Strong backwardation holds in Europe but only in the prompt, Asia well supplied while US faces challenging Q2

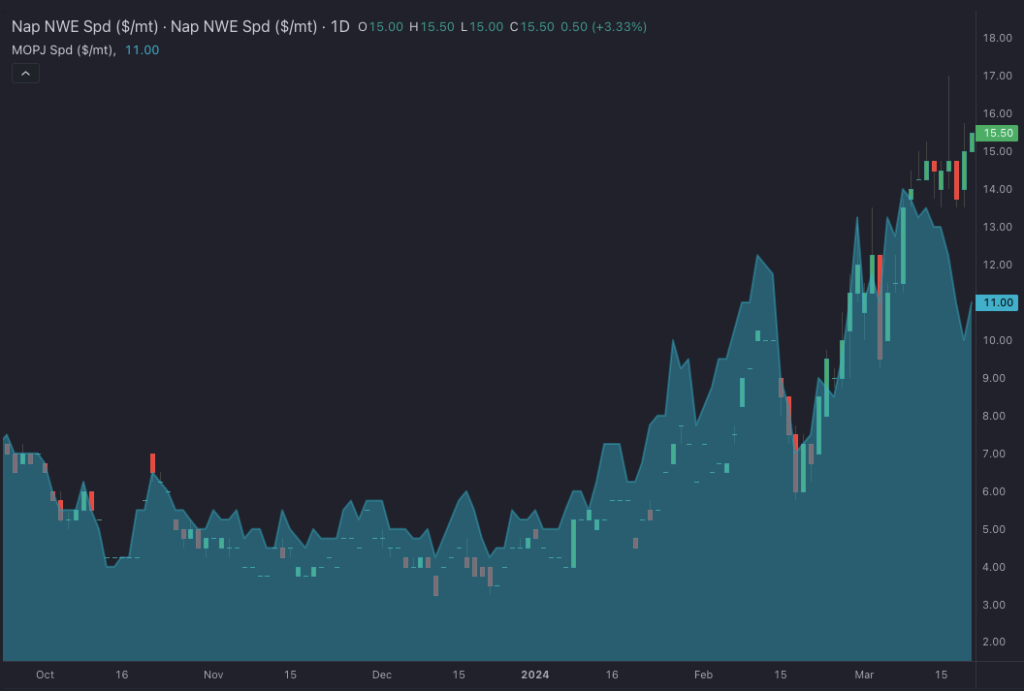

Naphtha time spreads have corrected during the last sessions with just one exception: the April-May in Europe is still holding steady with a backwardation above $15/mt, which has led the E/W box to fall below $5/mt, a level that had not been reached since last October.

This points to a consolidation of the current market trend with Europe being the tightest market and Asia remaining well covered with AG exports into Q2. AG exports to Asia hit their highest level since last October.

The prolonged increase in AG production following the end of the TA season, which reached its peak in January, has deactivated the demand shortage risks that threatened the Asian market during the first part of Q1 following the onset of attacks in the Red Sea.

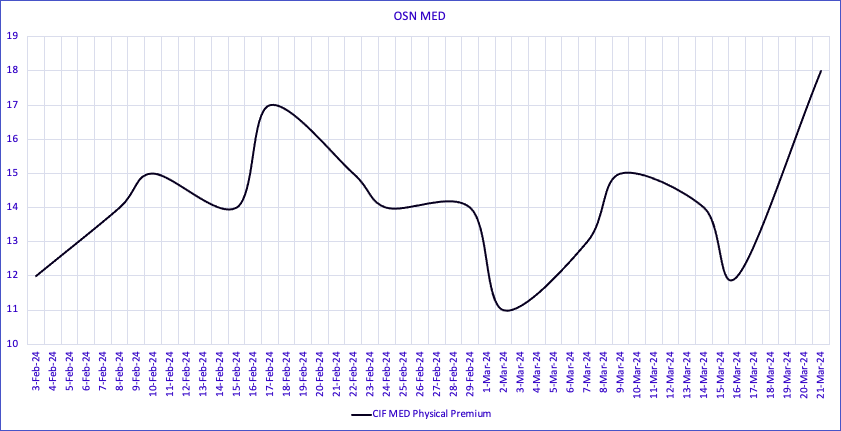

Physical premiums in Europe have reflected the ongoing dynamic with a significant increase this week as April became the delivery window.

We’ve seen the biggest increase so far this year, and despite NWE remaining stronger, the largest increase has been in Med premiums, in line with the rises in TC6 that marks the arbitrage to the north.

Europe needs to retain as much product as it can, as the current backwardation for April-May suggests, and it won’t be until later in Q2 that an increase in European runs and a potential fall in gas-nap will help alleviate the pressure on European naphtha.

Blending has also increased naphtha demand optimism in Europe with EBOB cracks climbing throughout the curve, allowing gas-nap to mark new highs.

Despite the high price of aromatics still impacting the cost of blending, the switch to summer-grade gasoline has increased the blending margin for E5 and E10 in Europe.

Combined with good petrochemical demand, the backwardation for April-May has increased by $2/mt, at a bearish time for the overall structure of the naphtha market.

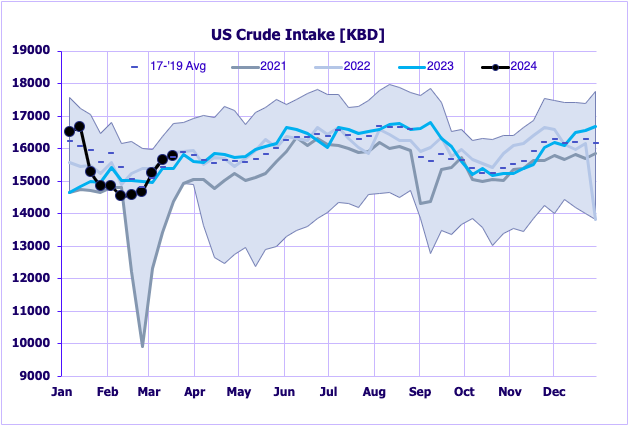

On the US side, despite the strength in RBOB due to lower stock levels, there has been a notable increase in crude oil processing in recent weeks, surpassing seasonal averages according to the latest EIA data.

This suggests that the recent trend in PADD3 inventories is likely to change direction soon.

In the naphtha market, USGC and NYH premiums have weakened compared to RBOB. Discounts are widening and RBOB is already trading quietly this week, potentially finding a ceiling.

That said a heavy Q1 PADD3 refinery maintenance season and cold weather related outages at the start of the year is still impacting the current market strength.

The outlook suggests that US Gulf Coast exports could be stimulated at the start of Q2, making both light and heavy naphtha cheaper as inventories increase, positioning it as an alternative to supply the Asian market.

Meanwhile, Europe will have to fight to keep as much product as possible during April, then face Q2 with a less tight market and be able to compete for exports to Asia.

Jorge Molinero is Commodity Owner for Naphtha and LPG at Sparta. Starting his career as a financial analyst with BBVA, Jorge quickly transitioned to market intelligence within the energy sector, spending 4 years as a naphtha analyst with Repsol before joining Sparta in early 2023.

Sparta is a live, market intelligence and forecasting platform that enables oil traders, refiners, banks, hedge funds and wholesalers to have access to real-time and global actionable insights to capture market opportunities before others.

To find out how Sparta can allow you to make smarter trading decisions, faster, contact us for a demonstration at sales@spartacommodites.com