Tightness might be difficult to sustain in the short-run but Q2 shaping up strong

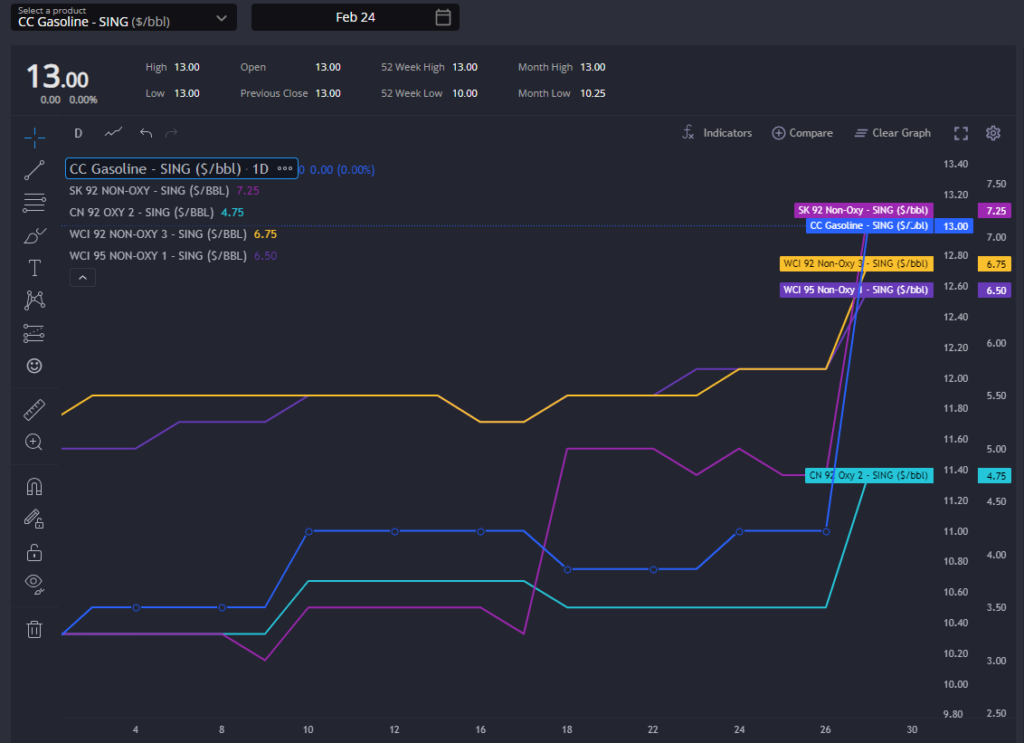

Starting off today in the East of Suez, prompt Sing 92 cracks and spreads have rallied somewhat over the last week or two as increased freight rates in the region are making it more costly to supply components into the Singapore blending hub.

Furthermore, the E/W spread has had to move in Asia’s favour to continue attracting European gasoline barrels despite the uptick in freight prices.

Sing 92 cracks are already coming off of their recent highs, with spreads also giving up some of their recent gains in the last few days, and there is unlikely to be any further room to the upside for now given the ability of regional exporters to respond quickly to positive pricing signals by adding supply to the regional market.

With a reliance on components transiting into Singapore to generate regional grades, freight rates in and around Singapore have an outsized impact on the cost of blendstocks in this particular hub.

Whilst there have been some fundamentally-driven upticks recently (high quality FCC gasoline streams have been pricing higher on increased demand), much of the uptick in costs for streams coming in from China, South Korea, or India are a reflection of increased logistics costs rather than a tightening of the balance in those exporters.

This is opening the door for European volumes to continue to price into East Africa and parts of the AG, closing the door further for any fundamentals support for the EoS volumes.

The European market has continued to show little physical strength in the prompt, with positive blend margins and contango market structure through Q1.

This isn’t massively surprising through the weaker regional demand period, but may be adding a hint of caution to the currently very positive Q2 forecast.

