Something’s Gotta Give

EUROPEAN STRENGTH LOOKING INCREASINGLY TENUOUS

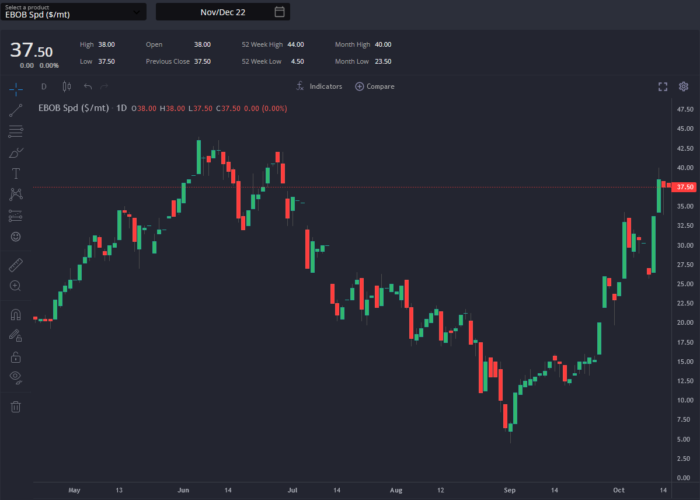

The European mogas complex continues to benefit from two main streams of support; a hole in regional supply from missing French barrels and residual exports locked in through August and September when European supply was the cheapest available.

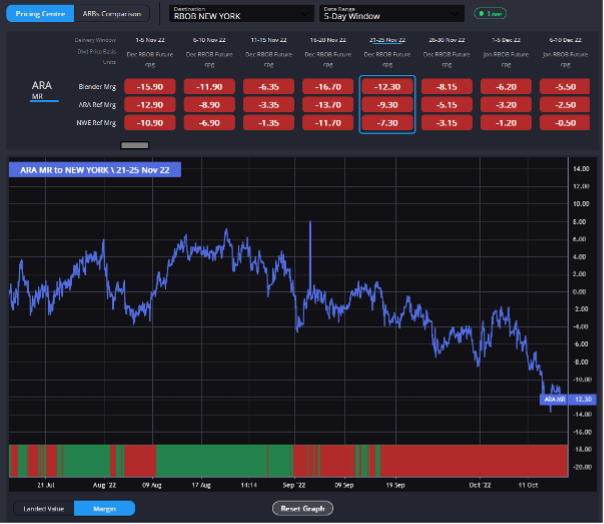

With outlets outside of Europe now almost exclusively cheaper to re-supply from non-European sources in the coming weeks, pressure is likely to begin mounting on EBOB cracks and spreads moving forward. The lead time between locking in arbs and those volumes actually moving has been able to sustain European support on the physical side for a while. However, with the advantage East of Suez barrels hold now firmly in place for over a month, these are likely drying up.

With the TA arb out of ARA also closed for around a month now, ongoing European strength boils down to a coin toss on how long French supply is out of the market. The nature of the outage means supply can return rapidly, potentially leaving those with substantial long positions in Europe holding the bag if markets move as quickly as they may well do once the strikes end.

EAST OF SUEZ CONTINUES TO PUSH BARRELS FURTHER OUT

Given the combination of multiple large-scale, highly complex, export-orientated refineries commissioned in the AG in recent years, and now a ready supply of below-market priced components being handled in parts of the region, the fact that the AG has become the cheapest global supply is not surprising. The question now is what kind of volume the region can reliably provide to export markets.

Until the net-length in the AG reaches levels which can saturate the markets it is competing with ARA or Singapore to supply, those regions should be able to resist having to pass on pricing pressure 1:1 and continue to focus on out-competing each other. However, this is a trend we only see continuing, a trend which players in ARA and Singapore will need to become more closely accustomed with in the months and years ahead.

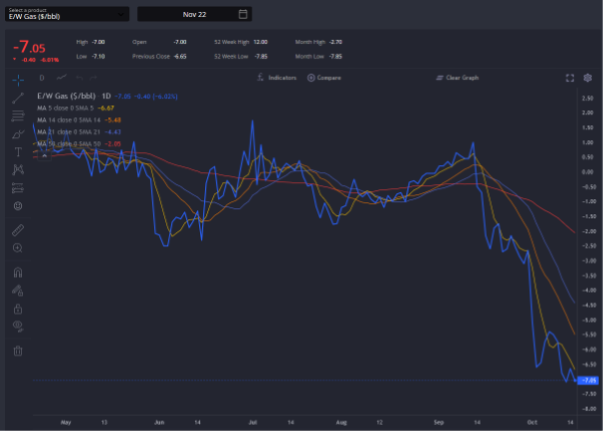

Focusing on Singapore briefly, we see positive econs throughout November into the Pacific and Africa, with the November E/W looking ready to hit a bottom around current levels as support should begin to emerge. December E/W is currently trading around -$3.60/bbl, around half of the November contract, and at these levels remains competitive (cheaper than ARA) into all East of Suez and Pacific destinations.

CONCLUSIONS

For those who have enjoyed the European mogas complex’s recent upside, it looks like it is about time to wind-up some of those positions. With the number of supporting factors dwindling, and the French strike outages remaining the only major pillar of support, this market could turn quickly now.

Conversely, the November E/W looks like it may be oversold on the premise of excess Chinese volumes and there may be room rather to the upside – or at least to take advantage of Singapore’s current ability to supply into more far-flung destinations.

Philip Jones-Lux is Commodity Owner for Sparta. Having worked with organisations such as JBC Energy and RP Global, Philip is a seasoned energy market analyst with expertise across the oil barrel and power markets

Sparta is a pricing and information platform that enables oil traders, refiners, banks, hedge funds and wholesalers to have access to real-time and global actionable insights to capture market opportunities before others.

To find out how Sparta can allow you to make smarter trading decisions, faster, contact us for a demonstration at sales@spartacommodites.com