Asia leads the uptrend and recent market movements suggest that a bottom has been reached

The naphtha market continues to show high volatility on paper both in Europe and Asia, following the higher backwardation this week.

February has seen the greatest amount of price since the beginning of sanctions against Russia in March 2022, but less Russian product and new attacks on Red Sea should keep the market strong.

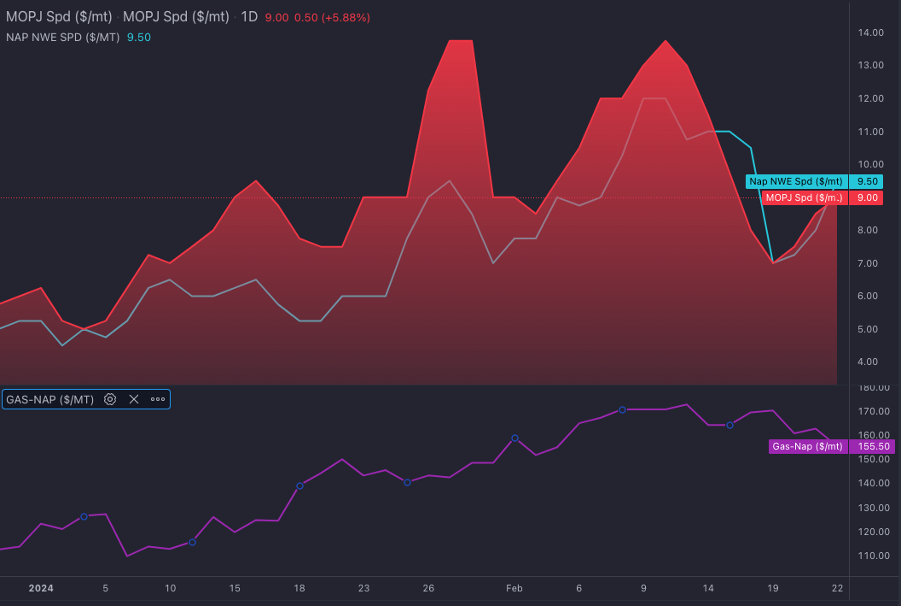

Regarding spreads, after the $2.50/mt increase, the backwardation in Asia between March and April is pointing towards $10/mt with the ceiling at the $14/mt from the beginning of the month.

Meanwhile, the E/W is approaching $20/mt amid the new Asian hikes, still far from the $30/mt highs seen at the beginning of March, but improving the arb from the West for April deliveries significantly.

In Europe, physical market premiums remain stable near this year’s highs, with increased petrochemical activity and E10 blending margins open in the face of historical highs in gas-nap.

We expect the Gas-Nap spread to remain strong for Q2 as a lighter crude slate will keep pushing European aromatic prices higher and March E10 blend will keep European blending grades strong. With Gas-Nap remaining at these levels and the recent drop in reformate, the blending margin has increased and we expect demand to remain strong in the coming weeks.

The petrochemical sector is also experiencing a positive moment in Europe due to the reduction of downstream inflows from Asia and low petrochemical stocks since the end of last year.

We expect this trend to continue, and European naphtha to maintain its current strength in spreads and physical premiums, with potential increases in the crack due to demand from both sources.

One of the notable developments from this week is the first naphtha cargo exported by Nigeria’s new Dangote oil refinery.

At a time when the demand for LVN for blending is expected to remain tight in Europe for Q2, new tenders from the African refinery could help alleviate the demand for LVN in NWE.

Gas-Nap keeps to seasonal highs despite $10/mt loss. (Sparta Historical Forwards)

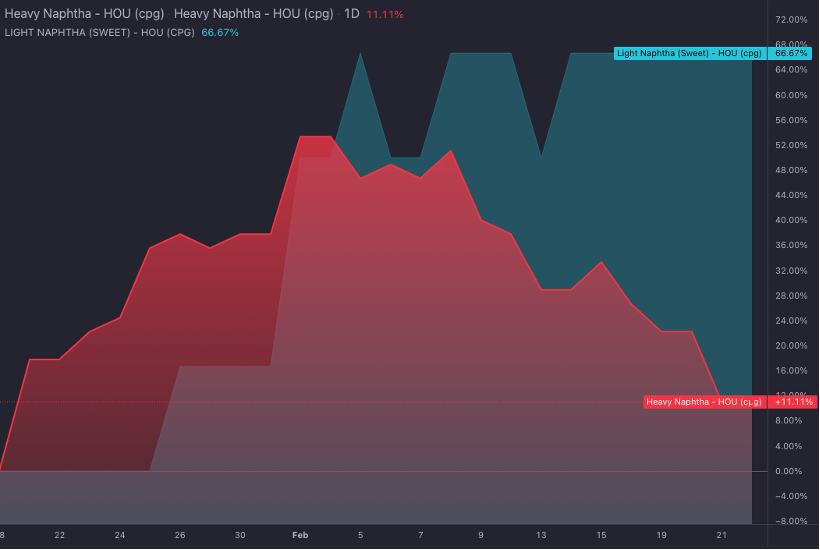

In Asia, despite a weakening OSN, prices for heavy naphtha have steadily increased in the last two weeks, although not enough to open the arbitrage for these grades from the US or Europe in the short term.

After the recent correction in the Sing 92 crack due to higher Asian gasoline stocks, Asian heavy naphtha premiums could correct downward vs MOPJ benchmark.

The naphtha crack in Asia dropped to over a two-month low amid high oil prices, supported by renewed US demand and fresh Red Sea attacks, but cracks are recovering from current lows after two days of increases in Asia and EU.

We do not expect further declines due to the increase in physical premiums in the Asian market and the rise in spreads, as well as the improvement in the economics of the arbitrage to Asia from the West.

In the US, the return of key refineries from maintenance or weather-induced outages are contributing to a prolonged decline in light naphtha premiums, more pronounced in the Gulf than in NYH.

However, light sweet and sour naphtha premiums have regained some of the lost strength, making exports to Europe or Asia more challenging in the short term.

Jorge Molinero is Commodity Owner for Naphtha and LPG at Sparta. Starting his career as a financial analyst with BBVA, Jorge quickly transitioned to market intelligence within the energy sector, spending 4 years as a naphtha analyst with Repsol before joining Sparta in early 2023.

Sparta is a live, market intelligence and forecasting platform that enables oil traders, refiners, banks, hedge funds and wholesalers to have access to real-time and global actionable insights to capture market opportunities before others.

To find out how Sparta can allow you to make smarter trading decisions, faster, contact us for a demonstration at sales@spartacommodites.com