Asia holds on while Europe faces a challenging Q4 for open-spec naphtha

Asia:

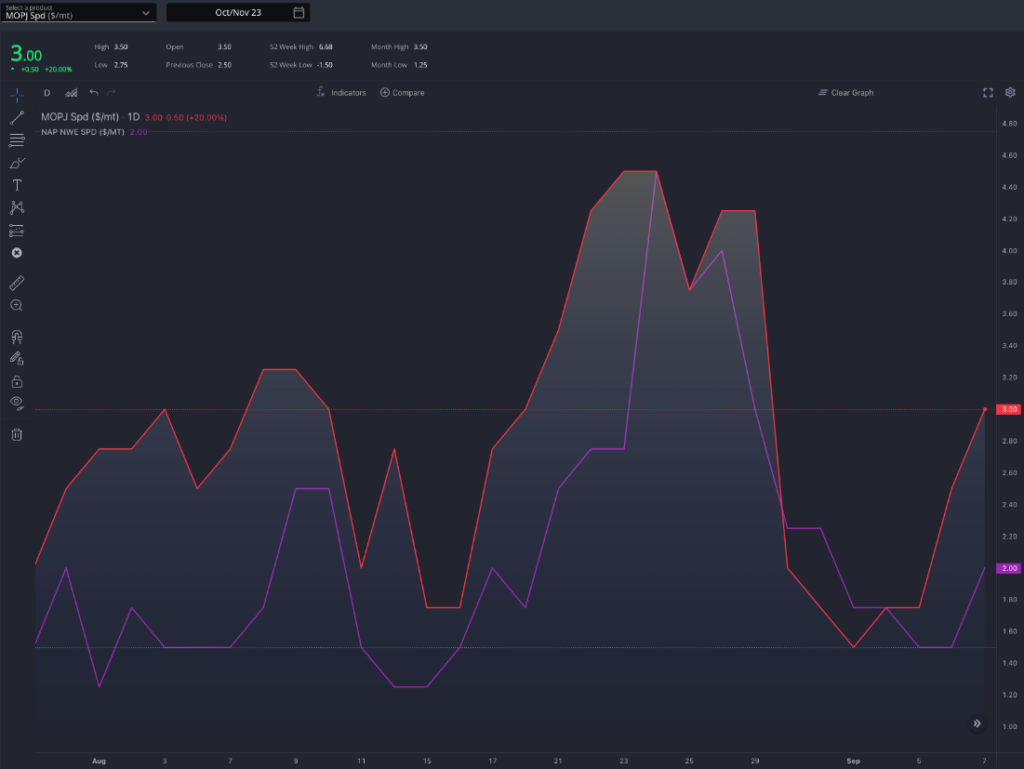

Despite some volatility, Asian naphtha markets have shown resilience in recent trading sessions. The time spread gained $1.5/mt on the MOPJ Oct/Nov spread, settling at +$3/mt. This comes after a slight dip from +$4.5/mt at the end of August.

While physical premiums for Chiba 2h Oct delivery weakened from +$7/mt to +$4/mt, they still outperformed their European counterparts. This may well open up the possibility of new spot arbitrage opportunities for Heavy Full-Range Naphtha (HFRN) and Full-Range Naphtha (FRN) in October (see chart), as we expect the E/W spread to widen and sales prices in the Far East to remain robust on healthy demand.

