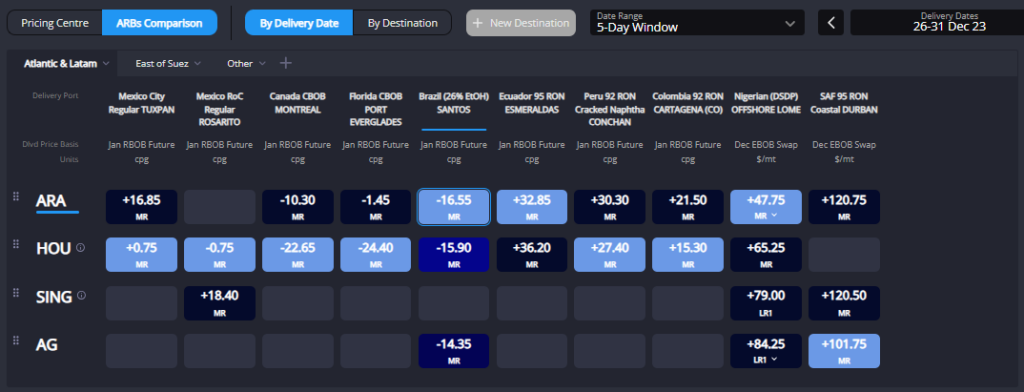

OSN Med & Skikda refinery arbs are open still to Chiba for Q1, but high freight and weaker sales prices are rapidly closing these margins.

What is still bullish is the signal from the light naphtha side. Light naphtha arbs into Far East from the Med are still shut amid high freight costs, and sales prices are still strengthening to try to open this up.

Moreover, Singapore LVN premiums have spiked; ARA C5+ premiums are also very strong.

From the AG, there is apparently still limited prompt availability (reflected in rapidly weakening freight rates) keeping AG-Far East light naphtha arbs shut down the curve for now; this picture is priced already into Asian naphtha pricing and is a situation that should reverse once AG avails pick up, with the assumption that current tightness is still related to refinery maintenance.

Another unusual situation which should be short-lived is the bullishness being attributed to limited Russian loadings to the East.

Russian runs, however, should ramp up seasonally and total Russian naphtha loadings in Nov are already climbing.

Reportedly low flows to Asia itself should also normalise going forward and any temporary spike in Russia-AG flows will also feed into higher prompt avails there going forward.

In the Atlantic Basin, one of the bigger changes in direction has been in European gasoline, which is now more competitive against the USGC into key LatAm destinations than it has been for a month. Low Gulf Coast runs and other efforts to limit light ends inventory (e.g. via exports) has started to eat into oversupply there. ARA is now pricing into the likes of Brazil as one of the cheapest supply sources; Brazil being a blend with particularly high naphtha-based content.

Lastly, another draw in PADD 1 mogas inventories last week brings levels rather close to the 50 mln bbl mark, which is approaching commercial minimums.

Heavy naphtha arbs from NWE to NYH continue to widen, reaching close to 10cpg this morning. The TA gasoline arb is also responding and could yet see ARA naphtha blending for the NYH pick up at least temporarily.

All this could well extend the apparent rally in blending grades in ARA. The paper market, however, may well see pressure coming from Asia once prompt avails pick up out of key supply locations.

Neil Crosby is an experienced energy market and commodity analyst, specialising in crude oil, oil products, biofuels, and carbon. With roles at OilX and JBC Energy, he has extensive expertise in global oil industry analysis, forecasting tools, bespoke research, and client communication. His focus on refining and petrochemicals underscores his specialisation.

Sparta is a live, market intelligence and forecasting platform that enables oil traders, refiners, banks, hedge funds and wholesalers to have access to real-time and global actionable insights to capture market opportunities before others.

To find out how Sparta can allow you to make smarter trading decisions, faster, contact us for a demonstration at sales@spartacommodites.com