Wind blown from the sails as Europe remains well supplied

Prompt E/W spreads have narrowed in recent days which, along with a lack of uptick in European cash diffs, has left even the Red Sea into Rotterdam route looking unattractive over the next few weeks and months.

This appears to be a further signal that the European market is perfectly happy with the preparations it has made to-date ahead of the 5th Feb Russian sanctions deadline.

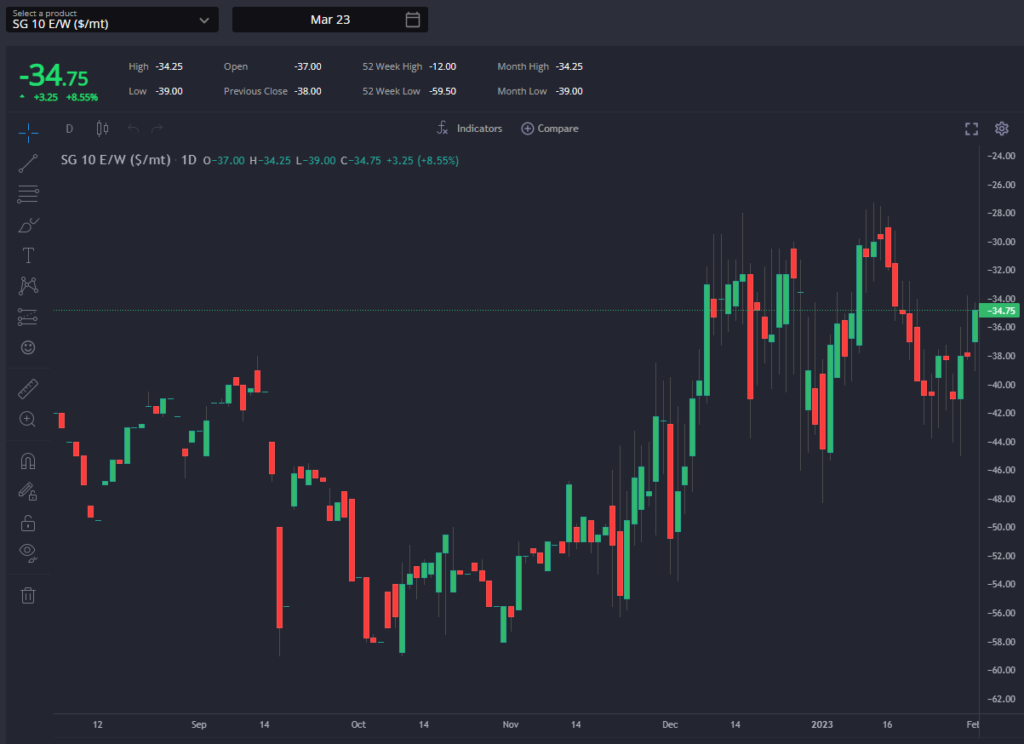

In this respect, without a serious change in local supply/demand fundamentals in Europe, these arbs are likely to remain closed in the short-term. A look at the ICE Gasoil Swap backwardation in recent days further points to a late flurry of arrivals satiating the market, with the Mar/Apr spread falling from $37/mt to below $24/mt in less than a week.

That being said, the picture has improved as we look as far out as H2-2023, in line with fundamentals expectations that recent inventory-filling will gradually wane and require almost-permanent open arbs from the AG and India.

Although the E/W has also narrowed through much of Q2 in recent days, Q3 and Q4 levels have actually widened slightly, now all posting wider than -$40/mt at the last count.

If the market appears to be expecting the AG to become the new primary supplier of the European short in diesel, it certainly is not doing the same for the US currently.

The forward HOGO swaps continue to trend around the 20cpg level through to at least Q4-23, precluding any real sense that a regular and sustained stream of vessels can be established on this TA route.

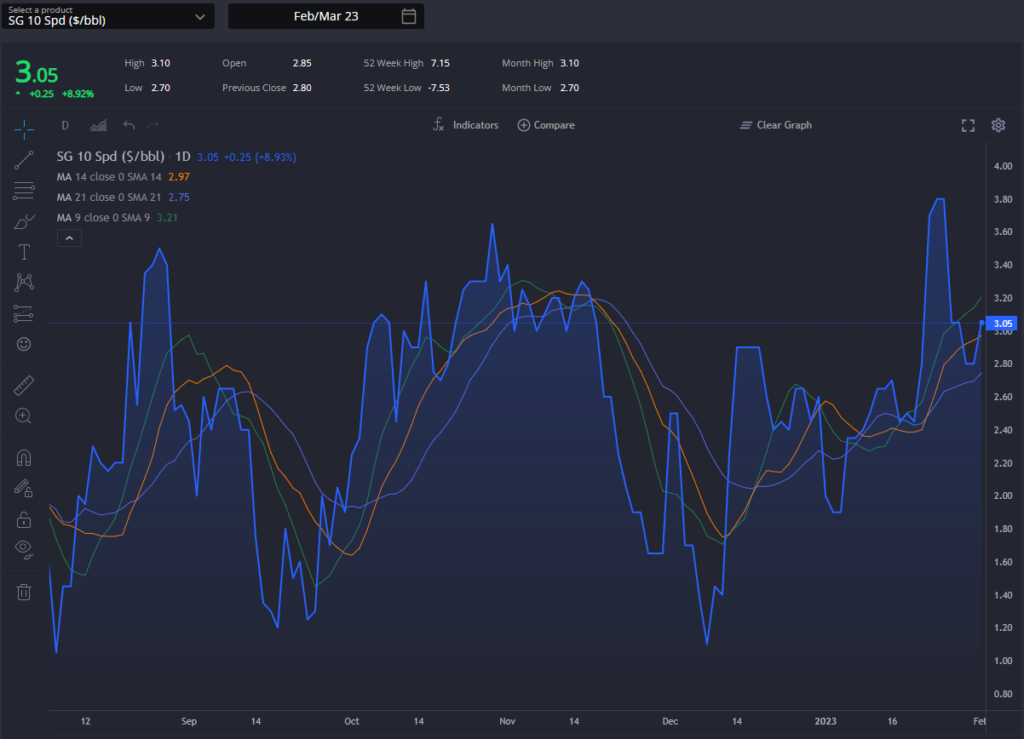

Finally, it is important not to forget the Asian side of the E/W equation, with Singapore structure strengthening gradually through recent weeks before proving unable to sustain those levels early this week.

Despite the latest wobble, the 9 day moving average at $3.20/bbl on the Feb/Mar spread look achievable in the short-run as Chinese exports slowdown.

With forward pricing currently weakening in Asia into the summer months, allowing some of those AG arbs to open back up into Europe, it will be important to keep an eye on whether the EoS market can really spare those volumes.

To this end we will be adding in the coming weeks additional routes to the Sparta tool, including more routes into and out of Singapore, Taiwan, and South Korea in order to give a fuller picture of where the pricing tells us barrels will be moving in the coming weeks and months.

[hubspot type=cta portal=7807592 id=38c8d3f4-d2d3-4781-a4a2-ba10ca4055bc]

Philip Jones-Lux is Commodity Owner for Sparta. Having worked with organisations such as JBC Energy and RP Global, Philip is a seasoned energy market analyst with expertise across the oil barrel and power markets

Sparta is a live, pre trade analytics platform that enables oil traders, refiners, banks, hedge funds and wholesalers to have access to real-time and global actionable insights to capture market opportunities before others.

To find out how Sparta can allow you to make smarter trading decisions, faster, contact us for a demonstration at sales@spartacommodites.com