Spring pricing is arriving early as last year’s quality issues look set to repeat

The European products market in general has been given a significant boost from the Red Sea disruptions, and that has been led by diesel primarily, with gasoline somewhat following on the coattails.

One thing to note is that the European export window into LatAm, WAF, and East Africa/ME regions has been wide open through January, and upticks in export flows have likely tightened gasoline blendstock availability in the short-run.

EBOB cracks have risen to incentivise greater refinery production, but also have needed to rise because blender margins were coming under pressure from tightening component markets.

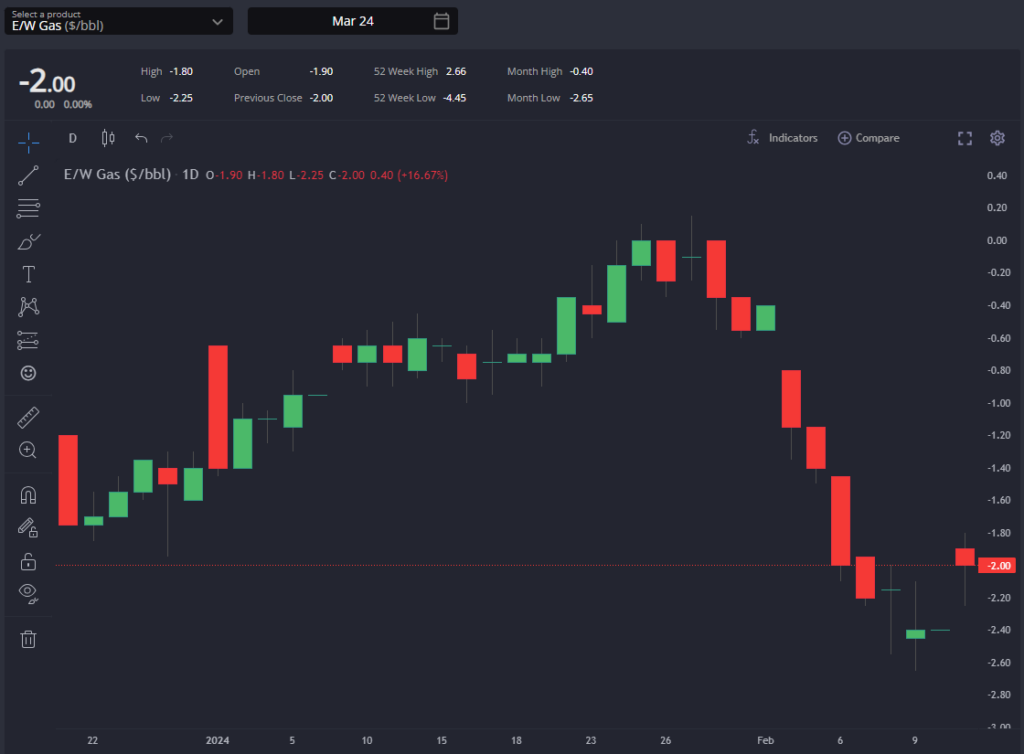

Despite European gas-nap absolutely skyrocketing recently, which is giving a significant blend cost advantage to European blenders over their US-based counterparts, the limiting factor now is likely to come from the higher quality/octane components.

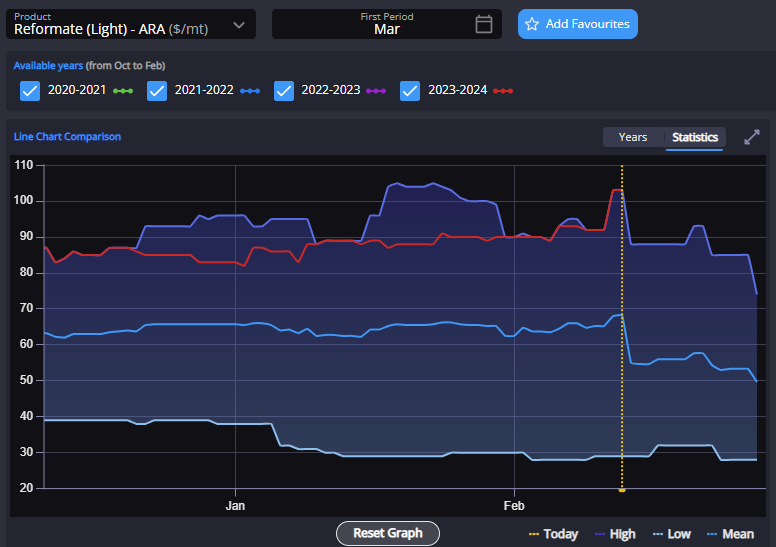

We’ve already started to see premiums on reformates, and toluene/MX rising dramatically so far this month.

