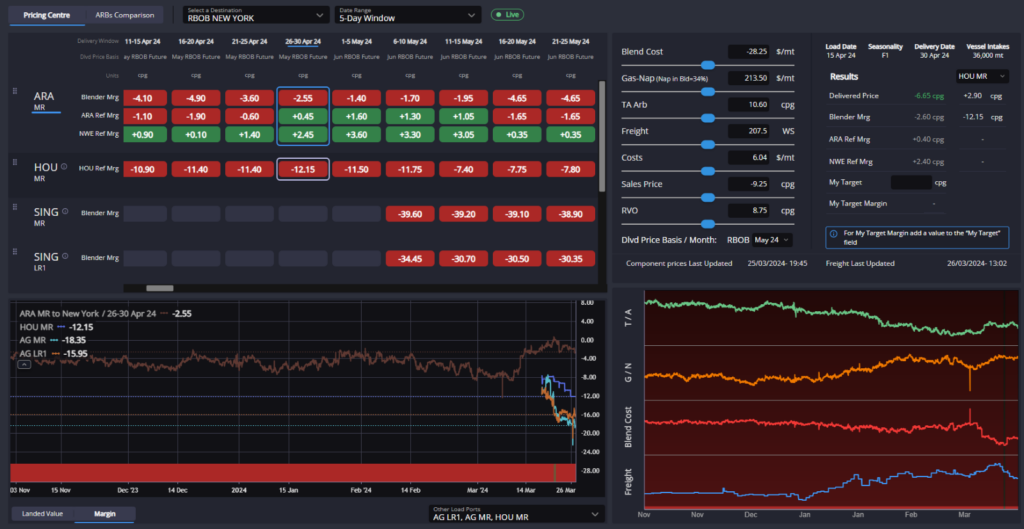

TA Arb still has some widening to go with US exports running unsustainably high and Europe still highly incentivised to produce max gasoline

The paper TA Arb widening out back into double-digit levels has opened up the next tranche of the arb to move volumes into PADD-1.

At these levels, we could expect a small uptick in the baseline of cargoes making their way TA through April, but crucially not enough to match typical seasonal levels.

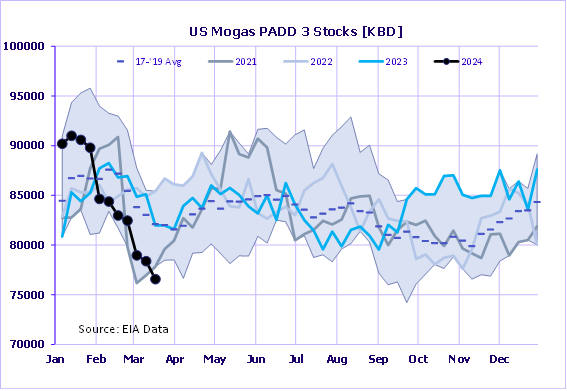

Furthermore, with May and June also showing essentially closed RBOB arbs for all but the most advantaged refinery players in Europe, the forward pricing picture is continuing to undersupply PADD-1 and is risking a repeat of last year’s dynamics which saw significant and sustained product draws through the end of Q1 and into Q2.

Despite market chatter of significantly decreased European supply in the coming weeks and months thanks to turnarounds at European refineries, much of this is well priced in already and the impact on gasoline supply is likely to be at least partly mitigated by a softening of the distillates complex, with gasoline cracks now decidedly higher than diesel through April.

With only a handful of outlets really pointing to ARA for resupply, and the E10 blend margin having recently closed once more, component pricing is likely to have hit a ceiling for now.

The exception to that may still come from higher octane components, however, which have their own dynamics to navigate.