Europe

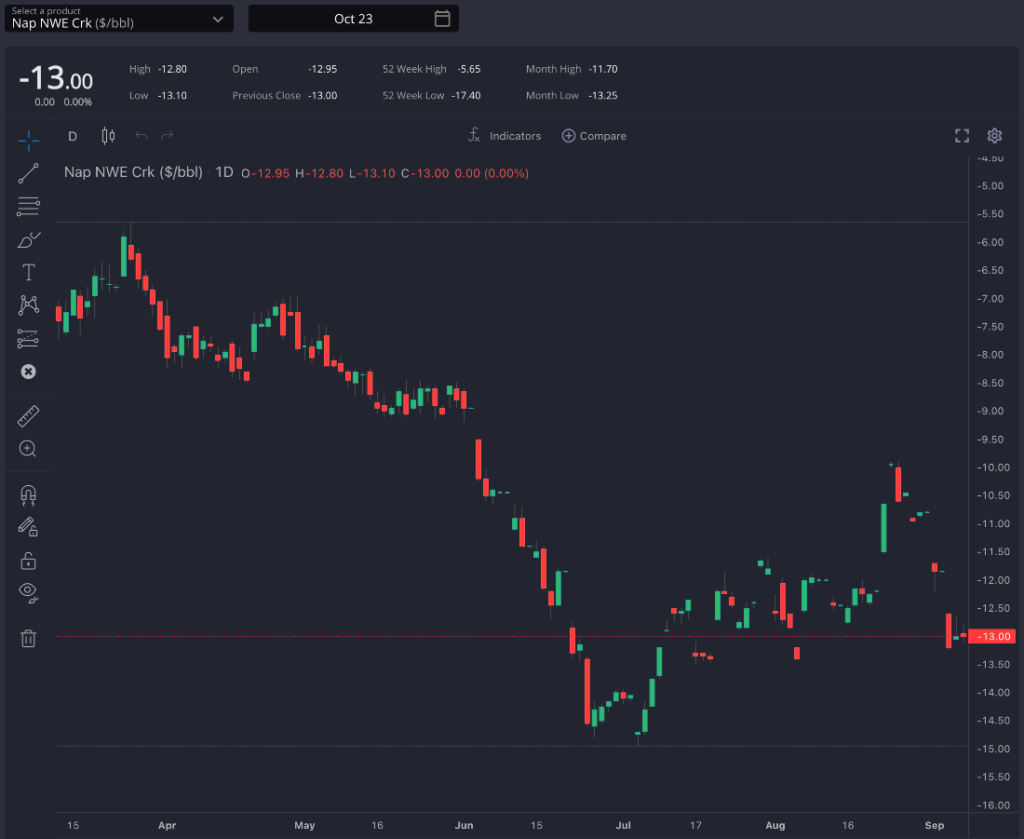

In Europe, the naphtha market faced a bearish week on the paper markets. Cracks traded lower, experiencing a $3/mt drop since August 25th on the October contract. This drop occurred despite Brent’s recent upside.

The physical market performed worse than the paper market, with negative premiums for OSN naphtha, currently trading at levels close to -$4/mt.

This reflects low cracker rates in the North and the diminishing value of paraffins for end users. With the gasoline market beginning to soften, support from this side is also waning.

The current question in the European market is whether it has bottomed out or can continue to fall further. There is no doubt that a return to contango is an option in the short term due to low petrochemical demand and its continued bleak outlook for Q4.

Gasoline also doesn’t seem to be poised for a rebound, with the T/A arb closed and the initial signs of weakness in gas-nap after the summer, currently trading at +$187.5/mt for the Oct 23 contract, having reached $215/mt in mid-August.

However, this weakness in the North makes the Mediterranean a candidate for exporting volume to Asia, both for HFRN grades and the Skikda Refinery, which has recently reached Asia, as well as for FRN.

OSN delivery prices still far from work to Asia with E/W at current levels (+$6/mt for Oct 23 contract) and physical premiums at +$4/mt on a Chiba arrival 2H Oct.

US

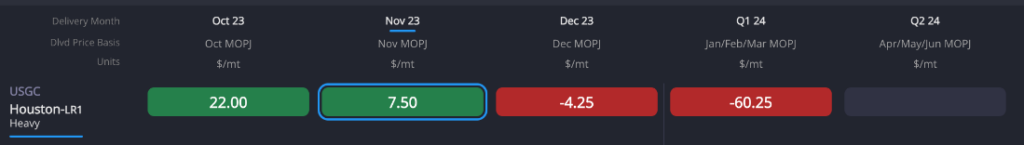

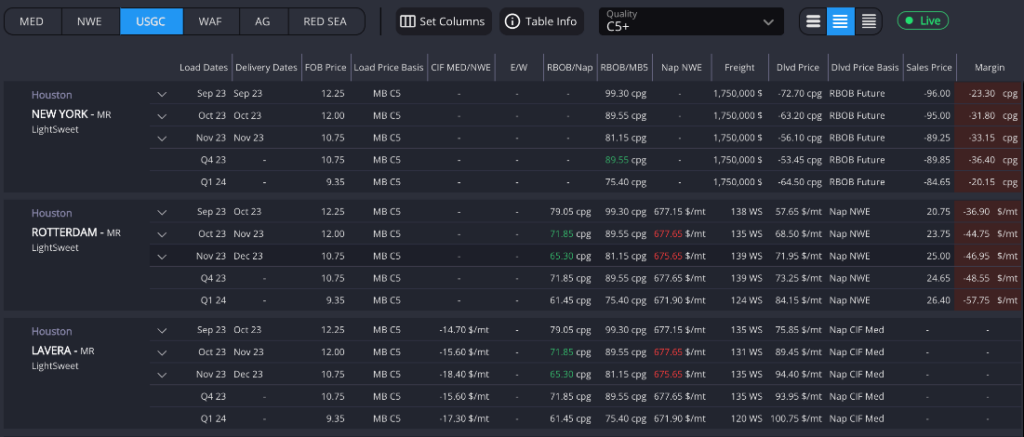

USGC heavy naphthas find Asia to be a more attractive option despite higher prices for Heavy Quality naphtha. Panama Canal demurrages have affected netbacks for USGC routes, limiting arrivals despite a substantial arb gap.

The recent spike in heavy naphtha premiums in the USGC has posed challenges, and it appears that previous highs for this arb may not be revisited in October. The key determinant will be the capacity of Asian heavy naphtha premiums, currently showing strength at +$80/mt for pure HVN and +$50/mt for lower-quality grades.

On the C5 side, lighter naphtha grades favor the local barge market as their top option. Arbitrage opportunities in MR to both NYH and Europe have weakened due to the strength of buying premiums.

Jorge Molinero is Commodity Owner for Naphtha and LPG at Sparta. Starting his career as a financial analyst with BBVA, Jorge quickly transitioned to market intelligence within the energy sector, spending 4 years as a naphtha analyst with Repsol before joining Sparta in early 2023.

Sparta is a live, market intelligence and forecasting platform that enables oil traders, refiners, banks, hedge funds and wholesalers to have access to real-time and global actionable insights to capture market opportunities before others.

To find out how Sparta can allow you to make smarter trading decisions, faster, contact us for a demonstration at sales@spartacommodites.com