In other words, we’re already starting to see a repeat of the situation from last spring/summer where gas-nap can widen even further but there simply isn’t the higher quality components available to blend the naphtha into.

The discrepancy in blend costs between regions has meant that European exports to lower-octane markets have been high recently, with flows to WAF benefitting.

Indeed, supply disruptions in the US are looking very supportive for the Atlantic Basin in general.

With US exports potentially dipping as a result, the call on European volumes into LatAm increases, and further solidifies ARA’s hold over the WAF market, which has seen a big uptick in flows recently.

The difference in the cost of delivering gasoline into WAF out of Europe vs the USGC (~$30/mt in recent weeks), for example, meant that there was a healthy margin to be made for European exporters in recent weeks, some of whom have likely blended cargoes and sent them to WAF in the expectation that they will be picked up eventually.

January was a very slow month for the European gasoline complex, and WAF remains a reliable export outlet for now (Dangote).

In the East of Suez, the market has taken something of a breather through the Chinese New Year break, with component pricing softening although the SG92 crack and spreads continue to move higher.

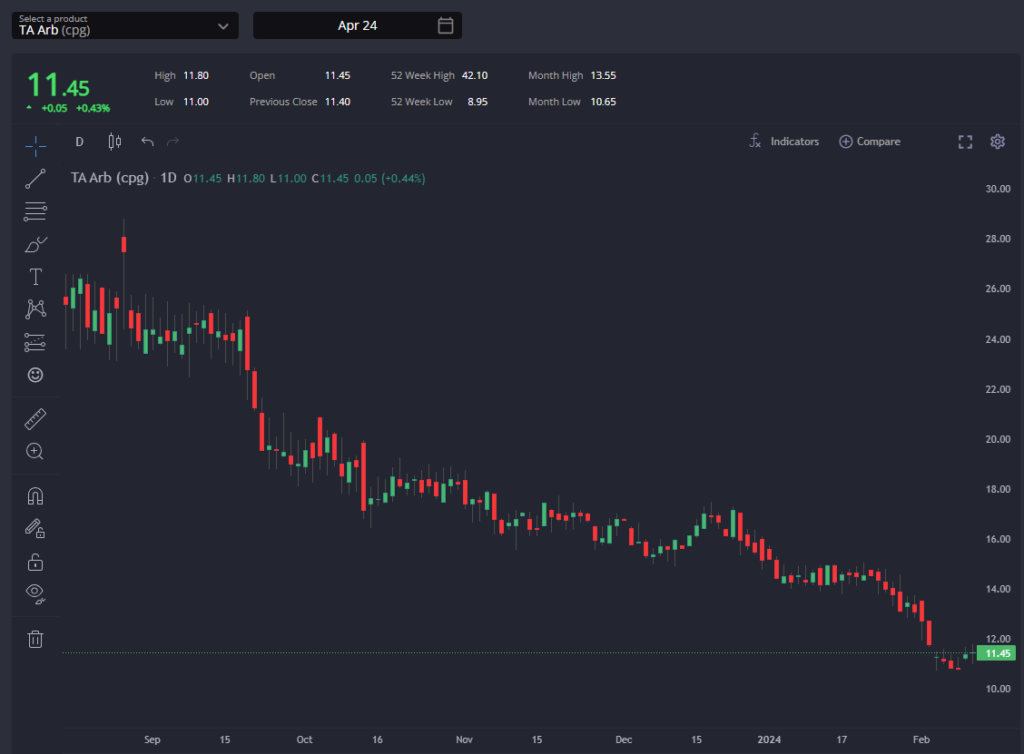

The rising E/W spread, however, is opening up more arb opportunities out of Singapore and the AG into destinations within the wider EoS region.

We remain a long way off opening up opportunities for EoS origins to place into the Atlantic Basin, however, even when we look further afield to May and June, potentially highlighting a discrepancy between forward pricing and the physical realities of what looks to be shaping up to be a tighter summer ahead for the Atlantic Basin gasoline market.

Philip Jones-Lux is Commodity Owner for Sparta. Having worked with organisations such as JBC Energy and RP Global, Philip is a seasoned energy market analyst with expertise across the oil barrel and power markets

Sparta is a live, market intelligence and forecasting platform that enables oil traders, refiners, banks, hedge funds and wholesalers to have access to real-time and global actionable insights to capture market opportunities before others.

To find out how Sparta can allow you to make smarter trading decisions, faster, contact us for a demonstration at sales@spartacommodites.com