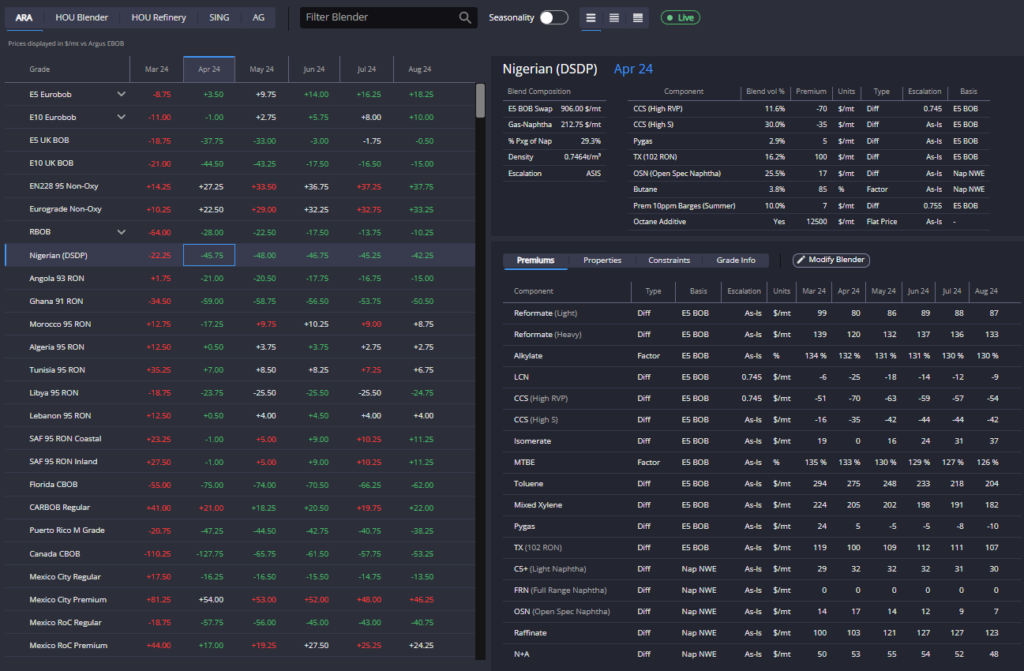

Despite record-high gas-nap spreads currently for Q2, the percentage of naphtha in the majority of the streams out of Europe remains conspicuously low with blend walls apparently appearing in RBOB, Nigerian, and other major export streams.

This is propping up high octane component premiums in Europe at the top end of their recent historical ranges, although I would wager that further room to the upside on these component premiums is likely limited until the overall pull on European volumes picks up.

For that to happen, we will need to see a further widening of the Q2 TA paper spread in the coming weeks.

After threatening to price into Nigeria briefly last week, barrels out of the AG and Singapore remain tantalisingly close to being workable into the Atlantic Basin but remain unavailable thanks to the recent narrowing of the E/W.

Whilst fundamentals don’t quite require those additional flows just yet, a price response from the US side of the Atlantic to shut down the exports from there would see the draw on European barrels picking up and invite these EoS barrels in.

For this, the E/W would likely move back into double-digit territory already by late-April, or by the 2nd half of Q2 at the latest.

Although Singapore is now placing barrels into the west coast of the Americas, the overall EoS balance is unlikely to be threatened by these additional tallies to the demand side, with strong export volumes being reported from major export markets still keeping a firm lid on any more upticks in the Sing92 complex.

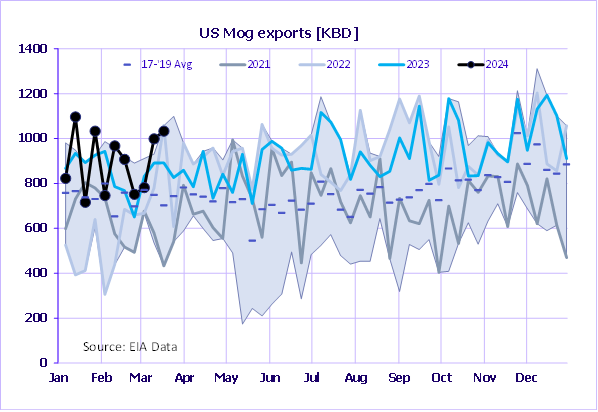

Indeed, despite falling inventories, it is the US exports which have remained high in recent weeks in a dynamic which will need to change before long in order to avoid an extremely tight late-Q2 US gasoline market.

TC14 strength is already starting to hamper some of the export economics for US gasoline grades, but there is still likely to need to be a response from the underlying RBOB market to help tip the balance.

Overall, it is hard to look past the need for the TA arb to widen further in the coming weeks, with a well-supplied European market and a US market which needs to reduce its recent net-export figures both helped by a shift in LatAm imports to pointing towards Europe for a few months at least.

Philip Jones-Lux is Commodity Owner for Sparta. Having worked with organisations such as JBC Energy and RP Global, Philip is a seasoned energy market analyst with expertise across the oil barrel and power markets

Sparta is a live, market intelligence and forecasting platform that enables oil traders, refiners, banks, hedge funds and wholesalers to have access to real-time and global actionable insights to capture market opportunities before others.

To find out how Sparta can allow you to make smarter trading decisions, faster, contact us for a demonstration at sales@spartacommodites.com