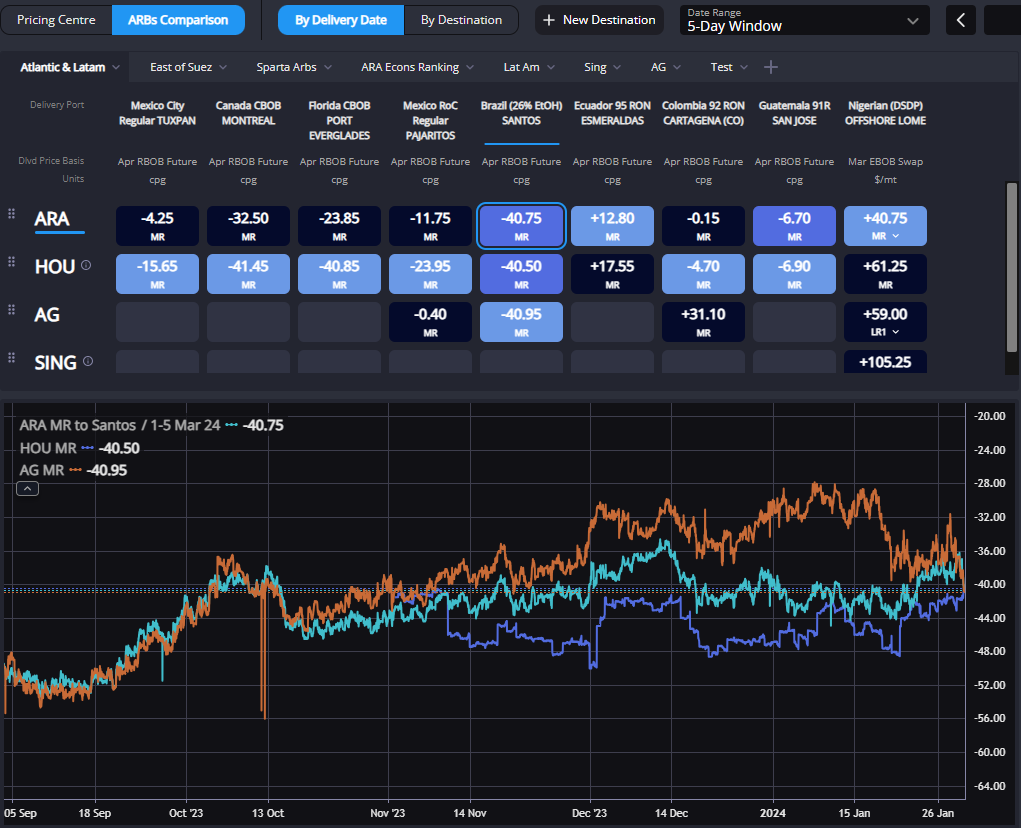

April/May spreads, for example, are trading in the top half of their historical range and the RBOB arb has moved to open up in Q2.

For now, no significant uptick looks like in the short-term for the EBOB complex given the wide open blend margins, and Q2 also appears to be supported by the open TA arb spreads.

Whilst a falling RVO price and still well-supported freight rates are keeping the prompt TA arb firmly shut, the picture into Q2 improves somewhat and is currently at levels which would support a slightly-below-average flow of RBOB out of Europe through April and May.

A supportive fundamentals picture in PADD-1, however, may require a wider arb spread than what we currently have looking forward, as the weakening RVO has also pulled the TA spread narrower in Q2.

With our TA arb calculation currently largely relying on a wider gas-nap to make the flows work once we reach April/May, the paper TA arb spread will likely be called upon to do more of the work and should widen between now and then.

Finally, competition to supply into Brazil is extremely tight in the prompt and is reflective of a quite balanced picture between the regional supply hubs currently.

With the US and ARA both dominating their ‘home’ regions, and ARA pricing competitively into the South American markets, the emergence of potential flows into Brazil from the AG points to a market there that is still able to put together naphtha-heavy volumes at competitive prices, even if higher quality volumes reliant on semi-finished streams are being hampered by rising physical premiums due to reduced supply through the ongoing AG maintenance season.

Philip Jones-Lux is Commodity Owner for Sparta. Having worked with organisations such as JBC Energy and RP Global, Philip is a seasoned energy market analyst with expertise across the oil barrel and power markets

Sparta is a live, market intelligence and forecasting platform that enables oil traders, refiners, banks, hedge funds and wholesalers to have access to real-time and global actionable insights to capture market opportunities before others.

To find out how Sparta can allow you to make smarter trading decisions, faster, contact us for a demonstration at sales@spartacommodites.com