Prompt RBOB arb nearly open but Q2 has further to go with Europe starting to look cheap

The European market continues to be the supplier-of-choice for the vast majority of both Latin America, Africa, and parts of the Middle East.

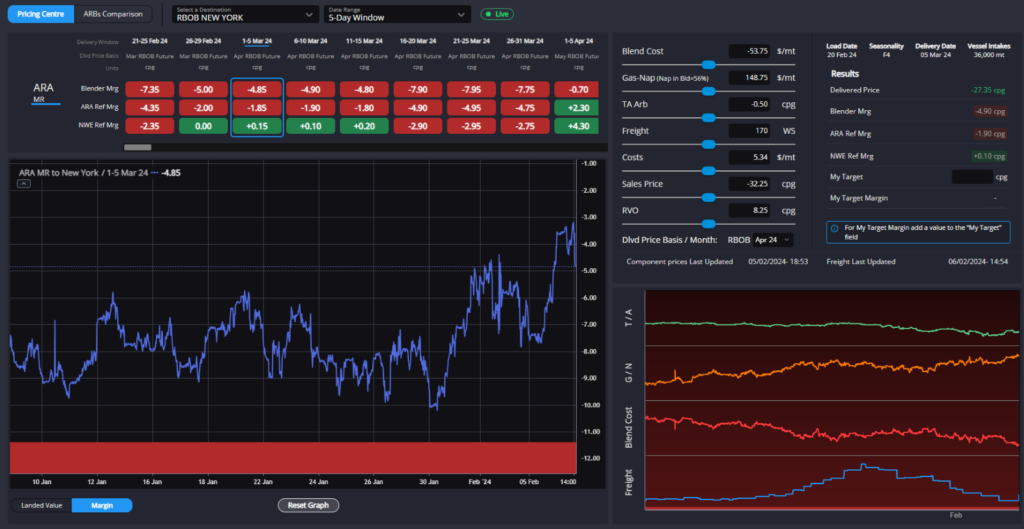

A historically wide gas-nap spread is helping to keep blend costs in ARA very reasonable, aided in part by difficulty in making naphtha arbs to the East work with current freight market dynamics, and this wide gas-nap spread is even starting to open up opportunities for some advantaged NWE players to try and move RBOB barrels in the prompt.

Although the latest 20 WS points added to the TC2 route today have almost closed this opportunity once more, the recent downward trend in this route as well as the consistently widening gas-nap and paper TA arb hovering around parity were threatening to see more cargoes added to the TA flow.

The US side of the equation appears to continue to resist such a move, however, with the RBOB complex seemingly unimpressed by recent low imports into PADD-1 and low PADD-3 runs and keeping the paper TA arb firmly shut.

The result continues to show that whilst PADD-3 exports dominate their home markets still, there is little market for USGC-origin gasoline outside of North America, and exports are likely to come in at-or-just-below their seasonal averages through the rest of Q1 as a result.

Very low crude runs recently would otherwise have put a bullish tint on our outlook for the US gasoline complex through the months ahead, but with inventories still way above their seasonal averages and export options looking limited, the bullish argument rests on crude intake not ramping up again quickly, with another freeze-off potentially on the cards according to the latest weather forecasts.

In the East, LR rates continue to hamper both Singapore blend costs and the ability for AG-origin barrels to find their way competitively into regional markets.

As we can see from the above chart, SK to Australia rates have more than doubled in recent weeks, and are symptomatic of a wider strengthening in EoS LR freight rates.

The knock-on effect is that cargoes from outside of the region are now pricing more competitively, with the regional discrepancy further exacerbated by strengthening naphtha prices in Asia compared to Europe.

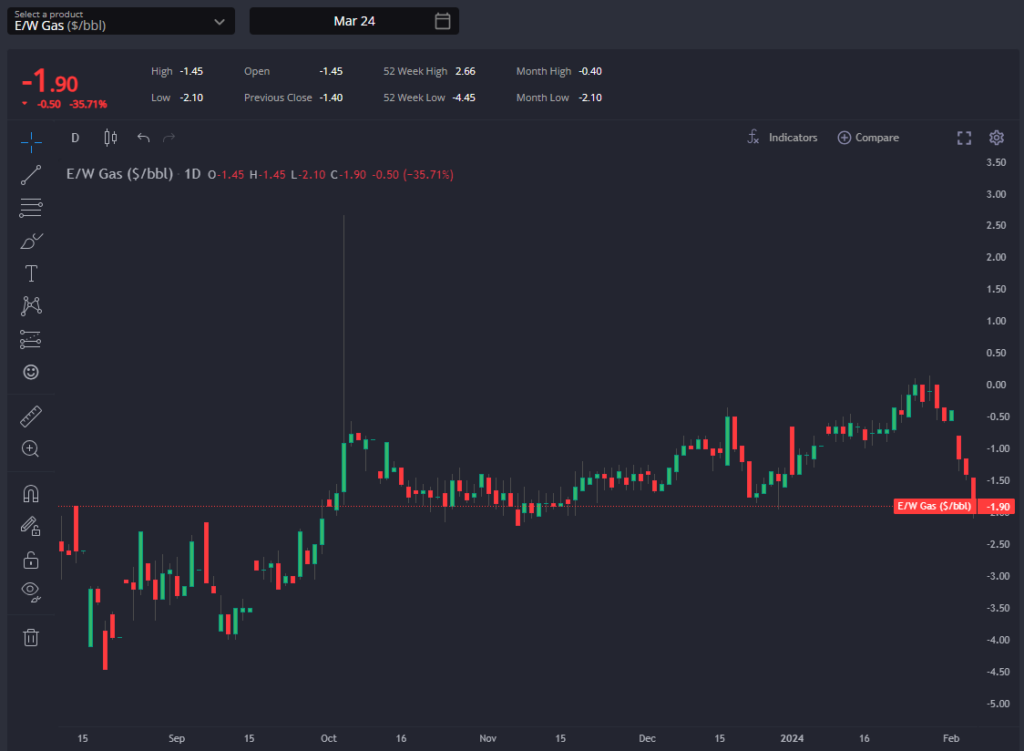

As such, we should expect a rising volume of gasoline from the West to be pushing into the East (despite Red Sea/Gulf of Aden issues), and with it a further widening of the E/W gasoline spread.

This dynamic was visible in our platform already over a week ago, and the bullish impetus for EBOB vs Sing 92 has already started to become visible in the March and April contracts.

Philip Jones-Lux is Commodity Owner for Sparta. Having worked with organisations such as JBC Energy and RP Global, Philip is a seasoned energy market analyst with expertise across the oil barrel and power markets

Sparta is a live, market intelligence and forecasting platform that enables oil traders, refiners, banks, hedge funds and wholesalers to have access to real-time and global actionable insights to capture market opportunities before others.

To find out how Sparta can allow you to make smarter trading decisions, faster, contact us for a demonstration at sales@spartacommodites.com