Short and mid-term consequences of the French strike

French refiners have now entered their 21st day of strikes. The tone has not cooled down and strikers are aiming “to bring France to a standstill”.

Another day of strikes and demonstrations are planned for tomorrow. Most French refiners are currently shut down or running at reduced capacity.

As a consequence, 13% of French gas stations have now run out of fuel. The biggest impact can be seen in the Med, Brittany and Normandy, where fuel is becoming scarce. Given these conditions, one would expect French players to be resupplying in ARA very soon.

In the meantime, and oddly enough, a large French refiner continues to be the most aggressive winter grade seller in the ARA window. This must be linked to a disposal of winter grade as the market transitions to summer grade, yet it remains quite surprising.

Friday was the first day of summer grade on the Argus window, and we could already see that summer grade was already trading in steep backwardation (trading at a whopping April swap +$28/MT for early April loading).

In the meantime, ARA blending margins remain mostly negative. Despite gas-nap rallying back to $160/MT in April, blending margins for summer grade E5 remain at historical lows, currently out of the money by $22/MT in April and $26/MT in May 23.

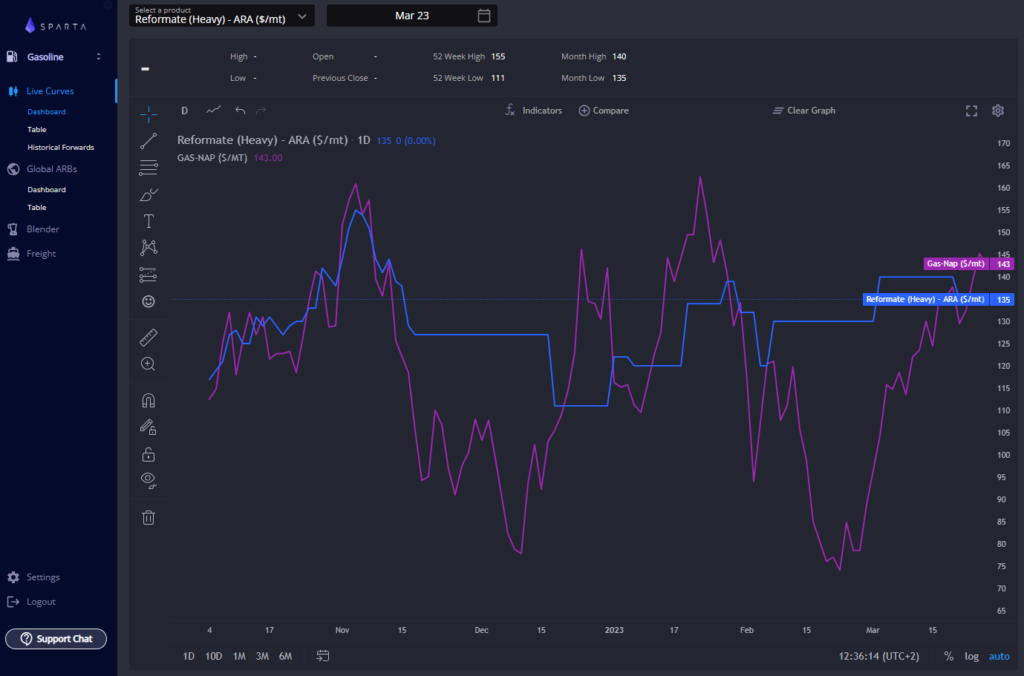

Indeed, high octane components like reformate or alky remain stubbornly high exacerbating these negative blend margins. As a result, this should remove any short-term selling pressure in the market.

That being said, E10 blend margins are close to breakeven, particularly in April (out of the money by only 3 USD/T). Given that the arbs are shut and only demand could come from France in the form of E10, this could be enough to keep octane component values elevated.

As a consequence of these strikes, the market is doing its job incentivising gasoline production elsewhere.

European Q2 cracks are at historical 8-year highs, trading all the way up to $23.85 on the 23rd March. Simultaneously Diesel cracks remain under pressure. The relative price action between gasoline and diesel clearly favour gasoline production for the summer.

It is also keeping Europe in defensive mode and ARBs from Europe remain shut to all major destinations. We are only seeing a reduced amount of cargoes heading to TA, Brazil and WAF, mainly from NWE and Med refiners.

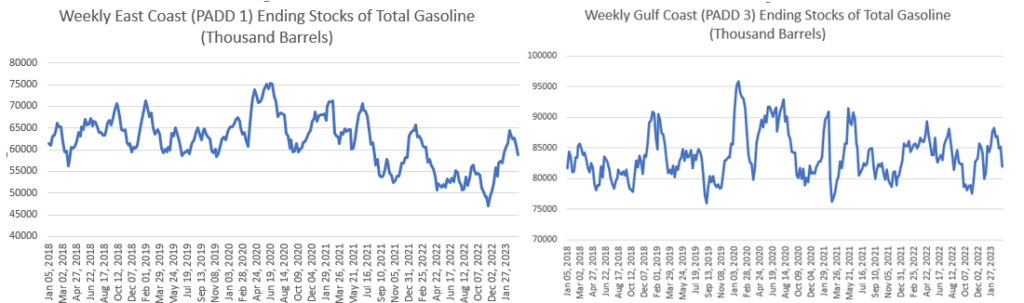

On the other side of the pond, stock levels in both PADD 1 and PADD 3 continue their decline. PADD 1 gasoline stock levels are at par to 2022 5-year historical low levels for end March.

The main difference is that last year, Q2 forward arbs were mostly open during Q1, whereas this year Q2 forward arbs have been shut and remain shut since end Dec 2022. As mentioned last week, we expect very little term business in traders’ and refiners’ books as we move into summer. If stock levels follow the same trends as last year, NY will need to do a much better job at attracting European barrels.

This obviously puts additional pressure on PADD 3 as the market’s go-to supplier for both domestic and Atlantic Basin demand. It would therefore not be surprising to see a repeat of arbs from Asia to Mexico and other LatAm destinations, as well as octane arbs into Houston. The difference is that, this year, the Asian market is much tighter with front-month spreads trading at $2.2/bbl.

That being said, refiners on both sides of the Atlantic are now clearly incentivised to maximise gasoline production vs diesel. Should this incentive continue following the end of French strikes, we could see a ramp-up in gasoline production in 2-3 months that could completely change the supply and demand picture at peak season. Similarly to last year, we could see some wild swings in spreads.

In terms of freight, TC2 should come under pressure in the near future as Europe remains in defence mode with Arbs shut across the board.

That being said, as refiners are now incentivised to maximise gasoline production, and as mentioned above, should this incentive remain post-French strikes, we could potentially see a push of gasoline barrels out of Europe in 2-3 months’ time.

[hubspot type=cta portal=7807592 id=38c8d3f4-d2d3-4781-a4a2-ba10ca4055bc]

Felipe Elink Schuurman is CEO and Founder of Sparta. A former trader, Felipe drives strategic vision and growth at Sparta. Before Sparta, Felipe worked and traded for BP, Vertical and Gunvor.

Sparta is a live, pre trade analytics platform that enables oil traders, refiners, banks, hedge funds and wholesalers to have access to real-time and global actionable insights to capture market opportunities before others.

To find out how Sparta can allow you to make smarter trading decisions, faster, contact us for a demonstration at sales@spartacommodites.com