Prompt NWE naphtha strength reopens Red Sea arb; Asia to remain unattractive for West-bound cargoes while USGC to buckle from Canadian demand loss

European naphtha remains the centre of attention amid ongoing active petrochemical demand and open blending margins for E5 and E10.

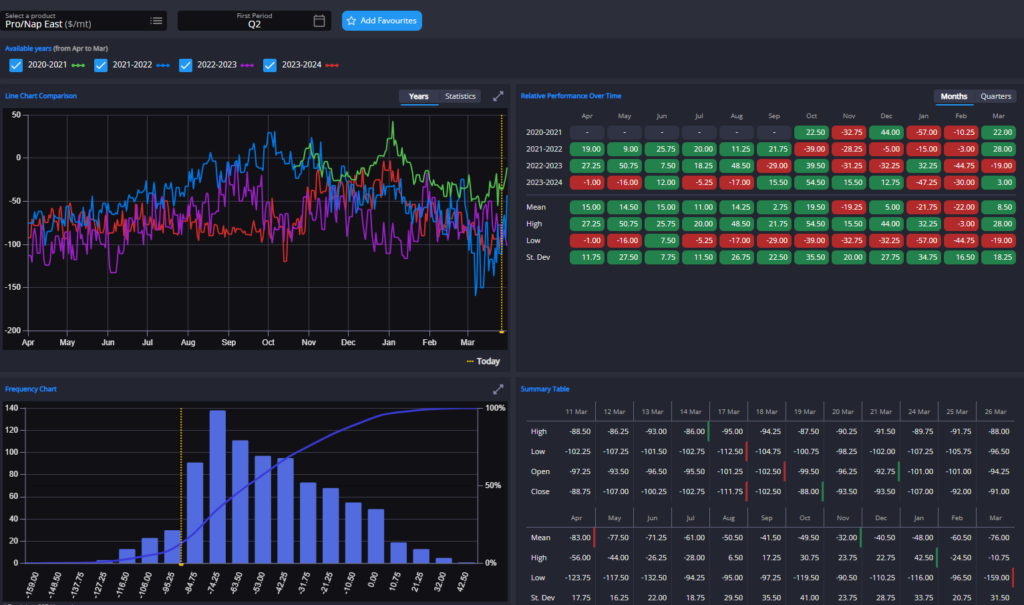

However, the backwardation in the prompt has plummeted $4/mt in line with the overall drop in MOPJ and CIF NWE time spreads.

European paraffinic naphtha premiums continue to rise as the region remains bereft of Asian petrochemical output, with regional plants having to run harder to make up the deficit, opening Red Sea arbs for April deliveries.

The arrival of light naphtha from the Middle East could provide relief to the prices of the European OSN if the Med or ARA can capitalise on current values, the latter being the main bearish indicators for the market in the short term.

Meanwhile, European aromatic prices are easing or finding a ceiling—largely due to rising production from naphtha-fed steam crackers—making the arbitrage for heavy naphtha to the US cheaper, as well as improving the blend margin alongside alkylate and reformate declines, despite the slight drop from gas-nap.

The Asian market should remain an unattractive destination for Western light and heavy naphtha cargoes, despite the slight rebound in Asian CIF prices and cheaper freight from Europe.

Increasing Middle East exports continue to keep the market well supplied, and historically low propane-naphtha swaps at the front of the curve will ensure a heavier use of LPG rather than naphtha in regional flexible steam crackers.

Further weakening MOPJ cracks and timespreads through Q2 are likely as more regional crackers have announced further extensions of ongoing turnarounds either on technical issues or are buckling under the weight of prolonged depressed steam cracker margins, despite recent signs of slight improvements in the latter.

While it would only take a reversion to historical norms from a flat price perspective for MOPJ to overtake propane as the cracker feedstock of choice in the region—meaning a narrower Q2 pro-nap swap is imminent—an overall cautious outlook from the petrochemical sector is likely to cap any significant Asian price upside.

Meanwhile, the US NY market continues to rise with shrinking discounts on RBOB for both heavy and light grades.

This improvement in physical premiums, coupled with the prolonged drop in freight from Europe to NYH, has opened the arbitrage between the two points for heavy naphtha.

The upcoming turnaround at Irving St John is likely the short-term catalyst for the increased call for components, although the actual gasoline arb has yet to be fully opened.

Conversely, USGC naphtha is likely to come under further pressure in the coming weeks ahead of Canadian oil sands turnarounds that will lower demand on northbound pipes.

Lower FOBs and the continuance of the downward trend in freight could open opportunities first for LatAm and then East of Suez bound cargoes.

Samantha Hartke, a veteran in commodity management, boasts substantial expertise in energy analysis and product management. In her role at Energy Aspects as Head of NGLs, she analysed global natural gas liquids markets. Previously, at PetroChem Wire, Samantha provided high-quality analysis of North American NGLs and olefins. Her expertise also extends to leading the commercial and operational aspects of IHS Chemical’s daily business information service.

Sparta is a live, market intelligence and forecasting platform that enables oil traders, refiners, banks, hedge funds and wholesalers to have access to real-time and global actionable insights to capture market opportunities before others.

To find out how Sparta can allow you to make smarter trading decisions, faster, contact us for a demonstration at sales@spartacommodites.com